A strategy with which to get into shorts. Usually before the cut-off, on stocks that can be shorted, JUNE JULY Harvest

This mechanism works perfectly

A couple of days - maybe three to four days before the cut-off date - we go short on the instrument and get a wonderful gain

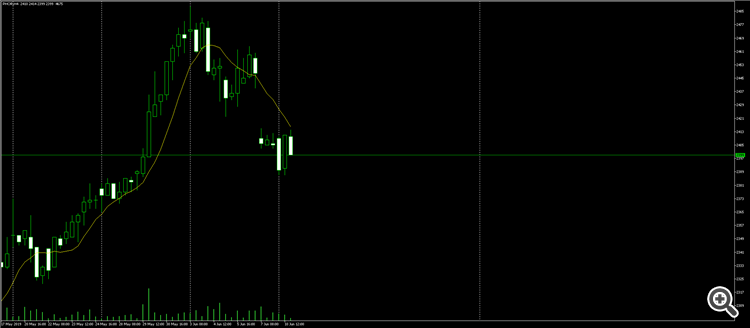

exampleMRKV , cut-off date 10.06.2019

Were there buyers there at the time?

I have never experienced a refusal, for example in forex, no price, no connection with the server and other tricks of the trickery is the norm, there are no such problems in the stock market.

I mean on a grown-up stock market, when your shares are properly in the register of shareholders, you are listed - if you were in the stock before the cut-off date, the firm that sold your shares has your details as a shareholder and you can even take part in shareholder meetings.

You don't sell a stake of, say, 51% of all the company's shares - it's no problem to go short :-)

Here the strategy simply means that you do not have this security, otherwise there is no point in selling it - it is logical to receive dividends.

And if the stock does not exist in the portfolio, it would be correct to take it short before the cut-off and obtain an income comparable to the dividends.

But for example I would be afraid to short on Sberbank - a very liquid security - the most liquid in the market - not sure that it will fail during a cut-off.

But if there is no share in the portfolio, then it would be very correct to short it before the cut-off and get an income commensurate with the dividends.

For example, I would be wary of shorting Uber, which is a very liquid security - the most liquid in the market - so it is not certain that it will fail at the cut-off.

My broker sends notices before the cut-off, for shorting enthusiasts, about the increased commission just by the dividend amount.

Here is an example:

Dear clients!

We would like to inform you that in connection with the drawing up on 11.06.2019 of the list of persons entitled to receive dividends on shares of PJSC "MMK" (hereinafter - the Issuer), for the conclusion of Special Repo transactions, on the first part of which clients buy shares of common stock of the Issuer (short positions), on 11.06.2019 the Bank's commission will be increased by an amount equal to 1.398 rubles. (the amount of dividends per share announced by the Issuer) multiplied by the number of securities under the above-mentioned Special Repo Transactions.

My broker sends a notice before the cut-off, for shorting enthusiasts, about the increased commission just by the dividend amount.

Generally speaking, bullshit. Usually there are futures on most shorting stocks. Sell the futures and live in peace. But there are also nuances in the form of backwardation.

I read the thread about this strategy. It turns out that you need a single account. But it is not clear to me what the profit is made of. For example, I have bought a stock. I observe that the futures contract is more expensive than the underlying asset (contango). I sell it. And then what? Wait for it to expire? Or not? Does this mean that the profit from such a transaction will be approximately equal to the reference interest rate?

I read the thread about this strategy. It turns out that you need a single account. But it is not clear to me what the profit is made of. For example, I have bought a stock. I observe that the futures contract is more expensive than the underlying asset (contango). I sell it. And then what? Wait for it to expire? Or not? So my profit on such a trade will be approximately equal to the base interest rate?

If we wait, then the base rate. If we don't wait, we close at backwardation.

I see. So we have no shares, we just sell the futures before the cut-off, then we buy them back.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This mechanism works perfectly

A couple of days - maybe three to four days before the cut-off date - we go short on the instrument and get a wonderful gain

exampleMRKV , cut-off date 10.06.2019