MultiTF Trend

- 지표

- Muhammad Iqbal

- 버전: 1.0

- 활성화: 5

MultiTF Trend Indicator for MetaTrader 5

MultiTF Trend is a technical indicator for MetaTrader 5 designed to display trend directions across multiple timeframes on a single chart. It uses Moving Average (MA) slope analysis combined with an ATR-based threshold to help identify periods of directional movement in the market.

This tool presents trend information in a structured and easy-to-read format, allowing users to observe trend alignment across various timeframes without switching charts.

Main Features

Trend Detection Based on MA Slope

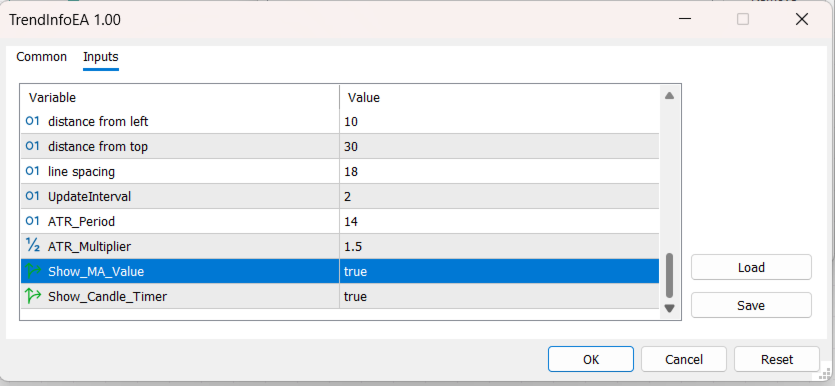

The indicator evaluates the slope of a user-defined Moving Average. When the slope exceeds an ATR-based threshold, the indicator highlights it as a period of stronger directional movement.

Multi-Timeframe Display

Trend information can be shown for M5, M15, M30, H1, H4, and D1. Each timeframe can be enabled or disabled according to user preference.

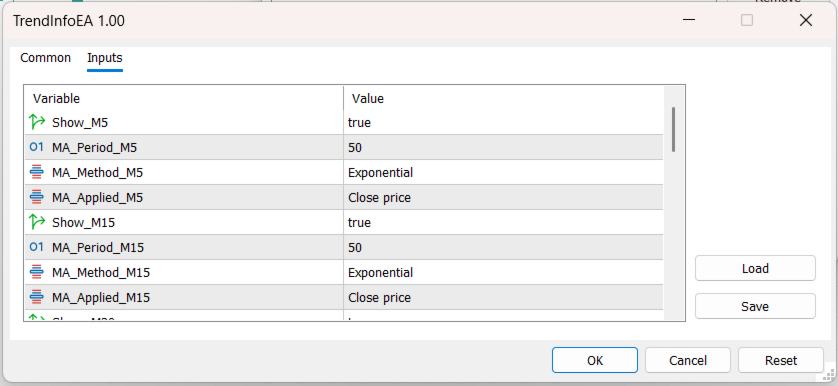

Configurable MA and ATR Settings

Users can set MA period, method (SMA, EMA, SMMA), applied price, ATR settings, and slope sensitivity. These parameters can be customized for each timeframe.

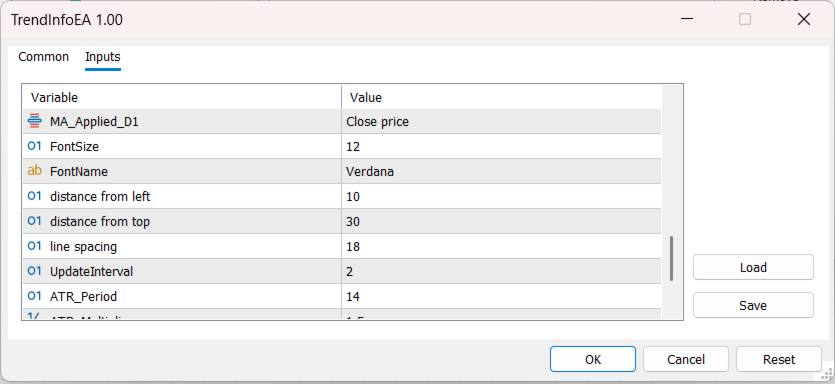

User Interface Options

The indicator provides adjustable label positions, fonts, and optional display of MA values and remaining candle time. Updates are performed at a defined interval.

Lightweight Operation

The indicator is designed to operate efficiently without affecting platform performance.

Technical Information

-

Platform: MetaTrader 5 (MQL5)

-

Inputs: Timeframe filters, MA settings, ATR threshold, candle timer options, visual settings

-

Compatibility: Works on any instrument supported by MetaTrader 5

-

Updates: Provided through the Market platform when available

Usage Notes

This indicator is intended to support technical analysis by visualizing trend conditions derived from MA slope and ATR comparison. It does not generate trading signals or guarantee trading outcomes. Users should evaluate the tool within their own trading approach and conduct appropriate testing before applying it in live market conditions.