Gabus Niveles

- インディケータ

- Gabriel Antonio Diaz Quevedo

- バージョン: 1.3

- アクティベーション: 5

Niveles G: Institutional Levels & Volume Profile Map

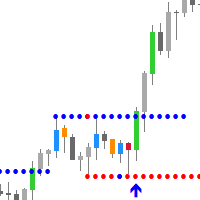

The Edge of Professional Trading Niveles G is not just another indicator; it is a comprehensive mapping tool that automates the identification of high-relevance institutional zones. Professional traders and algorithms don't react to random prices—they react to specific liquidity anchors. Niveles G plots these anchors automatically, keeping your chart clean and your strategy focused.

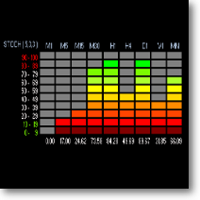

Why These Levels Are Crucial? In trading, these levels represent Institutional Liquidity. Large participants use Daily, Weekly, and Volume Profile benchmarks to enter or exit massive positions. When multiple levels align (confluence), the probability of a sharp market reaction increases significantly.

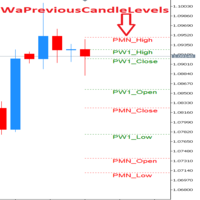

Key Levels Included:

-

Intraday (4H): Current 4H Open and Previous 4H High/Low/Mid. Essential for identifying intraday trend shifts.

-

Daily & Monday: Previous Day High/Low and the Monday Mid-Range. Monday's range often sets the tone for the entire week's volatility.

-

Weekly Context: Current Weekly Open and Previous Week High/Low/Mid. These are the "major anchors" for swing traders and institutions.

-

Volume Profile (Daily): POC (Point of Control), VAH (Value Area High), and VAL (Value Area Low). The POC acts as a magnet for the price, while the Value Area shows where 70% of the volume was executed.

Advanced Technical Features:

-

Smart Anti-Collision System: Exclusive logic that prevents labels from overlapping when levels are close, ensuring a professional and readable interface.

-

Total Customization: Independent controls for each timeframe (4H, Daily, Weekly, Monthly).

-

Zero Lag & No Repaint: Levels are calculated based on closed data, providing fixed and reliable references.

-

High-Resolution UI: Designed for modern displays with clean, customizable typography.