You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Scalping techniques and Journal

Hello traders,

We had some nice trade signials today.

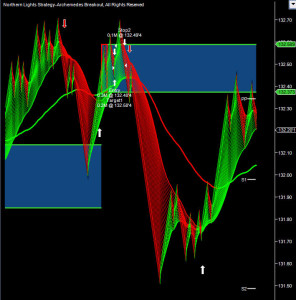

Pound dollar was very calm in Tokyo session.She gave only one signal after the London open with the potential of 170 pips.

Notice how narrow is the Tokyo session.

Then BOE made a Super Thursday for bears with the following key points

The GBPUSD has broken below the 50% of the trading range for the year - keeping the sellers in control and the dip buyers/longs nervous.

Traders will now keep an eye on that level for resistance. If the price can not get back above this level, the sellers remain in the dominant position.

The low from October 13 at 1.5199, is the next obvious target to get to and through. Swing lows from June and the beginning of September come in at 1.5188 and 1.5158 respectively. At the end of Sept/beginning of October the pair moved below these swing lows, but activity was more two-way. I think the market can "see" the other swing lows as more important targets. The 61.8% at 1.50849 corresponds with the May low.

GBPUSD super Thursday bear party.

GBPJPY acted similarly following GBPUSD potential for 200 pips.

EURJPY gave a long signal in the London open with potential to 55 pips.

I have made a ninjatrader template for a scalping technique to share today.

Download below:

This scalping technique works in the one-minute time frame. It’s quite simple to understand and is composed of an automatic trendline, the Stochastic indicator and MACD

The Scalping Setup

Indicators: Stochastic with settings: (5,3,3) and MACD with settings: (13,26,9)

Preferred time frame(s): 1 min chart

Trading sessions: Euro ans US Sessions

Preferred Currency pairs: Medium to high volatility pairs (EUR/USD, GBP/USD, USD/JPY, GBP/JPY, EUR/JPY,…

Download

Download the Forex Scalping Strategy With MACD and Stochastic for ninjatrader.

GBP/USD 1 Min Chart Example in ninjatrader

Trading Rules

Long Trade Setup:

The MACD indicator must be above the zero line (bullish territory).

Wait for the Stochastic indicator to go back above 20 from below (oversold).

This is the signal to enter a long position.

Place stop loss 1 pip below the most recent swing low point.

Price objective: Set at 10 pips above the entry point.

Short Trade Setup:

The MACD indicator must be below the zero line (bearish territory).

Wait for the Stochastic indicator to go back below 80 from above (overbought).

This is the signal to enter a short position.

Place stop loss 1 pip above the most recent swing high point.

1inscalpmacdstochtemplate

Scalping Journal and strategy template 7 11 2015

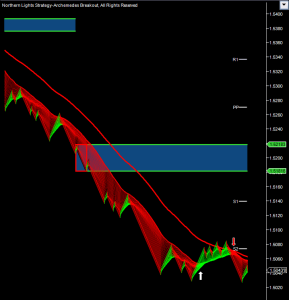

Scalping Journal and strategy template follows.Yesterday we had the biggest news event of the month.We took a scalping trade in the morning after the London open in EURJPY and then closed the station.In the afternoon one hour approx after the NFP release the pair gave a superb short signal ,provide a nice retracement for entry in the trigger chart and then produced more than 100 pips potential. Pound dollar was still under influence from the BOE comments so it didn't produce any fresh signals hust continued the melt down which filled the pockets ofÂ* swing traders follwing the signal from super bear Thursday

Pound dollar was still under influence from the BOE comments so it didn't produce any fresh signals hust continued the melt down which filled the pockets ofÂ* swing traders follwing the signal from super bear Thursday GBPJPY provided some range trading with profitable signals followed by retracements as our forex system dictates.As you can notice from the length of the blue box which is the Archimedes indicator provided a lot of volatility.

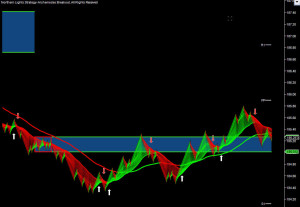

GBPJPY provided some range trading with profitable signals followed by retracements as our forex system dictates.As you can notice from the length of the blue box which is the Archimedes indicator provided a lot of volatility. On the news side the U.S. Non-Farm Payrolls report blew away estimates, forcing investors to change the probability of a December interest rate hike by the U.S. Federal Reserve from 50% to 70%.The U.S. Non-Farm Payrolls report for October showed the addition of 271,000 jobs, soundly beating estimates of about 179,000. The unemployment rate ticked lower to 5 percent, marking full-employment. Average hourly earnings increased 9 cents or 0.4%, for an annualized increase of 2.5 percent. This put it slightly above the Fed’s mandated inflation target of 2.0 percent.The stronger-than-expected jobs report drove up U.S. Treasury yields, triggering steep breaks in the December Treasury Bonds and December Treasury Notes markets. Both futures contracts reached their lowest levels since late August. The 2-Year Cash market yield reached a high of 0.958 percent, its highest level since May 2010.Higher yields made the U.S. Dollar a more attractive investment, forcing foreign currency markets sharply lower across the board. Sellers also hit the precious metals markets on the news with December Comex Gold futures dropping over $50.00 for the week. The scalping strategy of the day is a 5 minute Strategy in ninjatrader .It is perfect for ranging conditions.I have removed the middle line in bollinger bands and painted the upper line to red in order to short it and the lower line toÂ* green in order to buy it.If you spot the ranging period it is a cash machine.In the lower chart you can count 8 trades , 7 win one stop loss hit.

On the news side the U.S. Non-Farm Payrolls report blew away estimates, forcing investors to change the probability of a December interest rate hike by the U.S. Federal Reserve from 50% to 70%.The U.S. Non-Farm Payrolls report for October showed the addition of 271,000 jobs, soundly beating estimates of about 179,000. The unemployment rate ticked lower to 5 percent, marking full-employment. Average hourly earnings increased 9 cents or 0.4%, for an annualized increase of 2.5 percent. This put it slightly above the Fed’s mandated inflation target of 2.0 percent.The stronger-than-expected jobs report drove up U.S. Treasury yields, triggering steep breaks in the December Treasury Bonds and December Treasury Notes markets. Both futures contracts reached their lowest levels since late August. The 2-Year Cash market yield reached a high of 0.958 percent, its highest level since May 2010.Higher yields made the U.S. Dollar a more attractive investment, forcing foreign currency markets sharply lower across the board. Sellers also hit the precious metals markets on the news with December Comex Gold futures dropping over $50.00 for the week. The scalping strategy of the day is a 5 minute Strategy in ninjatrader .It is perfect for ranging conditions.I have removed the middle line in bollinger bands and painted the upper line to red in order to short it and the lower line toÂ* green in order to buy it.If you spot the ranging period it is a cash machine.In the lower chart you can count 8 trades , 7 win one stop loss hit. Forex Scalping Strategy With Bollinger BandsScalping the GBP/USD and EUR/USD 5 min trading charts with Bollinger Bands. This strategy works best in a range-bound market environment characterized by almost flat horizontally aligned Bollinger Bands.Scalping SetupIndicators: Bollinger Bands with default 20,2 settingsPreferred time frame(s): 5 minTrading sessions: EUR, USPreferred Currency pairs: GBP/USD, EUR/USDDownload the Forex Scalping Strategy With Bollinger Bands for Ninjatrader.

Forex Scalping Strategy With Bollinger BandsScalping the GBP/USD and EUR/USD 5 min trading charts with Bollinger Bands. This strategy works best in a range-bound market environment characterized by almost flat horizontally aligned Bollinger Bands.Scalping SetupIndicators: Bollinger Bands with default 20,2 settingsPreferred time frame(s): 5 minTrading sessions: EUR, USPreferred Currency pairs: GBP/USD, EUR/USDDownload the Forex Scalping Strategy With Bollinger Bands for Ninjatrader.

range scalping.zipGBP/USD Chart: Strategy ExampleTrading RulesBuy Rules:Bollinger Bands needs to be almost flat (range trading)The price touches the lower Bollinger BandOpen BUY position. Set stop loss at 10 pips below the entry price. Close the trade at the upper Bollinger Band.Sell Rules:Bollinger Bands needs to be almost flat (range trading)The price touches the upper Bollinger BandOpen SELL position. Set stop loss at 10 pips above the entry price. Close the trade at the lower Bollinger Band.

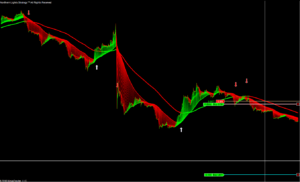

swing trade with Northern Lights Strategy indicator.Hello,I haven't post lately due to the fact I am testing Northern Lights in Swing trading.In the below chart you can see an equivalent of the daily chart on GBPJPY The position currently is in plus 563 pips and I checking it 2-3 times per day.The charts you see are real time and the entries shown do not repaint.The Northern lights Strategy indicator is real time not lagging and can help you take profitable signals in your specific style either it is scalping ,intraday or swing trade.With the new teamviewer 11 I can connect with my tradestation from Samsung smartphone and follow my swing trade closely.Northern Lights and www.forexraiders.com became official ninjatrader third party addonpartners and trainers for the ninjatrader platform.Here's the latest on the other key pairs?*for today?*10 August 2016

The position currently is in plus 563 pips and I checking it 2-3 times per day.The charts you see are real time and the entries shown do not repaint.The Northern lights Strategy indicator is real time not lagging and can help you take profitable signals in your specific style either it is scalping ,intraday or swing trade.With the new teamviewer 11 I can connect with my tradestation from Samsung smartphone and follow my swing trade closely.Northern Lights and www.forexraiders.com became official ninjatrader third party addonpartners and trainers for the ninjatrader platform.Here's the latest on the other key pairs?*for today?*10 August 2016

USDCHF: 0.9775 near session lows as USD-neg sentiment prevailsOffers:0.9800 0.9830 0.9860 0.9900 0.9930 0.9950Bids: 0.9760 0.9730?*0.9700 0.9660 0.9630 0.9600EURCHF: 1.0913 underpinned still on general euro demandOffers: 1.0930 1.0950 1.0980 1.1000Bids:?*1.0880 1.0850?*1.0800?*1.0780 1.0750USDCAD: 1.3040 on lows with USD sellers and oil buyers returningOffers: 1.3080 1.3100?*1.3160 1.3180?*1.3200 1.3230 1.3250Bids:?* 1.3030 1.3000?*1.2980 1.2950 1.2930 1.2900NZDUSD: 0.7228 underpinned with the RBNZ in focusOffers:?*?*0.7250 0.7280 0.7300Bids: 0.7200 0.7180 0.7160 0.7130 0.7100

Just some threads of the forum, CodeBase tools related to the subject -

More -

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

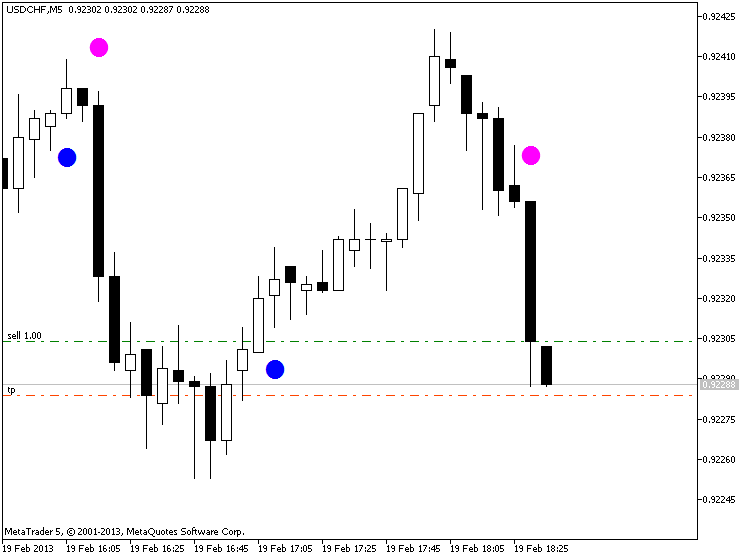

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

And finally (just to keep this thread alive) - the article: