You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.18 21:23

Dollar Index - long term breakdown to correction (based on the article)

The price on monthly chart is located above Ichimoku cloud in the bullish area of the chart. The price is on secondary correction within the primary bullish trend by breaking monthly support level at 95.22 to below together with descending triangle pattern and with the bearish reversal support level at 91.87 as the next monthly target.

Chinkou Span line is crossing historical price to below for the breakdown to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.19 15:06

Intra-Day Fundamentals - EUR/USD, GBP/USD and Dollar Index: Residential Building Permits

2017-07-19 13:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From economiccalendar article :

==========

Dollar Index M5: range price movement by Residential Building Permits news events

==========

EUR/USD M5: range price movement by Residential Building Permits news events

==========

GBP/USD M5: range price movement by Residential Building Permits news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.20 15:42

Intra-Day Fundamentals - EUR/USD, USD/JPY, Dollar Index and Bitcoin/USD: Philadelphia Fed Business Outlook Survey

2017-07-20 13:30 GMT | [USD - Philly Fed Manufacturing Index]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia.

==========

From official report :

==========

Dollar Index M5: range price movement by Philadelphia Fed Business Outlook Survey news events

==========

EUR/USD M5: range price movement by Philadelphia Fed Business Outlook Survey news events

==========

USD/JPY M5: range price movement by Philadelphia Fed Business Outlook Survey news events

==========

BTC/USD M5: range price movement by Philadelphia Fed Business Outlook Survey news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.22 09:17

Dollar Index - daily bearish breakdown (based on the article)

Price on the daily chart is on promary bearish breakdown by the descending triangle pattern to be broken to below together with 93.88 support level for the bearish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.27 14:54

Intra-Day Fundamentals - EUR/USD, GBP/USD and Dollar Index: Durable Goods Orders

2017-07-27 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = hange in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From abcnews article :

==========

EUR/USD M5: range price movement by Durable Goods Orders news events

==========

GBP/USD M5: range price movement by Durable Goods Orders news events

==========

Dollar Index M5: range price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.29 08:24

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The big driver for this week seemed to emanate from the Federal Reserve’s statement accompanying the rate decision. There was no press conference, and no updated forecasts; but in the Fed’s statement the bank mentioned that balance sheet reduction may begin ‘relatively soon’. This was largely inferred to mean their next meeting on September 20-21, and while the Fed has said previously that they anticipate invoking balance sheet reduction while also continuing to normalize rates, markets don’t appear to be buying that thesis just yet. U.S. data remains rather soft, and the Fed even voiced concern about lackluster inflation in that statement on Wednesday; and this makes for a difficult environment for tighter operating conditions, much less tightening on dual fronts with both higher rates and balance sheet reduction"

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.05 09:51

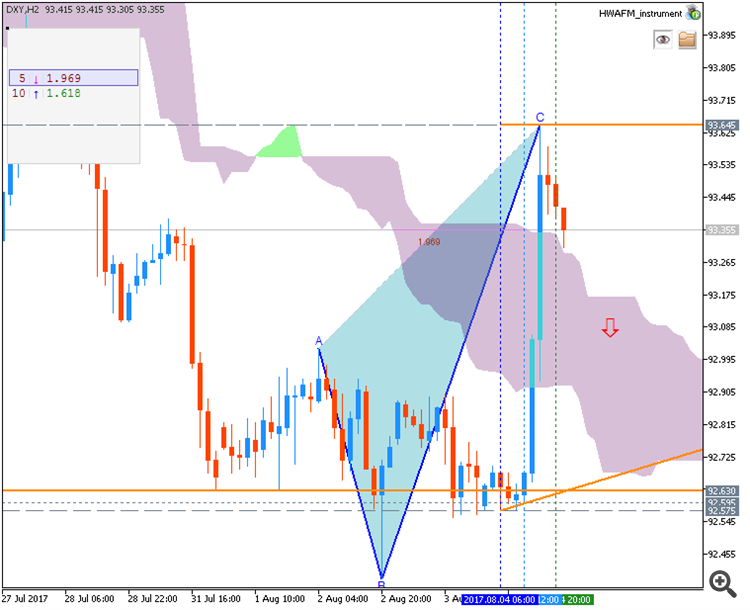

Weekly Outlook: 2017, August 06 - August 13 (based on the article)

The US dollar remained on the back foot throughout most of the week, with the jobs report allowing for a comeback. Is this a temporary correction or the start of a dollar rally? The upcoming week features US inflation figures, the JOLTs data, a rate decision in New Zealand and more.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.10 19:32

Dollar Index - monthly correction; 91.93 is the key (based on the article)

The price on the monthly chart was bounced from 103.82 resistance level to below for the secondary correction to be started. Price is trying to test 91.93 support level together with descending triangle pattern to below for the correction to be continuing with 88,26 long-term bearish reversal target.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.13 09:01

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The US Dollar finds itself torn between the influence of speculation about Federal Reserve monetary policy and swelling geopolitical risk. This ought to make for a volatile week ahead critical economic news-flow comes across the wires against a backdrop of simmering tension between the US and North Korea. Sizing up scheduled event risk, minutes from July’s FOMC meeting take top billing. As ever, traders will be keen to gauge the level of confidence in policymakers’ standing projection – last updated in June – for three interest rate hikes in 2017 (of which two are already in the history books)."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.15 16:14

Intra-Day Fundamentals - EUR/USD, Dollar Index and GOLD (XAU/USD): U.S. Advance Retail Sales

2017-08-15 13:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From marketwatch article :

==========

EUR/USD M5: range price movement by U.S. Advance Retail Sales news events

==========

Dollar Index M5: range price movement by U.S. Advance Retail Sales news events

==========

XAU/USD M5: range price movement by U.S. Advance Retail Sales news events