すべてのブログ

✅ Risk Sentiment Softens in Equities, FX Awaits Data — ADP in Focus Today 📉 Equities: AI Profit-Taking & Monthly Rebalancing Weigh on Sentiment Equity markets remain generally unstable in earl...

✅ Yen Pauses as Tokyo Reopens — USD/JPY Heavy Near ¥154, Reversal Selling Dominates 💹 USD/JPY: Verbal Intervention Triggers Yen Rebound; Dips to ¥153 Handle Temporarily Following the three-day wee...

✅ Quiet Start to the Week — Yen Selling Persists as USD/JPY Holds Around ¥154 💹 USD/JPY: Calm Opening, Yen Carry Still in Play Tokyo markets opened quietly on Monday due to the Culture Day holiday...

✅ Weekly FX Outlook|“Seismic Signals” in U.S. Labor via ADP & ISM — Tug-of-War Between Yen Carry and the “Takaichi Trade” 📊 Weekly Result (Oct 27–31): –$75,800...

✅ Market Pauses After Major Events — USD/JPY Holds in the ¥154 Range Amid Month-End Adjustments 💹 USD/JPY: Taking a Breather After Heavy Event Week, Short-Term Overheating Seen This week featured...

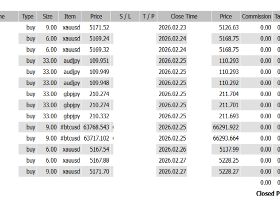

EQUITY PARAGON EA — XAUUSD(ゴールド)取引のための最新型エクイティベース自動売買システム Equity Paragon EA は、従来の SL/TP(ストップロス/テイクプロフィット) に依存せず、 口座エクイティ(Equity)を動的に管理 する次世代型アルゴリズムです...

📊 October 30, 2025|Major Currencies, Gold & BTC Technical Overview...

BTCUSD long entered at 110501.70. Stop at 109251.00. Entered ahead of the US-China summit (starting in about an hour). Anticipating a major risk-on BTC rally if the talks proceed smoothly...

✅ Market Cautious Ahead of FOMC, BOJ, and ECB—USD/JPY Fluctuates Around the Upper 151 Range 💹 FX Market: Calm Before the Triple Central Bank Week In tonight’s New York session, the U.S...

Perplexity APIキーの取得方法(ANS EA 用) AI News Strike EA MQLマーケットページはこちら: https://www.mql5.com/ja/market/product/153455 製品マニュアルはこちら: https://www.mql5...

AI News Strike EA v1.0 導入マニュアル & セットファイル AI News Strike EA MQLマーケットページはこちら: https://www.mql5.com/ja/market/product/153455 1...