CiSD MT4

- Indicatori

- Thank-god Avwerosuoghene Odukudu

- Versione: 1.13

- Aggiornato: 5 febbraio 2026

- Attivazioni: 5

Change in State Delivery (CiSD).

Overview:

The Change in State delivery (CiSD) is a microstructure indicator that identifies critical pivotal points where the market (Price delivery Algorithm) shifts its directional focus from seeking liquidity on one side of the market to the other. Specifically, it signals a transition from buyside-driven liquidity to sellside-driven liquidity. CiSD marks the precise opening price that signals fundamental change in market structure and delivery direction.

Notice: If you are new to this concept, please review the ICT instructional videos first. For those already familiar with the material: if the indicator output differs from the lesson, please provide me with the error details along with the specific video name and timestamp.

| Concept & Methodology: |

|---|

What is State Delivery?

State delivery refers to the Market (Price algorithm) active pursuit of liquidity pools. The market operates in distinct "states" where price is delivered either:

- Bullish State Delivery: Actively seeking Buyside liquidity (buystops, sell limits above highs) and premium inefficiencies.

- Bearish State Delivery: Actively seeking Sellside Liquidity (sellstops, buy limits below lows) and discount inefficiencies.

What is Change in State Delivery (CiSD)?

A Change in State Delivery (CiSD) occurs when price transitions from one delivery state to the opposite:

- From Bullish to Bearish: Price stops seeking Buyside liquidity and pivots to target Sellside liquidity.

- From Bearish to Bullish: Price stops seeking Sellside liquidity and pivots to target Buyside liquidity.

The CiSD opening price is the specific candle open that initiates this directional shift. This price level becomes a critical reference point as it marks where the market's intent changed, establishing a new delivery bias.

Key Components

- CiSD Opening Price

- A pivot point for the new directional bias

- A potential invalidation level for the current delivery state.

- A reference for measuring premium/discount zones

- Delivery Direction

- Bullish CiSD: Market now seeks premium inefficiencies and/or Buyside liquidity

- Bearish CiSD: Market now seeks discount inefficiencies and/or Sellside liquidity

- Target Zones

- Premium Inefficiencies: Fair Value Gaps (FVG), imbalances, and unfilled orders above current price

- Discount Inefficiencies: Fair Value Gaps (FVG), imbalances, and unfilled orders below current price

- Liquidity Pools: Buyside (above) or Sellside (below) concentrations

- Combination Targets: Both inefficiencies and liquidity on the same side

The opening price of the candle that triggers the change in state delivery. This price level acts as:

Once a CiSD is identified, the indicator determines the new market directive:

Based on the CiSD, the market will now pursue:

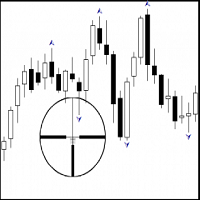

Visual Representation

The indicator displays:

- CiSD Level Line: Horizontal line at the opening price where state change occurred.

- Directional Arrow: Visual indicator showing new delivery direction.

- Color Coding:

- -Bullish CiSD: Blue/Green tones

- -Bearish CiSD: Red/Orange tones

- Label: Text showing "CiSD" with timestamp and price level

Glossary of Terms

- Liquidity: Areas where large numbers of pending orders are concentrated (typically above/below key price levels).

- Buyside Liquidity: Concentration of buy-stop orders above current price (targets for bearish moves).

- Sellside Liquidity: Concentration of sell-stop orders below current price (targets for bullish moves).

- State Delivery: The market's current directional focus in seeking liquidity pools.

- Premium Zone: Price area above a reference level (generally considered "expensive").

- Discount Zone: Price area below a reference level (generally considered "cheap").

- Inefficiency: Price imbalances or gaps where one-directional order flow dominated, leaving unfilled orders.

⚠️ Disclaimer

This indicator is a tool for market analysis and does not guarantee trading profits. Past performance does not indicate future results. Trading forex, stocks, and other financial instruments involves significant risk of loss and is not suitable for all investors. Always use proper risk management and never risk more than you can afford to lose. You should carefully consider your investment objectives, level of experience, and risk appetite before making any trading decisions.

L'utente non ha lasciato alcun commento sulla valutazione.