YouTubeにあるマーケットチュートリアルビデオをご覧ください

ロボットや指標を購入する

仮想ホスティングで

EAを実行

EAを実行

ロボットや指標を購入前にテストする

マーケットで収入を得る

販売のためにプロダクトをプレゼンテーションする方法

MetaTrader 5のための新しいエキスパートアドバイザーとインディケータ - 142

Weis Wave Scouterは、MetaTrader 5向けに開発された革新的なインジケーターであり、WyckoffメソッドとVSA(Volume Spread Analysis)の確立された原則を組み合わせています。精度と深みを求めるトレーダー向けに設計され、累積ボリューム波の分析を通じて市場を戦略的に読み取り、トレンドの反転ポイントや継続ポイントを特定する支援を行います。

Weis Wave Scouterは、クラシック、ナイトビジョン、オーシャンブリーズといったカスタマイズ可能なカラーテーマで、上昇波と下降波を色分けしたヒストグラムで明瞭に表示します。主な機能には、ボリュームピークの検出、低アクティビティゾーン(DeadZone)の識別、およびボリュームベースの波の反転に関するカスタマイズ可能なアラートが含まれます。また、エフォート対リザルト分析、因果関係、需給バランスといったWyckoffおよびVSA理論の基本概念をサポートしています。Brick Size、Volume Scale Factor、Pivot Lookbackといったパラメータで柔軟に調整でき、あらゆるスタ

Drawdown Guardian Pro (v2.8) - MT5用の強化された口座保護ツール! 壊滅的な損失が発生する前に阻止しましょう!「Drawdown Guardian Pro」は、MetaTrader 5口座を継続的に監視し、事前に定義された制限に達すると自動的に安全対策を適用する包括的なリスク管理ツールです。制御不能なEA、市場のボラティリティ、または感情的な手動取引からの保護に最適です。 主な機能 (v2.8): 多彩なドローダウン制限:固定(日次/全体、%または通貨単位)およびトレーリングドローダウンを監視。 絶対的なエクイティレベル:最小および最大の閾値を設定。 柔軟な時間フィルター:特定の時間帯や曜日に取引を許可またはブロック。 動的なリスク可視化:チャートがインジケーターに!背景色の変化と中央テキストが危険レベルを即座に通知。 カスタマイズ可能な主要アクション:管理対象の全/損失/利益ポジションを決済、新規取引をブロック、通知。 待機注文の削除:制限に達した場合に管理対象の待機注文を自動的に削除するオプション。 アクティブな事後ブロック:ブロック 後 に開かれた

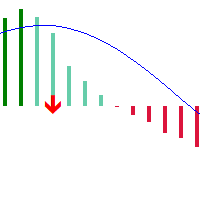

KT Top G は、価格アクションに基づいたインジケーターで、スマートなチャネル分析を組み合わせることで、潜在的な市場の天井と底を識別します。反転の可能性が検出されると、チャート上に太くて見やすい矢印を表示し、市場が反転する前に事前に通知します。 大きな矢印: 価格の勢いの変化や消耗を検出して、高確率な天井と底を示します。 小さな矢印: 低確率の反転ポイントを示しますが、市場が実際に反転する前に突破されることが多いです。

特徴 幅広い互換性: 通貨ペアはもちろん、株式、ETF、インデックスなどの他の金融商品でも使用可能です。 マルチタイムフレーム対応: スキャルピング用のM1とM5、スイングトレード用のH1、H4、D1でも優れたパフォーマンスを発揮します。 ミッドライン付きのチャネル内蔵: 矢印とともに、現在のレンジとトレンド方向を示す動的な価格チャネルを表示します。 リペイントなし: 矢印が一度表示されると消えることはなく、信頼性のあるシグナルを提供します。 ボラティリティへの適応性: チャネルの長さとスムージング係数を調整することで、急激な値動きにも対応できます。 個別アラート

No Brain Gold EA

***************************************************************************************************************

世界で最もシンプルなエキスパートアドバイザーです!

MT5プラットフォームに接続するだけで使用できます。

学習、パラメーター設定、設定、監視は不要です!

GOLDシンボルをブローカーと一致させ、5分足チャートに表示するだけです。たったこれだけです!

その知能はシンプルではありません。複数のインジケーターとスロープを用いて、売買シグナルを検出します。ニュース発表による予期せぬブレイクアウトが発生した場合でも、高度なブレイクアウト検出機能がポジションを安全に保護します。

今すぐお試しください。あなたのトレードツールとしてご活用ください。 ********************************************************************************************

DAX WaveTimer:

PRICE PROMOTION! This almost - GIVE AWAY - price promotion is only LIMITED TIME. Buy now!

New: WaveTiming is proud to present a fully automated DAX trading bot.

Interesting additional feature: user-defined adjustable equity risk percentage. We don’t try to predict the market. Instead, DAX WaveTimer is built to respond effectively in both upward and downward trends.

The core concept is clear and efficient. The intelligence of the carefully structured order sets with adaptive lo

MT5用kit-trader golden days トレーディングを支援する、完全かつ非常に効果的なスリップです。トレーディング自体は非常に難しいものです。トレーダーの97%が負け組で、勝ち組の3%の取引に資金を提供しているのも不思議ではありません。このスリップは、トレーディングレベルを向上させ、注文をよりコントロールできるようにすることを目的としています。 ストップロス、テイクプロフィット、トレーリングストップ、そしてダイナミックオーダーアジャストメントを備えたスリップは、トレーダーに次のようなメリットをもたらします。 リスク管理 - ストップロスは自動的に損失を抑制します。 利益の確保 - テイクプロフィットとトレーリングストップは利益を保証し、トレンドを追跡します。 感情の抑制 - 事前に定義されたルールに従うことで、衝動的な意思決定を排除します。 エントリー/エグジットの最適化 - ダイナミックアジャストメントにより、感情に左右されずに市場に適応できます。 結果:エラーの減少、一貫性の向上、そして効率的なトレーディング。

ICTロンドンオープンキルゾーンインジケーターは 、 ICT、SMC (スマートマネーコンセプト)、 流動性に基づく市場構造戦略 といった制度的コンセプトを実践する外国為替トレーダー向けに設計された、 スマートマネー ベースの取引ツールです。このインジケーターは、アジアセッションとロンドン市場のオープンの間の流動性フローの重複により、ボラティリティと価格変動が顕著になることで知られる、 GMT 午前6時 から午前8時までのロンドンオープンキルゾーンをハイライトします。

この時間帯は、マーケットメーカーが流動性ハンティングを行う高確率のセットアップの トリガーゾーン として機能することがよくあります。このインジケーターは キルゾーンレンジを自動的にマークし 、前セッションの高値と安値の スイープ 、特に アジアセッションレンジを 特定します。これらの流動性スイープは、多くのICTエントリーモデルの重要な要素です。このツールは、スイープ後に価格が プレミアムゾーン または ディスカウントゾーン に達したかどうかを分析するのに役立ち、 MSS(市場構造シフト)、 構造の崩

IGold AIは、AIと機械学習を駆使した高度な技術を搭載した新しいEAです。XAUUSDの価格とデータベース内のレンジを分散比較することで、価格構造を分解し、独自のスキャルピングを行うための潜在的な注文を見つけ出します。

AIは主に当社のサーバーで動作し、独自の技術を採用しています。価格を比較すると、当社のサーバー上でリアルタイムに価格を比較し、他の市場と比較することでマッチングを行います。これにより、複数のネットワークを参照します。

データベースのニューラルバージョン0X32

マーチンゲール法なし

ヘッジなし

次の価格:$399。残り3点。

時間に応じてスリッページを調整するための内部分析。スリッページが低いランクの場所がわかっている場合。

1日の始まりから終わりまで、驚異的な日次分析を実施しています。

なお、私の戦略開発は、長年のプロトレーダーとしての経験を積んだ私自身が設計し、AIの自己適応機能を追加することでパフォーマンスを最適化し、さらに向上させています。

これは真のスキャルパーであり、利益は実際に確定し、テイクプロフィットとストップロスでコントロール

Freya AI é uma assistente virtual de ponta, desenvolvida exclusivamente para o mercado australiano, que utiliza o poder da inteligência artificial avançada para oferecer um desempenho incomparável. Projetada com algoritmos de aprendizado de máquina de última geração, a Freya AI combina processamento sofisticado de linguagem natural (PLN) com modelos de aprendizado profundo para proporcionar experiências intuitivas e fluidas ao usuário. Totalmente automatizada, esta assistente de IA é otimizada

このEAのデフォルトパラメータおよび添付画像のパラメータは実戦取引に使用することを禁止します!

適用口座:スプレッド低・手数料低のデモ口座。 製品のハイライト: 金融ブロガー向けに設計され、高評価のデモ展示口座を構築可能。中国某SNSプラットフォームの取引口座ランキングで、このEAを使用した口座がA+評価を獲得(ランキングで唯一)。 評価アップのコツ:単一通貨ペア(例:XAUUSDのみ)で運用すると評価が上がりやすい。他の銘柄(例:US30)を取引する場合は別途口座の使用を推奨。 リスク警告: 添付パラメータはXAUUSDデモ取引専用(実戦とデモでは市場メカニズムが異なり、同等の効果を保証できません)。 パーセンテージ資金管理戦略を採用しているため、バックテストで安全なパラメータを確定し、ロスカットリスクを回避してください。 パラメータ説明: SarStep/SarMaximum/StepCycle/RiskPercent:添付パラメータはトレンド保守戦略用。攻撃的な設定では短期的に高利益を得られる可能性があるが、リスクも極めて高い。 取引環境制約:複数注文の処理効率はサーバー処理能

Ay XAUUSD Expert ゴールド専用M15トレンド自動売買EA|安定型スキャル・デイトレ両対応

ゴールド自動売買の新定番! 高精度トレンド判定 × コツコツ型ロジック × 右肩上がりの実績! 「Ay XAUUSD Expert」は、ゴールド(XAUUSD)M15専用に設計された高性能トレンドEAです。 アップダウンの激しい相場にも強く、急変動でもブレない独自アルゴリズムを搭載。

<主な特徴> ・M15専用・ゴールド特化型EA(XAUUSD向け自動売買) ・独自ロジックでトレンドと押し目をしっかりキャッチ ・急変動やノイズにも強い安定稼働設計 ・資金管理・リスクコントロール自動化 ・毎日利益を積み上げるコツコツ型運用 ・パラメータ調整不要!デフォルトのまま即運用可能 ・バックテストでも右肩上がりの安定成績! ・スキャルピング・デイトレード両対応/長期運用も

<使い方> 通貨ペア:XAUUSD(ゴールド) 時間足 :M15(15分足)

<こんな方におすすめ> ・ゴールド自動売買で“安定して利益”を狙いたい方 ・どの期間でも右肩上がりのパフォーマンスを重視する方 ・トレ

Cross Hedge EA Cross Hedge EA is a hedging EA is a Gold scalping bot preferably whose exit based on "Zone Recovery Algorithm". Note :- Default settings are not the exact settings and even not for Backtesting so reach personally after downloading. Use Cent account with $300 deposits atleast for gold and US30. Reach personally for best setup and broker Have a Look at its live working ID- 308382411 Password - Crosshedge@13 Server - XMGlobal MT5 6 Live Real Account stats is available on Myfxbook MT

MAScalperEA is a powerful and agile trading robot designed for fast-paced scalping on the M1 chart. Combining a dynamic Moving Average crossover system with smart chart pattern detection, it ensures high-probability entries in trending markets. Featuring robust risk management, customizable lot sizing, trailing stops, and trend filtering across multiple timeframes, MAScalperEA is your trusted tool for navigating the fast world of Forex scalping with confidence and precision. Perfect for traders

Moving Average Crossover EA Introduction: The History of a Time-Tested Strategy The Moving Average Crossover strategy is one of the oldest and most respected technical analysis methods in financial markets, dating back to the 1930s when traders first began using moving averages to smooth price data. Richard Donchian, often referred to as the "Father of Trend Following," was among the first to popularize the use of moving average crossovers in the 1960s. This strategy gained further prominence w

FREE

LYNXの機能 LYNXは、ストキャスティクス、MACD、RSIの各指標を組み合わせて取引のエントリーシグナルを生成するエキスパートアドバイザーです。 あらゆる外国為替シンボル、あらゆる金属シンボルを取引します。主要なもの(USD、GBP、JPY、EUR、AUD、CAD、XAUの組み合わせ)を推奨します。 ユーザーは、各シンボルでこのロボットのインスタンスを実行することにより、任意の数のシンボルを並行して実行できます。 グリッド、マーチンゲール、ヘッジング戦略は使用しません。バックテストで指数関数的な成長を示す他のEAに惑わされないでください。 口座タイプ:ネッティングまたはヘッジング。常にネッティングルールを使用します。 初期残高、ロットサイズ、レバレッジは、ブローカーの制限の対象となります。 必要なユーザーレベル:初心者から上級トレーダーまで。ライブ取引を実行する前にパラメータを最適化することをお勧めするため、ユーザーはMetaTrader 5の最適化ツールを知っている必要があります。 ユーザーは、トレーニングデータに基づいて、高い年間収益率、低いリスク、高い勝率、高い期待収益、

The Candle Smoother is an indicator for MetaTrader 5 that helps you see price movements more calmly and clearly. It removes unnecessary "market noise" and displays the true trend more effectively.

What does the "Candle Smoother Indicator" do?

It smooths the classic candlestick data (Open, High, Low, Close). This filters out chaotic, hectic candles. Additionally, an EMA line (Exponential Moving Average) is calculated based on the smoothed prices. This helps you better recognize where the market

FREE

SwiftScalperLite v3.3 — Advanced Scalping EA for XAUUSD (Gold) SwiftScalperLite v3.3 is a high-performance, precision-engineered Expert Advisor designed for scalping XAUUSD (Gold) on the H1 timeframe . Built for trading accounts ranging from $1,000 to $100,000 , it delivers consistent performance in both trending and ranging markets by leveraging advanced entry logic, dynamic risk controls, and intelligent filters. Key Features Multi-Stage Entry System

Executes trades in up to 3 dynami

The SuperTrend Strategy is a widely-used technical indicator based on the Average True Range (ATR), primarily employed as a trailing stop tool to identify prevailing market trends. The indicator is designed for ease of use while providing reliable insights into the current market trend. It operates based on two key parameters: the period and the multiplier . By default, it uses a period of 15 for the ATR calculation and a multiplier of 3 . The Average True Range (ATR) plays a crucial role in th

FREE

Bollinger Bands Expert Advisor with ATR, Trailing Stop and Multi-Symbol Trading Introduction: Harnessing Statistical Volatility Bollinger Bands, developed by John Bollinger in the 1980s, have become one of the most versatile technical indicators for identifying market volatility and potential reversal points. The indicator uses standard deviations to dynamically adjust band width based on recent price action, making it adaptive to changing market conditions. This Expert Advisor implements a clas

FREE

Discover Smarter, More Versatile Trading with Tabow 3.7 Tabow 3.7 is the latest evolution of our precision-built expert advisor (EA), designed to help traders identify potential tops and bottoms using the Awesome Oscillator (AO). This updated version significantly expands your strategic toolkit by embedding five distinct trading strategies directly into the code. Tabow 3.7 doesn't just execute trades; It integrates advanced internal conditions and dynamic trade management tools to deliver st

FREE

RSI Expert Advisor with ATR, Trailing Stop and Multi-Symbol Trading Introduction: The Science Behind RSI Trading The Relative Strength Index (RSI) was developed by J. Welles Wilder in 1978 and has become one of the most trusted momentum oscillators in technical analysis. What began as a manual calculation method in Wilder's book "New Concepts in Technical Trading Systems" has evolved into an indispensable tool for traders across all markets. The RSI's power lies in its ability to quantify price

FREE

Quantitative Gold Trading System: Apex Gold Trend Matrix 19 Years of Market Deconstruction, 6 Years of Algorithmic Refinement, 4 Years of Live Testing

From trading intuition to mathematical certainty. Product Information Live Signal: https://www.mql5.com/en/signals/2305042?source=Site+Profile+Seller

https://www.mql5.com/en/signals/2305035?source=Site+Profile+Seller https://www.mql5.com/en/signals/2274718?source=Site+Profile+Seller https://www.mql5.com/en/signals/2305039?source=Site+Profile

Interceptor – The Ultimate Expert Advisor Welcome to Interceptor , our most advanced Expert Advisor: a multi-currency, fully automated, and flexible trading system, compatible with any time frame. Designed to meet any trading style, Interceptor combines two operating modes in a single system: Stop Loss Mode and Martingale Mode . Why choose Interceptor? No optimization : completely avoids the risk of overfitting. Dynamic entry : uses an innovative and highly sophisticated entry logic based on mar

Are you tired of those old, boring TP and SL lines cluttering your charts? Free now, celebrating release of Live Chart Viewer utility https://www.mql5.com/en/market/product/158488

Struggling to showcase your trades in a way that actually grabs attention ?

Worry no more! Introducing the ultimate solution you’ve been waiting for... The TPSL Bounding Box PRO Indicator! PRO Version (With Risk to Rewards Ratio and more Modern Look Stats)

With just a simple setup, you can transform you

FREE

Introduction Smart Trade Panel is a manual trading assistant for MetaTrader 5.

It allows you to perform simple actions such as Buy, Sell, Close All positions, or set a Break Even stop, with a single click. Full Description Smart Trade Panel – Manual Buy/Sell, Break Even, Close All EA for MetaTrader 5 This tool helps traders manage positions manually through a clean and accessible interface.

It can be used in different trading styles and helps simplify order execution on the chart. ️ Feat

The Gold Scalper EA is a precision-engineered expert advisor designed to dominate the XAUUSD (Gold) market through smart support and resistance-based scalping. Built with a clean, simplistic and minimalistic trading logic without any overcomplicated jargon that most EAs try to advertise, this Gold scalping robot executes high-probability breakout trades with surgical accuracy using simple basic support and resistance trading while keeping drawdowns minimal and protecting your capital at all time

Flow – Hotkey Tool for Discretionary Traders Take full control of MT5 with your keyboard and mouse.

Flow is a powerful hotkey-based assistant designed specifically for discretionary traders who want to place orders, draw tools, and operate charts with speed and precision. No more right-click menus or wasting time. Just trade.

Key Features Order Execution Place pending Buy/Sell orders (limit or stop) instantly with just a mouse click. Stop Loss and Take Profit lines are automatically attac

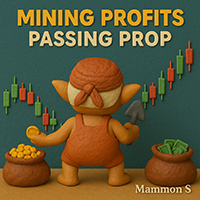

Mining Profits, Passing Prop

We are not just offering you a trading bot — We're providing a complete, intelligent system designed to help you generate consistent returns and pass prop firm challenges with confidence.

Mammon S is a specialized algorithmic bot for the gold market. It executes secure, optimized trades across different timeframes based on your preferences. Designed to preserve capital and deliver stable profits with extremely low drawdown, it also adheres to strict prop firm comp

CowMeleon EA — Adaptive Market Logic | Smart Entries | Single Daily Trade Precision-crafted Expert Advisor designed for disciplined traders who value consistency, institutional logic, and real-time market reading. Overview CowMeleon EA is not your average bot. It executes only one carefully selected trade per day, based on a proprietary logic inspired by the techniques of institutional traders. Built for traders who seek quality over quantity — CowMeleon doesn't chase setups. It waits, w

Morning Range Breakout (Free Version) Morning Range Breakout (Free Version) is a straightforward trading advisor that implements a breakout strategy based on the morning range. It identifies the high and low within a specified time interval (e.g., 08:00–10:00 UTC) and opens a trade on a breakout upward or downward. The free version includes core functionality without restrictions. All parameters and messages are in English, per MQL5 Market requirements. Key Features Detects morning range based

FREE

Morning Range Breakout PRO Morning Range Breakout PRO is a professional trading advisor designed for breakout trading based on the morning range. It includes advanced features such as trend filtering, breakeven functionality, entry time restrictions, and range visualization. All parameters and messages are in English, per MQL5 Market requirements. Key Features Customizable range formation interval (UTC hours) Trend filter using moving average Limited entry window after range completion One trade

FREE

N ewStorm is designed mainly to trade after news events, and to open trades based on news results. The EA can be used for swing trading by opening positions based on fundamental analysis with its SL and TP, or it can be used as scalper to profit from quick market move during the news to book some profit. An advanced grid recovery system is included that incorporates several advanced features such as ATR‐based grid spacing, dynamic lot allocation, smart drawdown reduction, trailing stops, and

GoldX It is an automated trading system that uses breakout signals, filtered by market volatility (ATR), to ensure that the price movement is strong and not a false breakout before entering a trade.

Recommended Settings: • Symbol: XAUUSD • Timeframe: H1 • Minimum Deposit: $500 • Recommended Broker: IC Markets (for optimal performance) • VPS: Strongly recommended for 24/7 operation

Important Notice Before Purchase Trading involves risk, and past performance does not guarantee future success. Ma

Ukeita Spike detector for All Gain and Pain Indices

Ukeita Spike Detector is a trend-sensitive indicator specially designed for Gain and Pain Indices

Gain and Pain synthetic indices are available 24/7 on Weltrade , similar to synthetic indices (Boom and Crash) offered by Deriv Broker .

This powerful tool helps detect incoming spike for Gain and Pain indices with high accuracy, making it a great addition to any strategy aimed at trading spikes safely.

Features

1) Detects incoming spikes f

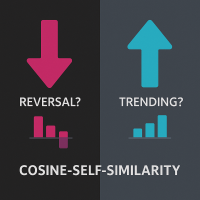

Cosine-Self-Similarity: Identify Trends & Reversals

What is Cosine Similarity? Cosine similarity measures how alike two sequences are by looking at the angle between them. A value of +1 means they move perfectly together, -1 means they move perfectly opposite, and 0 means there's no directional relationship. This indicator applies this concept to price returns.

Is the market trending strongly, or is it choppy and reversing? Gain insight with the Cosine-Self-Similarity indicator!

This powerfu

1. Method Overview Random Trader EA is an automated trading system for MetaTrader 5 that initiates trades with a randomly chosen buy or sell direction. Despite the random entry, the EA incorporates robust risk management, dynamic position sizing, and sophisticated exit strategies. This unique approach serves as a valuable tool for research, portfolio diversification, and as a foundational template for developing and evaluating risk management techniques within algorithmic trading. 2. Key Featur

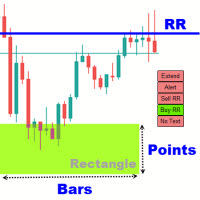

Rectangle Trading Custom is a powerful technical analysis tool designed for price action and range-based traders. It allows users to define consolidation zones and receive alerts when the price breaks out of these zones or approaches trendlines drawn on the chart. Rectangles and Trendlines will be extended into future with one click. Rectangle point size, name and prices will be displayed around rectangle. Key Features: Draw Trading Zones (Rectangle Zones)

Users can manually draw rectangles to

CatRSI is a trading robot for the EURUSD currency pair on the M1 or M5 timeframe. The trading strategy uses the RSI (Relative Strength Index) indicator. To speed up the selection of parameter values (optimization), you can use opening prices, but you need to check the selected values on every ticks. By default, the parameter values are set for 5-digit quotes.

Parameters. Ret. If Ret is false, then when the oversold level is reached, a buy is made, and when the overbought level is reached

Risk Management EA - Advanced Trading Tool with Visual Controls Description: This comprehensive Risk Management EA transforms your trading experience with an intuitive visual interface directly on your chart. Take full control of your trades with precise risk calculation, customizable entry/exit points, and one-click order execution. Key Features: Visual Trade Management : Drag-and-drop SL/TP lines with real-time profit/loss calculations Automated Risk-Based Position Sizing : Instantly calculate

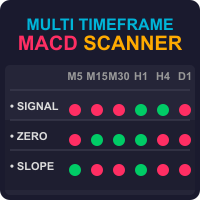

Discover the Power of the Multi Timeframe MACD Scanner for MT5 The MTF MACD Scanner indicator is a practical tool for traders using MetaTrader 5 (MT5). It takes the well-known MACD (Moving Average Convergence Divergence) indicator and turns its data into easy-to-read dashboard and candle colors on your chart. This helps you spot market trends, momentum shifts, and potential reversals without needing to analyze separate MACD lines and switch between timeframes. What Does It Do? This indicator cr

Ultimate Chart Navigator - Instant Symbol Switcher for MetaTrader 5 Love it? Hate it? Let me know in a review! Feature requests and ideas for new tools are highly appreciated. :) Try "The AUDCAD Trader":

https://www.mql5.com/en/market/product/151841 Tired of Wasting Time Switching Charts? Save time and supercharge your trading workflow with the Ultimate Chart Navigator—the professional-grade tool that puts instant symbol switching at your fingertips.

Perfect for forex traders, commodity

FREE

Realized Volatility Indicator Description The Realized Volatility Indicator measures the actual volatility observed in the market over a specified period.

Unlike implied volatility (which is based on options pricing), realized volatility is based directly on historical price movements, offering a pure and objective view of market turbulence. This indicator can be used to: Assess market conditions, Optimize risk management, Fine-tune trading strategies based on volatility behavior. Key Features

FREE

A Revolutionary Guardrail for 95 % of Traders; This expert will save you from Emotions and from yourself. What if you had an EA that will shutdown the MT5 for the whole day when your daily profit or loss is reached? Well, this one does just that. Say goodbye to overtrading, trading without SL, not auto trailing you profit, and revenge trading. How many times have you watched a winner turn into a loser because you moved your TP or simply forgot to set one? How much capital have you let slip thro

The Trading Engine that turns your trend-following strategies into controlled performance

THIS IS NOT A 100% FULLY AUTOMATED ALGORITHM

Discover Gain Engine , the trading engine that maximizes profits while giving you complete freedom to choose your market entries.

Reduce drawdown, let the trend run, and watch your equity grow in a stable, measurable way.

Try it in backtest today: select a time period with a clear trend and you’ll see profits multiply.

Then test it when the trend turns into

Based on the classic MACD indicator, this version introduces color concepts and adds golden/death cross arrow markers to represent MACD trend changes, helping investors make better decisions.

1. The MACD histogram bars display different colors when positioned above or below the zero line 2. When the MACD histogram is above the zero line and the current MACD value is greater than the previous value, it displays in dark color, indicating a continuing upward trend 3. When the MACD histogram is ab

MADVENOM ALGO EXPERT ADVISOR Unleash Precision. Dominate the Synthetic Markets. MADVENOMPRO ALGO EA is a cutting-edge, trend-following Expert Advisor engineered exclusively for synthetic indices, specifically the Boom and Crash markets.

It combines institutional-grade market analysis, smart trade management, and advanced loss mitigation into a fully automated system — built for traders who demand accuracy, consistency, and dominance. Core Features: Smart Trend Detection : Analyzes H1 to M5 stru

CTJMFiboSignal is The Power of Technical Analysis at Your Fingertips Embark on a seamless trading journey with CTJMFiboSignal , your go-to premium indicator for technical analysis mastery. Integrating advanced Fibonacci Retracement techniques with ZigZag patterns , this cutting-edge tool is designed to boost your confidence, adaptability, and accuracy in the ever-evolving world of market trading. Why CTJMFiboSignal Stands Out Supreme Accuracy:

Gain the upper hand in market analysis

Break Even Zone – Real-Time Floating P/L Visual Indicator Quick Overview:

Break Even Zone is a powerful visual indicator that automatically highlights your floating profit or loss directly on the chart. It displays a red zone when your open trades are in floating loss , and a green zone when they are in floating profit – helping you make smarter, faster decisions. ️ Key Features: Red Zone Block appears when your trades are in floating loss Green Zone Block shows up when trades are in f

Helvetia Edge is an advanced algorithmic trading system built specifically for the EURCHF currency pair on the M15 timeframe. Named after the Latin word for Switzerland found on Swiss coins, this expert advisor utilizes a refined Bollinger Bands strategy with separate configurations for Long and Short trades. Key Features Ultra-specialized: trades only EURCHF on the M15 timeframe Separate strategies for Long (Buy) and Short (Sell) with fully distinct parameter sets Multi-layer exit logic combini

The Digital Buy/Sell Power Indicator is an advanced, visually intuitive tool that monitors buying and selling pressure across timeframes (M1 to Monthly), displaying momentum on a 0-100 scale with glowing digital readouts. Equipped with a movable panel, timeframe toggle switches, and a weighted algorithm for accurate Buy/Sell/Neutral signals, it provides traders with precise, actionable market dynamics. All time frames can be used at once to give a better perspective of market direction. Lowerin

FREE

Indicador IMI (Intraday Momentum Index) Descrição O Indicador IMI (Intraday Momentum Index) é uma poderosa ferramenta de análise técnica desenvolvida para identificar a força do momentum e potenciais reversões no mercado. Este indicador quantifica a relação entre ganhos e perdas durante um período específico, ajudando traders a avaliar a dinâmica atual do mercado. Características Oscila entre 0 e 100, facilitando a interpretação das condições de mercado Identifica com precisão áreas de sobrecomp

FREE

RTS5PatternBTCPrice is an analytical tool for MetaTrader 5 that systematically searches for historical similarities in price action and evaluates how the market behaved after similar situations.

The indicator provides both visual and statistical information that can be used to support trading decisions. It compares the current price pattern, defined by a selected number of candles, with historical data.

The similarity results are displayed using a histogram with three categories: Good Match –

FREE

Daily Weekly Monthly High Low - Your Ultimate Tool for Precision Market Analysis

The 200 free download promotion has ended. The price has now been updated. Thank you, everyone!

Love it? Hate it? Let me know in a review! Feature requests and ideas for new tools are highly appreciated. :)

Try "The AUDCAD Trader":

https://www.mql5.com/en/market/product/151841 Overview:

Elevate your trading strategy with Daily Weekly Monthly High Low , a sophisticated MQL5 indicator designed to pinpoint c

Smart Hedge Trader – MT5 Expert Advisor Link to MT4 version Smart Hedge Trader MT4 Smart Hedge Trader is an MT5 Expert Advisor designed to manage trades using a dynamic hedging approach combined with configurable risk controls. It operates by analyzing market conditions and executing calculated strategies to manage exposure across multiple positions. This EA is suitable for traders seeking a structured, automated trading system that adapts to market volatility with minimal manual input. Features

Range Filter Buy and Sell O Range Filter Buy and Sell é um indicador técnico avançado que combina filtragem de movimentos de preço com geração de sinais claros de compra e venda.

Ele utiliza um sistema inteligente de suavização baseado em médias móveis exponenciais do range de preços, adaptado por um multiplicador configurável. Principais recursos:

Filtragem de tendências (Alta, Baixa ou Neutra) com cores distintas no gráfico:

• Tendência de alta (linha verde)

• Tendência de baixa (linha verm

Boost your forex profits with Blues Protector, an advanced MQL5 Expert Advisor designed for MetaTrader 5. This automated trading bot dynamically manages your stop-loss levels to secure gains and reduce risks. Blues Protector EA - User Manual (For MT5 - Ready-to-Use EX5 File) 1. What This EA Does The Blues Protector EA automatically secures your profits by smartly adjusting stop-loss levels when your trade reaches a predefined profit level. It works silently in the background, protecting

Ultimate MT5 Trade Panel – Full Control at Your Fingertips Take your trading to the next level with the Ultimate MT5 Trade Panel – a powerful, fully customizable tool designed for speed, precision, and complete control over your trades. Whether you manage a few positions or hundreds across multiple symbols, this panel will make your life easier! Key Features: Multiple Close Options Close All Positions & Orders with One Click Close Only Buy Positions Close Only Sell Positions Close All Pr

Bitcoin Tambora MT5 is a special expert advisor for Bitcoin/ BTC/ BTCUSD. This EA is designed with follow trend and candle box breakout (my secret) method for entry position. This EA is a single entry method use stop loss and take profit. Price $ 30 only for promotion. Price will increase over time. Noted : Please make sure your balance is enough. If balance is not enough, I recommend using cent account. This EA has been rigorously tested at several backtest levels, but past results do not gu

NY Open Breakout EA is a fully automated trading robot specifically designed to capture strong breakouts during the New York trading session, focusing on major forex pairs and indices correlated with the US Dollar. Key Features: Automatically defines the trading zone based on customizable time settings. Opens trades when the price breaks above or below the identified zone. Smart built-in risk management with automatic stop loss and take profit settings. Advanced Martingale loop system to reco

Joker Pro — 5 Years of Proven Results on EURUSD H1 Backed by 5 years of verified backtesting on the EURUSD H1 timeframe, Joker Pro is your ultimate trading solution—combining precision, power, and professional risk management for serious traders. Discover Joker Pro — Precision Meets Performance Step into the future of trading with Joker Pro , a cutting-edge Expert Advisor (EA) crafted for consistent performance and strong risk controls. Whether you’re growing your personal account or aiming for

Triplet Cloud MTF is an indicator for trend-following strategy. It presents the trend in HTF from the LTF Chart that allows traders focus on looking for trade entry in the right direction and increase striking rate. It comes with simple input setup. You will only need to choose HTF you want to follow its trend and set the alert setup, then all is set. Here are the mostly selected HTF setup for each of entry timeframe: M1 Entry : M15 Trend M5 Entry : H1 Trend M15 Entry : H4 Trend H1 Entry

ECN ProSmart: An Innovative Algorithm for Intersession Trading In the fast-paced world of Forex, where every second counts, a revolutionary tool is emerging - ECN ProSmart. This Expert Advisor does not just automate trades, but transforms the approach to trading at the intersection of global sessions, combining intelligent analysis and flexibility of strategies. Precision synchronized with the market ECN ProSmart is based on the study of the transitional phases between the Asian, European and Am

Using Breakout EA (Expert Advisor) has clear advantages over manual breakout trading, combining the strengths of breakout strategies with the power of automation in MQL4/MQL5 as follows:

Advantages of using Breakout EA 1. 100% automatic

EA can detect Breakout points and send trading orders immediately without having to watch the screen

Suitable for strategies that require "speed" in entering orders after breaking through resistance/support

2. Trade 24 hours a day without missing opportunitie

Gold Boom – Professional Gold Trading Explosion (XAU/USD) Gold Boom is a modern Expert Advisor (EA) built using MQL5, specifically designed for trading XAU/USD (Gold) .

It leverages a professional pending order system based on High-Frequency Trading (HFT) techniques, similar to those used by top institutional trading firms. Key Information: Main symbol: XAU/USD (Gold) Minimum deposit: $200 Minimum leverage: 1:30 Recommended timeframe: M15 Optimal broker: IC Markets (or any broker with low spre

Copy signals from Telegram channel to MT4/MT5 (Telegram bot must be added as an Admin in the channel) Input * Telegram bot token: Get your bot token by chatting with @BotFather * Multi- order for multi-tp signals * Signals filter by "not included text" * Option to Modify/Close by Reply message * Range Entry Mode: No open order if the price is out of range Setup on your MT4/MT5: - MT4/MT5 => Tools => Options => Expert Advisors => Tick on Allow Algo Trading & Allow WebRequest, add API Telegram

Gold EA: Proven Power for 1-Minute Gold Trading Transform your trading with our Gold EA, meticulously crafted for 1-minute charts and delivering over 2000% growth in 5 years from just $100-$1000 . No Martingale, No AI Gimmicks : Pure, time-tested strategies with robust money management, stop loss, and take profit for reliable performance across multiple charts. Flexible Trading Modes : Choose Fixed Balance for safe profits, Mark IV for bold growth, or %Balance for high rewards—combine Mark IV an

Momentum Echo – Real-Multi Currency Alert System Overview: Momentum Echo is a real-time alert system designed to monitor price with precision. It identifies aggressive market moves, capturing critical moments when price moves against the normal range signifying possible: Never miss a retracement even when away from your trading computer Stop hunts to eliminate retail positions Volatility breaks out of consolidation zones Price luring traders into premature entries Momentum surges confirm market

GoldenPulse XAU Trend EA is a precision-engineered Expert Advisor built exclusively for trading XAUUSD (Gold). It utilizes a robust convergence of four powerful indicators—Standard Deviation, Stochastic Oscillator, Williams’ %R, and MACD Signal—to detect high-probability trend and momentum setups in the gold market. With a focus on volatility filtering, overbought/oversold reversals, and momentum confirmation, the EA dynamically adapts to changing gold price behavior.

Key Features:

Multi-i

CYP Trade Manager Pro MT5: The Trader's Edge in Position Management

Transform How You Manage Trades - Focus on What Matters Why Most Traders Fail - And How CYP Trade Manager Pro Solves It

Many traders have solid entry strategies but lack proper trade management - the key difference between professionals and amateurs. CYP Trade Manager Pro handles the critical "after entry" phase of trading that most EAs ignore, giving you the edge that institutional traders use every day. Who Is It For Manual

This EA implements a range trading strategy using three key indicators: Bollinger Bands : Identifies overbought (upper band) and oversold (lower band) conditions Default period: 20, deviation: 2.0 Relative Strength Index (RSI) : Confirms overbought/oversold conditions Default period: 14 Overbought threshold: 70 Oversold threshold: 30 Moving Average : Determines the overall trend direction Default period: 35 (SMA) Entry Conditions: Buy Signal : Price touches or crosses the lower Bollinger Band RS

FREE

MetaTraderマーケットはMetaTraderプラットフォームのためのアプリを購入するための便利で安全な場所を提供します。エキスパートアドバイザーとインディケータをストラテジーテスターの中でテストするためにターミナルから無料のデモバージョンをダウンロードしてください。

パフォーマンスをモニターするためにいろいろなモードでアプリをテストし、MQL5.community支払いシステムを使ってお望みのプロダクトの支払いをしてください。

取引の機会を逃しています。

- 無料取引アプリ

- 8千を超えるシグナルをコピー

- 金融ニュースで金融マーケットを探索

新規登録

ログイン