Alphabet EA Performance Results for 2024: Comparison with Testing Results

In the world of Forex trading, finding effective strategies to maximize profits and minimize risks is critical. Two popular approaches are using the multi-layer perceptron (MLP) strategy and mean reversion which are implemented in our Alphabet AI trading advisor.

⭐️⭐️⭐️⭐️⭐️ MT4 Version Available Here: https://www.mql5.com/en/market/product/108004

⭐️⭐️⭐️⭐️⭐️ MT5 Version Available Here: https://www.mql5.com/en/market/product/108005

✅ Live Signal: https://www.mql5.com/en/users/delmare/seller

Alphabet EA is an algorithmic trading advisor that we added to the Market in November 2023 to automate trading on the MetaTrader 5 platform. After a year of its operation, we gathered valuable data that helped evaluate the strategy’s effectiveness. In this post, I will compare the results of real trading with backtesting data for the same period to see how well the testing matches actual performance.

Trading Results for 2024

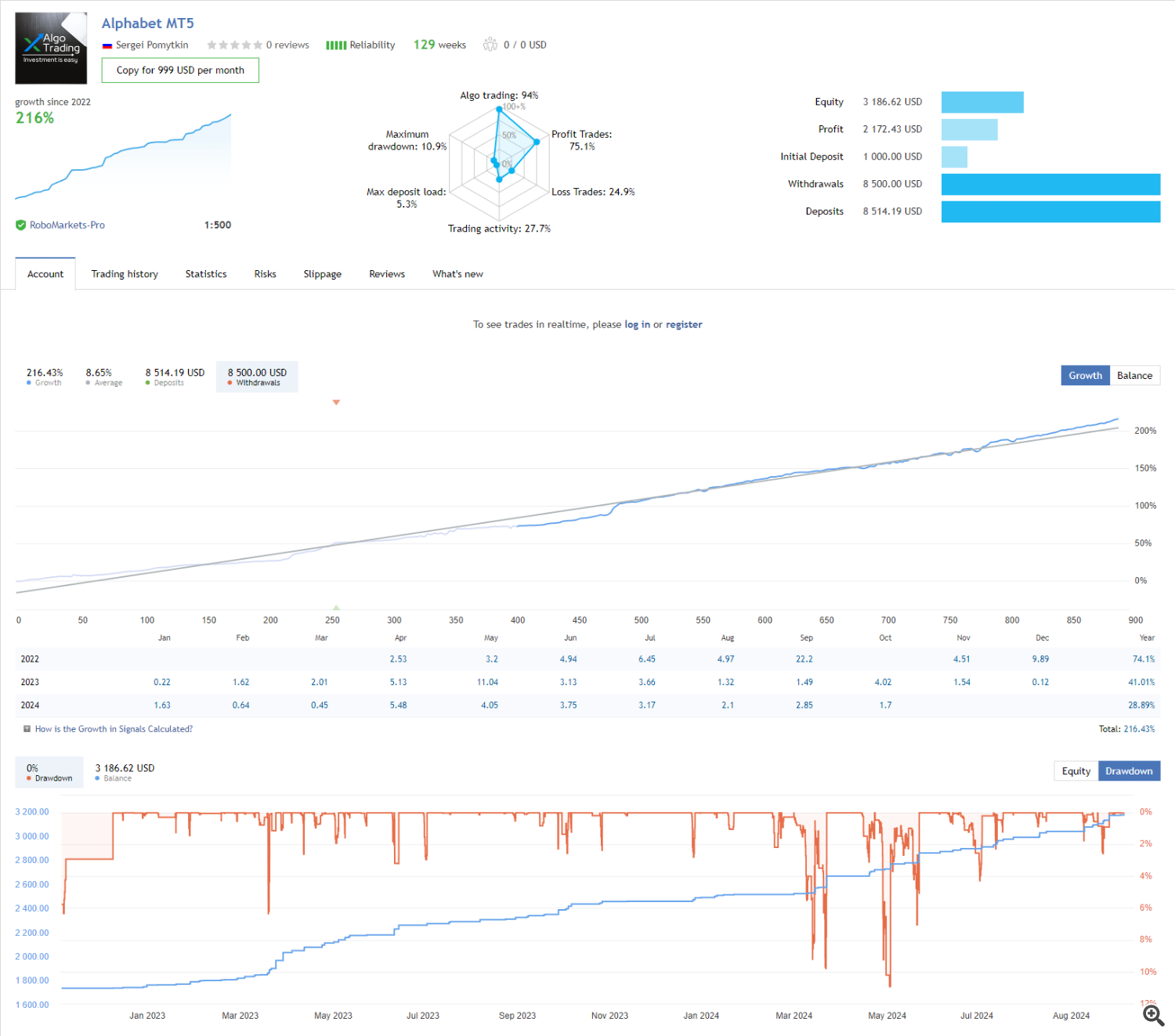

Real Trading

For 2024, the Alphabet EA achieved the following results:

- Net profit: $713.66.

- Maximum drawdown: 10.9%.

- Total trades: 211.

- Profit factor: 3.38.

- Average trade size: $3.38.

The real trading chart shows steady growth in capital with only occasional and minor drawdowns. The maximum drawdown was just 10.9%, indicating a low level of risk. The overall capital growth for the year exceeded 200%, which is an excellent result for a long-term strategy.

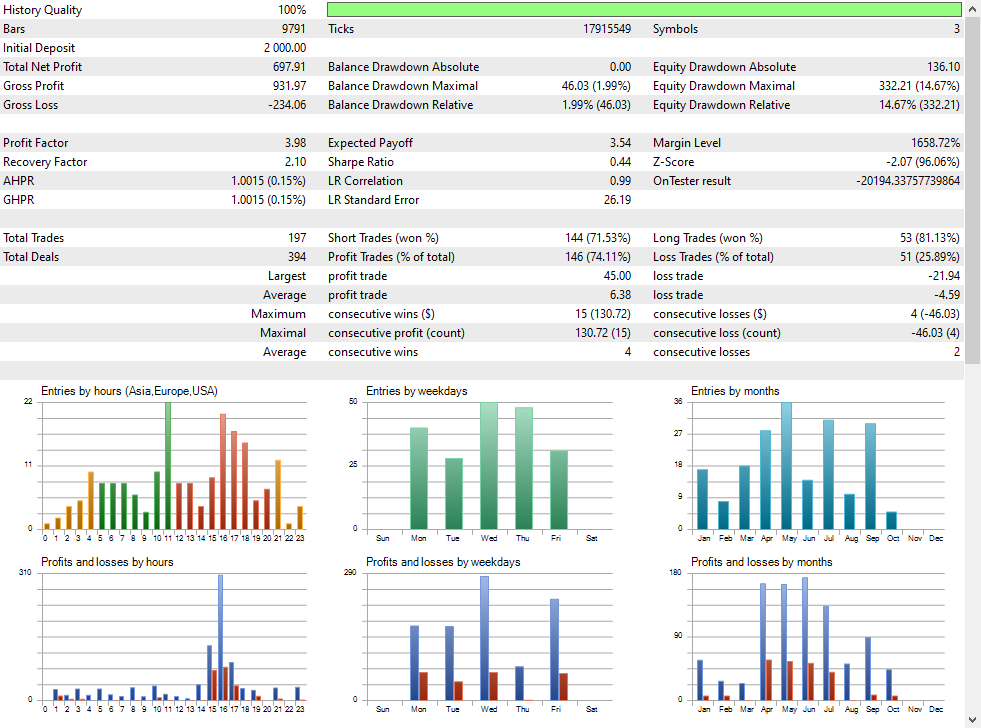

MetaTrader 5 Testing Results

Simultaneously, I conducted backtesting on historical data to evaluate how well real trading results match the forecasts:

- Net profit: $697.91.

- Maximum drawdown: 14.67%.

- Total trades: 197.

- Profit factor: 3.98.

- Average trade size: $3.54.

The backtesting results are almost identical to the real trading outcomes, confirming the algorithm's effectiveness. The backtest showed slightly lower profits and a slightly higher drawdown, but these differences are insignificant. This confirms that the EA works reliably on both historical data and in live trading.

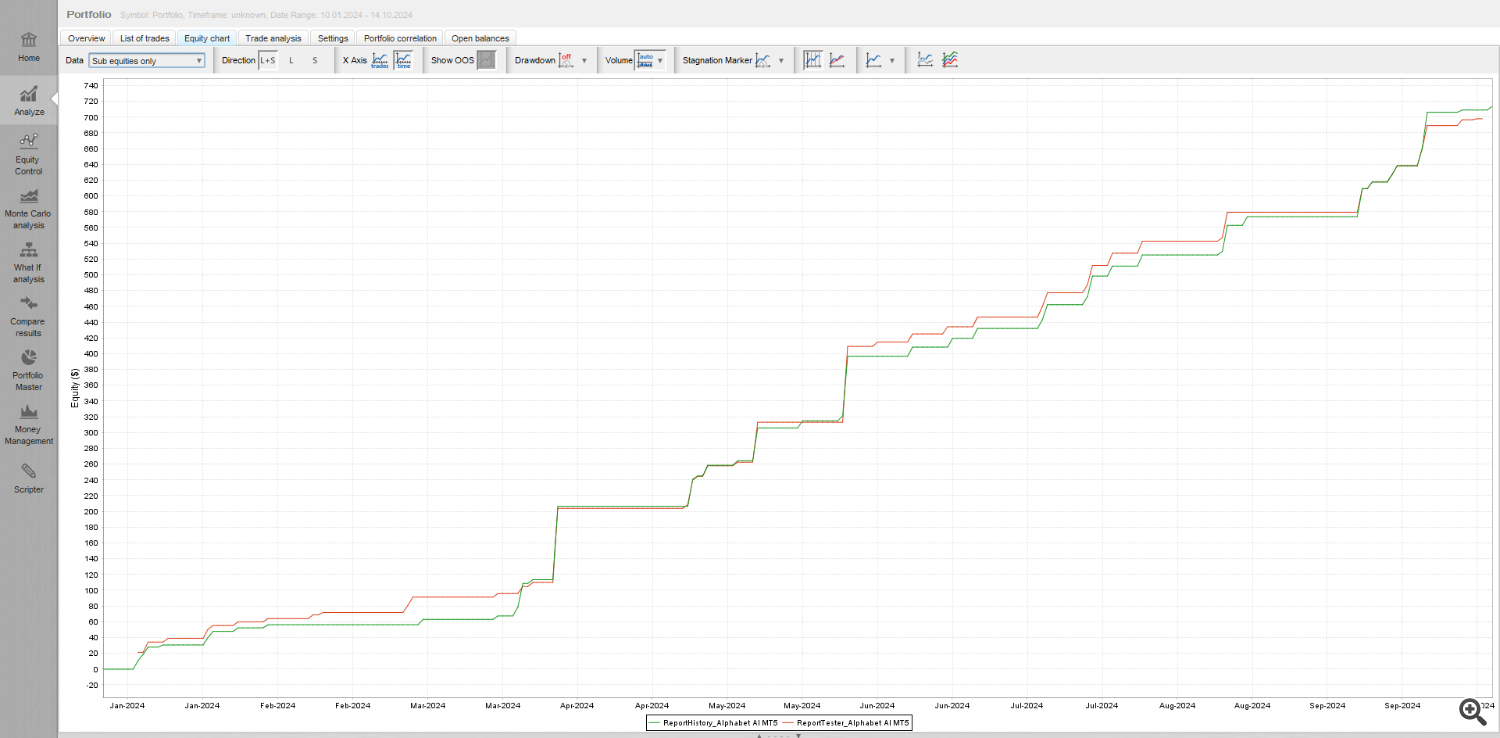

Real Trading vs Testing Comparison

Below is a chart comparing the profit curves from real trading and backtesting. As you can see, the curves are almost identical. This indicates that the strategy performs similarly in 95% of cases during both testing and live trading.

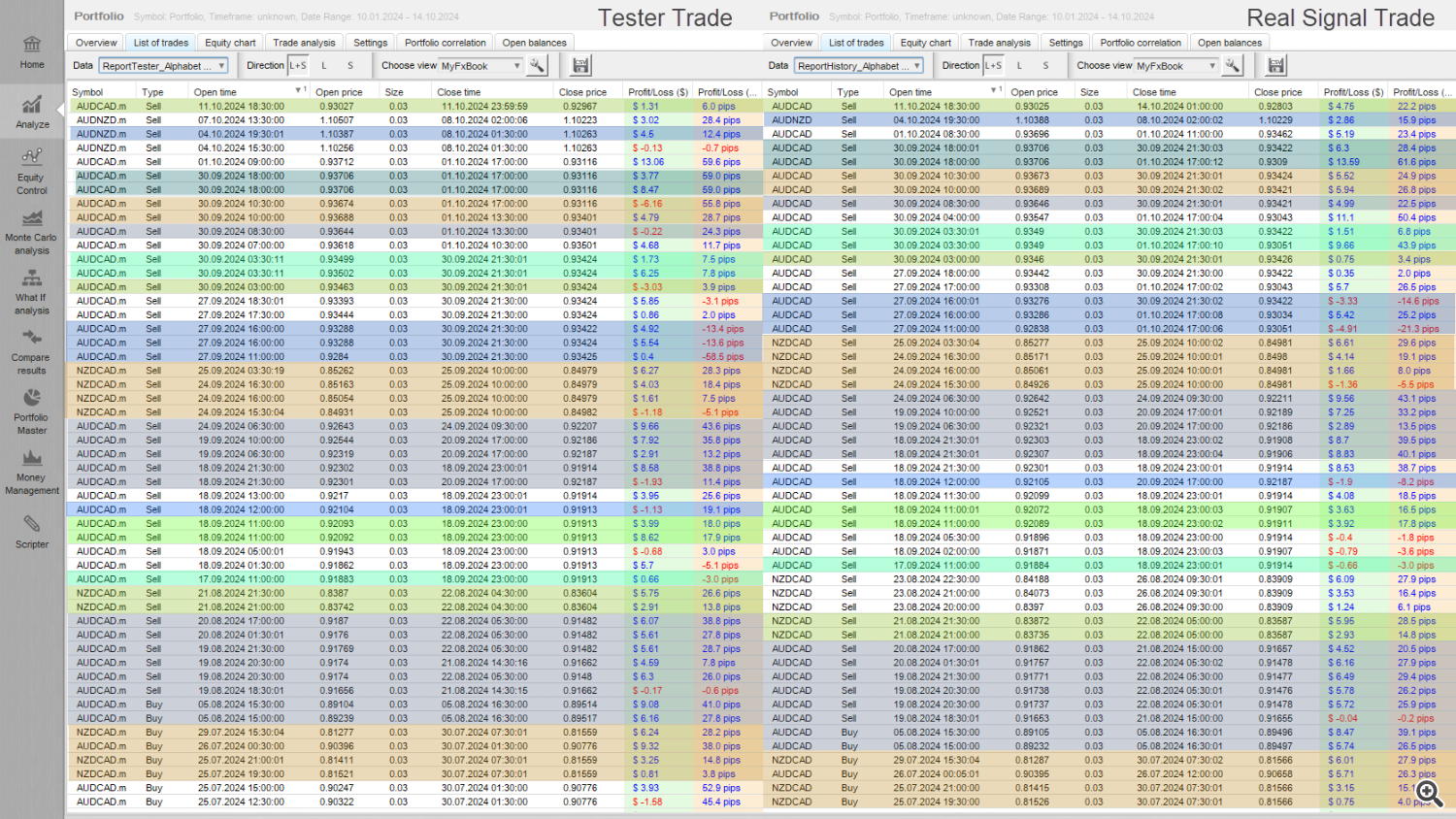

Additionally, let’s take a closer look at the chart based on trades from the last few months. In the table below, I highlighted the trades that match between the test and the real trading reports. As shown, the majority of trades coincide in both time and results.

Throughout 2024, the results of real trading and testing remained almost identical. The average drawdown and profit are nearly the same, which demonstrates the strategy's reliability.

- Real profit: $713.66 versus test profit: $697.91.

- Real trading drawdown: 10.9% versus test drawdown: 14.67%.

- Profit factor: 3.38 in real trading and 3.98 in backtesting.

The minimal differences between testing and live trading results confirm the high quality of the algorithm and its ability to adapt to changing market conditions.

Conclusions and Lessons Learned

After a year of operation, Alphabet EA proved its effectiveness and resilience to market fluctuations. The EA showed excellent results in both real trading and backtesting. The low drawdown and steady capital growth make it a highly reliable tool for long-term automated trading.

Plans for the Future

In 2025, I plan to test Alphabet EA on additional currency pairs and different market conditions. There is also an intention to optimize certain parameters to further improve efficiency and reduce risks.

Subscribe to our resources: