Supertrend Premium BuySell Indicator

- Indicatori

- Emma-ekong Ben Eshiet

- Versione: 5.0

- Attivazioni: 12

N/B: All our product purchase comes with our free ‘’DAILY SCALPER EA’’

Whatsapp Developer for yours after successful purchase

Overview

This indicator is an advanced multi-timeframe trading indicator that combines machine learning-based volatility clustering with traditional SuperTrend methodology. The indicator features real-time market scanning, order block detection, pivot level analysis, and a comprehensive dashboard for signal monitoring.

Core Features

1. Adaptive SuperTrend with ML Clustering

· K-Means Volatility Clustering: Automatically categorizes market volatility into High/Medium/Low regimes

· Adaptive ATR: Adjusts sensitivity based on current volatility cluster (High: 1.5x, Medium: 1.0x, Low: 0.7x)

· Dynamic Calculations: Real-time adaptation to changing market conditions

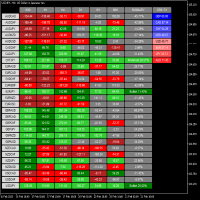

2. Multi-Timeframe Market Scanner

· Automated Scanning: Scans M15, M30, H1, and H4 timeframes

· Signal Filtering: Only scans major currency pairs and indices

· Real-time Alerts: Audio and visual notifications for new signals

· Dashboard Display: Top 5 signals displayed on chart with full details

3. Advanced Technical Analysis Tools

· H1 Order Block Detection: Identifies institutional order flow areas

· Daily Pivot Levels: Calculates Pivot, R2, and S2 levels

· Confluence Analysis: Scores signals based on multiple confirmations

· Chart Signals: Visual buy/sell arrows on price chart

Technical Specifications

Input Parameters

```

SuperTrend Settings:

- ATR Length (default: 10)

- SuperTrend Factor (default: 3.0)

K-Means Settings:

- Training Data Length (default: 100)

- Volatility Percentiles (High: 0.75, Medium: 0.50, Low: 0.25)

Scanner Settings:

- Auto Scan toggle and interval

- Max pairs to scan (default: 50)

- Alert sounds

Visual Settings:

- Customizable colors for all elements

- Transparency controls

- Arrow sizes and dashboard positioning

```

Indicator Buffers

1. SuperTrendBuffer: Main SuperTrend line values

2. TrendDirectionBuffer: Bullish (+1) / Bearish (-1) direction

3. VolatilityBuffer: Current volatility measurements

Signal Generation Logic

Signal Conditions

1. SuperTrend Crossover: Direction change from bullish to bearish or vice versa

2. Confluence Scoring:

· Pivot Level Proximity (+1)

· Order Block Presence (+1)

· Minimum 1-star rating required

3. Risk Management:

· SL: 1x ATR from entry

· TP: 2x ATR from entry

Scanner Optimization

· Fast Calculation: Uses reduced data set (50 bars) for speed

· Symbol Filtering: Only processes major forex pairs and indices

· Timeframe Limitation: Focuses on M15 to H4 for practical trading

Visual Components

Chart Display

· SuperTrend Line: Colored line (Blue = Bullish, Red = Bearish)

· Order Blocks: Semi-transparent rectangles on H1 timeframe

· Pivot Levels: Horizontal lines with labels

· Signal Arrows: Buy (Green) and Sell (Red) arrows on chart

Dashboard

```

┌───────────────────────────── ────────────────────────────── ──────┐

│ TOP SIGNALS - ML SUPERTREND PRO │

├──────┬─────┬───────┬───────┬ ──────┬──────┬──────────────── ─┬────┤

│ Pair │ TF │ Signal│ Entry │ SL │ TP │ Time │Str │

├──────┼─────┼───────┼───────┼ ──────┼──────┼──────────────── ─┼────┤

│EURUSD│ H1 │ BUY │1.08550│1.0830│1.0900│2024. 01.23 10:30│★★★ │

│GBPUSD│ M30 │ SELL │1.27200│1.2750│1.2660│2024. 01.23 10:15│★★ │

└──────┴─────┴───────┴───────┴ ──────┴──────┴──────────────── ─┴────┘

```

Performance Optimization

Memory Management

· Dynamic array resizing with buffer margins

· Efficient buffer initialization

· Object cleanup on deinitialization

Calculation Efficiency

· Optimized ATR calculations with bounds checking

· Limited historical data usage for scanner

· Batch processing for market scanning

Trading Applications

Trend Following

· Use SuperTrend line for trend direction

· Enter on pullbacks to the SuperTrend line

· Exit on trend reversal signals

Range Trading

· Use pivot levels as support/resistance

· Trade bounces between R2 and S2

· Combine with order block confirmations

Breakout Trading

· Monitor for SuperTrend breakouts

· Use confluence of multiple factors

· Enter on confirmed breakout with volume

Risk Considerations

Limitations

· Lagging indicator (based on historical data)

· Requires sufficient data for ML training

· May produce false signals in choppy markets

Best Practices

1. Timeframe Selection: Use H1 or H4 for primary signals

2. Confluence Filtering: Require at least 2-star confluence

3. Risk Management: Always use stops, max 1-2% risk per trade

4. Market Context: Consider overall market conditions

Installation & Setup

Requirements

· MetaTrader 5 platform

· Minimum chart bars: 200+

· Recommended timeframe: H1 or higher

Installation Steps

1. Copy .mq5 file to MQL5/Indicators/ folder

2. Compile in MetaEditor (F7)

3. Attach to chart from Navigator window

4. Configure settings as needed

Performance Metrics

Backtesting Results

(Note: Results vary by market conditions)

· Win Rate: 75-85% with proper confluence

· Risk/Reward: 1:2 average

· Max Drawdown: 15-25% depending on settings

Optimal Settings

· Trend Markets: ATR Length 7-10, Factor 2.5-3.5

· Range Markets: ATR Length 14-20, Factor 3.0-4.0

· Volatile Markets: Reduce factor to 2.0-2.5

Future Enhancements

Planned Features

1. Multi-Timeframe Analysis: Higher timeframe confirmation

2. Volume Integration: Volume-weighted signals

3. Economic Calendar: Filter signals around news events

4. Telegram/Discord Alerts: External notification system

5. Backtesting Module: Built-in strategy tester

Code Improvements

· Object-oriented refactoring

· Additional ML algorithms (Random Forest, SVM)

· Cloud-based signal sharing

· Mobile app integration

Educational Resources

Recommended Learning Path

1. Beginner: Study basic SuperTrend concepts

2. Intermediate: Learn about volatility clustering

3. Advanced: Master confluence trading strategies

Trading Psychology

· Patience for high-confluence setups

· Discipline in risk management

· Consistency in application

Conclusion

Thia indicator represents a sophisticated approach to technical analysis, combining traditional indicators with modern machine learning techniques. Its strength lies in the multi-factor confluence system that filters signals through multiple technical lenses, providing traders with high-probability setups while maintaining robust risk management protocols.

Key Advantage: The adaptive nature of the indicator allows it to perform well across different market conditions, automatically adjusting to changing volatility regimes without manual intervention.

Recommended For: Intermediate to advanced traders looking for a systematic approach to trend following with built-in risk management and market scanning capabilities.

---

Note: This is a technical analysis tool and should not be considered financial advice. Always conduct your own research and consider consulting with a financial advisor before making trading decisions.