QSR 300 Ronin

- Experts

- YIVANI KUNDAI CHITUMWA

- Versione: 3.14

- Attivazioni: 20

QSR 300 Ronin: Spartan Defense Meets Samurai Precision

Quant Signal Registry (QSR) presents 300 Ronin—an algorithmic trading solution engineered specifically for the distinct volatility of USDJPY.

Like the 300 Spartans who held the line at Thermopylae, this EA is built on a foundation of unyielding defense. Like a masterless Ronin, it strikes with lethal precision, specifically tuned to the rhythm of the Japanese Yen.

Most EAs fail because they don't know how to retreat. They fight the market until account is destroyed. QSR 300 Ronin is different. It utilizes a proprietary "Dual-Constant Time-Phalanx" protocol to protect your capital when the market turns against you.

🛡️ The "300" Logic: Mathematical Defense

Inspired by the discipline of the 300 at Thermopylae

When the market becomes chaotic, the brave do not charge blindly; they hold their ground. QSR 300 Ronin features an evolved Dual-Constant Time-Phalanx.

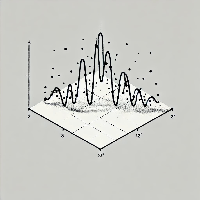

If a loss occurs, the EA refuses to revenge trade. Instead, it enters a calculated "Cool-Down" state, effectively raising its shield. Using a dynamic mathematical sequence, it pauses trading by weaving the Fibonacci Sequence with the universe's two most fundamental constants: π (Pi) and e (Euler’s Number).

Pause = 3600 x N_{Fib} x (π ↔ e)

Dynamic Adaptation:

The system oscillates its defense mechanism at every level of a carefully curated Fibonacci sequence, alternating the multiplier between the circular logic of π and the natural curve of e.

The result? As market turbulence increases, the EA’s defensive stance breathes with the market rather than fighting it. It holds the line with geometric precision, waiting out the storm until the odds favor the brave again.

⚔️ The "Ronin" Logic: USDJPY Precision

Optimized for the liquidity and trends of the Japanese Yen.

A Ronin strikes only when the opening is clear. This EA uses a Triple-Filter Quant Model to identify high-probability entries, filtering out noise to capture true momentum.

-

Macro Bias (The Master): Analyzes the Daily SMA to ensure we never trade against the major trend. A lower timeframe may be selected.

-

Momentum Strike (The Katana): Uses a sharp local SMA crossover to pinpoint the exact entry candle. A higher timeframe may be selected.

-

Volatility Confirmation (The Kiai): Validates the move using ADX Directional Indexes (DI+ > DI-) to ensure the trend has genuine strength before committing capital.

Technical Specifications

-

Symbol: Optimized for USDJPY (The Ronin's Home).

-

Timeframe: M1 is the recommended chart to place the advisor on.

-

Strategy Type: Trend Following / Volatility Breakout.

-

Risk Architecture: Non-Martingale. Uses Time-Decay recovery logic rather than lot-size compounding.

Why QSR 300 Ronin?

-

No Revenge Trading: The code physically prevents the EA from over-trading after a loss.

-

Quantifiably Robust: Built on the mathematical certainty of Fibonacci time cycles and π.

-

Psychologically Safe: Watch your EA sit calmly on the sidelines during market chop, preserving your equity for the winning trends.

Join the Quant Signal Registry.

Equip your terminal with the discipline of a Spartan and the precision of a Ronin.

Download the Demo & Test the USDJPY Performance Now!