Burning Grid - How to use the Expert Mode to create an iFunds Setup

🔥 Burning Grid – How to Use Expert Mode to Create an iFunds Setup

🧠 What is Burning Grid?

Burning Grid is an advanced grid trading Expert Advisor designed to eliminate common weaknesses of traditional systems: no martingale logic, no uncontrolled averaging, and no drawdown traps. Instead, Burning Grid operates with:

-

Fixed strategies per symbol

-

Defined exit points with accepted losses

-

Individual risk settings per symbol and trade direction

-

A visually structured dashboard for full transparency

-

Full compatibility with prop firm requirements

With these features, the EA is ideal for traders who want to trade structured, rule-based, and with capital preservation in mind—even at a professional level.

You can read more about the system’s logic and philosophy in my detailed strategy blog, or explore the signals directly on the product page on MQL5.

💼 What is iFunds?

iFunds is a modern prop trading capital accelerator. Its goal: to provide ambitious traders with funding—without typical challenges like drawdown traps, strict daily loss limits, or direct user comparisons. iFunds offers a performance-based payout model and flexible risk rules.

A setup compatible with iFunds typically requires:

-

Clearly defined max risk per trade and symbol

-

Limited total account drawdown

-

A stable equity curve

-

No detectable patterns or copy-trading behavior

-

Strong and transparent risk management

🧩 How the Expert Mode Works

Expert Mode allows advanced users to override the global EA settings on a per-symbol basis. This makes it possible to create a finely tuned setup tailored specifically to iFunds requirements.

🔧 Which Parameters Can Be Adjusted per Symbol?

-

Risk profile: Override to Low, Medium, High, Default or Off

-

Buy risk [%]: individual risk for long strategies

-

Sell risk [%]: individual risk for short strategies

-

Spread limit [pips]: maximum allowed spread per symbol

These settings apply only to the selected symbol and override the global EA configuration.

📊 Example Configuration for an iFunds-Compatible Setup

| Symbol | Mode | Buy% | Sell% | Spread |

|---|---|---|---|---|

| EURUSD | Medium | 1.0% | 1.0% | 12 |

| GBPJPY | Low | 0.6% | 0.6% | 15 |

| USDCAD | Off | - | - | - |

Explanation:

-

EURUSD trades with a balanced profile and tolerates only moderate spreads.

-

GBPJPY is traded more conservatively due to its volatility.

-

USDCAD is completely disabled due to poor performance in current market conditions.

🔍 How to Find the Right Values for Expert Mode

To build an iFunds-compatible setup, you must determine optimal parameters per symbol via the Strategy Tester. Each symbol should be tested individually.

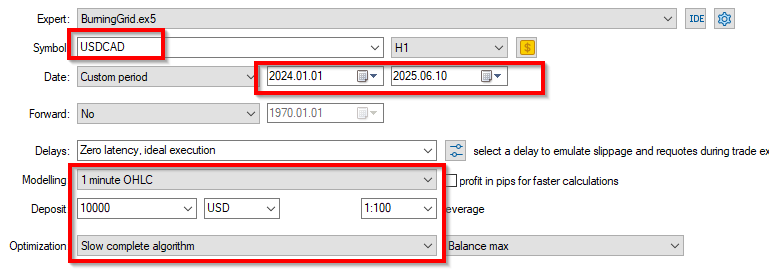

📌 Step 1: Prepare the Strategy Tester

-

Open Strategy Tester in MetaTrader 5.

-

Select the Burning Grid EA.

-

Enter the test symbol (e.g., USDCAD).

-

Set the timeframe to H1.

-

Choose a test period such as 2024.01.01 to 2025.05.31.

-

Use Modeling = "1 Minute OHLC" for realistic but efficient results.

-

Set leverage to 1:100 (standard for iFunds) and a realistic balance (e.g., $10,000).

-

Select “Slow complete algorithm” under Optimization.

Goals per symbol:

-

Identify the most stable risk profile

-

Determine the maximum tolerable spread

-

Assess behavior of buy vs. sell logic

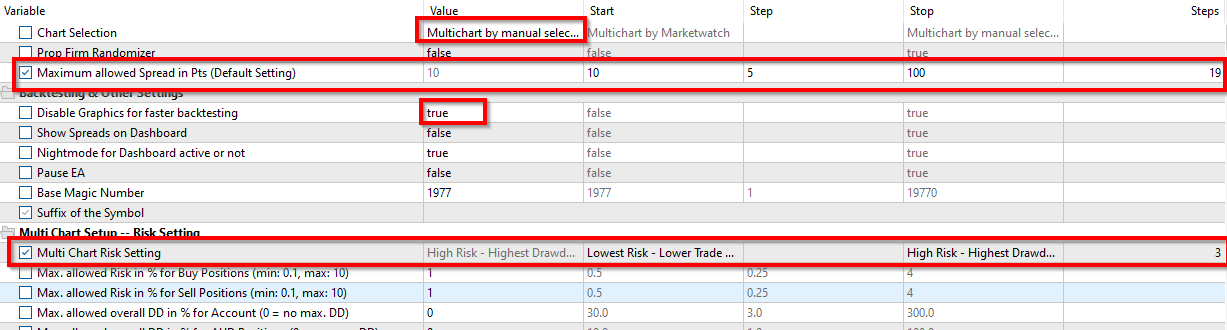

📌 Step 2: Configure Optimization Parameters

Inside the EA input settings:

-

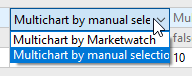

Set Chart Selection to "Multichart by Marketwatch" – this limits testing to the selected symbol.

-

Disable graphics for faster testing

-

Enable and test spread range: e.g., Start = 10, Stop = 100, Step = 5 → 19 spread values

-

Enable all risk profiles

-

Set all drawdowns to 0 (disable protection)

-

Set Buy and Sell Risk % to 1.0 each

-

Leave symbol overrides unset (Default)

Resulting in 3 risk levels × 19 spreads = 57 test cases per symbol.

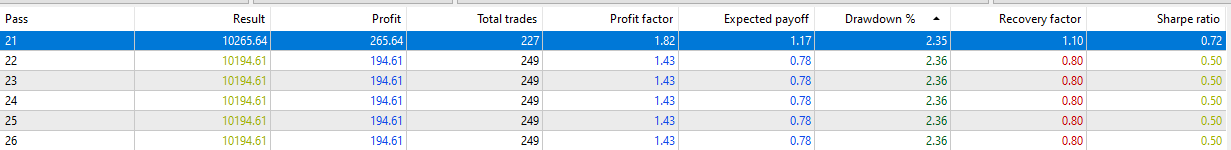

After starting the optimization, you’ll need to wait for results to calculate. Once complete, sort by lowest drawdown.

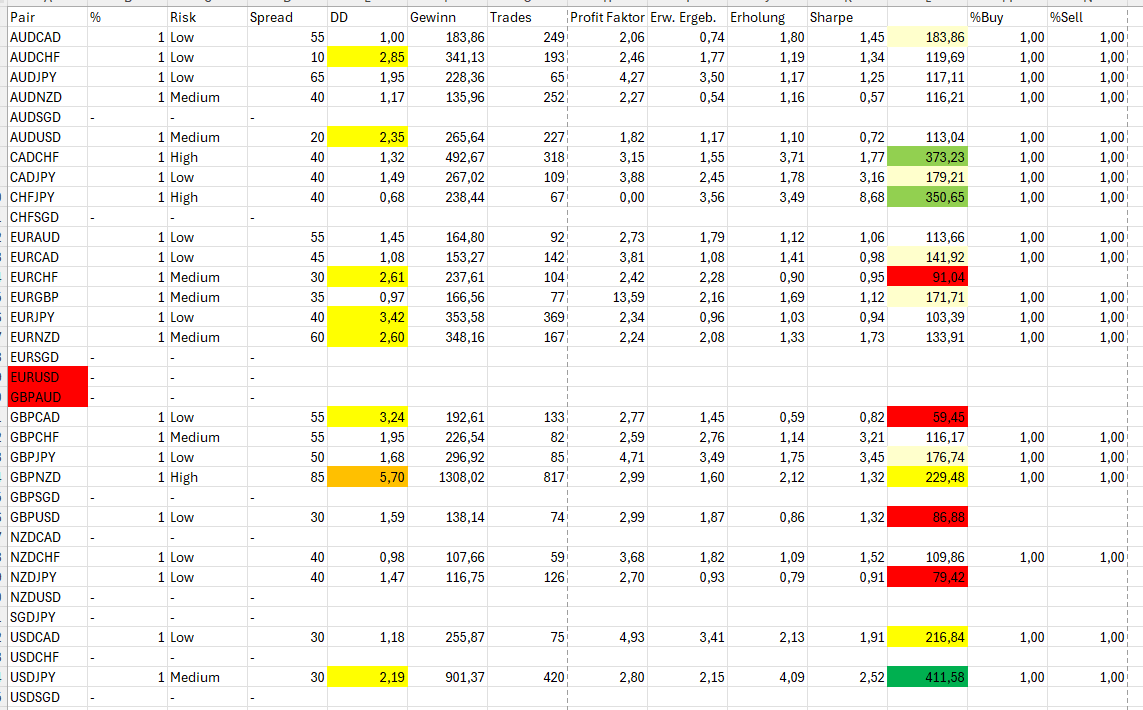

Select configurations with both low drawdown and solid profit/drawdown ratio. Transfer these results into an Excel sheet like this:

From here, prioritize symbols with the highest profit per 1% drawdown and build your optimized iFunds portfolio.

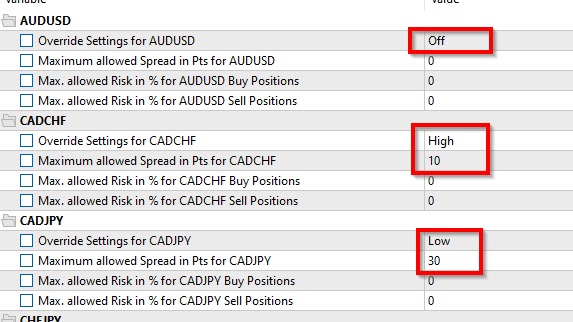

🧩 Final Step: Apply Configuration to the Setup

-

Disable optimization (set "Optimization = None")

-

Change Chart Selection to "Multichart by manual selection"

-

In the "Override Settings" tab, apply the values from your Excel sheet:

-

Select risk profile (Low / Medium / High / Off)

-

Input spread limits per symbol

-

-

Set all unused or unprofitable symbols to Off

Now your setup is ready for live execution – targeted, verified, and fully aligned with iFunds specifications.

📈 Example of Consolidated Test Results

With all parameters entered, a final backtest can be run. In this example, the period is short (01.01.2025–31.05.2025) to simulate immediate account behavior under live funding conditions.

A 50K USD iFunds account (1:100 leverage, 10% max drawdown, 50/50 split) was used. Parameters were slightly adjusted based on previous Excel findings.

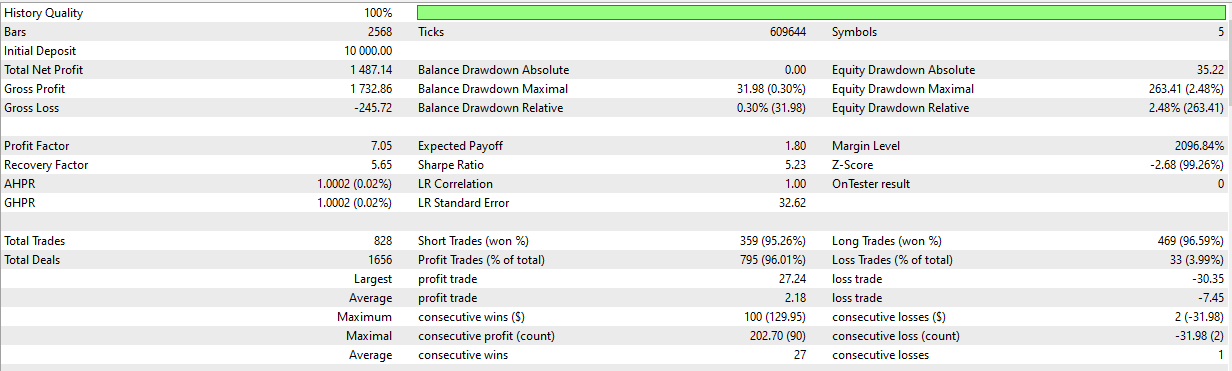

Initial result:

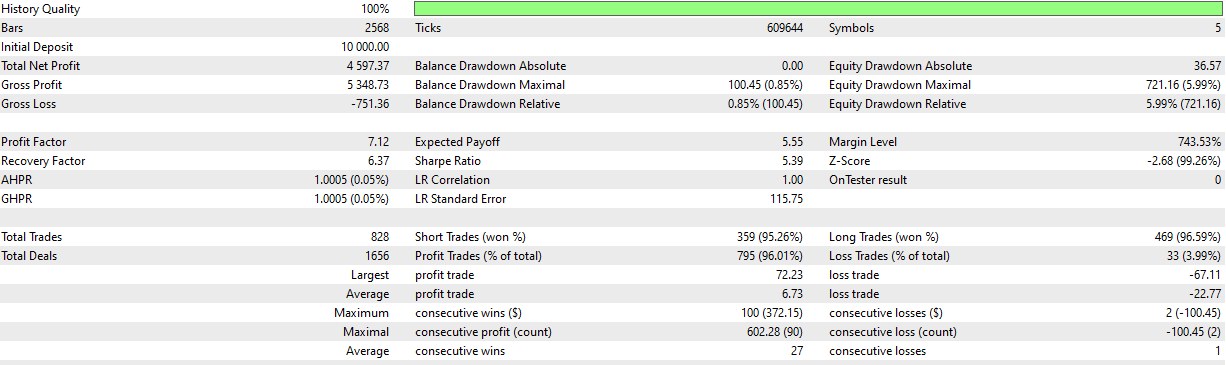

Followed by a refined version with excellent metrics:

-

Net Profit: $4,597 at 5.99% max drawdown

-

Profit Factor: 7.12

-

Sharpe Ratio: 5.39

-

Recovery Factor: 6.37

-

Win Rate: 96.01% across 828 trades

With drawdown safely below the 10% limit, the setup leaves enough buffer for market volatility. These settings are now used live in my iFunds 50K signal:

➡️ https://www.mql5.com/en/signals/2312769

✅ Advantages for iFunds Deployment

-

Granular risk allocation per symbol

-

Controls for currency correlation and DD clustering

-

No need for multiple EA instances

-

Fully traceable for reporting and prop firm verification

Conclusion: Expert Mode turns Burning Grid into a modular toolset for building structured, funding-grade portfolios with full control.

🛒 Burning Grid on MQL5 Marketplace - https://www.mql5.com/en/market/product/135273

📖 Read the Full Blog Article - https://www.mql5.com/en/blogs/post/762740

💬 Join the Community & Support Group - https://www.mql5.com/en/messages/0151274c579fdb01