당사 팬 페이지에 가입하십시오

- 조회수:

- 5231

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Real author:

MetaQuotes

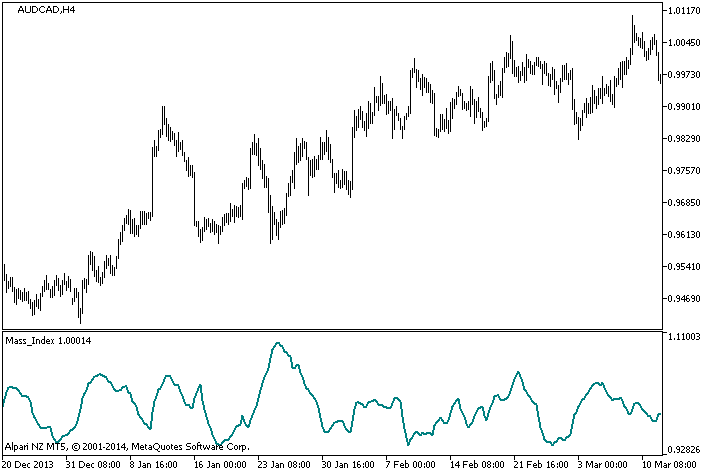

The Mass Index is intended for detection of trend turns based on changes in the bandwidth between the highest and the lowest prices. If the bandwidth expands, the Mass Index increases, if it narrows, the index decreases.

The Mass Index was developed by Donald Dorsey. A special model constructed by the indicator and called 'reversal bulge' should be considered the most important signal from the Mass Index. The reversal bulge is formed when the 25-period mass index, first, exceeds 27 and then falls below 26.5. In this case, the price turn is quite possible independently on the general nature of the trend, and it does not matter, whether prices move up, down or fluctuate within the trading range.

To detect what exactly signal - to buy or to sell - is produced by the reversal bulge, 9-period exponential moving average of prices is frequently used. When a reversal bulge appears, it is time to buy, if the moving average falls (with a view to a reversal), and sell, if it increases.

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

This indicator was first implemented in MQL4 and published in CodeBase on 08.02.2007.

Fig.1. Mass_Index Indicator

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/2428

Chaikin_Volatility

Chaikin_Volatility

Chaikin's volatility indicator.

Chaikin_Volatility_HTF

Chaikin_Volatility_HTF

The Chaikin_Volatility indicator with the timeframe selection option available in input parameters.

Simple dollar index indicator

Simple dollar index indicator

Special aspects: "holidays problem" is solved (problems arising due to absence of ticks).

NonLagMA_v5

NonLagMA_v5

This is a moving where effect of retardation is lessened by means of damped cosinusoid defining coefficients' ratios in equation of the linearly weighted average (LWMA).