Rejoignez notre page de fans

- Vues:

- 18606

- Note:

- Publié:

- Mise à jour:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

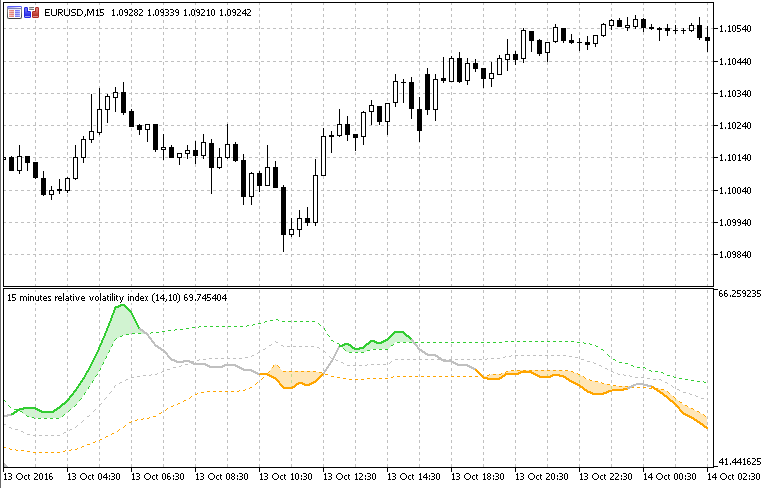

This indicator can use the fixed levels too (as the "basic" version — when floating level period is set to <=1)

but in that case it clearly shows how introducing floating levels can

completely change the nature of the indicator. This indicator has the

floating levels (which you can turn off by setting the floating levels

to less than 1), and it seems that it really needed something like that

(like all RSI like indicators, long periods of relative volatility index

tend to get flatter and flatter, and then the fixed levels are becoming

useless).

Deviation from the original calculation is that

smoothing is added. Without smoothing (when smoothing is set to <=

1), the results is "jumpy" and in order to avoid that kind of too much

signals, smoothing was added. Even longer periods of smoothing can be

used (it does not cause significant lag) — but some experimenting is

advised.

T3_Double Bands

T3_Double Bands

Three T3s calculated: of high (upper line), close (middle line) and low (lower line).

Nonlag_MA_MACD

Nonlag_MA_MACD

MACD variation that uses Nonlag MA.

Step Stochastic

Step Stochastic

The upgraded version of Stochastic without repainting.

DT Oscillator

DT Oscillator

It is a DT oscillator as described by Robert Miner with some additional features.