You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Currency Strength MQL5

forcodes, 2020.04.08 23:41

This is just a video showing the method I use to calculate currency strength, that works for me. Hope it helps someone:

Candlesticks - Harami

Forum

Libraries: MQL5 Wizard - Candlestick Patterns Class

newdigital, 2013.09.16 18:44

Hammer

The Hammer candlestick formation is a significant bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends.

The Hammer formation is created when the open, high, and close are roughly the same price. Also, there is a long lower shadow, twice the length as the real body.

When the high and the close are the same, a bullish Hammer candlestick is formed and it is considered a stronger formation because the bulls were able to reject the bears completely plus the bulls were able to push price even more past the opening price.

In contrast, when the open and high are the same, this Hammer formation is considered less bullish, but nevertheless bullish. The bulls were able to counteract the bears, but were not able to bring the price back to the price at the open.

The long lower shadow of the Hammer implies that the market tested to find where support and demand was located. When the market found the area of support, the lows of the day, bulls began to push prices higher, near the opening price. Thus, the bearish advance downward was rejected by the bulls.

Hammer Candlestick Chart ExampleThe chart below of American International Group (AIG) stock illustrates a Hammer reversal pattern after a downtrend:

In the chart above of AIG, the market began the day testing to find where demand would enter the market. AIG's stock price eventually found support at the low of the day. In fact, there was so much support and subsequent buying pressure, that prices were able to close the day even higher than the open, a very bullish sign.

The Hammer is an extremely helpful candlestick pattern to help traders visually see where support and demand is located. After a downtrend, the Hammer can signal to traders that the downtrend could be over and that short positions should probably be covered.

However, other indicators should be used in conjunction with the Hammer candlestick pattern to determine buy signals, for example, waiting a day to see if a rally off of the Hammer formation continues or other chart indications such as a break of a downward trendline. But other previous day's clues could enter into a traders analysis. An example of these clues, in the chart above of AIG, shows three prior day's Doji's (signs of indecision) that suggested that prices could be reversing trend; in that case and for an aggressive buyer, the Hammer formation could be the trigger to go long.

The bearish version of the Hammer is the Hanging Man formation

Another similar candlestick pattern to the Hammer is the Dragonfly Doji

----------------

Hammer and Hanging Man Candlestick EA - expert for MetaTrader 5

Candlesticks patterns. Inverted Hammer (part #2)

Forum

Libraries: MQL5 Wizard - Candlestick Patterns Class

newdigital, 2013.09.18 12:33

Inverted Hammer

The Inverted Hammer candlestick formation occurs mainly at the bottom of downtrends and is a warning of a potential reversal upward. It is important to note that the Inverted pattern is a warning of potential price change, not a signal, in and of itself, to buy.

The Inverted Hammer formation, just like the Shooting Star formation, is created when the open, low, and close are roughly the same price. Also, there is a long upper shadow, which should be at least twice the length of the real body.

When the low and the open are the same, a bullish Inverted Hammer candlestick is formed and it is considered a stronger bullish sign than when the low and close are the same, forming a bearish Hanging Man (the bearish Hanging Man is still considered bullish, just not as much because the day ended by closing with losses).

After a long downtrend, the formation of an Inverted Hammer is bullish because prices hesitated their move downward by increasing significantly during the day. Nevertheless, sellers came back into the stock, future, or currency and pushed prices back near the open, but the fact that prices were able to increase significantly shows that bulls are testing the power of the bears. What happens on the next day after the Inverted Hammer pattern is what gives traders an idea as to whether or not prices will go higher or lower.

Inverted Hammer Candlestick Chart ExampleThe chart below of the S&P 500 Futures contract shows the Inverted Hammer foreshadowing future price increases:

In the chart above of e-mini future, the market began the day by gapping down. Prices moved higher, until resistance and supply was found at the high of the day. The bulls' excursion upward was halted and prices ended the day below the open.

Confirmation that the dowtrend was in trouble occured the next day when the E-mini S&P 500 Futures contract gapped up the next day and continued to move upward, creating a bullish green candle. To some traders, this confirmation candle, plus the fact that the downward trendline resistance was broken, gave the signal to go long.

It is important to repeat, that the Inverted Hammer formation is not the signal to go long; other indicators such as a trendline break or confirmation candle should be used to generate the actual buy signal.

The bearish version of the Inverted Hammer is the Shooting Star formation----------------

Hammer and Hanging Man Candlestick EA - expert for MetaTrader 5

Candlesticks patterns. Hanging Man

Forum

Libraries: MQL5 Wizard - Candlestick Patterns Class

newdigital, 2013.09.17 12:28

Hanging ManThe Hanging Man candlestick formation, as one could predict from the name, is a bearish sign. This pattern occurs mainly at the top of uptrends and is a warning of a potential reversal downward. It is important to emphasize that the Hanging Man pattern is a warning of potential price change, not a signal, in and of itself, to go short.

The Hanging Man formation, just like the Hammer, is created when the open, high, and close are roughly the same price. Also, there is a long lower shadow, which should be at least twice the length of the real body.

When the high and the open are the same, a bearish Hanging Man candlestick is formed and it is considered a stronger bearish sign than when the high and close are the same, forming a bullish Hanging Man (the bullish Hanging Man is still bearish, just less so because the day closed with gains).

After a long uptrend, the formation of a Hanging Man is bearish because prices hesitated by dropping significantly during the day. Granted, buyers came back into the stock, future, or currency and pushed price back near the open, but the fact that prices were able to fall significantly shows that bears are testing the resolve of the bulls. What happens on the next day after the Hanging Man pattern is what gives traders an idea as to whether or not prices will go higher or lower.

Hanging Man Candlestick Chart ExampleThe chart below of Alcoa (AA) stock illustrates a Hanging Man, and the large red bearish candle after the Hanging Man strengthens the bears thinking that a downward reversal is coming:

In the chart above of Alcoa, the market began the day testing to find where demand would enter the market. Alcoa's stock price eventually found support at the low of the day. The bears' excursion downward was halted and prices ended the day slightly above the close.

Confirmation that the uptrend was in trouble occured when Alcoa gapped down the next day and continued downward creating a large bearish red candle. To some traders, this confirmation candle, plus the fact that the upward trendline support was broken, gave the signal to go short.

It is important to repeat, that the Hanging Man formation is not the sign to go short; other indicators such as a trendline break or confirmation candle should be used to generate sell signals.

The bullish version of the Hanging Man is the Hammer formation----------------

Hammer and Hanging Man Candlestick EA - expert for MetaTrader 5

----------------

An Introduction to ECNs

This video provides an introduction to electronic communications networks (ECNs), systems that allow buyers and sellers of stocks to trade directly without an intermediary.

==============

Most forex traders participate in the forex market with forex brokers. There are mainly two types of forex brokers: market makers and electronic communications networks (ECNs). In this article we want to introduce the latter type of brokers, the ecn forex broker.

What is an ECN forex broker?

ECN forex broker is a financial expert that provides the clients with direct access to other forex participants in the currency market by using electronic communications networks (ECNs). Unlike market makers, which always trade against their clients to make profit, an ECN forex broker only creates opportunities of trading between forex traders.

How does an ECN forex broker work?

The ECN forex brokers provide a medium by passing on the prices for different market participants such as banks, market makers and other traders in the market. Then the best bid/ask quotes will be displayed on the trading platforms based on these prices. ECN forex brokers also serve as counterparties to forex transactions, but it is a settlement that they operate on instead of pricing basis. While fixed spreads are offered by some market makers, spreads of currency pairs can be very different, determined by the trading activities of the currency pair. In active trading periods, sometimes you cannot get ECN spread at all, especially in those very liquid currency pairs such as the majors (EUR/USD, GBP/USD, USD/JPY, USD/CHF) and some currency crosses.

Pros and cons of the ECN forex broker

The ECN forex broker has both advantages and disadvantages. The pros and cons of the ECN forex broker are as follows.

The pros of the ECN forex broker can be presented in following aspects.

Traders can usually get better bid/ask prices for they are derived from multiple sources.

At certain time traders may trade on prices with no spread or with only very little spread.

Genuine ECN forex broker will pass on the orders to a bank or other trading participants on the opposite side of the transaction instead of trading against the traders.

It is very likely that the prices on the ECN forex broker are more volatile.

Traders can take on the role of market traders to other traders on the ECNs since they can offer a price between bid and ask.

The cons of the ECN forex broker can be presented in following aspects.

Many ECN forex brokers do not provide integrated charting or new feeds.

Some trading platforms are not so easy for traders to use or operate.

Since there are variable spreads between the bid and the ask prices, it may be difficult to calculate stop-loss and breakeven points in pips in advance.

Forex traders are obligated to pay commissions for each transaction.

It is obvious that there are both pros and cons of an ECN forex broker. Traders have to take many factors into consideration when choosing a forex broker.

Forex Broker Types - MM,NDD,STP,ECN

This is small 10 minute education video about the following: the difference between Forex Broker Types - MM,NDD,STP,ECN

Basic Guide Metatrader 4 Mobile Metatrader 5 Mobile. Tutorial MT4 & MT5 in Forex. IOS app Beginners

This is a basic introduction about MT4 and MT5 mobile trading platform. Metatrader 5 is a mobile trading platform that allows you to trade on the go. It is one of the most used trading platforms in the forex market if you wish to know more about it.

00:22 - Basic Guide Metatrader 4 Mobile

00:27 - How to add currency pair in mt4 and mt5 mobile app

00:59 - how to pen chart of currency pair in mt4 and mt5 mobile app

01:05 - How to change time frame in mt4 and mt5 mobile app

01:13 - How to check account balance in mt4 and mt5 mobile app

01:27 - How to open a trade in mt4 and mt5 mobile app

01:50 - How to add indicators in mt4 and mt5 mobile app

02:22 - How to add object in mt4 and mt5 mobile app

02:29 - How to change background of the chart in mt4 and mt5 mobile

02:44 - How to add broker in mt4 and mt5 mobile app

Breakouts with the ATR

Forum on trading, automated trading systems and testing trading strategies

ATR Trailing Stop - Help

Sergey Golubev, 2020.07.31 19:31

ATR Histogram Percentages - indicator for MetaTrader 5

Forum

Indicators: ATR_MA_Oscillator

newdigital, 2013.10.23 18:52

An Easy and Advanced Way to Set StopsTalking Points:

- Stops are a necessity because no trading strategy wins 100% of the time

- Traders can use ATR to calculate stop distances based on recent price activity

- Price Action can be used to set stops in trending, or ranging market environments

As traders, we know we need them, but it’s much like the advice of ‘get your annual checkup with a Doctor,’ where most of us simply don’t want to do it.But in the field of trading, risk management isn’t just a preference; it’s a necessity.

And the reason for this is simple: Because you cannot tell the future. And this means that no matter how hard you try, or how great a trader you become, you will simply never be able to avoid losing entirely. And as a natural extension of that fact, since you will lose on some trades, having sloppy risk management means that one or two losers can wipe away the gains of many small winners.

I know this may sound too simplistic; but this is exactly what was found to be The Number One Mistake that Forex Traders Make: They often win more frequently than they lose - but they lose so much when they are wrong that it wipes away all of the gains from their winners and then some.

Average losses (in red) far outpace average wins (in blue) :

The first step to avoiding The Number One Mistake Forex Traders Make is to set a stop. This allows you to cap the risk on any one trade, so that if it doesn’t go in your direction, you can stem the bleeding before it becomes too unbearable.

Below, we’re going to look at two popular, yet different ways of setting stops. One easy way that is often employed by professional traders for the sake of simplicity; and another more advanced method that may suit certain trading styles more adequately.

The Easy Way

First off, just because this is an easier way of setting a stop does not make it any less valid. This is classified as ‘the easy way’ simply because most traders can pick this up right now, and begin using it instantly with a minimum of instruction.

Average True Range is a favorite indicator of many professional traders, and one of the great things about it is that it’s rather simple in its design. While many indicators wear multiple hats and try to do a few different things at once, ATR is just a measure of price movements over a specific period of time.

If those movements increase in value, ATR goes up. If those movements decrease, ATR goes down (see below).

ATR measures volatility, and this allows traders to set stops based actual market behavior :

There are a few nuances of ATR that traders need to know before applying. We cover these, in depth in the article Managing Risk with ATR. The first is the format with which the indicator displays values. While it looks like an oscillator like RSI, and moves similar to an indicator like ADX; the real value of ATR is in its value. It will measure the ‘Average True Range’ of the last x periods, where x is the input you choose. The default, and most common input for ATR is 14 periods. The value of ATR will read in the price format of the currency pair being analyzed. So, for instance; if a value of .00760 is shown on EURUSD, that means 76 pips (4th place to the right of the decimal is a single pip in the quote).

ATR displays values in the format of the currency pair’s price :

There is a slightly easier option, and for traders that are using short-term techniques this can be extremely helpful. There is a custom indicator available for Trading Station desktop that automatically calculates, and displays ATR on the chart in a very easy-to-read format. This is completely free, and can be downloaded from the FXCM App Store at this link (link). As you can see below, not only does it display ATR, but it even rounds the ‘.6’ fractional pip as appropriate.

The ‘ATR_Pips’ Indicator displays Average True Range in an easy-to-read format :

The Advanced Way

Price Action can have a huge impact on a trader’s performance. Inclusion of price action into an approach will often take place regardless of the trader or type of trading being done. Price action can help traders read trends, find support and resistance, and perhaps most importantly - manage risks.

Because, after all - if prices are trending higher, and we’re seeing continuous higher-highs, and higher-lows, wouldn’t it be reasonable to consider closing the trade if the trend reversed?

Remember, this is the number one mistake traders make, and this is the reason stops are so important. If the trend reverses, the trader’s best advice is often to close the trade and look for greener pasture elsewhere... because if the reversal continues against the trader, one loss can wipe away a lot of gains.

If traders are trading a trend, they can look to the previous opposing-side swing for stop placement. So, if an up-trend is being traded, we should be able to see higher-highs, and higher-lows. If we are buying to take part in the up-trend, we can look to place our stop below the prior swing-low (see picture).

During an up-trend, stops can be placed below the previous swing-low :

On the other hand, if we’re selling in a down-trend, we would want to look to place our stop above the prior swing-high.

During down-trend, stops can be placed above the previous swing-high

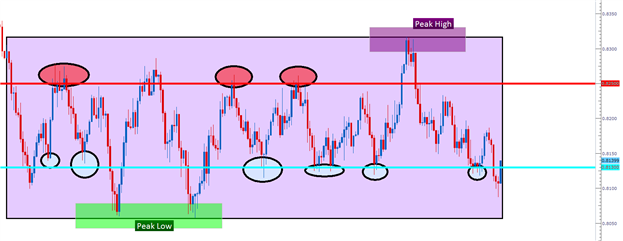

In How to Analyze and Trade Ranges with Price Action, we look at stop placement in

range-bound markets. If a range is being traded, the ‘peak-high’ and ‘peak-low’ should be identified (see below).

Traders can look to place their stop just outside of the peak of the opposing side of their position. So, if buying, traders would look to place their stop just below the peak-low; and if selling just above the peak-high. This way, if the range turns into a breakout against the trader, the bleeding can be stopped before one loser wipes away the gains from a lot of winners.

If you’d like to become a better Price Action trader, we’ve put together the basics into a Brainshark curriculum. The link below will take you directly to the lesson, and after filling in a few pieces of information into the guestbook the session will begin.

Difference between ECN, market makers and STP brokers

In a perfect world the cost of buying and selling currencies would be the same, no matter which Forex broker you use. Unlike the stock market where we get heavy regulation and where stock prices are derived from a single exchange, prices vary from different Forex broker platforms. The reason why is because currency prices are derived from the Interbank market which is a conglomerate of banks and hedge funds that provide prices to various Forex brokers around the world. The better the relationship between the Interbank market participants and the broker means that the prices are cheaper. We expand on this in the video tutorial whilst also describing the main difference between ECN, market makers and STP Forex brokers. You may be surprised how some brokers take you for a ride and it is this lack of knowledge that they thrive on when trying to get you to sign-up as a customer.