Join our fan page

- Views:

- 8859

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Basics:

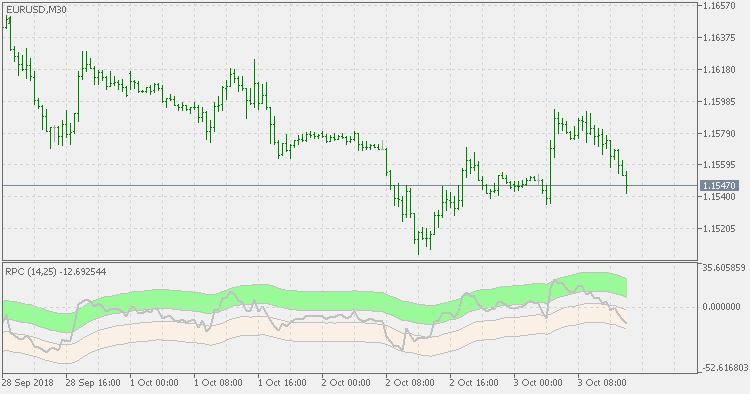

RSI indicator is frequently used in trading decisions coupled with levels checking. Levels are supposed to show if there is overbought or oversold condition. But frequently we are neglecting the fact that the market is adjusting itself to price changes, and that indicators like RSI may actually show overbought and oversold conditions even when the market already adjusted itself.

This version:

It is using the RSI and is constructing an high and low neutral zones using a simple EMA lag - in this case the lag of an average is our ally - without adding that lag, the breakout will never happen. When the RSI crosses the top most or lowest bound, only then consider that a "real" overbought or oversold condition is happening.

Usage:

You can use it for possible reversal conditions detecting.

Wilson Relative Price Channel - mod

Wilson Relative Price Channel - mod

Wilson Relative Price Channel - modification

Laguerre RSI - no gamma

Laguerre RSI - no gamma

Laguerre RSI - without using the gamma parameter

DSL QQE histo

DSL QQE histo

Discontinued signal line QQE - histogram

ATR adaptive Laguerre filter

ATR adaptive Laguerre filter

ATR adaptive Laguerre filter