SwingTracer – Adaptive Swing Signal Indicator

Join the channel to stay updated: https://www.mql5.com/en/channels/forexnewadvisor

SwingTracer is an adaptive swing trading indicator designed to identify potential swing reversal points by dynamically analyzing recent price movements and volatility. It helps to capture early signals of trend shifts by detecting changes in price momentum using an ATR-based dynamic range.

Core Concept Includes:

- Calculation of dynamic support and resistance levels based on recent price swings and ATR volatility

- Detection of potential swing reversals when price breaks above or below these adaptive levels

- Visual signals with arrows marking probable buy and sell swing points on the chart

- Alert system synchronized with arrow signals to notify traders of new swing signals in real-time

SwingTracer is especially useful for intraday and swing traders looking to identify reliable entry points in trending and ranging markets.

How It Works

Signal generation is based on:

- Swing and Range Analysis: The indicator calculates dynamic thresholds from recent highs and lows adjusted by ATR-based volatility over a configurable number of bars (NumBars).

- Adaptive Thresholds: Support and resistance levels adapt to recent market conditions, allowing timely detection of swing reversals.

- Trend Reversal Detection: Buy signals occur when price moves below the dynamic lower threshold and then reverses upward; sell signals occur when price moves above the upper threshold and then reverses downward.

- Signal Synchronization: Arrows are drawn exactly when swing reversals are confirmed, and alerts are triggered simultaneously (if EnableAlerts is true).

- Non-Repainting Logic: Signals appear only after bar close, ensuring reliable and stable swing signals without repainting.

All calculations are performed using closed candles and adaptive ATR ranges to ensure robustness and accuracy.

Arrows and Alerts

The indicator provides clear visual and audio cues to assist in decision making:

- Blue Arrows: Indicate potential buy swing points.

- Red Arrows: Indicate potential sell swing points.

Arrow positions adjust dynamically according to recent price volatility to ensure clear and meaningful signals on the chart.

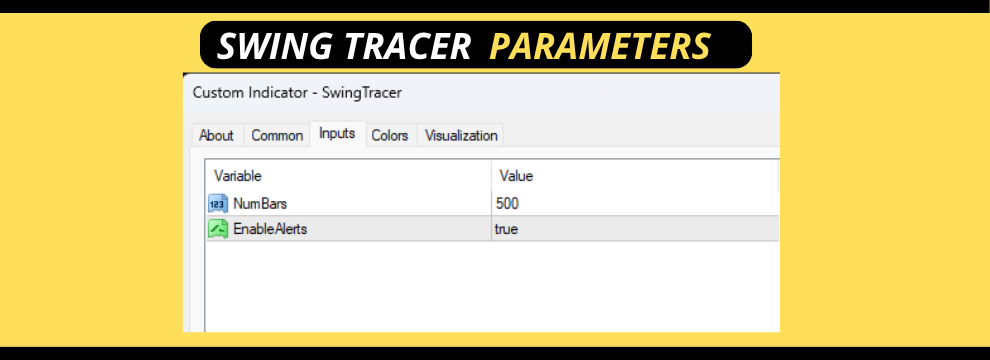

Parameters Overview

- NumBars: Number of bars used to calculate recent swing ranges and volatility for threshold calculation.

- EnableAlerts: Enables or disables real-time alerts when new swing signals are detected.

Parameters can be customized to suit different trading styles, from fast intraday swings to longer-term position entries.

Best Use Practices

- Recommended Markets: Works well on Forex majors, indices, and liquid commodities.

- Best Timeframes: Suitable for M1 to H4 charts for scalping, swing and intraday trading.

- Sessions: Most effective during active market hours with moderate to high volatility.