Market Condition Evaluation based on standard indicators in Metatrader 5 - page 87

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.15 07:49

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

Slowing inflation in the U.K. may spur a larger correction in the GBP/USD as it allows the Bank of England (BoE) to retain its highly accommodative policy stance for an extended period of time.

What’s Expected:

Why Is This Event Important:

The BoE may further delay its exit strategy in an effort to address the ongoing slack in the U.K. economy, but Governor Mark Carney may show a greater willingness to normalize monetary policy sooner rather than later as the central bank anticipates a stronger recovery in 2014.

Easing input prices paired with the slowdown in private sector credit may prompt businesses to offer discounted prices to U.K. households, and a weaker-than-expected inflation print may generate a larger pullback in the GBP/USD as it raises the BoE’s scope to retain its highly accommodative policy stance for an extended period of time.

Nevertheless, the resilience in household consumption along with the pickup in wage may encourage U.K. firms to raise consumer prices, and a stronger-than-expected CPI print may heighten the bullish sentiment surrounding the British Pound as it fuels interest rate expectations.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Slows to 1.6% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBPUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Headline & Core U.K. Inflation Exceeds Market Expectations- Need green, five-minute candle to favor a long GBPUSD trade

- Implement same setup as the bearish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBP/USD Weekly

GBP/USD H4

February 2014 U.K. Consumer Price Index

GBPUSD M5 : 24 pips price movement by GBP - CPI news event :

The YoY figure for U.K. CPI came in at 1.7% as expected and the MoM figure at 0.5%. The Pound saw a move to the upside that was quickly retraced, but the GBPUSD pair ended the day up 45 pips from the release. As for insight into this print, if we do see CPI come in under market expectation it is likely that we may see GBP weakness. This may be especially pronounced in the context of a possible double top and resurgence of USD strength post-Retail Sales that came in better than expected on Monday morning in NY.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.15 10:48

2014-04-15 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - CPI]

if actual > forecast = good for currency (for GBP in our case)

==========

Slight fall in Inflation to 1.6% in March 2014

The rate of inflation faced by households fell to 1.6% in the year to March 2014. The Consumer Prices Index (CPI) – the headline measure of inflation – grew by 1.6% in the year ending March 2014, down from 1.7% in February. Putting the CPI figure into context, a basket of shopping that cost £100.00 in March 2013 would have cost £101.60 in March 2014.

CPIH, the measure which includes owner occupiers’ housing costs, grew by 1.5%, down from 1.6% in February. RPIJ, the improved variant of the Retail Prices Index (RPI) calculated using formulae that meet international standards, grew by 1.8%, down from 2.0%.

The slowdown in inflation came primarily from the price movements of motor fuels. Petrol prices were unchanged between February and March this year compared with a rise of 2.2 pence per litre between the same two months a year ago. Diesel prices fell by 0.4 pence per litre this year compared with a rise of 1.9 pence per litre in 2013.

Other smaller downward effects came from clothing and furniture & household goods. In each case, prices rose between February and March 2014 but by less than between the same two months a year ago.

The most notable, partially offsetting, upward effects came from the restaurants & hotels and alcohol & tobacco sectors. With the former, prices for accommodation services rose by more between February and March 2014 than between the same two months of 2013. With the latter, the upward contribution came principally from spirits.

It is also worthwhile thinking about the sectors that contribute to the actual rate of inflation (i.e. what makes up the 1.6%) in addition to the sectors that contribute to changes in the rate (i.e. what made inflation change from 1.7% to 1.6%). For most recent months, prices in the housing, water, electricity, gas & other fuels sector have been the largest contributor to the inflation rate and currently account for a quarter of inflation. On the other hand, motor fuels are currently having a downward pull on inflation with prices down by 6.6% in the year to March. Average petrol prices were around £1.29 per litre in March 2014 compared with over £1.38 per litre a year earlier.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.04.15

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 60 pips price movement by GBP - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.18 07:54

Japan Tertiary Industry Index Plunges In February

An index measuring tertiary industrial activity in Japan was down a seasonally adjusted 1.0 percent on month in February, the Ministry of Economy, Trade and Industry said on Friday - standing at 100.6.

That was well shy of forecasts for an increase of 0.2 percent following the 0.9 percent jump in January.

Among the individual components of the survey, activity was down for accommodations, finance, transportation, wholesale trade, real estate and health care.

Activity was up for communications and utilities; learning support was flat.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.21 20:46

Market Condition - With Forex Volatility So Low, How Might we Trade?- US Dollar trades at potentially important resistance, Euro at key support

- Forex volatility prices trade near record-lows, setting up for slow moves ahead

- We’re focusing on range trading opportunities in all except the JPY pairs

The US Dollar continues to stick to tight ranges versus the Euro, Japanese Yen, and other counterparts. How might we trade if forex volatility continues to drop?Watch the video above and updated automated strategy outlook below. What happens when volatility inevitably surges?

Definitions

Volatility Percentile – The higher the number, the more likely we are to see strong movements in price. This number tells us where current implied volatility levels stand in relation to the past 90 days of trading. We have found that implied volatilities tend to remain very high or very low for extended periods of time. As such, it is helpful to know where the current implied volatility level stands in relation to its medium-term range.

Trend – This indicator measures trend intensity by telling us where price stands in relation to its 90 trading-day range. A very low number tells us that price is currently at or near 90-day lows, while a higher number tells us that we are near the highs. A value at or near 50 percent tells us that we are at the middle of the currency pair’s 90-day range.

Range High – 90-day closing high.

Range Low – 90-day closing low.

Last – Current market price.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.23 20:31

Trading the News: Reserve Bank of New Zealand Interest Rate Decision (based on dailyfx article)

According to a Bloomberg News survey, all of the 15 economists polled anticipate the Reserve Bank of New Zealand (RBNZ) to deliver another 25bp rate hike in April, but the statement accompanying the rate decision may have a greater impact on the NZD/USD as market participants weigh the outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

Indeed, fresh commentary from RBNZ Governor Graeme Wheeler may keep the New Zealand dollar afloat as the board retains a hawkish tone for monetary policy, and NZD/USD may continue to carve higher highs & higher lows should the central bank continue to deliver a series of rate hikes in 2014.

The RBNZ may lay out a more detailed exit strategy amid the pickup in global trade along with the ongoing improvement in the labor market, and a further shift in the policy outlook should prop-up the higher-yielding currency as the central bank moves away from its easing cycle.

However, the RBNZ may sounds less hawkish this time around as the cooling housing market reduces the threat of an asset-bubble, and the New Zealand dollar may face a larger decline in the days ahead should the central bank soften its approach in normalizing monetary policy.

How To Trade This Event Risk

Bullish NZD Trade: RBNZ Pledges More Rate Hikes for 2014

- Need green, five-minute candle following a hawkish statement to consider a long NZD/USD trade

- If market reaction favors a long Kiwi trade, buy NZD/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bearish NZD Trade: Governor Wheeler Softens Hawkish Tone for Monetary Policy- Need red, five-minute candle to favor a short NZD/USD trade

- Implement same strategy as the bullish New Zealand dollar trade, just in opposite direction

Potential Price Targets For The Rate DecisionNZD/USD Daily

March 2014 Reserve Bank of New Zealand Interest Rate Decision

NZDUSD M5 : 115 pips price movement by NZD - Interest Rate :

As expected, the RBNZ upped its official cash rate to 2.75% at the March meeting from 2.50% previously. Although we saw chop at the print, the NZD/USD rate went as high as 130 pips from the rate at the release. Once again it is expected that we will see a 25bps hike in rates, although weaker than expected CPI data for the month of March does pose a risk. The RBNZ could choose to hold back on a rate hike and let such a failure to raise rates weaken the Kiwi exchange rate. A surprise of more than 25bps in hikes could help the Kiwi regain strength lost over the past two weeks.

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.04.24

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 42 pips price movement by NZD - Interest Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.25 07:50

Trading the News: U.K. Retail Sales (based on dailyfx article)

The British Pound may face a larger correction over the remainder of the week as U.K. Retail Sales are expected to contract 0.5% in March.

What’s Expected:

Why Is This Event Important:

A decline in private sector consumption may prompt a bearish reaction in the GBP/USD as it limits the Bank of England’s (BoE) scope to normalize monetary policy sooner rather than later, but the data print may exceed market expectations as Governor Mark Carney sees a stronger recovery in 2014.

Sticky price growth along with the slowdown in private sector credit may drag on consumption, and a marked decline in retail sales may prompt a larger pullback in the GBP/USD as it dampens the outlook for growth and inflation.

Nevertheless, positive real wage growth paired with the ongoing improvement in the labor market may prompt a further expansion in household spending, and a better-than-expected print may heighten the appeal of the sterling as it puts increased pressure on the BoE to raise the benchmark interest rate off of the record-low.

How To Trade This Event Risk

Bearish GBP Trade: U.K. Retail Sales Disappoints

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Household Spending Unexpectedly Picks Up- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

February 2014 U.K. Retail Sales

GBPUSD M5 : 64 pips price movement by GBP - Retail Sales news event

Retail sales out of the U.K. beat across the board in February and sent GBP over 50 pips higher against the greenback. Textiles saw heavy weakness relative to other stores while predominantly food stores had a healthy 1.9% gain vs. a 3.7% decline in January. After the Pound pulled off key resistance levels on Wednesday, room remains for another test of resistance if we do see another beat this month. Note that we have U.K. GDP data to kick off event risk on Tuesday of next week.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.04.25

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 30 pips price movement by GBP - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.29 07:17

Trading the News: U.K. Gross Domestic Product (based on dailyfx article)

The advance U.K. 1Q Gross Domestic Product (GDP) report may generate fresh highs in the GBP/USD as the stronger recovery in Britain puts increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

A pickup in economic activity may heighten the bullish sentiment surrounding the British Pound as it puts increased pressure on the Bank of England (BoE) lift the benchmark interest rate off the record-low, and Governor Mark Carney do little to halt the appreciation in the sterling as it helps to achieve the 2% target for inflation.

The resilience in private sector consumption along with the ongoing improvement in the labor market may prompt a marked pickup in the growth rate, and an upbeat GDP report may spur fresh highs in the GBP/USD as it raises the outlook for growth and inflation.

Sticky price growth paired with efforts to cool the housing market may generate a weaker-than-expected GDP print, and a dismal development may spur a larger correction in the GBP/USD as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Economic Recovery Accelerates

- Need green, five-minute candle following the GDP print to consider a long British Pound trade

- If market reaction favors a bullish sterling trade, buy GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: 1Q GDP Disappoints- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

1Q 2014 U.K. Gross Domestic Product (GDP)

GBPUSD M5 : 35 pips price movement by GBP - GDP news event

The GBPUSD pair was almost unchanged on the hour and day following fourth quarter GDP results for 2013. The that print the pair traded lower until February 5th and has been on the rise ever since. The breakdown of the results show that distribution, hotels % restaurants outperformed last quarter while electricity/gas, forestry & fishing lagged compared with the third quarter. Current market expectations are calling for a 0.9% QoQ and 3.2% YoY rise.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.04.29

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 46 pips price movement by GBP - GDP news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.01 12:55

2014-05-01 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

if actual > forecast = good for currency (for GBP in our case)

==========

UK Factory Growth At 5-month High

The U.K. manufacturing sector expanded at the fastest pace in five months during April, led by faster growth in output and new orders, survey data from Markit Economics showed Thursday.

The seasonally adjusted Markit/Chartered Institute of Purchasing & Supply Purchasing Manager's Index climbed to 57.3 in April from 55.8 in March, which was revised from 55.3. Economists had forecast a score of 55.4.

Factory output growth hit an eight-month high with gains across the consumer, intermediate and investment goods sectors. New order growth climbed to its highest in three months, led by improved demand from both domestic and export markets.

Employment grew for the twelfth successive month and the pace of increase equaled February's near 3-year peak. Firms expanded capacity to met higher production in the face of rising demand.

Input prices fell for a second straight month, but the latest fall was only moderate and slower than that signaled in the previous month. Output prices rose for the tenth successive month as companies raised prices due to strong demand and efforts to improve operating margins.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.05.01

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 30 pips price movement by GBP - Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.07 16:42

2014-05-07 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

==========

Yellen: Economy Improving But Rates To Remain Low

Slack in the labor market and low inflation will keep interest rates near zero even as the broader economy gradually improves, Federal Reserve Chair Janet Yellen told Congress Wednesday morning.

In remarks prepared for her semi-annual testimony before the Joint Economic Committee, Yellen expressed concerns about slow wage growth, high levels of long-term unemployment and those people working part-time who want full-time work.

The U.S. economy is picking up after a winter lull brought on by unusually bad weather across much of the country, but the labor market is "far from satisfactory" despite the unemployment rate falling to 6.3 percent in April.

"With the harsh winter behind us, many recent indicators suggest that a rebound in spending and production is already under way, putting the overall economy on track for solid growth in the current quarter," Yellen said.

She expects growth will expand at a "somewhat faster pace" this year than the 1.9 percent growth rate seen in 2013.

However, inflation is likely to run below the Fed's 2 percent target, so a high degree of monetary accommodation remains warranted for the foreseeable future, according to Yellen.

The recent housing market slowdown "could prove more protracted than currently expected," and could prevent a more robust recovery from a weak first quarter that saw the economy grow only 0.1 percent.

"Adverse developments abroad, such as geopolitical tensions or an intensification of financial stresses in emerging market economies" also pose a risk to the economic outlook.

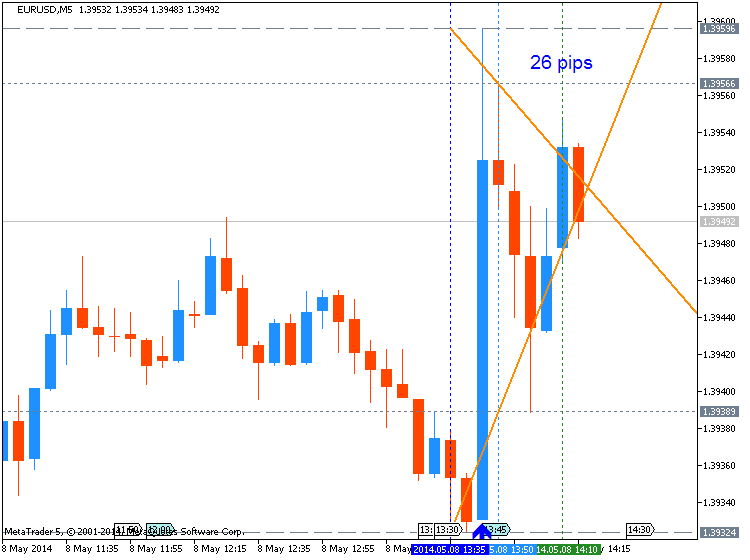

EURUSD M5 : 26 pips price movement by USD - Fed Chair Yellen Speech news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.08 12:01

Trading the News: European Central Bank Interest Rate Decision (based on dailyfx article)

According to a Bloomberg News survey, 56 of the 58 economists polled anticipate the European Central Bank (ECB) to retain its current policy in May, but the EUR/USD may struggle to hold its ground should President Mario Draghi show a greater willingness to further embark on the easing cycle.

What’s Expected:

Why Is This Event Important:Indeed, the ECB is coming under increased pressure to implement more non-standard measures amid the persistent threat for deflation, and we may see the central bank lay the groundwork to ease policy further in the coming months as the Governing Council struggles to achieve its one and only mandate to preserve price stability.

Subdued price growth paired with the ongoing contraction in private sector lending may prompt the ECB to adopt a more dovish outlook for monetary policy, and we may see the EUR/USD give back the advance from the beginning of the month should the fresh batch of central bank rhetoric drag on interest rate expectations.

However, the ECB may stick to the sidelines amid the positive developments coming out of the monetary union, and the EUR/USD may continue to carve higher highs & higher lows in May should the central bank remain reluctant to implement more non-standard measures.

How To Trade This Event Risk

Trading the ECB interest rate decision may not be as clear cut as some of our other trade setups as the press conference with President Draghi ends with a Q&A session

Bearish EUR Trade: ECB Ramps Up Dovish Tone/Sets Expectations for More Easing

- Need red, five-minute candle following the decision/statement to consider a short Euro trade

- If market reaction favors a short trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Retains Wait-and-See Approach- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Potential Price Targets For The Rate DecisionEUR/USD Daily

April 2014 European Central Bank Interest Rate Decision

EURUSD M5 : 32 pips price movement by EUR - Interest Rate news event

The ECB kept rates on hold once more in April and stated that the central bank was not excluding the use of unconventional tools if needed. Although the rate decision sent the Euro higher, when Draghi took the stage and said that the use of unconventional tools was a possibility, we saw Euro weakness across the board. Volatility was relatively weak as has been the case over the last few weeks. Market participants will note Draghi’s language in regards to the Euro as he has become more comfortable in using his position to talk down the Euro.

EURUSD M5 : 26 pips price movement by EUR - Interest Rate news event