You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2014-04-17 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

if actual > forecast = good for currency (for AUD in our case)

==========

Business confidence still high, says NAB

Things are getting better for Australian businesses, with confidence still at elevated levels and trading conditions on the improve.

The National Australia Bank business survey for the March quarter found business confidence fell two points to six points.

A reading above zero indicates optimists outweigh pessimists.

Despite a dip in confidence in the first three months of the year, it was still a positive result, NAB chief economist Alan Oster said.

"Confidence has been generally trending higher across the board and is still positive for most industries," he said.

"Mining is still the only sector to have a negative confidence index.

"An anticipated decline in many commodity prices, coinciding with rising global supplies and a moderating demand outlook for China, is weighing on mining firms."

Business conditions rose to their highest levels in 18 months, up two index points to zero.

Mr Oster said business conditions were still soft however, despite gradual improvement.

"Forward indicators point to further modest improvements over coming months, but still indicate below trend rates of growth and soft demand for labour," he said.

"Despite a lift in trading conditions, weak demand continues to be the biggest constraint on output, with almost 60 per cent of firms reporting a want of sales and orders.

"This may start to ease over coming quarters with firms starting to report improving forward orders."

Seasonal Forces May Overshadow German PPI, US Claims Data

The Japanese Yen outperformed in overnight trade as the Nikkei 225 benchmark stock index declined, boosting demand for the safe-haven currency. Comments from Bank of Japan Governor Haruhiko Kuroda likewise helped. The central bank chief said policymakers’ easing effort is having the intended impact, with the economy moving toward the 2 percent inflation target. The remarks hinted the BOJ may not be quick to expand its easing effort, a move that has been the subject of heavy speculation as softening economic data and April’s 3 percent increase in the sales tax threatened the central bank’s deflation-fighting goals.

The March set of German PPI figures headlines an otherwise uneventful economic calendar in European hours. The pace of wholesale deflation is expected to moderate a bit, with the gauge posting a year-on-year drop of 0.7 percent compared with a 0.9 drawdown in the prior month. While the PPI print is typically not very market-moving, the absence of alternative catalysts may see the report generate some interest, particularly given the pickup in ECB stimulus expansion bets recently. With that in mind, a disappointing print is likely to weigh on the Euro amid a swell in easing expectations, and vice versa.

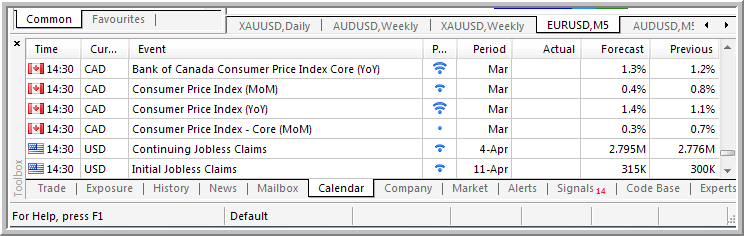

The US economic calendar is rather light as well, with the weekly set of Jobless Claims numbers on tap. Economists are penciling in mild increases in initial and continuing applications for unemployment benefits. US data flow has started to show notable signs of improvement relative to expectations over the past two weeks, opening the door for an upside surprise. A sizeable-enough positive deviation from consensus forecasts may further erode doubts about the continuity of the Fed’s QE “tapering” cycle, bolstering yield-based support for the US Dollar.

Seasonal considerations are likewise important to bear in mind. Most major financial markets will be closed for the Good Friday holiday, meaning today marks the end of the trading week for a considerable share of investors. In fact, key exchanges in Europe as well as Hong Kong and Australia will be closed through Monday of next week. That means a period of protective profit-taking ahead of the long gap normal trading conditions may be a meaningful driver of volatility in the hours ahead, opening the door for reversals in prevalent trends. Ebbing pre-holiday liquidity may amplify such moves, warning those traders still holding open exposure to tread cautiously in the near term.

USD/CNH: Chinese Yuan Depreciation to Blame on Gold Selloff?

In March we touched on the fact that China (consuming half of copper trade per annum) was using 80% of their imports as pure loan collateral and/or to get around capital controls. When the People’s Central Bank of China began to widen the Yuan band in the face of slowing growth and as to target some shadow financing vehicles, we saw heavy selling of copper as some highly leveraged commodity backed loans were unwound. The recent run-up in gold prices combined with the highest USD/CNY fixing rates in months may have forced the unwinding of some extremely overleveraged positions. Although the systems of financing are often complex as we saw with copper, gold has been used for some even more complex and lucrative structures surrounding the skirting of capital controls. Yesterday, USD/CNH hit its highest level since February of 2012.

In regards to the depreciating Yuan, political pressure continues to build with Treasury officials warning the Chinese not to weaken the Yuan for their economic benefit. Meanwhile, the daily reference rates out of the PBoC continue to move higher toward the ominous 6.25 mark. That is said to be the level where a large concentration of leveraged financial vehicles may experience some serious stresses. A run towards and through that mark could be quick and does provide trading opportunities for those who keep tabs on Chinese credit markets during these volatile and uncertain times.

Note: USD/CNH vs. USD/CNY

“CNH is an offshore version of the RMB introduced by the Hong Kong Monetary Authority and People's Bank of China which allows investors outside of mainland China to gain exposure to the RMB.”

Trading the News: Canada Consumer Price Index (based on dailyfx article)

A rebound in Canada’s Consumer Price Index (CPI) may spur a near-term pullback in the USD/CAD as it dampens bets of seeing the Bank of Canada (BoC) further embark on its easing cycle.

What’s Expected:

Event Important:

Heightening price pressures may keep the BoC on the sidelines as it limits the threat for deflation, and Governor Stephen Poloz may endorse a more neutral tone for monetary policy as the central bank head sees a ‘soft landing’ in the Canadian economy.

Rising input costs paired with the pickup in private sector consumption may encourage Canadian firms to boost consumer prices, and a marked uptick in the CPI may spur a near-term pullback in the USD/CAD as it limits the threat for deflation.

However, the headline reading for inflation may continue to undershoot amid the slowing housing market along with the downturn in business sentiment, and a weaker-than-expected CPI print may heighten the bearish sentiment surrounding the Canadian dollar as it puts increased pressure on the BoC to further embark on its easing cycle.

How To Trade This Event Risk

Bullish CAD Trade: Price Growth Climbs 1.4% or Greater

- Need red, five-minute candle after the CPI report to consider short USD/CAD entry

- If the market reaction favors a bullish Canadian dollar trade, establish short with two position

- Set stop at the near-by swing high/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish CAD Trade: Canada Consumer Prices Disappoint- Need green, five-minute candle following the release to look at a long USD/CAD trade

- Carry out the same setup as the bullish loonie trade, just in reverse

Potential Price Targets For The ReleaseUSD/CAD Daily

USDCAD M5 : 55 pips price movement by CAD - CPI news event :

2014-04-17 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - CPI]

if actual > forecast = good for currency (for CAD in our case)

==========

U.S. Jobless Claims Remain Steady, Pointing to Recovering Labor Market

New jobless claims applications in the U.S. remained close to the levels last seen before the recession in the week ending April 12, while factory production in the Mid-Atlantic region gained this month, indicating the economy is recovering from the negative effect of the extreme winter weather.

Fresh applications for state unemployment benefits rose 2,000 to 304,000 last week, reported the Labor Department on Thursday, though they still hovered near a 6 ½ -year low that was recorded the previous week. It was also lower than the economists’ prediction of 315,000 fresh applications, according to a Reuters survey.

"The data add further evidence to the notion that the economy has exerted positive momentum at the start of the second quarter," Sam Bullard, a Charlotte, North Carolina-based senior economist at Wells Fargo Securities told Reuters.

The claims survey covered nonfarm payrolls. Nonetheless, despite surging last week, fresh unemployment claims have declined 19,000 between March and April, indicating that the labor market is improving. The average job growth per month in February and March was 195,000 per month, while the unemployment rate held steady at 6.7 percent.

An improving job market may raise the possibility that the Fed will hike benchmark interest rates, which have hovered near zero since December 2008.

Separately, the Philadelphia Federal Reserve Bank announced that the state’s business activity index rose to 16.6 in April, compared to 9.0 in March. The reading, which exceeded economists’ estimates of an increase to 10.0, was the strongest in 7 months. A figure above zero shows the state’s manufacturing industry, which straddles Delaware, southern New Jersey and eastern Pennsylvania, has expanded.

New shipments and orders also rose, while factory hiring rose and workers worked more hours than in March.

Japan Tertiary Industry Index Plunges In February

An index measuring tertiary industrial activity in Japan was down a seasonally adjusted 1.0 percent on month in February, the Ministry of Economy, Trade and Industry said on Friday - standing at 100.6.

That was well shy of forecasts for an increase of 0.2 percent following the 0.9 percent jump in January.

Among the individual components of the survey, activity was down for accommodations, finance, transportation, wholesale trade, real estate and health care.

Activity was up for communications and utilities; learning support was flat.

Wal-Mart Ventures Into Money Transfer Service

Wal-Mart intends to offer a money transfer service in a bid to keep its customers buying more from its store.

The largest retailer in the world announced a new money transfer service today, which it says will reduce fees by as much as 50% compared with competition. Dubbed Walmart-2-Walmart, the service will be implemented in conjunction with Ria Money Transfer, a Euronet Worldwide subsidiary.

According to Bloomberg, shares of similar money transfer firms MoneyGram and Western Union plunged almost immediately on the developments.

Wal-Mart customers will be able to start using the service on April 24. The service allows them to move as much as $900 to and from the retailer’s US stores, which are more than 4,000.

The move is quite significant and could be something of a paradigm shift in the industry, potentially triggering a pricing battle.

With the service, up to $50 is transferable for a $4.50 service fee while it will cost $9.50 to move $900.

Wal-Mart said that other similar service providers may charge up to $70 to aid the transfer of less than $1000.

As USA Today reports, Western Union’s New York transfer fees for $900 as indicated on the firm’s website are in the range of $20 if a bank account is used and $85 using a credit or debit card.

The latest developments expand Wal-Mart’s financial provisions for its customers, especially the unbanked. The firm’s other financial services include tax preparation and prepaid debit cards.

MoneyGram wasn’t immediately available for comment. However, Western Union told The Associated Press via an email statement that, “Our retail product and service offerings today are already quite diverse. The company is well positioned in the U.S. domestic money transfer space, having offered a fee of $5 for $50 since 2009.”

Wal-Mart is trying to bolster foot traffic to its brick and mortar stores.

Trading Video: Liquidity Delays EURUSD, GBPJPY, Yen Setups

Great trading opportunity lies ahead, but expectations must be reasonable for when and where we can act. The final trading day of this week will be drained of liquidity due to the observation of a market holiday for many regions, and the subsequent conditions curb the necessary developments we need to instigate the seismic shift that we are inevitably heading towards. In today's trading video, we discuss why short-term trade setups are ill-advised but why medium-term setups for the likes of EURUSD, GBPUSD and others offer considerable opportunity.

AUDUSD Technical Analysis (adapted from this article)

The Australian Dollar declined as expected against its US counterpartafter the pair put in a Shooting Star candlestick below the 0.95 figure. The pair is now testing support at 0.9325, the 23.6% Fibonacci retracement, with a break downward on a daily closing basis initially exposing the 38.2% level at 0.9242. Alternatively, a move above trend line support-turned-resistance at 0.9429 aims for the April 10 highat 0.9460.

Prices are trading too close to relevant support to make a short trade attractive from a risk/reward perspective. We will continue to stand aside for now, waiting for an actionable opportunity to present itself.