Squeeze Momentum Plus

- Indicatori

- Quang Huy Quach

- Versione: 1.1

- Aggiornato: 3 settembre 2025

1. Introduction

The Squeeze Momentum Plus is a powerful technical analysis tool designed to help traders identify periods of low market volatility (the "squeeze" phase) and assess the direction and strength of price momentum. This indicator combines the principles of Bollinger Bands and Keltner Channels to detect changes in market volatility, along with a momentum oscillator to measure buying/selling pressure.

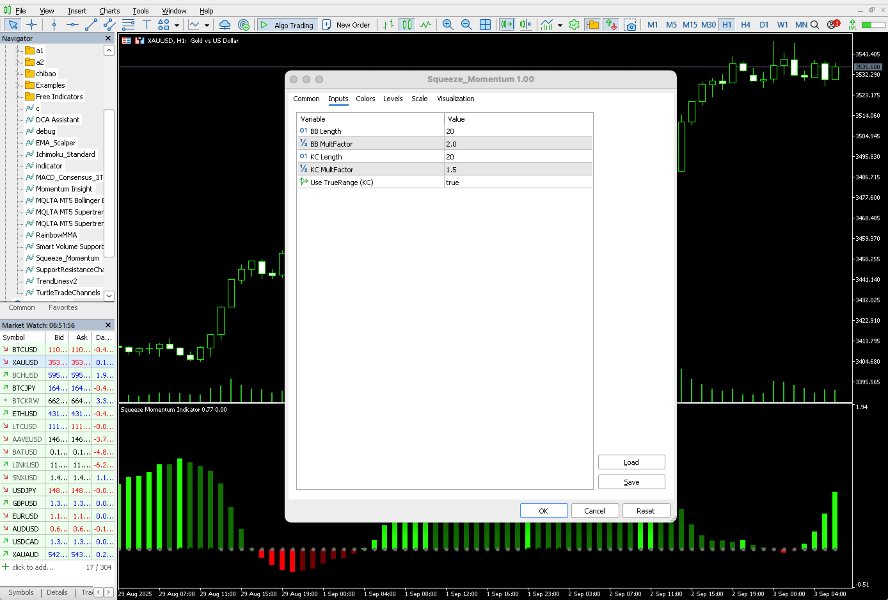

2. Key Components of the Indicator

The Squeeze Momentum Plus is displayed in a separate window below the price chart and consists of two main components:

2.1. Squeeze Dots

These are small dots located on the indicator's zero line, representing the market's volatility state:

- Black Dots (Squeeze On): Appear when the Bollinger Bands are entirely within the Keltner Channels. This indicates a period of very low volatility, often interpreted as a phase of energy accumulation that may precede a significant price move.

- White Dots (Squeeze Off / Release): Appear when the Bollinger Bands expand outside the Keltner Channels. This indicates that volatility is increasing and the "squeeze" state has ended. This visual cue suggests a notable price move may be developing.

- Yellow Dots (No Squeeze): Appear when the market is in an intermediate state, being neither in a clear squeeze nor a release.

2.2. Momentum Histogram

These are colored bars that represent price momentum. The height of the bar indicates the strength of the momentum, and the color indicates its direction and change.

- Bright Green Bars (Lime): Represents positive momentum that is increasing in strength.

- Dark Green Bars (Green): Represents positive momentum that is decreasing in strength. This may suggest a potential slowdown or consolidation.

- Orange Bars (Orange): Represents negative momentum that is increasing in strength.

- Gold Bars (Gold): Represents negative momentum that is decreasing in strength. This may suggest a potential bounce or weakening of selling pressure.

3. How to Interpret the Indicator's Signals

This indicator provides analytical signals based on volatility and momentum. The following interpretations are for technical analysis purposes and do not constitute trading advice.

3.1. Volatility Release

The primary analytical event is the transition from Black Dots to White Dots (Squeeze Off). This indicates that a period of low volatility has concluded and a period of higher volatility is beginning, which often accompanies a significant price movement.

3.2. Momentum Analysis

-

Following a Squeeze Release (White Dots appear):

- If the histogram shows Bright Green (Lime) bars, it suggests the subsequent move is driven by strong and increasing upward momentum.

- If the histogram shows Orange bars, it suggests the move is driven by strong and increasing downward momentum.

-

Assessing Momentum Changes:

- A transition from Bright Green to Dark Green bars indicates that upward momentum is weakening.

- A transition from Orange to Gold bars indicates that downward momentum is weakening.

- This weakening of momentum can suggest a potential pause or reversal in the current price move.

-

Momentum Shift:

- When the histogram crosses the zero line from positive to negative (or vice-versa), it signals a fundamental shift in the direction of market momentum.

4. Important Considerations

- Combine with Other Tools: The Squeeze Momentum Indicator works best when used with trend-identifying tools, support/resistance levels, or other confirming indicators.

- Not a Perfect Signal: No indicator is foolproof. False signals can occur.

- Timeframes: The indicator can be used on various timeframes, but effectiveness and signal frequency may vary.

- Risk Management: Always adhere to strict risk management principles.

5. Disclaimer

The information in this document is for informational and educational purposes only. Financial trading carries high risks and may result in the loss of capital. You should seek advice from a financial professional before making any trading decisions.