BOOM and CRASH Envelopes Scalper

- Эксперты

- Allan Munene Mutiiria

- Версия: 1.0

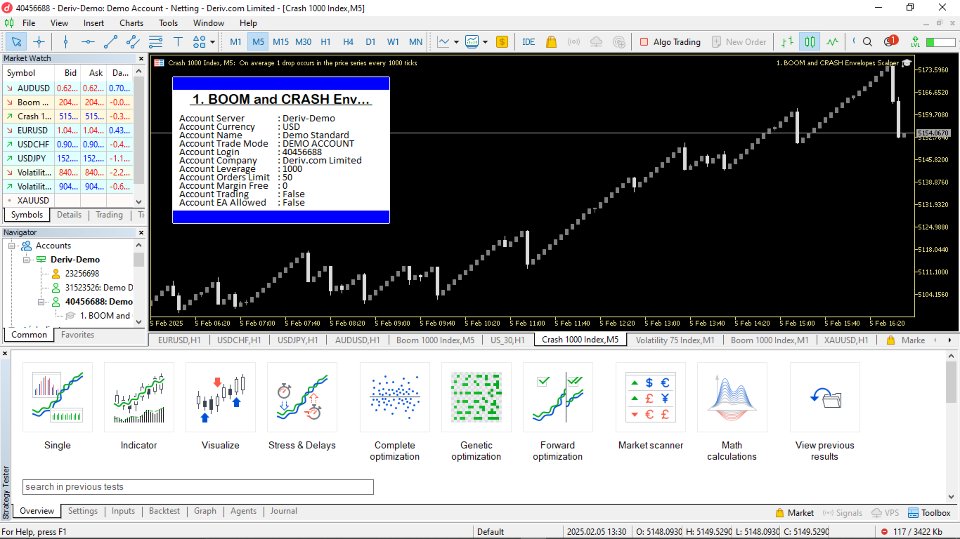

Unleash your trading potential with the BOOM and CRASH Envelopes Scalper MT5 EA, a meticulously crafted Expert Advisor designed for MetaTrader 5, tailored specifically for the high-octane Boom and Crash indices. This EA combines the precision of Envelopes and RSI indicators with a robust scalping strategy, offering traders a dynamic tool to capitalize on rapid market movements. Whether you're a seasoned scalper or a newcomer to synthetic indices, this EA delivers a powerful, customizable framework to navigate the markets with confidence.

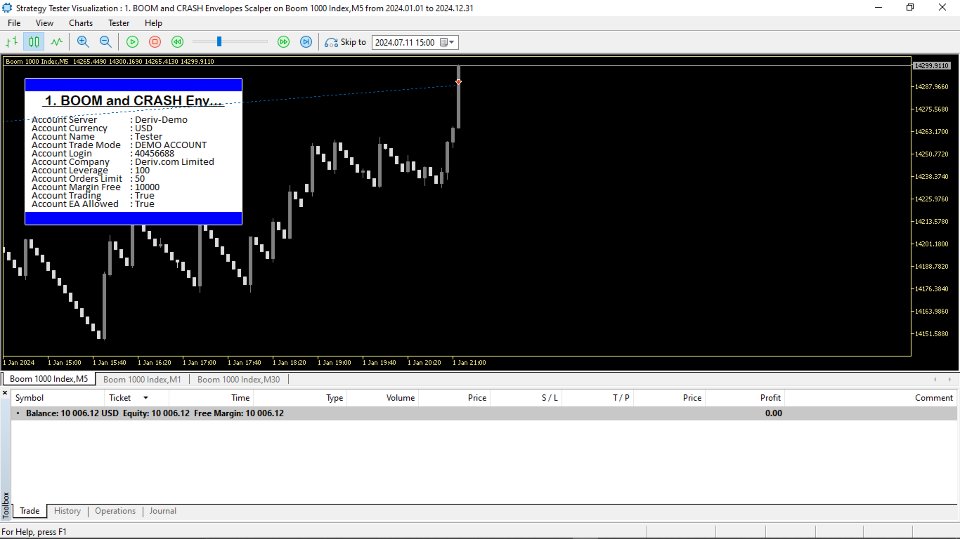

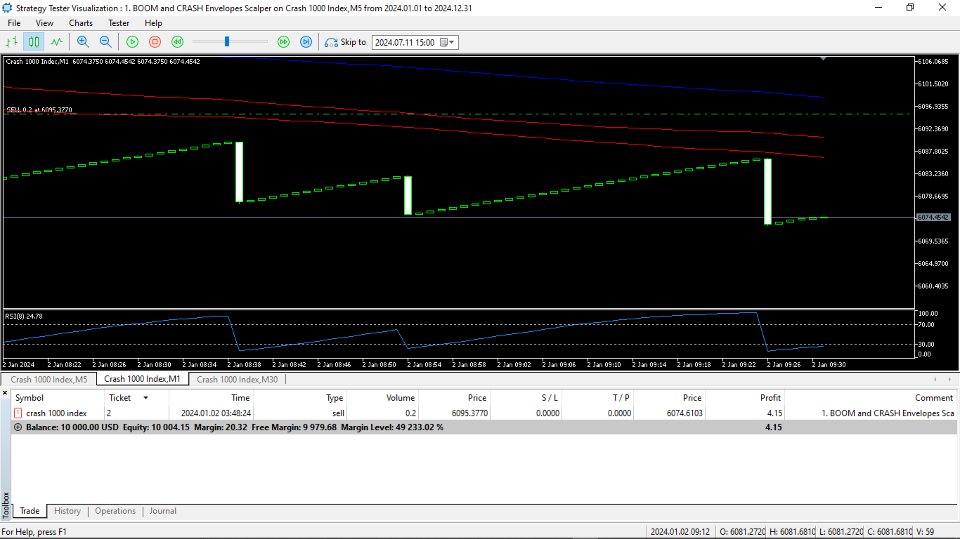

At its core, the BOOM and CRASH Envelopes Scalper leverages a strategy driven by Envelopes (upper and lower bands) and RSI signals on the M1 timeframe, complemented by SMA and EMA trend filters on M30 and M1 timeframes. It opens trades when price interacts with the Envelopes bands and RSI crosses predefined thresholds (default: 11 for Buy, 89 for Sell), ensuring precise entries. Additional orders can be triggered at a pip offset (default: 10 pips) to maximize opportunities in trending markets. With tight Take Profit (3 pips) and Stop Loss (9 pips) settings, the EA is built for quick, disciplined scalping.

Risk management is paramount. The EA calculates lot sizes as a percentage of account balance (default: 1%), ensuring trades align with your risk tolerance. Manual TP/SL adjustments are supported via chart lines, offering flexibility for hands-on traders. A sleek on-chart dashboard displays critical account details—server, currency, trade mode, leverage, and more—keeping you informed in real-time.

Key Features:

- Precision scalping with Envelopes and RSI-based signals.

- Dynamic lot sizing based on account balance percentage.

- Tight TP/SL settings for disciplined risk management.

- Manual TP/SL adjustments via draggable chart lines.

- Real-time dashboard for account and trade insights.

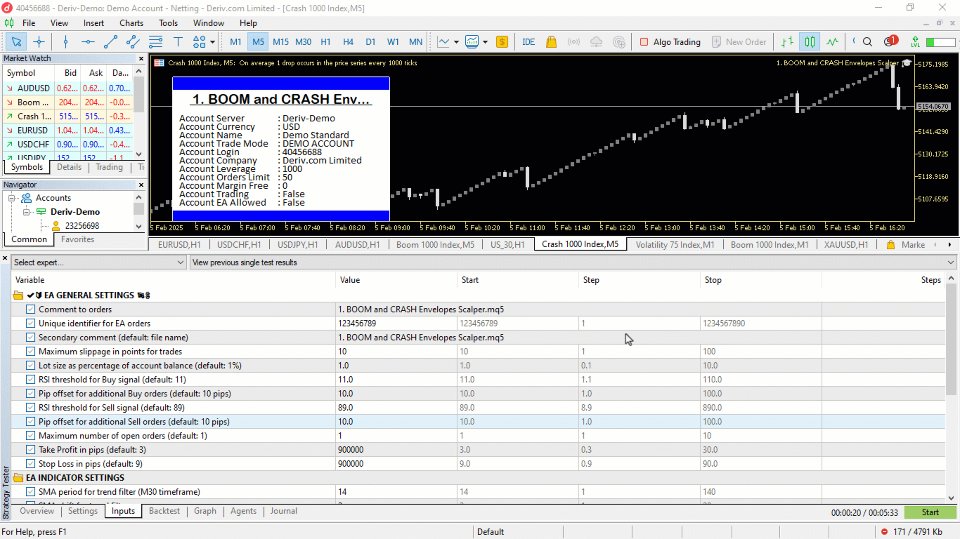

Inputs Description

- Order Comment: Custom comment for trades (default: file name).

- Magic Number: Unique identifier for EA trades (default: 123456789).

- Display Order During Timeframe: Timeframe for order info display (default: M1).

- Max Deviation Slippage: Maximum slippage in points (default: 10).

- Lot Size Percentage: Lot size as a percentage of account balance (default: 1%).

- OpenBuy_Const_0: RSI threshold for Buy signals (default: 11).

- OpenBuy_Const_1: Pip offset for additional Buy orders (default: 10 pips).

- OpenSell_Const_0: RSI threshold for Sell signals (default: 89).

- OpenSell_Const_1: Pip offset for additional Sell orders (default: 10 pips).

- Max Number of Open Orders: Limits simultaneous open orders (default: 1).

- Take Profit Module Value: Take Profit in pips (default: 3).

- Stop Loss Module Value: Stop Loss in pips (default: 9).

- iMA_SMA8_ma_period: SMA period for trend filter on M30 (default: 14).

- iMA_SMA_4_ma_period: SMA period for reverse trend filter on M30 (default: 9).

- iMA_EMA200_ma_period: EMA period for long-term trend on M1 (default: 200).

- iRSI_RSI_ma_period: RSI period for signals on M1 (default: 8).

- iEnvelopes_ENV_LOW_ma_period: Envelopes lower band period on M1 (default: 95).

- iEnvelopes_ENV_LOW_deviation: Lower band deviation (default: 1.4%).

- iEnvelopes_ENV_UPPER_ma_period: Envelopes upper band period on M1 (default: 150).

- iEnvelopes_ENV_UPPER_deviation: Upper band deviation (default: 0.1%).

How It Works

The EA monitors price action on the M1 timeframe, using Envelopes to identify overbought/oversold conditions and RSI crossovers to trigger trades. A 200-period EMA and 4/8-period SMAs provide trend context, ensuring trades align with market direction. When conditions are met, the EA opens a Buy or Sell order with predefined TP/SL levels. If the price moves against the initial position, additional orders may open at set pip intervals, up to the maximum order limit. The on-chart dashboard provides real-time insights, and manual TP/SL adjustments allow for tailored risk management.

Usage Tips

- Backtest Thoroughly: Optimize settings on a demo account to match your trading style and market conditions.

- Start Small: Use the default 1% lot size and adjust based on your risk tolerance.

- Monitor Volatility: Boom and Crash indices are highly volatile; ensure sufficient margin and test settings carefully.

- Stay Connected: Incase of anything, just reach out for support.

Disclaimer

The BOOM and CRASH Envelopes Scalper MT5 EA is designed for high-volatility synthetic indices like Boom and Crash, offering significant profit potential but carrying substantial risks. Scalping strategies can lead to rapid losses in adverse market conditions, especially with insufficient capital or aggressive settings. Always backtest and optimize on a demo account before deploying on a live account. Past performance does not guarantee future results. Trading involves risk, and losses may exceed your initial investment. Use with caution and ensure you understand the strategy’s implications. Happy trading!