You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

How to start with MetaTrader and forex, the beginning

Sergey Golubev, 2018.03.23 06:12

Paramon Trading System

The history of the development.

Paramon is username of the trader who created this system long time ago for Metatrader 3 (Metatrader 4 and Metatrader 5 did not exist in that time - it was very long time ago). Paramon named his system Paramon Scalping (but as we see - it is not real scalping). He did not use any indicators and he traded just price action only using M5 timeframe charts (MT3).

Later on - the other traders created indicators for MT3 and MT4 to use this system (Maksigen indicators or/and Paramon indicators) just because they could not trade live without any indicator (having just price only on the chart). For now - Paramon indicators were converted to MT5.

Paramon is legendary person and he was the first trader in our Metatrader world who started to trade breakout systems live on real account without any indicators placed on the chart.

We should always remember the people who were the first.

--------------

How to Trade and Free to Download

Forum on trading, automated trading systems and testing trading strategies

Which strategy is best to close the position?

Sergey Golubev, 2013.05.29 08:03

If you have a strategy so exit should be part of it. Strategy without exit is not a strategy.

What the people are using for exit?

I think - closing on overbough/oversold (stochastic etc), support/resistance (povit/fibo) and simple trailing stop are most popular for the people who consider about "let the profit run"

Ultra - ATR scalping tool - indicator for MetaTrader 4

Experimental indicator I wrote for myself. It's made to show some reference (it's more like a rifle scope, than a rifle). Main components are pip scale, ATR/pivot, MA level, RSI, and spread alert. Can be used on any timeframe, but since it's made for scalping it is somewhat adjusted for M1-M15.

This indicator can be used for scalping -

----------

Hi/lo mod - indicator for MetaTrader 5

It is a very old version of High/Low indicator (basically the idea comes from a Gann High Low activator with some modifications).

Modification was made at that time to allow users to use the indicator in scalping but as well in trending mode.

Usage is simple :

TRADING MANUAL - What is Scalping, What I Need to Scalp Successfully, Which Pairs Should I Scalp and Strategies for Scalping (adapted from the article)

What is Scalping?Scalping is a style of trading that has become very popular, mainly because it provides a lot of opportunities to make money. It is also very quick. Although there is sometimes a lot of waiting around, the profit or loss usually comes very quickly, so you do not have to sit biting your nails for hours wondering whether the trade is going to be a success, and where you should exit it. Very often the whole trade takes only a few seconds.

Scalping is the act of making fast trades for (usually) small profits, in and out for a few pips.

What Do I Need to Scalp Successfully?

Before we get too involved in the question of how to do it, you need to be properly equipped to do it right to have a chance of succeeding. Unfortunately, just knowing how to do it is not enough. This is because the essence of scalping is taking advantage of fast execution and reasonably tight spreads. If your broker is unable to offer these, then even if you know what are doing and do it right, you will not be able to scalp profitably. So the first thing you need is a high-quality broker that executes trades quickly without rejecting them just because the market is moving fast. At the retail level, this is not so very easy to find.

Which Pairs Should I Scalp?

There are two types of directional trading, by which I mean traditional long or short trading. You either bet that the movement will continue from a particular level, or that it will reverse. Either way, what are relying on in order to make a profit is the meaningfulness and quality of support or resistance levels. This leads to an important point which is often neglected: major pairs produce more meaningful support and resistance levels, because they are real and not synthetic. For example, if EUR/USD has not touched 1.30 in a long time, and after falling more than 100 pips hits that level, it is very likely to make some kind of bounce upwards, providing an opportunity for a long scalp. If EUR/AUD has not touched 1.30 in a long time, it is less likely to provide a bounce, because what is really important is what is going on with EUR/USD and AUD/USD. So stay away from crosses, unless both of the crossed currencies have a scalp at exactly the same time against the USD.

Strategies for Scalping

Simple put, you are going to get better results by looking for bounces instead of continuations. This will tend to mean trading against the trend, or at least the short-term trend. Do not worry about that. What you need to do are look for levels that are likely to provide a bounce. They key levels to look for can be found as follows:

- Highs and lows of previous days, weeks and months, especially where that end of the cdle is wicky.

- Weekly and monthly opens.

- Round/whole numbers.

- Pivot points.

Executing Scalping TradesThere is no substitute for executing these trades manually. Of course if you think 1.30 is going to be a good level for a bounce, you could set an order at that level. However, sometimes the price might stall just half a pip away from that level before turning around, in which case your order would not get filled. For this reason, it helps to scalp with your finger on the trigger manually for both entries and exits. This is why it is so important that you use a good broker.

The advantage of scalping is that you only need and expect to get out with a few pips of profit. This is another reason why you need to have your finger on the trigger and your eye on the price. You will “feel” where the price is starting to turn.

It is a good idea to take something like 80% or 90% of a winning trade off at the first pause, an leave the rest on the table while moving the stop loss to break even. You will eventually get some huge winners where what began as a scalp can become a major long-term swing high or low.

Perhaps the hardest thing about scalping is knowing where to put your stop loss. It might be better to just put an emergency stop loss on and get out manually when you feel the level really start to break in the wrong direction. It is worth remembering that it helps to keep stop losses tight, because where you are looking for bounces, the good trades should bounce pretty tightly.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting

Sergey Golubev, 2018.07.30 18:34

It is very interesting indicator was uploaded today in CodeBase (I used this indicator for MT4 for manual trading in scalping with very good results) -

----------------

Trend Scalp - indicator for MetaTrader 5

In the early days there was one version of Trend Trigger Factor by M.H. Pee described in the Technical Analysis of Stocks and Commodities magazine in December, 2004. That was actually wrongly coded for MetaTrader 4.

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

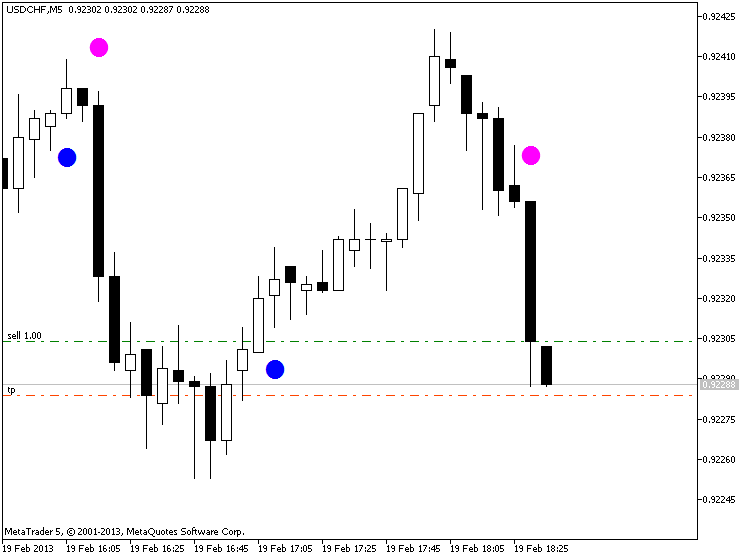

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Scalping the forex market

All the ins and outs on scalping the Forex market. May Chris dives into the world of Scalping where he explains in great detail how this style of trading can be accomplished in the Forex market. This live webinar not only clarifies how a trader can scalp but also provides every Forex trader with a great guidance and extra tips.

Forum on trading, automated trading systems and testing trading strategies

Scalping system

Sergey Golubev, 2018.07.26 12:24

Something to Read - Forex Price Action Scalping: an in-depth look into the field of professional scalping

by Bob Volman

Forex Price Action Scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does Forex Price Action Scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting. The book, counting 358 pages, opens up a wealth of information and shares insights and techniques that are simply invaluable to any scalper who is serious about his trading.

"Bob Volman (1961) is an independent trader working solely for his own account. A price action scalper for many years, he was asked to bundle all his knowledge and craftsmanship into an all-inclusive guide on intraday tactics. Forex Price Action Scalping is the long-awaited result. PUBLISHER'S NOTE: On youtube several obscure videos, posted by commercial vendors, falsely claim affiliation with the book and the author. We sharply condemn these practices."

LotScalp - expert for MetaTrader 4

LotScalp EA scalper, incredible 1430% = last year!!!

We started with 1 000$ and now we have 13 410$

TP only 5 pips!