You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

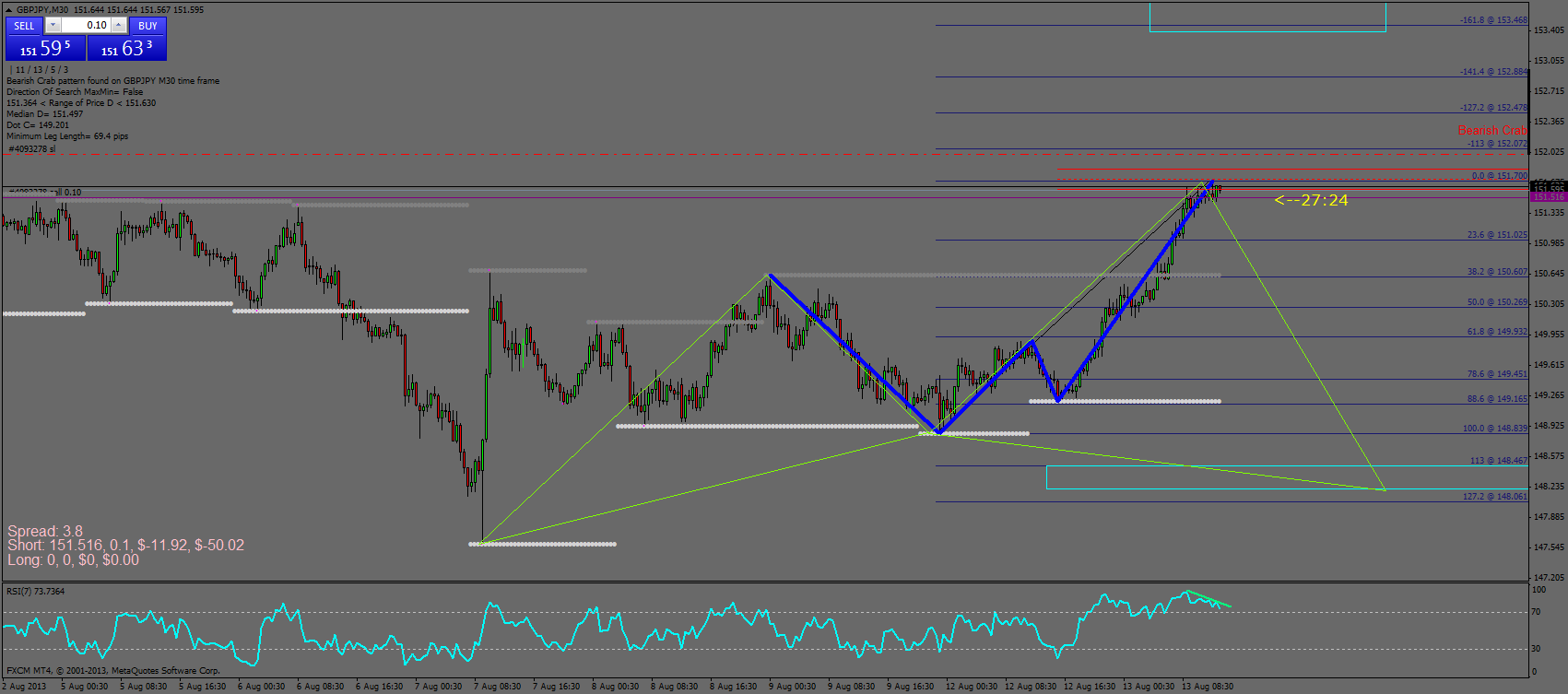

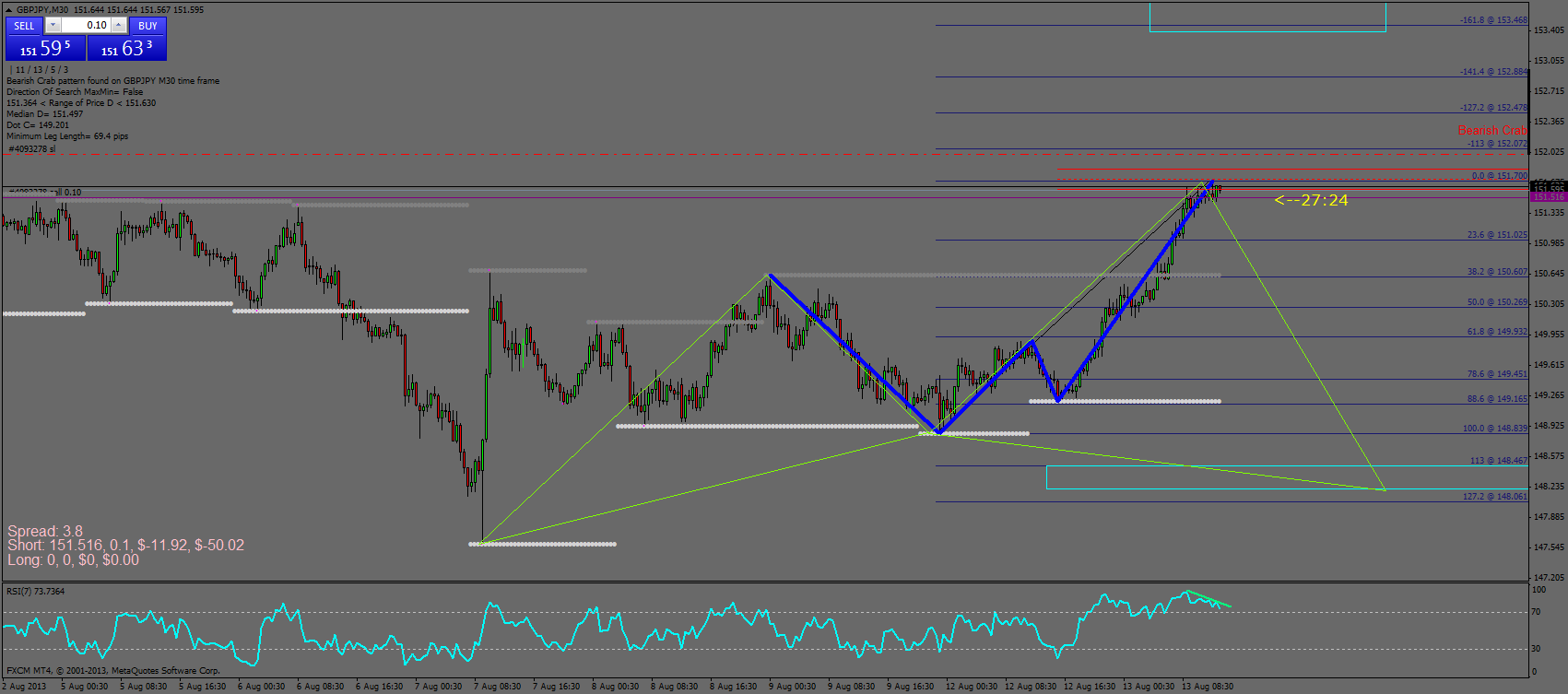

got another idea for the GBPJPY beside the navarro that have about 29 hours to complete otherwise it'll invalidate that

I went aggressive C on cypher- actually it appear to be safety C - we have RSI divergence on LTF and also bearish crab so.. up to you

I am planning to break even at 100 pips(it's around 38.2)

and keep rolling down with the trend 200 more pips and then begin my way up again.

Edited: I have been stoploss hunted, re-entered, if i'll get stopped out again, I am out of this idea

got another idea for the GBPJPY beside the navarro that have about 29 hours to complete otherwise it'll invalidate that

I went aggressive C on cypher- actually it appear to be safety C - we have RSI divergence on LTF and also bearish crab so.. up to you

I am planning to break even at 100 pips(it's around 38.2)

and keep rolling down with the trend 200 more pips and then begin my way up again.

Edited: I have been stoploss hunted, re-entered, if i'll get stopped out again, I am out of this ideaVery nice plan. What pattern did you take and get stopped-out?

Very nice plan. What pattern did you take and get stopped-out?

no pattern, just aggressive C for the upcoming cypher, stops went above 141.4% but too close above that level,

I got stopped out maybe because of this chain-reaction:

Euro hits the skids again as the EUR/GBP dam breaks @ Forex Factory

I got mail notificiation telling my gbpjpy stoploss hit for 50 pips and it was weird because I just left the computer watching it already 15 pips in profit, the minute later -50 pips.

no pattern, just aggressive C for the upcoming cypher, stops went above 141.4% but too close above that level,

I got stopped out maybe because of this chain-reaction:

Euro hits the skids again as the EUR/GBP dam breaks @ Forex Factory

I got mail notificiation telling my gbpjpy stoploss hit for 50 pips and it was weird because I just left the computer watching it already 15 pips in profit, the minute later -50 pips.I mentioned about this before but 161.8 extention and inversion is powerful. The crab on EURJPY, the pair bounced after touching 161.8. GBPJPY also touched 161.8 and now waiting for it to start bouncing. Another example on USDGBP. Just look at th pic below. Look for 161.8 regardless of patterns. If you see some confluence, divergence or anything, maybe it's a good opportunity to trade. Keep it mind though, it doesn't work 100%.

I mentioned about this before but 161.8 extention and inversion is powerful. The crab on EURJPY, the pair bounced after touching 161.8. GBPJPY also touched 161.8 and now waiting for it to start bouncing. Another example on USDGBP. Just look at th pic below. Look for 161.8 regardless of patterns. If you see some confluence, divergence or anything, maybe it's a good opportunity to trade. Keep it mind though, it doesn't work 100%.

nothing works 100% but in that case I wouldn't look for a trade in the gbpusd but in the eurusd/usdchf

because of their correlation, there might be a pattern to trade and It might be a nonsense, but let assume that GBPUSD have rsi divergence and EURUSD just showing oversold conditions and a pattern,

right now there is EURUSD 60m chart 121 pattern and kinda divergence, but think of it as there was no divergence at all, maybe it could give us some sense where the market is heading.

what do you think? I think it's worth testing

nothing works 100% but in that case I wouldn't look for a trade in the gbpusd but in the eurusd/usdchf

because of their correlation, there might be a pattern to trade and It might be a nonsense, but let assume that GBPUSD have rsi divergence and EURUSD just showing oversold conditions and a pattern,

right now there is EURUSD 60m chart 121 pattern and kinda divergence, but think of it as there was no divergence at all, maybe it could give us some sense where the market is heading.

what do you think? I think it's worth testingEURUSD and USDCHF pairs are counter-related (I don't know if it's a right term but I call it like that). Yes there's a bullish 121 on H1 EURUSD while there's a bearish 121 on H1 USDCHF. Both pairs reached 78.6 retracement of the last swing. There's a divergence forming on both pairs on H4. Maybe they're trying to go different direction. I pay attention to EURCHF pair as well. There might be a bearish bat on the pair daily chart.

EURUSD and USDCHF pairs are counter-related (I don't know if it's a right term but I call it like that)

positive correlation is when a pair move along

negative correlation is when a pair move in the exact other direction

AUDUSD M30 - Potential bearish cypher and bat.

NZDUSD M30 - Potential bearish cypher and FC butterfly.

Excuse me, but I wanted to know if anyone can help me to determine the targets of these patterns:

121

Black Swan

5-0

Leonardo

Navarro

3 drivers

thanks