TRADER'S GUIDE:

It is an ExpertAdvisor developed exclusively for the MetaTrader5 and MetaTrader4 platform, based on a very simple hedging strategy.

Part 1: The hedging strategy

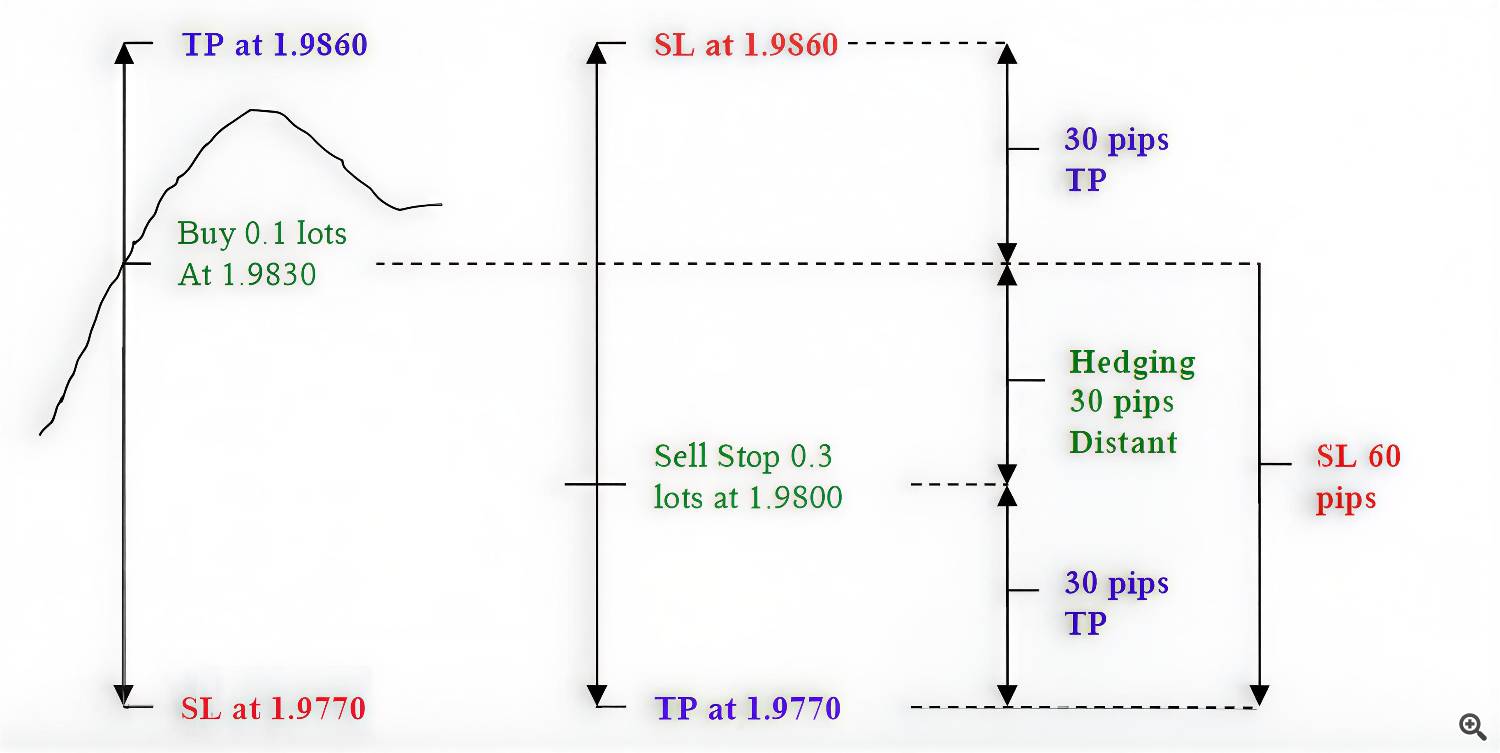

The EA open one first position in the trend direction (identified via an MA cross). A few milliseconds after placing the Buy market order, the EA places a Sell Pending Stop with the selected lot multiplier and distance (only on Legacy Mode).

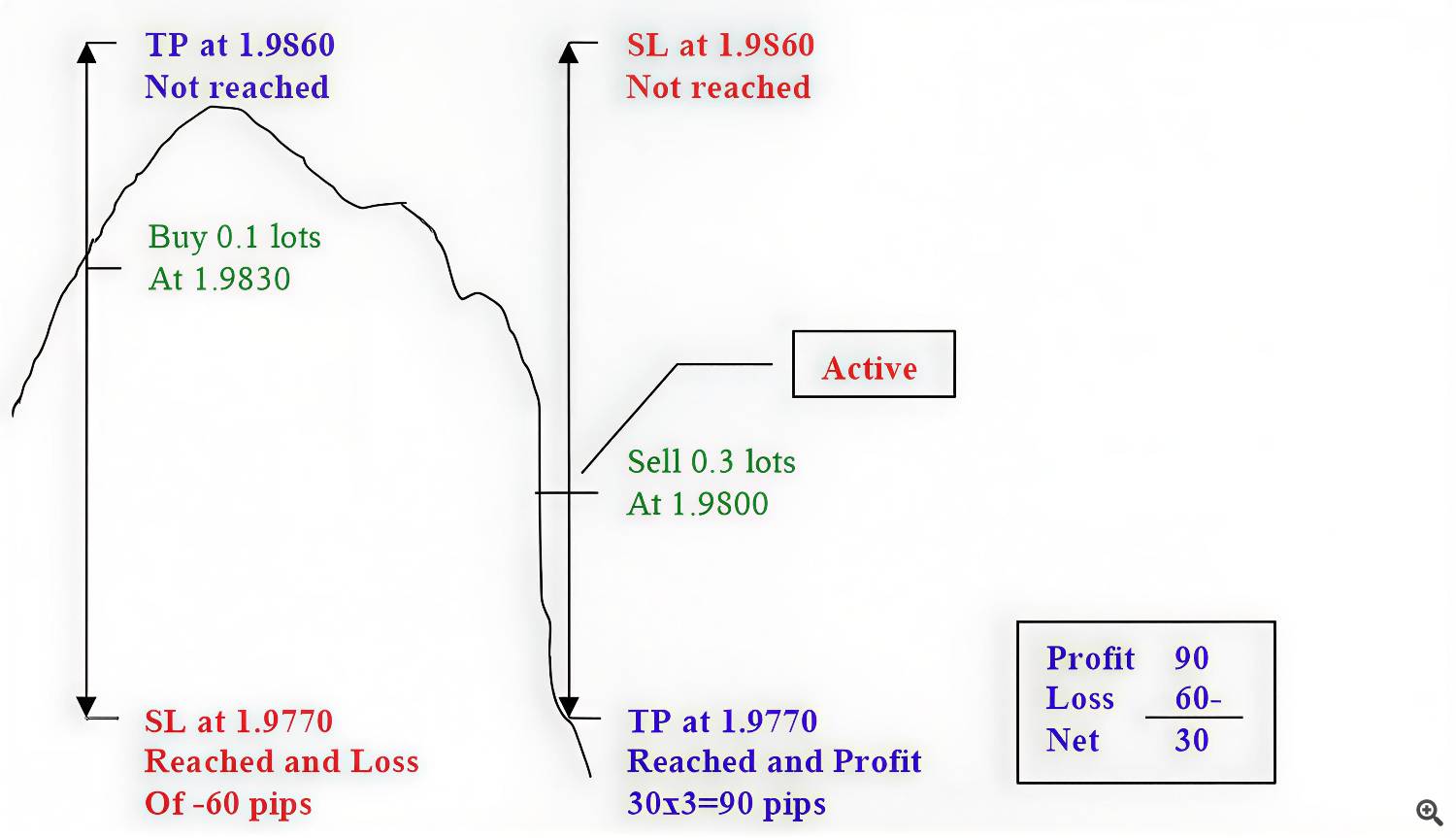

The TP and the SL are reversed for both orders, so if the first TP of the Buy is not reached, and the price goes down, the Sell Stop become an active Sell.

So when you hit the SL of the first Buy, you also hit the TP of the Sell, which is 2 o 3 times bigger than the SL, according to your selected multiplier.

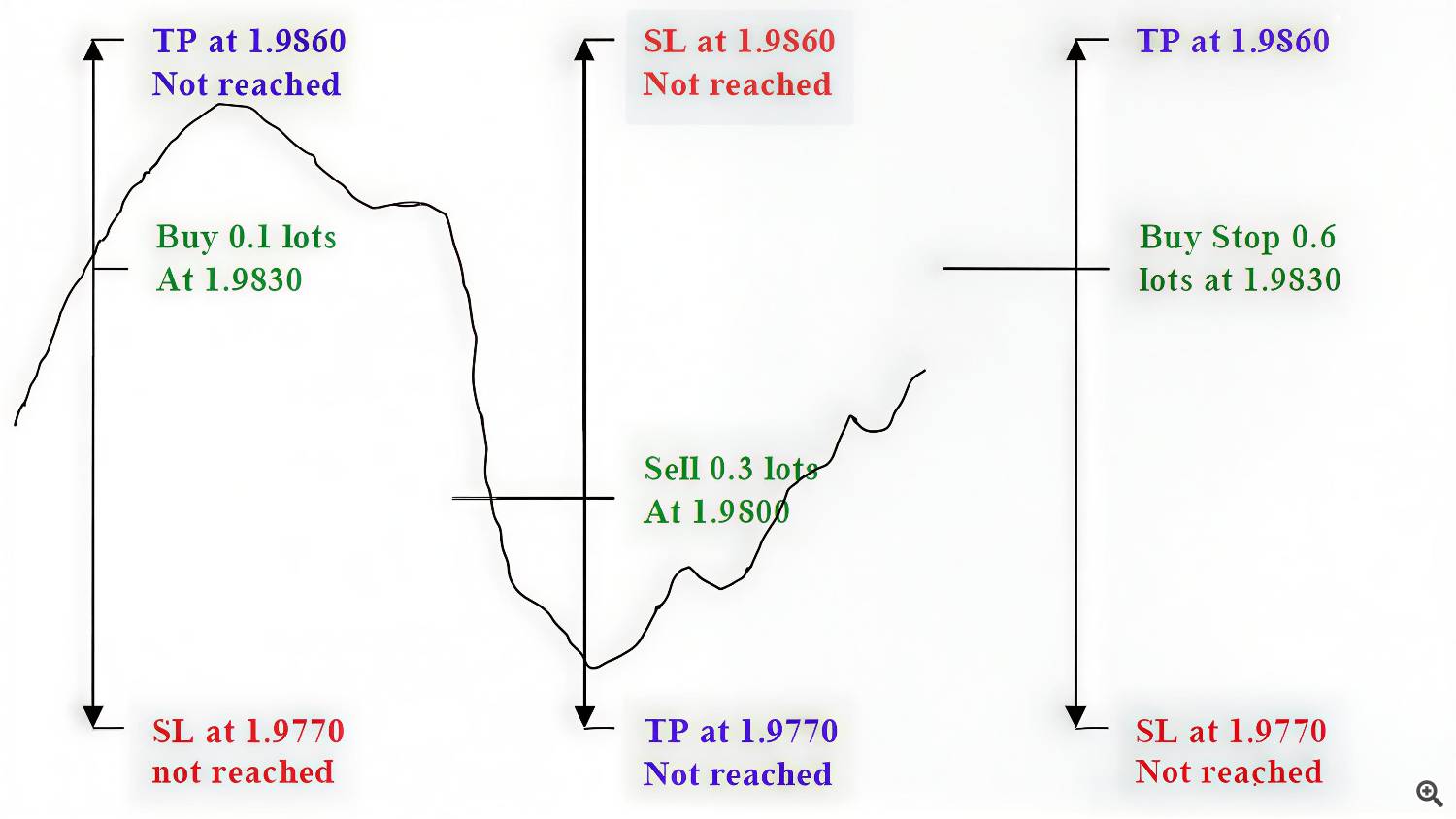

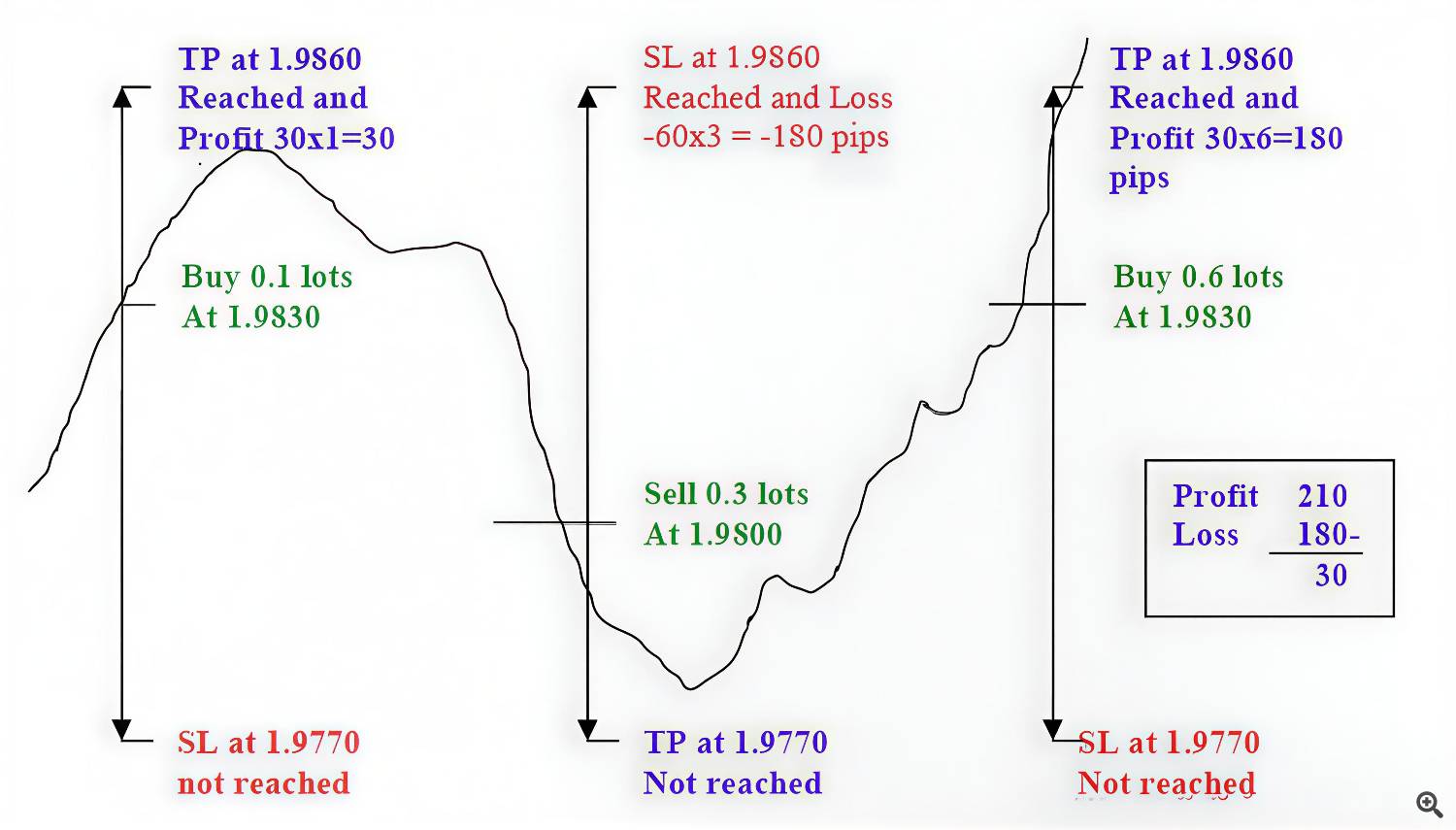

If also the Sell TP is not reached by the market price, a Buy Stop Pending is placed over the original Buy entry, so everywhere the market wants to go, you also hit SL and TP at the same time... And TPs are always bigger than SLs.

An example of settings for TP, SL and Distance is a constant ratio of 25/50/25 or 50/100/50 for forex pairs, or 1000/2000/1000 for Gold. So TP and Distance will be the same value, then the SL will always be 2 times TP/Distance values.

You can also experiment by yourself to find alternative settings that suits your trading target.

The crucial point of this strategy is to find a time period when the market will move enough. So you should prefer high volatility pairs and assets, like XAUUSD, than a ranging one.

Also money management is the second key, so you have to choose a low start lot to let the EA open larger pending orders, I suggest 0.01 cause you also have to consider a multiplier of 2.5 or 3.0 for each consecutive order.

See images below for a visual explanation of the strategy.

So here are my tips for using EA correctly and making the most of its potential.

Part 1: Setting up the EA for trading

- EA Mode: Stealth mode use only market orders. ATR mode autoset the TP/SL/Distance parameters. Legacy mode use pending stops for hedging orders.

- Autotrade: true by default, the EA opens positions automatically. I suggest to use this function under your personal supervision. If you choose false, you have 2 buttons on the panel to start open a position.

- Initial Lotsize: is the lot of the first trade, both for Stealth, Legacy or manual mode.

- TP: here you can input the TP of every order in points (in Stealth Mode this value sets also the Distance and SL between orders with autocalculation)

- Distance: here you can input the Distance of every hedging order in points, this value must be the same as TP (works ONLY on Legacy Mode)

- SL: here you can input the SL of every order in points, this value must be double of TP/Distance (works ONLY on Legacy Mode)

- Money SL: here you can input the max loss in money you would have on every cycle.

- Lot Multiplier: this is the coefficient for next pending order. I suggest to use a value greater than 2.5

- Max Orders: max numbers of open orders (both buy and sell)

- Max Lotsize: max lotsize reachable for positions/orders

- Trade on New Bar: If active, it allows the EA to open a new cycle only when the new candle opens (this is for the first order only)

- Start/End Hour: Time filter for opening a new cycle in autotrade mode (positions and subsequent hedging orders continue to be open even outside the filter hours)

Stealth is the newest and most efficient, in my opinion, as it uses only market orders instead of pending orders, thus hiding the strategy from the broker until its execution.

I've received several private requests to reintroduce the old pending stop function, so I've decided to offer this option. I personally will only use Stealth mode from now on.

The second choice is whether to use autotrading or open the first position manually.

Here, the choice is subjective. I personally use the EA only a few hours a day after the London opening, so I prefer to use it in autotrade mode and with a time filter active from approximately 8:00 AM to 2:00 PM.

However, if you're a trader who wants complete control, you can disable autotrade and open the first order manually through the EA panel with the Buy and Sell buttons.

NOTE: the EA only recognizes positions opened via the panel buttons, not those opened manually or by other EAs.

These three factors are crucial; in fact, when using Stealth Mode, the TP, once entered, automatically manages the distance (which will be the same) and the SL in points (which will always be double).

You won't have to do this calculation yourself, so you can simply choose the TP and optimize it according to your needs.

The new ATR mode automatically sets the TP/SL/Distance parameters based on the AverageTrueRange values for the timeframe in which the EA is active. This is very useful if you don't know how to set these values and want to use parameters consistent with price movement.

If you wish to use Legacy Mode with pending orders, you will need to manually enter the Distance and SL values, which should be set as follows: Distance equals the TP value, SL double the TP value.

Any other choice will cause the EA to malfunction. I mention this because many users have manipulated this ratio in the past and have written to me saying that the EA didn't work properly.

This is also why I created Stealth Mode with only one adjustable parameter.

Keep in mind that too small TPs (for XAUUSD, for example, values below 200) do not allow the EA to operate in profit, as the distance is too small and the spread and commissions could eat up more than 50% of the final profit, nullifying the operation.

My suggestion is to use values greater than 200 for XAUUSD, always keeping in mind that this value is the minimum and therefore will also be the riskiest of all.

It can generate large profits but also large exposure in the account in terms of margin and DD.

For safer trading, you should choose values higher than 2000 or 4000 and always test first with demo accounts or backtesters (even if the reliability is questionable).

For me, the best test remains a demo account and a session lasting at least a month in order to cover different scenarios.

The Money SL is an individual choice for each trader, who must build their own money management system.

Every balance will be different, and the percentage of risk to be taken is subjective. I might want to risk the entire account or half of it, while someone might only want to risk a quarter or a tenth.

This is a personal choice, so in my sets I don't specify a predetermined amount, but I risk the entire balance; it's up to you to adjust it.

Keep in mind that values that are too small will expose the EA to continuous losses. I remind you that this is an EA that works with growing lots, so it requires a certain margin of freedom in DD to operate.

For me (and again, this is not an indication, but a suggestion), values around 30% of the balance are acceptable, even up to half.

I encourage you once again to perform your tests in demo mode before real-life trading.

The Lot Multiplier is the third and final crucial parameter to set in this strategy, as it will determine the final profit when the EA exits in TP.

As explained in the strategy in the previous paragraph, to compensate for SLs taken at the same time as the TP, the EA requires increasing lots, so it goes without saying that a multiplier lower than 2 will bring little or no profit.

Values higher than 2 can bring profit but will barely offset losses, so I would aim for values around 2.5 or 3.

Any higher value will be even more profitable but will expose the account to a higher required margin and consequently a higher DD.

In my sets, I always use 2.5 or 3, and that's fine by me.

All other parameters are self-explanatory, such as Max Lot Size and Max Orders. It should be noted that the Time Filter only applies to the first order.

If there are running orders outside of these hours, the EA will continue to manage them and open new hedge orders to compensate.

Once the TP (or Money SL) is reached, the EA will close all orders and not open a new cycle since it is outside of its operating hours.