Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.02 07:49

Key Levels To Watch In The U.S. Dollar (based on the article)

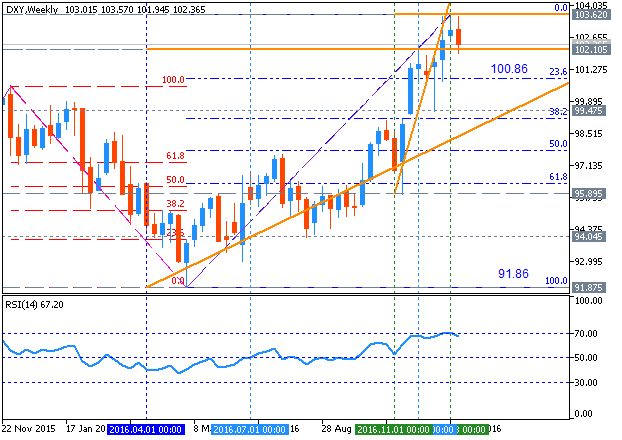

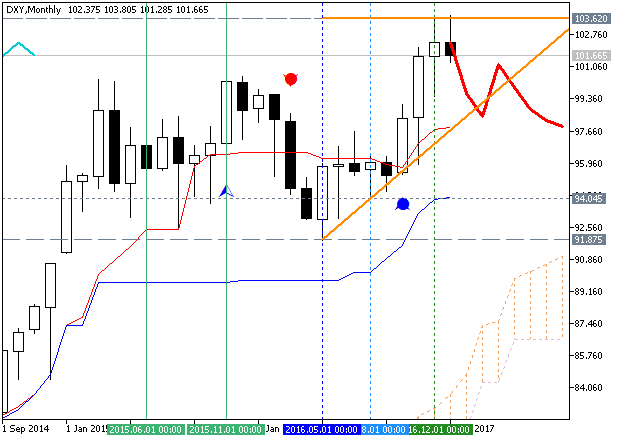

"The chart below shows the former trading range between 92 and 100 in the U.S. Dollar Index. The dollar's break to the upside creates a bullish signal as long as the Dollar Index stays above the 100 support level. A strong break below the 100 level would be necessary to negate the bullish signal. A pullback or re-test of the 100 support level is certainly possible and wouldn't negate the bullish signal provided the Dollar Index doesn't break below the support."

"The long-term U.S. Dollar Index chart shows the former trading range and recent breakout. As long as the Dollar Index holds above the key 100 support, there is very little resistance overhead all the way up to 120, which marked the highs in 2001 and 2002. Due to its history and psychological significance, the 120 level may act like a magnet for the U.S. Dollar Index over the next couple of years."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.24 10:01

US Dollar Q1 2017 Forecast - Dollar Draws on Many Sources to Extend 14-Year High (based on the article)

Fundamental Analysis

- "While the US economy is not on a runaway pace, it has nevertheless proven robust over the years while other major economies have wavered. In this environment where appetite for return is so prominent, a competitive economic pace can draw capital as readily as a central bank rate hike – and critically, more consistently. The promise of fiscal stimulus targeting infrastructure could significantly augment the pace of expansion and further draw contrast to those countries that have stagnated. The approval and details of the program remain to be seen, but a degree of speculative anticipation is already priced in."

- "While the promise of a more robust economy is a draw for investment and thereby lever for the currency, it is speculation of interest rate hikes that provides the practical expectation for return. The Federal Open Market Committee (FOMC) hikes rates for the second time in its very nascent hawkish regime on December 14th. That represented a 12-month gap between moves, but the second increase was full expected. Heading into the two-day meeting, the market had fully priced in the hike. The hawkish winds were further lifted by the forecasts for interest rates over the coming three years. In particular, the group increased its expectation for hikes in 2017 from two to three 25 basis point moves. That was the first time in 18 months that the central bank had increased its forecasts."

- "Though it hasn’t evoked this role in some time, it is important to remember that the Dollar is an ultimate safe haven asset. Yet, to truly take advantage of that position, the collapse in sentiment would need to be market-wide and intense. As it happens, a moderate degree of speculative flight would likely hurt the Greenback as it would curb rate expectations. In fact, through the past two years, the correlation between the DXY Dollar Index and VIX has flipped its traditional correlation to an unusual inverse relationship. A steady course for the global financial system and economy would bode well for the Dollar through rate speculation while intense risk aversion could recharge a long-dormant and significantly undervalued theme. In between these extremes though, the currency could very well struggle."

Technical Analysis

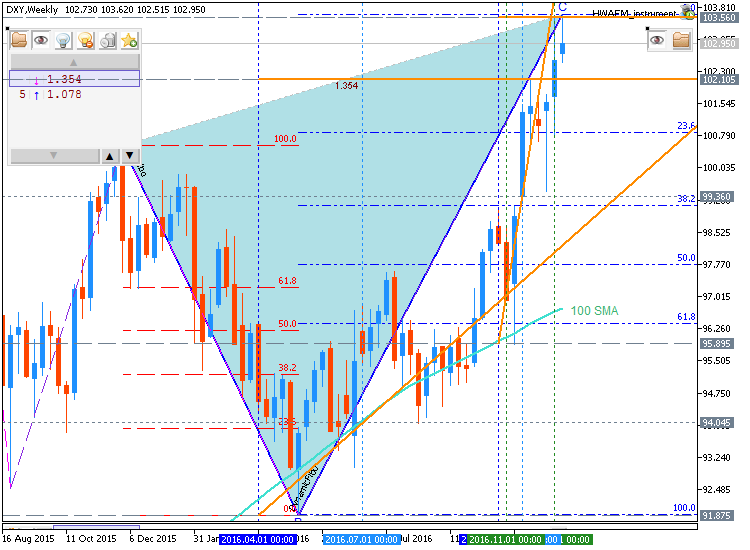

- "The DXY rally has now pushed above the 61.8% retracement of the 2001-2008 decline (101.80). From my perspective, the time element of the cycle is most interesting. The rally from March 2008 is now in its 105th month (as of December 2016). There have been 2 longer USD cycles; the 1992-2001 rally lasted 106 months and the end of Bretton Woods to 1978 decline lasted 109 months."

- "Finally, the shape of the rallies from 1992 and 2008 are similar and the wave counts might end up as identical. Proposed wave C now subdivides into 5 waves which indicates high risk of a top. It’s noted too that wave 5 already equals wave 1 (in points…not %) at 103.32. The angle of the rallies on the monthly log chart are defined by the B-2 line. The median lines for both sequences were support for waves 4 of C. After the 2001 top, the median line was support on the first leg down and the break of the ML signaled the onset of the bear."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 05:41

Weekly Outlook: 2017, January 08 - January 15 (based on the article)

The US dollar wobbled in the wake of 2017, torn between good and bad news. US Retail sales, consumer sentiment and PPI stand out. These are the highlights for this week.

The US monthly employment report showed a lower than expected job growth in December but wages registered a 2.9% annualized gain. The economy added 156,000 positions while expected to increase 175,000. The unemployment rate edged to 4.7% from 4.6%. However, wage growth was the most significant factor in December’s report as average hourly wages jumped 10 cents to $26, the highest gain since 2009, indicating the US labor market has fully recovered. The final report of 2016 also comes amidst a presidential transition period. Donald Trump has promised aggressive fiscal measures including tax cuts and higher domestic spending to boost economic growth beyond the mild expansion witnessed so far.

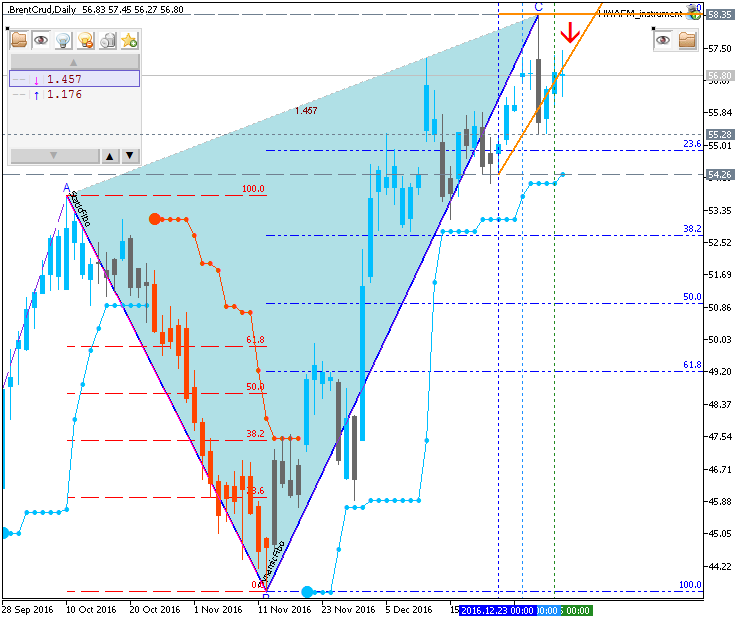

- US Crude Oil Inventories: Wednesday, 15:30. Oil prices increased as Saudi Arabia consented to OPEC’s plea to reduce output after prices fell on Us data.

- US Unemployment Claims: Thursday, 13:30. Economists expected a higher reading of 262,000.

- US Retail sales: Friday, 13:30.

- US PPI: Friday, 13:30.

- US UoM Consumer Sentiment: Friday, 15:00. Economists expected a milder rise to 94.3.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 09:44

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "Top-tier economic data will not enter the picture until late in the week. Retail sales, consumer confidence and PPI figures are all due to cross the wires on Friday, with consensus projections pointing to improvements all around. Such outcomes may offer a lifeline to the greenback much like the jobs report. However, there seems to be ample space for the resumption of profit-taking on long-USD positions before whatever support is to be found on the statistical front emerges."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.10 06:13

Dollar Index: long-term correction to 94, or tradable crises in 2017 (based on the article)

- Breakup of the European Union

- Military Clash Between China and the U.S. and/or U.S. Ally

- Successful North Korean Weaponized ICBM

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.11 08:07

US Dollar Index – Too Many Questions: breaking support level at 100 to below for correction? (based on the article)

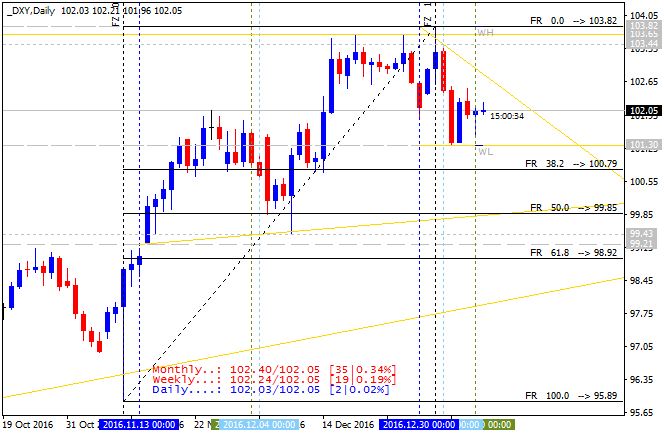

- "As is the case with EUR/USD and USD/CHF, continued failure at trend extremes warrant caution although there is nothing ‘solidly bearish’ to work with just yet. Weakness below 100.51 (December 2015 high) would suggest a broader reversal."

- "100.51 (2015 high) is classified as a decision point (make or break level). It’s OK to lean towards the long side as long as that level holds. Weakness below would suggest a broader reversal is underway."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.13 07:39

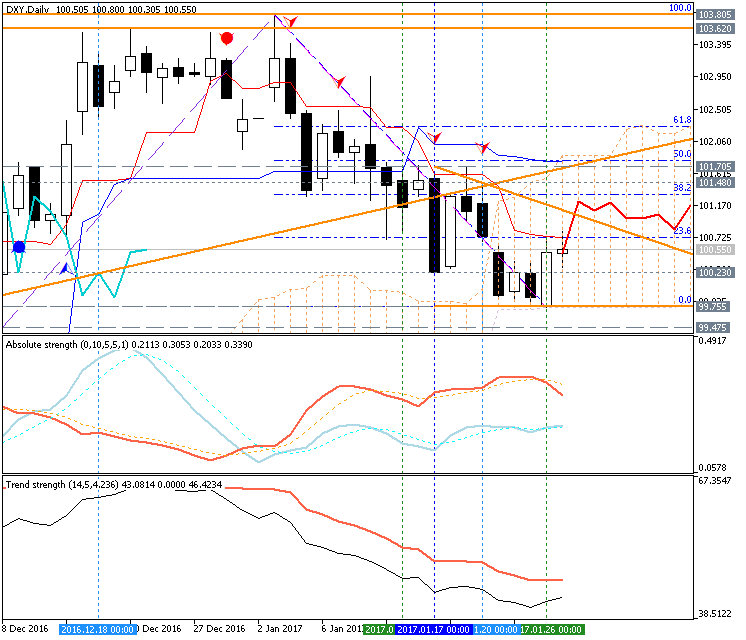

Dollar Index Technical Analysis: daily correction within the primary bullish trend; 100.72 is the key support level to watch (based on the article)

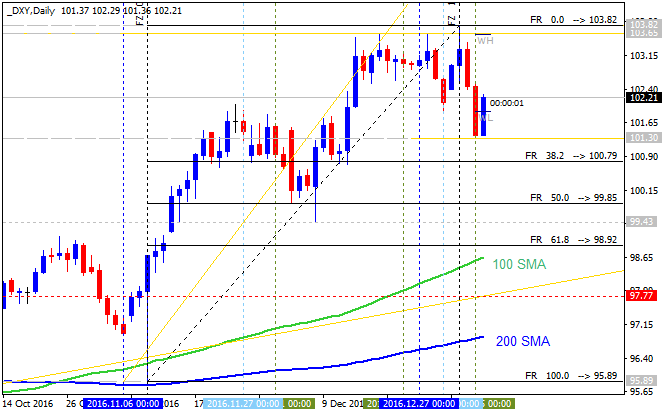

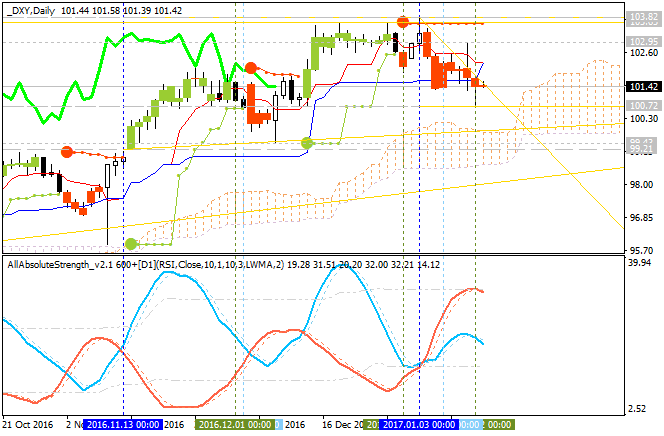

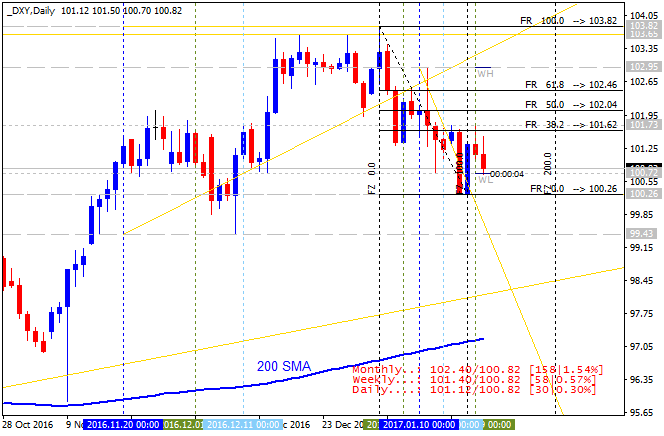

Daily price is located above Ichimoki cloud in the bullish are of the chart: the price was bounced from 103.82 resistance level to below for the secondary ranging correction to be started within the primary bullish market condition. Descending triangle pattern was formed by the price tobe crossed for the correction to be continuing, and Absolute Strength indicator is evaluating the trend as the ranging in the near future.

- "The US Dollar has taken a surprising step back as many anticipated the strong move that ended 2016 would carry through in early 2017. However, we have since seen a pull-back that is worth watching as a deeper setback could cause many of the long positions to bail out on the trade, which could have the effect of removing short-term support for USD."

- "DXY trading between the second half of Q3 2016 to today has remained well within the price channel on the chart below drawn with Andrew’s Pitchfork. The handle is drawn off an extreme momentum low in early June. You can also see that the late December price action rubbed against the top of the channel before breaking down, which now turns our attention to the bottom of the rising channel near 100.00/50 to see if we get a strong bounce. If we do, we can assume that the strong trend in USD is resuming."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.15 06:22

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "Going into the new year, the standby narrative envisioned accelerating growth and bubbling inflation powered by a hefty dose of fiscal stimulus championed by the President-elect. This would spur the Fed to adopt a steeper rate hike path. Not surprisingly, this proved to be overwhelmingly supportive for the greenback and pushed it to the highest level in 14 years."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.21 16:46

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "Big-ticket fundamental news-flow does not enter the picture until Friday, when market participants will get their first look at fourth quarter US GDP figures. The annualized growth rate is expected to have slowed to 2.2 percent in the final three months of the year, down from 3.5 percent in the preceding period. Robust improvement in US data outcomes relative to consensus forecasts over the same period suggests analysts may be underestimating the economy’s vigor, opening the door for an upside surprise."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.28 14:50

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The fundamental evidence seemingly points to a steady US economy that is broadly in the same place as the last time Janet Yellen and company sat down for policy meeting. Confirming as much may do little to assuage concerns that this relatively rosy status quo will not be shattered by a sharp pivot on the fiscal side."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dollar Index January-March 2017 Forecast: bullish ranging within narrow s/r levels for the bullish to be continuing or for the correction to be started

W1 price is located above Ichimoku cloud in the bullish area of the chart. The price is on secondary ranging within the following narrow support/resistance levels:

- 103.62 resistance level far above ichimoku cloud in the bullish area of the chart, and

- 102.10 support level located above Ichimoku cloud in the beginning of the secondary correction to be started.

Chinkou Span line is located above the price indicating the ranging condition, Trend Strength indicator is estimating the trend as the primary bullish, and Absolute Strength indicator is evaluating the trend as a secondary ranging within the primary bullish market condition.Trend:

W1 - ranging bullish