PrevDayVAH

- Göstergeler

- Everett Wright

- Sürüm: 1.0

- Etkinleştirmeler: 5

📌 Previous Period Volume Profile [VAH/VAL/POC] — Professional Institutional-Level Reference Levels

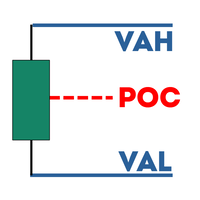

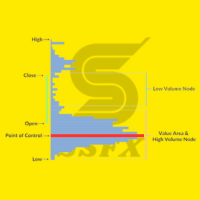

Previous Period Volume Profile gives traders instant visual access to the most important volume-based levels from the prior session: Point of Control (POC), Value Area High (VAH), and Value Area Low (VAL).

These levels are widely used by professional traders to anticipate liquidity magnets, rotation zones, high-probability reversals, and continuation setups.

Unlike full histogram packages that clutter the chart, this tool stays clean, minimal, and fast—perfect for intraday scalpers, day traders, and swing traders who want institutional structure without heavy visuals.

✨ What It Does

✔ Automatically calculates the previous period’s POC / VAH / VAL

✔ Supports Daily, Weekly, H4, and H1 profiles

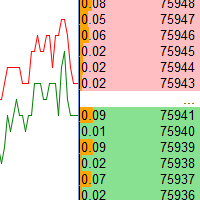

✔ Projects levels forward into your current session with clean lines

✔ Includes optional labels for each level

✔ Updates only when a new period completes (no repainting, no noise)

✔ Designed for clarity, simplicity, and high-performance execution

These levels help you instantly identify:

• Where buyers and sellers transacted most

• Likely reaction points for Nasdaq, S&P, FX, or crypto

• Areas where liquidity clusters and algo responses occur

• Session-to-session market structure shifts

🎯 Why Traders Use It

POC, VAH, and VAL are foundational references for:

• Fade and reversal setups

• Break-and-retest structure

• Liquidity sweeps

• Range-to-trend transitions

• London / NY session reaction zones

• High-probability scalp locations

If you trade indices, forex, metals, or crypto, these levels anchor your execution with the same reference points professionals use daily.

🔧 Customization

• Choose profile timeframe (H1, H4, Daily, Weekly)

• Adjust Value Area %

• Configure line style, color, width

• Toggle labels on/off

• Clean forward projection with zero chart clutter

💼 Who This Is For

This indicator is built for:

• Intraday / scalping traders

• Pros who use volume-driven reference levels

• Traders who want clean charts with high-signal tools

• Anyone building an institutional-style execution model

⭐ Final Notes

This is a precision-built tool designed to be simple, reliable, and actionable. No noise. No bloat. Just the three levels that matter most.

If you need help integrating it into your trading system, reach out anytime—I support all users.