Step Analysis Indicator

- インディケータ

- Rafael Gazzinelli

- バージョン: 1.21

- アップデート済み: 26 8月 2025

Check it out here: Daily Drop Analyzer EA

The Step Analysis Indicator performs an automated backtest of a simple daily strategy: buy when the price drops a certain percentage from the previous close and sell at the same day's close (or vice versa for short strategy).

It tests multiple entry percentages ("steps") and displays the results in a dynamic, sortable table. This helps you identify which percentage level historically performed best for each asset.

You can adjust parameters like strategy direction, analysis period, filters, and visual options by pressing CTRL+I on the chart.

What You’ll See

The result table shows these 10 key metrics for each tested step:

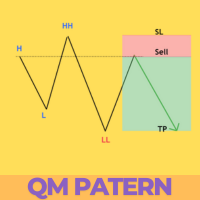

- Step(%): Price variation from previous close that triggers a trade (negative for buy, positive for sell).

- RecovFactor: Recovery Factor = Gross Result / Max Drawdown. Measures the strategy's resilience.

- Trades: Total number of trades for this step.

- HitRate(%): Percentage of profitable trades.

- Active(%): Days with at least one trade, as % of the total period.

- Result(%): Gross result from all trades (cumulative return).

- Max L/P(%): Highest % profit from a single trade (based on close).

- L/P Avg(%): Average % profit/loss per trade.

- DD(%): Max drawdown from peak result to worst subsequent point (cumulative).

- Max DD(%): Worst drawdown in a single trade, using the lowest (buy) or highest (sell) price, always negative.

Why Use It

- Instant backtests across multiple entry points with no coding.

- Auto-identifies the most effective drop/rise percentage per asset.

- Custom filters highlight the most consistent strategies.

- Save time and improve decision-making with data-backed insights.

How to Use

- Apply the indicator to any D1 chart in MetaTrader 5.

- Press CTRL+I to customize parameters (strategy direction, filters, step size, etc.).

- Review the table to identify optimal entry conditions.

- Use sorting and filters to focus on high-performing strategies.

Configurable Parameters

- Trade Direction: Choose between Buy or Sell strategy.

- Analysis Period: Number of daily candles used (default: 120).

- Minimum Hit Rate (%): Filter out low-accuracy setups.

- Alert Hit Rate (%): Highlight steps with high success rate.

- Minimum Active Days (%): Filter steps with too few trades.

- Minimum L/P Avg (%): Filter steps with low average return.

- Maximum Drawdown (%): Filter out high-risk steps.

- RangeMax: Max price drop/rise to test (0% to ±5%).

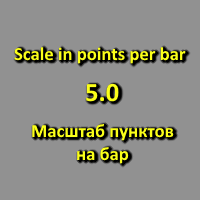

- Step: Percent increment (e.g., 0.1%) between levels tested.

- Max Visible Rows: Controls how many steps appear at once in the table.

Example

With default settings, the indicator may reveal that a -0.5% drop consistently gives better results than other levels. This lets you adjust your strategy based on objective historical data.