A strategy with which to get into shorts. Usually before the cut-off, on stocks that can be shorted, JUNE JULY Harvest - page 15

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Have you been graphing? A candlestick chart or a potick chart? To estimate maximum returns and how long do they last?

Added:

Yes, I can see a candlestick chart from Dimitri. More of a candlemaking interest... i.e. showing max/min yield per candle

yes it's a comrade prostotradera's development

This is not "lousy FOREX", but a leading company in Russia (Sberbank), no longer cancelled, not even reduced, only increased (which is also unbelievable).

Anything can happen.

They have already postponed dividend payments once, and in the 90s they ditched everyone and still haven't paid them back.

It's a state-owned company, it will get paid off.

Anything can happen.

The dividend payment has already been postponed once, and in the 90s they screwed everyone until now, and they still haven't paid it off.

It's a state-owned company, it will get paid off.

You're such a pessimist :)

Consequences of sitting at home (coronovirus)?Now I'm looking at yesterday's prices and I don't understand something.

In this strategy, as far as I understand, we profit from contango and dividends. Dividends make sense. But the contango is not so clear. I look at the price of futures SBRF-9.20 at the time of one of your transactions (13.04 14:19): 19611 (taken from the flipper, approximately estimate). Looking at the spot price at that point: 199 (again, roughly). Question: where's the contango? Backwardation after all....

Accordingly, when you buy the stock and sell the futures, don't you lock in a loss at that point (yesterday)?Now I'm looking at yesterday's prices and I don't understand something.

In this strategy, as far as I understand, we profit from contango and dividends. Dividends make sense. But the contango is not so clear. I look at the price of futures SBRF-9.20 at the time of one of your transactions (13.04 14:19): 19611 (taken from the flipper, approximately estimate). Looking at the spot price at that point: 199 (again, roughly). Question: where's the contango? Backwardation after all...

Accordingly, when you buy the stock and sell the futures, do you not record a loss at that point (yesterday)?If I understand this strategy correctly. When there is a backwardation one should buy the futures. From the pictures I understand that the September futures were bought and the June futures were sold.

If I understand this strategy correctly. When backwardation you have to buy futures. I understood from the pictures that the September futures were bought and the June futures were sold.

No. The stock was bought and the 9.20 futures were sold - 100%. If you look carefully at the screenshots, at 2pm there were -21 contracts and 210 shares respectively. And at 18 o'clock it was -53 futures contracts (53 lots sold) and consequently 530 shares were bought. We have to buy shares to get divs.

But we should only buy shares and sell futures when the contango is in place. And we have backwardation (the futures are worth less than the spot).

Added:

The only thing that comes to mind is that we are "sacrificing" key rate yields to get giant divs. But divs of 18.7p at a share price of 199p is clearly not the 14% we're talking about.

But, frankly, what is there to analyse that is not in real time?

Prices change, dividends are paid at different times, and their size varies.

Not in real time I would like to see the history. Namely, how long the spread lasts and how often/probably it is possible to make a profit on the backwardation before the futures expire (how likely it is to increase the yield).

No. Shares were bought and futures 9.20 - 100% were sold. If you look carefully at the screenshots, at 2pm there were -21 text contracts and 210 shares respectively. And at 18 o'clock it was -53 futures contracts (53 lots sold) and consequently 530 shares were bought. We have to buy shares to get divs.

But we should only buy shares and sell futures when the contango is in place. And we have backwardation (the futures are worth less than the spot).

Added:

The only thing that comes to mind is that we are "sacrificing" key rate yields to get giant divs. But divs of 18.7p at a share price of 199p is clearly not the 14% we're talking about.

It could be that the main calculation is on dividends.

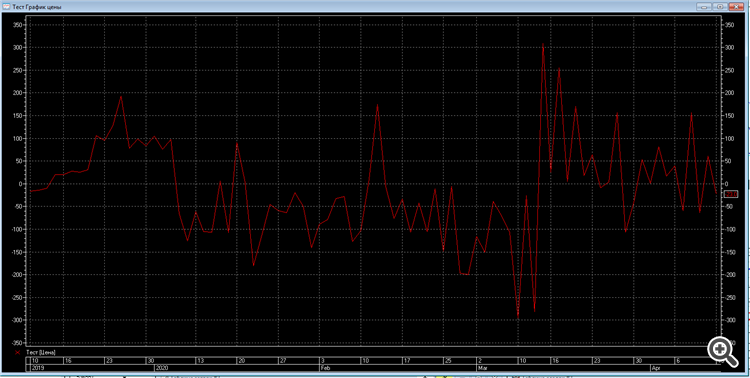

I found a function in QuickBooks called "basket of instruments". I created a test basket and added minus 1 contract magnet futures 06.20 and plus 1 lot of magnet share (magnet 1 futures equals 1 share) I got a picture like this.

It turns out that this basket can be used to monitor contango and backwardation.

It could be that the main calculation is on dividends.

Found a function in QuickBooks called "basket of instruments". I created a test basket and added there minus 1 contract magnet futures 06.20 and plus 1 lot of magnet share (magnet 1 futures equals 1 share) I got a picture like this.

It turns out that you can use this basket to keep track of contango and backwardation.

Probably you can, but it won't tell you the annual percentage. But of course, it's better than nothing.

Probably you can, only she won't tell you the annual percentage. But of course, it's better than nothing.

I wrote a script in Lua to calculate the percentage. And you can use this picture to track the dynamics. So, if it is minus then it is contango, if it is plus then it is backwardation. If we look at the chart, we can see that contango was close on the 10th of March with the price 295.5 rubles (11%), and minimum was 458.0 rubles (18%)

If you monitor it manually, you can calculate the percentage beforehand and add the line (level) to the chart.