Join our fan page

- Views:

- 4812

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

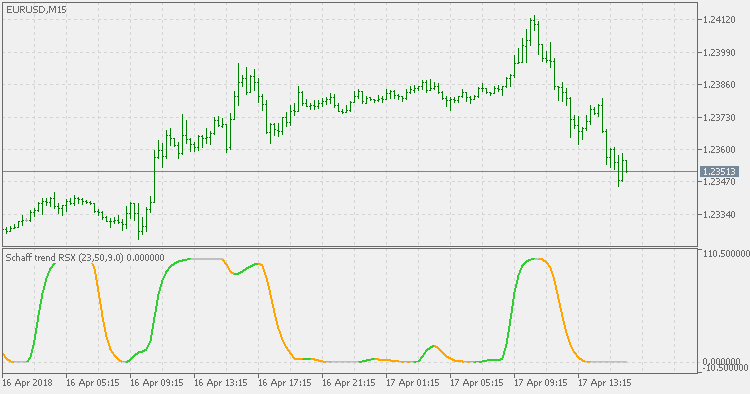

Schaff Trend RSI is a useful indicator, but if we follow the slope of the RSI as a signal, it might give us a bit too much signals.

The solution seems obvious: since RSX is "a smoother RSI" without a lag, in this version RSX is calculated instead of RSI. That makes the slope much smoother and produces significantly less color (slope) changes.

Schaff Trend RSI

Schaff Trend RSI

Schaff Trend RSI is an RSI of the MACD.

Kaufman AMA with filter

Kaufman AMA with filter

In addition to the usual parameters that are controlling the way Kaufman AMA is calculated, this version has adjustable smoothing and filter that can eliminate insignificant AMA changes.

Schaff TCD RSI

Schaff TCD RSI

Schaff Trend Convergence Divergence indicator has the benefit of putting the Schaff Trend CD on a scale of zero to 100, making it easier to identify potential overbought and oversold levels in a currency trend and is using RSI for a final calculation.

Schaff TCD RSX

Schaff TCD RSX

As a logical step to filter out more the possible false signals, this variation of Schaff TCD RSI is using RSX (which is a smoother RSI than the "regular" RSI) to produce a smoother result.