-> Sonic v2.46

🔵 Sonic MT4 -> https://www.mql5.com/en/market/product/105916

🔴 Sonic MT5 -> https://www.mql5.com/en/market/product/105892

-> Onyx v1.18

🔵 Onyx MT4 -> https://www.mql5.com/en/market/product/109736

🔴 Onyx MT5 -> https://www.mql5.com/en/market/product/109743

-> CARA v1.30

🔵 CARA MT4 --> https://www.mql5.com/en/market/product/112537

🔴 CARA MT5 --> https://www.mql5.com/en/market/product/112600

Intro

This manual is a general user-guide for all Blue Algos EA include:

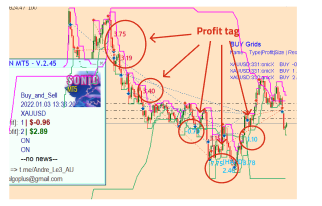

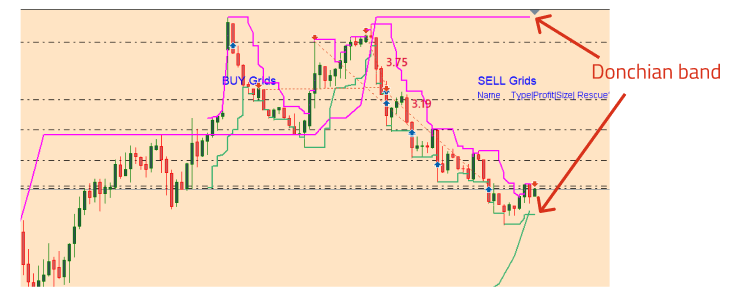

1| BlueSonic Donchian EA ('Sonic') is multi-currency ➕ multi-timeframe EA base on Donchian indicator.

2| BlueOnyx Pi EA ('Onyx') is multi-currency ➕ multi-timeframe EA base on multi-layer / cross-timeframe Fibonacci indicator.

3| Blue CARA EA ('CARA') is multi-currency ➕ multi-timeframe ➕ multi-strategies EA base on various Smart Money Concept (ICT) setups.

Other than normal one-off entry, users would have option to activate grid series to maximize return from sub-optimal entry. What make Sonic stand out from other grid EA on the market is its core advantages:

-

Ease and flexibly to set up (ONLY one-chart needed) which suit many trading styles: trend-follow, counter-trend, breakout, market-open session, night-scalping etc.

-

Cutting-edge order management and risk management system (thanks to the built-in GridRescue module) and well-researched/well validated features

-

Institutional-grade trading logic built into the code architecture to address many known grid-trading related circumstance without the hefty price tag

🔴 Recommendation for quick start:

- minimum account balance: $1500 (for 1:500 leverage) or $3000 (for 1:200 leverage) for each Symbol. Use cent account if needed

- start lot: 0.01

- symbols:GOLD : XAUUSD

FOREX : most FX majors and minors cross of USD, EUR, GBP, AUD, CAD (🙅♀️ avoid JPY, NZD, CHF and exotics pairs)

INDICES : GER40, NASDAQ100,SP500 etc.

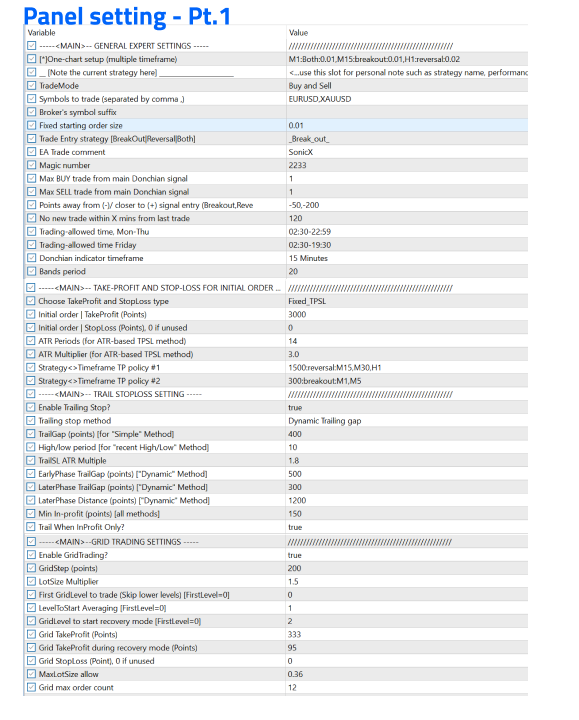

Panel Setting

2 Parameters explanation

1. GENERAL EXPERT SETTING

| # | Inputs | Description | |

|---|---|---|---|

| GENERAL EXPERT SETTING | |||

| 1.1 | One-chart setup (multiple timeframe) | Strategy string with syntax: <Timeframe>:<EntryType>:<StartLot> where: - <Timeframe>: M1, M5, M15, M30, H1, H4, D1, W1, MN1 (case insensitive) - <EntryType>: either one of these values "BreakOut", "Reversal", or "Both" (case insensitive) - <StartLot>: the starting lot of the initial trade, e.g. 0.01 Multiple strategy string can be entered seperated by comma "," | "M5:Both:0.01" this will instruct Sonic to trade Breakout and Reversal trades on M5 timeframe with start lot of 0.01 "M1:breakout:0.01,M15:reversal:0.02" this will instruct Sonic to trade breakout strategy on M1 start with 0.01 lot and reversal strategy on M15 start with 0.02 lot |

| 1.2 | __[Note the current strategy here]___ | This is a string placeholder where you can jot down some note about current specified strategy - for quick memory note. It does not have any effect on the EA operation. Handy if you want to quickly save a secondary strategy string to swap out with another one | |

| 1.3 | TradeMode | Choose from dropdown: - "Buy_and_Sell" - "BuyOnly" - "SellOnly" - "NoTradeAllowed" | |

| 1.4 | Symbols to trade | List of Symbol which Sonic would operate on. | String list of broker's symbols, separated by comma(,): - "EURUSD,GBPUSD,USDJPY" If your broker use suffix for their symbols, you can either use the "Broker's symbol suffix" input parameter below or just insert it directly here as follows: - "EURUSD.pro,GBPUSD.pro,USDJPY.pro" if this field left blank, then BlueSwift will only operate on the current chart's symbol only (i.e. the chart's symbol where you drop BlueSwift on) |

| 1.5 | Broker's symbol suffix | Broker's designated suffix for their tradable symbols | Aside from field #4, you can also add your broker's suffix for trading symbol here. For example: if your broker's instruments are EURUSD.ecn then put ".ecn"if your broker's instruments are EURUSD.. then put ".."This can be blank if you already include the symbol suffix in the field #4 above |

| 1.6 | Fixed starting order size | Start lot size. If the One-chart setup strategy string (field #1) above is empty (blank) then this start lot will be applied | |

| 1.7 | Trade Entry strategy [BreakOut|Hedge|Both] | Select the trade entry strategy when price cross or touch the High/Low Donchian Band If the One-chart setup strategy string (field #1) above is empty (blank) then this start lot will be applied | BreakOut: EA will open BUY (SELL) when price cross upward (cross downward) the High (Low) Donchian band |

| 1.8 | EA Trade Comment | order comment that will be displayed in the initial orders from Donchian entry signal | |

| 1.9 | Magic Number | order magic number | Note: Sonic will add internal suffix and prefix to this magic number so differentiate between each timeframe and entry type (BreakOut | Reversal) as follow: Prefix "31" for M1 "32" for M5 ... Suffix: "0" for BreakOut, "1" for Reversal So let says user set this field to "445" and if a BreakOut order placed in M1 timeframe it's magic number will be: "314450" ---------------- For MT4: please use a 3rd party EA or journal site like Myfxbook, FXBlue to get the order's magic number For MT5: you can view order's magic number in the terminal order tab |

| 1.10 | Max BUY trade from main signal | Number of Buy order allowed for main signal entry (for each timeframe) *this does not count grid order spawned from the main trade | for example if this field = 1 then there would only be 1 buy order allowed for the selected timeframe. If user has set Sonic to trade 3 timeframes then this means that there would be up to 3 Donchian buy order can be entered at any time |

| 1.11 | Max SELL trade from main signal | Number of Sell order allowed for main signal entry (for each timeframe) *this does not count grid order spawned from the main trade signal | |

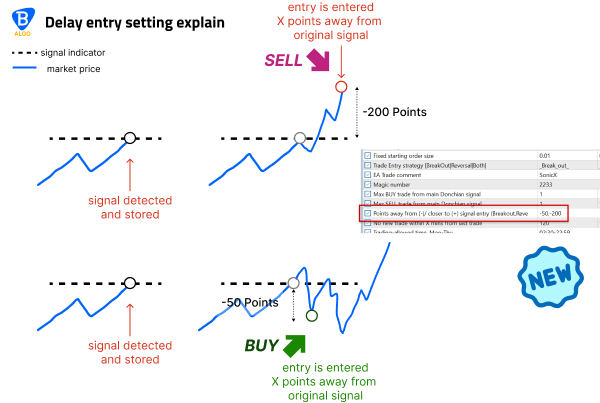

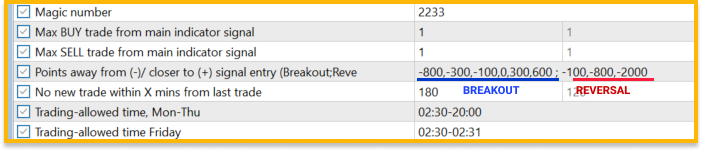

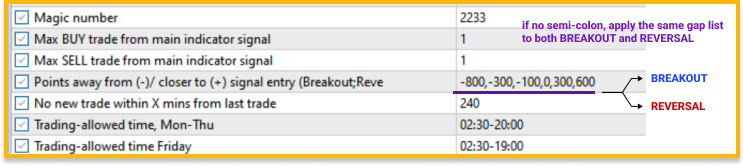

| 1.12 | Points away from (-)/closer to (+) signal entry (BreakOut;Reversal) | Signal 'Delayed' entry gap: this allows user to have Sonic enter trade X points further from original trade signal's entry price (where price cross the signal price). Negative number: entry is pushed 'behind' the direction of the signal. For example if signal is BUY (SELL), then -100 means 100 point BELOW(ABOVE) signal price level Positive number: entry is pushed 'forward' in the direction of the signal. For example if signal is BUY, then 100 means 100 point ABOVE (BELOW) signal price level (see the illustration on the right for more info) |  ------------------------------------------------------------------------------------------------------------------------------ From latest updates, users can set multiple Delay entry gap for both BreakOut and Reversal entries. The separation between BreakOut and Reversal entries is marked by semi-colon (`;`): syntax: <BreakOut entrygap1>,...,< BreakOut entrygapN >; <Reversal entrygap1>,...,< Reversal entrygapN > Example:  This means that: - when price touch ANY level(s) that are 800, 300, 100, 0 points behind or 300, 600 points (forward) of a entry signal -> open BREAKOUT trade - when price touch ANY levels(s) that are 100, 800, 2000 points behind of an entry signal -> open REVERSAL trade Note: if you only provide one list of entry gap offset then EA will apply this same list to both BreakOut and Reversal trade entry  |

| 1.13 | No new trade within X mins from last trade | Number of minutes within the latest trade that expert will not allow open another trade. | Useful to avoid too many trade open close to each other when user choose to allow Expert open more than one active order (e.g. set item #1.10 and #1.11 above with value more than 1) For example if user set Max number of BUY order to "2" and this item to "120" (minutes). Then each new BUY will not be opened within 120 minutes of the previous BUY order open time |

| 1.14 | Trading-allowed time, Mon-Thu | The time range in which Donchian main signal trade is allowed to place from Monday to Thursday | String of time-range, separate by comma (,) Format for each time-range (<Start time>-<Endtime>) (where time is in "hh:mm" format) For example 04:30-10:00 means Start Time = 4:30 and End Time = 10:00. Sonic will place new entry from Donchian signal within this time-range User can set multiple time-ranges, separated by comma: 04:30-10:00,14:30-22:59 |

| 1.15 | Trading-allowed time Friday | The time range in which Donchian main signal trade is allowed to place on Friday | same as #1.13 |

| 1.16 | indicator timeframe | The timeframe for the Donchian indicator If the One-chart setup strategy string (field #1) above is empty (blank) then this start lot will be applied | If user use one-chart strategy string then the Donchian indicator's timeframe will be according to each timeframe in the one-chart strategy string --- author note: from Sonic v2.40 this option has been built-in and user no longer need to input this. Will have this hide in future release |

| 1.17 | Indicators' past candles to scan | The periods of the main trading indicator (number of past candle) of the current EA - | - for Sonic it's the lookback candles for Donchian band - for Onyx it's the loobback candles for Start and End points of Fibonacci line |

| 1.18 *Unique for Onyx | entry policy for Fibo-level (;) separated | Different levels of Fibonacci for signal entry to be captured and order to be placed. Separated by semicolon (;) between Breakout and Reversal entry type and | Example: "breakout:50,123.6,161.8; reversa l:-61.8,78.6" This will instruct Onyx to: - for Breakout entry type (same direction with Fibo line): enter at fibo level 50.0, 123.6 and 161.8 - for Reversal entry type (against direction with Fibo line): enter at fibo level -61.8 and 78.6 |

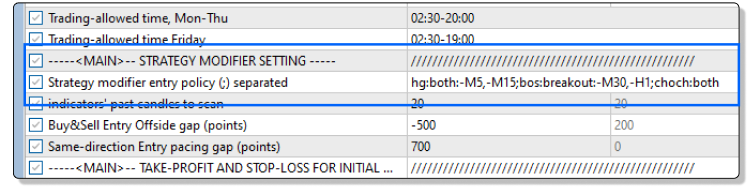

| 1.19 *Unique for CARA | Strategy modifier entry policy (;) separated | Pick and choose between four different setup: - HG or FVG (Hidden gap or FairValueGap) - BOS: break of structure - CHOCH: change of character - OB: orderblock | Syntax: {hg|bos|choch|ob}:{breakout|reversal|both}:{timeframe exception} Example  this means that: HG: trade both BREAKOUT and REVERSAL signals on all timeframes, except M5 and M15 BOS: trade BREAKOUT signals only all timeframes, except M30 CHOCH: trade both BREAKOUT and REVERSAL signals on all timeframes |

2. TAKE-PROFIT AND STOP-LOSS SETTING

Take proft and stop loss setting for the initial order (placed when Donchian entry signal detected)

| # | Inputs | Description | Value and examples |

|---|---|---|---|

| 2.1 | Choose TakeProfit and StopLoss type | Choose from 2 type of TakeProfit & StopLoss: - Fix TPSL - ATR | "Fix TPSL": user define fix TP and SL using points away from order open price "ATR": TP and SL is set base on ATR factor |

| 2.2 | TakeProfit (Points) | TP for initial order placed by Donchian signal in points | whole number (integer). For example if set to 500 then this means TakeProfit is set 500 points from the order open price |

| 2.3 | StopLoss (Points) - 0 if unused | SL for initial order place by Donchian signal in points | whole number (integer). For example if set to 2500 then this means StopLoss is set 2500 points from the order open price. If user want to disable StopLoss (no stop loss) then set this to 0 |

| 2.4 | ATR Periods | (for TPSL's ATR method) the number of past candle to calculate ATR value | |

| 2.5 | ATR Multiplier | (for TPSL's ATR method) the factor that the ATR value in #2.4 to be multiplied by | For example if user set ATR Multiplier = 3.0 then the current ATR value calculated from ATR indicator will be multiplier by this factor and then add / subtract from the order open price to arrive at TP and SL value |

| 2.6 | Strategy<>Timeframe TP policy #1 | Allow user to set different TakeProfit level for each timeframe & strategy combination - slot 1 | Available from version 2.43, user can have different TakeProfit for each Timeframe x Strategy combination.The policy syntax would be: <TP points>:<strategy>:<list of timeframe to apply> for example: "1500:reversal:M15,M30,H1" means that TakeProfit will be set to be 1500 points for reversal trade on M15, M30 and H1 signal. This is useful for the volatilty and strategy winrate differences often seen in each timeframe. For example with BreakOut strategy generally smaller TakeProfit level should be preferred than a bigger TakeProfit. Also in smaller timeframe like M1 to M15, generally user may also want to have smaller TakeProfit where as |

| 2.7 | Strategy<>Timeframe TP policy #2 | As above - slot 2 | as above, here user can add additional Timeframe x Strategy combination for different TakeProfit points. For example user can set: - Strategy<>Timeframe TP policy #1 = "1500:both:M30,H1,H4,D1" - Strategy<>Timeframe TP policy #2 = "500:breakout:M1,M5" The above would lead to: -> for M1, M5 timeframe:breakout trade to have 500 points TP -> for M30, H1, H4,D1 timeframe: breakout and reversal trade to have 1500 points TP -> any combination that not listed in the policy #1 and #2 then the fixed TP (item #2.1) will apply |

3. TRAIL STOPLOSS SETTING

| # | Inputs | Description | Value and examples |

|---|---|---|---|

| 3.1 | Enable Trailing Stop? | Toggle on / off Trailing Stop | True = TrailingStop ON / False = TrailingStop Off |

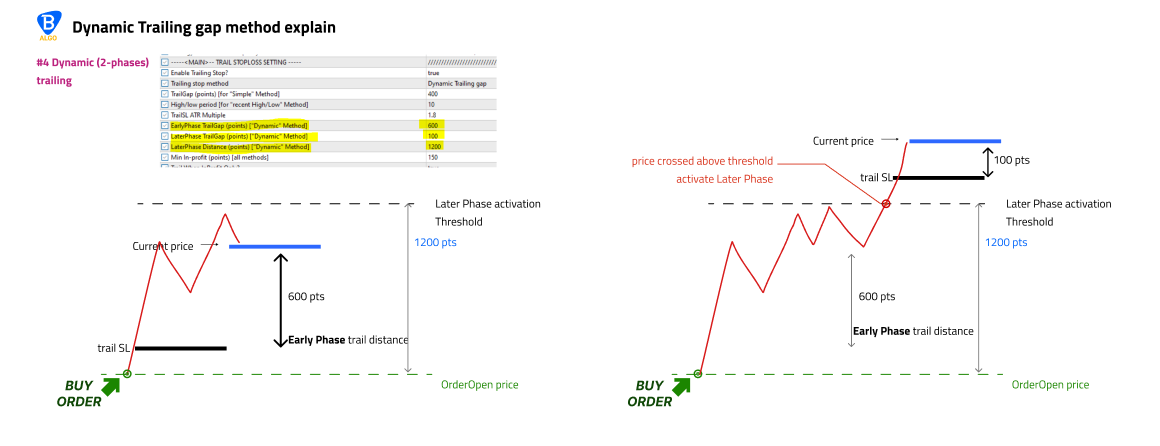

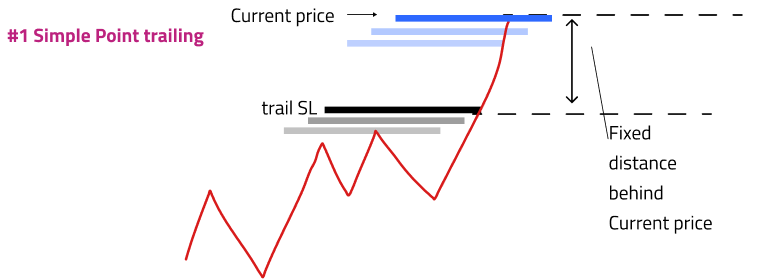

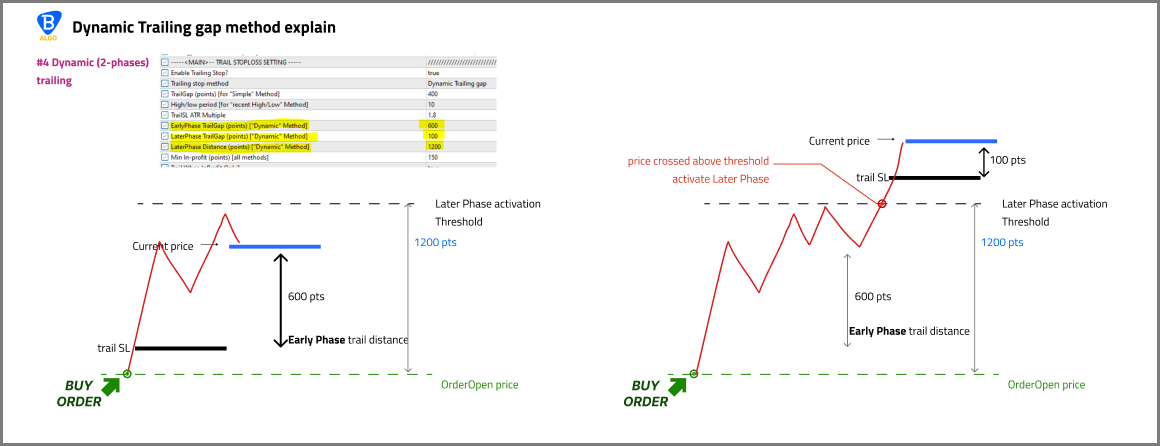

| 3.2 | Trailing Stop Method | Choose between 4 trailing methods: - Simple Point - Last High / Low - ATR - Dynamic | 1 Simple Point: price is trailed X points (gap) behind the current price 2 Last High / Low: price is trailed to latest lowest Low (highest High) price for Buy (Sell) order 3 ATR: like Simple Point but the gap behind the current price is calculated using ATR 4 Dynamic: this can also be known as 2-phase trailing. User can define two seperate trailing gap (behind the current price) for each phase. For example, in 'Early' phase, EA can trail SL a large gap away from price e.g. 600 points. Order Stoploss will gradually trail close to such 600 points distance. Then once the market price has traveled pass a 'threshold' distance, says 2000 points, then this trigger the 'Later' phase - which user define a smaller trail gap e.g. 200 points. This will cause the stoploss to 'jump' straight to 200 points behind the market price once the 'Later' phase is triggered. Using this method will help user: - avoid Stoploss being touched by current price on retracement at the early phase which prematurely close the order - securing larger chunk of profit when price extend further to the order's direction |

| 3.3 | TrailGap (points) [for "Simple" Method] | number of point for trail gap behind current price | Example: if TrailGap=400, then once price crossed the mimimum profit point (field #3.9 below) then StopLoss will be trail 400 points behind current price whenever price move forward in the order's direction |

| 3.4 | High/low period [for "recent High/Low" Method] | the periods (number of past candle) to scan for High and Low price (for High / Low trailing method) | Example if user set High/low period = 10 then EA will scan the Highest high / Lowest low of the last 10 candle |

| 3.5 | TrailSL ATR Multiple | The ATR multiplier for determine the SL price (for "ATR" method) | |

| 3.6 | EarlyPhase TrailGap (points) ["Dynamic" Method] | The trail gap (in points) for 'Early' phase (for "Dynamic" method) | Example if user set this to 600, then until price reach the 'Later' phase threshold, SL will be trailed within 600 points behind price (see the "Dynamic Trailing gap method" illustration below) |

| 3.7 | LaterPhase TrailGap (points) ["Dynamic" Method] | The trail gap (in points) for 'Later' phase (for "Dynamic" method) | Example if user set this to 200, then once price reach the 'Later' phase threshold, SL will be trailed within 200 points behind price (see the "Dynamic Trailing gap method" illustration below ) |

| 3.8 | LaterPhase Distance (points) ["Dynamic" Method] | The distance (in points) threshold to activate 'Later' phase | Once price has traveled for this distance away from order open price, then 'Later' phase will be activated and the 'Later' phase trail gap will be applied ( see the "Dynamic Trailing gap method" illustration below ) |

| 3.9 | Minimum In-profit (points) [all methods] | The minimum in-profit points that order needed to trigger StopLoss to start trailing | |

| 3.10 | Trail When InProfit Only? | Only trail SL when price is "in-profit" | e.g. if true, then StopLoss will not start trailing until price is above open price (for Buy orders) or below open price (for Sell orders) |

"Dynamic Trailing gap method" illustration

4. GRID TRADING SETTINGS

| # | Inputs | Description | Value and examples |

|---|---|---|---|

| 4.1 | Enable GridTrading? | Toggle grid trading ON/OFF | If true then grid trading mode = ON. Grid order will be placed for each initial order from Donchian entry signal |

| 4.2 | GridStep (points) | Distance between each grid level | |

| 4.3 | LotSize Multiplier | Lot size's multiplier for each subsequent grid level | |

| 4.4 | First GridLevel to trade (Skip lower levels) [FirstLevel=0] | the first 'real' level for the first grid order to be placed after the initial Donchian entry signal order | This value instruct Sonic's grid trading module to skip any level (by using a 'virtual' level tracking system) until price reach this First GridLevel -> so the higher the value, the more 'delayed' for first grid order to start after the initial Donchian order See the illustration for more example: <<TBA>> |

| 4.5 | LevelToStart Averaging [FirstLevel=0] | the grid level where lotsize multiplier (#field 4.3) will start to apply | Example if user set this equal to 2, then multiplier will only applied after the 2nd level of the grid, so if the first order lot size is 0.01 and multipler is 1.5 then : Donchian intial order (1st grid order) : 0.01 (1st level) 2nd grid order : 0.01 (2nd level) 3rd grid order : 0.02 (1.5 x 2nd grid order) |

| 4.6 | GridLevel to start recovery mode [FirstLevel=0] | The grid level where grid will consider itself needed to be in 'recovery' mode *Note: this 'recovery' mode is determined within grid trading module and is not related to the DD Rescue operation which is another seperated module | Value set in this field will trigger the Grid's TakeProfit during recover mode (field #4.8) For example, if user set this value to 3, then grid is not considered being in 'recovery' mode until the 3rd grid level. |

| 4.7 | Grid ($) TakeProfit | The TakeProfit for the whole grid basket, in points | TakeProfit price is determined using weighted average open price from all current grid orders and the points value set in this field. User can enable EA to 'draw' the basket's TakeProfit line on chart in item |

| 4.8 | Grid ($) TakeProfit during recovery mode | The TakeProfit for the whole grid basket, in points, during 'recovery' mode | Once grid reach the level which trigger 'recovery' mode (field #4.6), then the grid's TP will apply this value instead of the one above (field #4.7) ---- Author note: recommend to set this field value very small, something like <50 points to increase the chance of grid to close all orders and get out of long drawdown on price retracement |

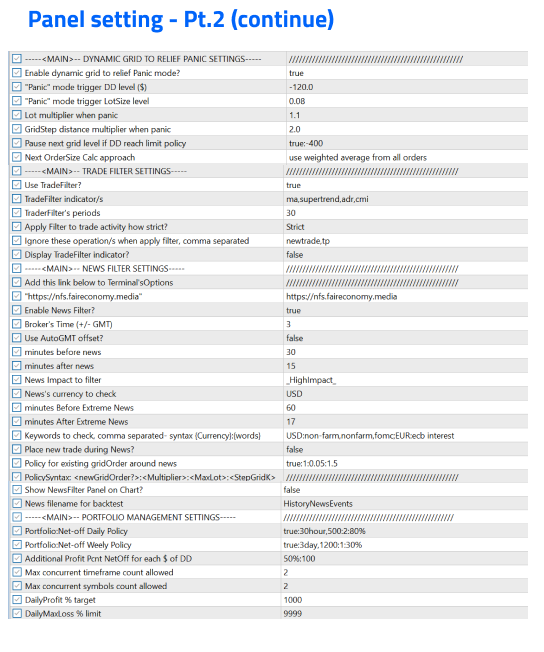

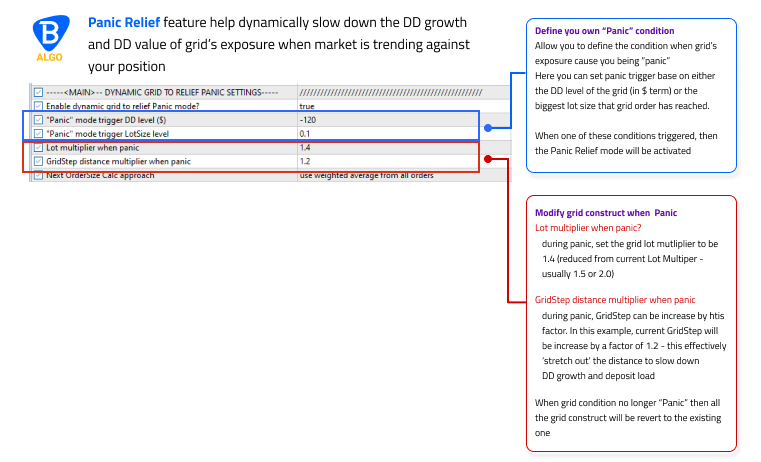

5. DYNAMIC GRID TO RELIEF PANIC SETTINGS

| # | Inputs | Description | Value and examples |

|---|---|---|---|

| 5.1 | Enable dynamic grid to relief Panic mode? | Toggle On(true) or Off(false) for dynamic grid | |

| 5.2 | "Panic" mode trigger DD level ($) | Panic trigger base on DD level (in $) | Example: if user set this to "-120" this means that dynamic grid mode will be activated when account DD is -$120 or more (*Note*: Drawdown input must be in negative amount) |

| 5.3 | "Panic" mode trigger LotSize level | panic trigger base on biggest lot size that grid order is currently have | Example: if user set this to "0.12" this means that dynamic grid mode will be activated when the current biggest order lot in the current grid is 0.12 or more (*Note*: biggest lotsize in individual grid , NOT the biggest lotsize in the whole account) |

| 5.4 | "Panic" mode trigger Start DistanceInterval | panic trigger base on the grid's distance between top (latest) and bottom (earliest) orders. | --( not yet implemented)-- |

| 5.5 | Lot multiplier when panic | the grid's lot multiplier when in dynamic grid mode | Example: if user set this to "1.2" then during dynamic grid mode, the lot multiplier for the next grid layer will be 1.2. When no longer in dynamic grid mode, then multiplier will revert to initial value |

| 5.6 | GridStep distance multiplier when panic | the grid's step distance 'scaling' factor when in dynamic grid mode | Example: Assuming user set intial grid step to 200 points between each grid layer. If user set this to "1.6" then during dynamic grid mode, the grid step will be multiplier by 1.6 times which will become 320 points for each new grid layer. When no longer in dynamic grid mode, then gridstep will revert to initial value. |

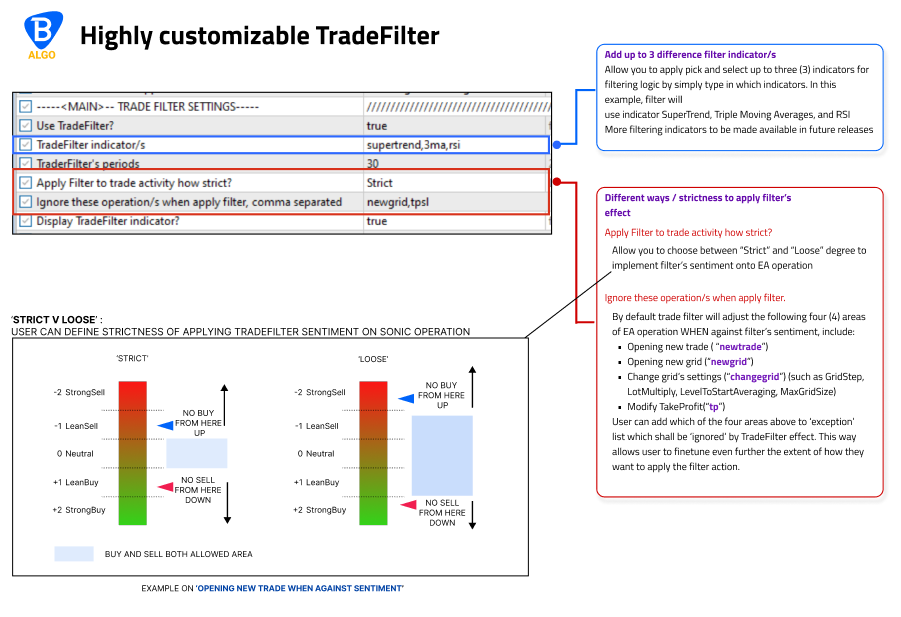

6. TRADE FILTER SETTINGS

| # | Inputs | Description | Values and examples |

|---|---|---|---|

| 6.1 | Use TradeFilter? | Toggle On(true) or Off(false) TradeFilter | |

| 6.2 | TradeFilter indicator/s | List of indicator(s) that user want TradeFilter to use for their filtering activities | At the time of writing, there is 5 possible indicators to add. THREE (3) of them are used for Sentiment reading and TWO (2) are for Market Structure reading Sentiment: - MA (or 3MA): Three moving-averages indicator - Supertrend: Pivot Supertrend indicator - RSI: Relative Strength Index Market Structure: - ADR: Average Daily Range indicator - CMI: Choppy Market Index indicator User can add indicators to TradeFilter just by simply type in the name of the indicator (case insensitive) as follows: -example #1 "ma,supertrend,adr,cmi" -example #2 "rsi,adr" -example #3 "all" then EA will add any indicator appear on the list. ------------------------------- *Tips: Type "all" will add all 5 indicators to TradeFilter operation (as in example #3) **Author note: more indicators to be make available in future release |

| 6.3 | TradeFilter's periods | ||

| 6.4 | Apply Filter to trade activity how strict? | ||

| 6.5 | Ignore these operation/s when apply filter, comma separated | ||

| 6.6 | Display TradeFilter indicator? |

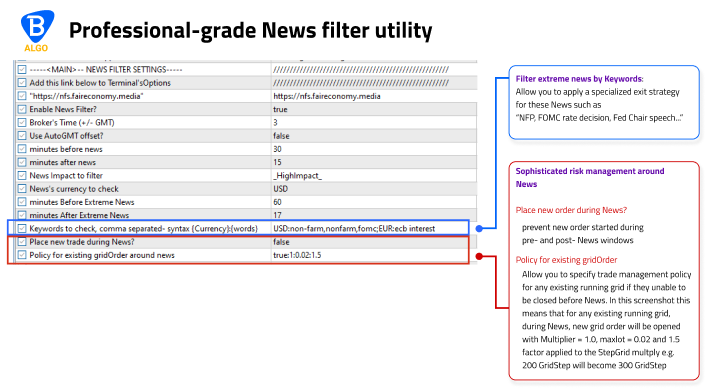

7. NEWS FILTER SETTINGS

News Filter setting allow user define trading and exit policy around News window

| # | Inputs | Description | Value and examples |

|---|---|---|---|

| 7.1 | Enable News Filter? | Toggle to enable/disable adding NewsFilter *Note: regardless whether News filter is turn ON/OFF, Sonic would still checking news data from forexfactory every 3 hours | |

| 7.2 | Broker's Time (+/- GMT) | The broker's time shift versus GMT time. | Broker's server time (the one displayed in terminal's Market sidebar) is often 2-3 hours different from the News's time which is base on GMT. This value will allow News's time to be 'synced' with broker's server time For example if your Broker's server time is GMT+3 then you should put this field to 3. If your broker change Day-light saving (DST) time during Winter and Summer (especially those with servers in EU and US) then you would need to update this field accordingly everytime your broker change DST |

| 7.3 | Use AutoGMT offset | Toggler ON/OFF auto GMT option | If true, then EA will auto-detect the broker's time versus GMT time and set the value accordingly (replacing field #6.2) If this auto-set value is not correct, you can always use field #6.2 to manually set the GMT offset. If in doubt, use the News headlines display on chart and cross-check with Forexfactory news calendar to check if broker's server time and News time are aligned or not |

| 7.4 | Minutes before news | Duration (in minutes) BEFORE News release | |

| 7.5 | Minutes after news | Duration (in minutes) AFTER News release | |

| 7.6 | News Impact to filter | The News event’s impact for NewsFilter: _HighImpact_ _MediumImpact_ _LowImpact_ | Only news with this impact or higher would be taken into consideration for NewsFilter action |

| 7.7 | News’s currency to check | The news impacted currency to be filtered | Only symbol that contains the currency impacted by the current active News event List of currency, separated by comma. Example: if user set this to "USD,EUR,GBP" then NewsFilter action will apply to: - XAUUSD - any EUR crosses - any USD crosses - any GPB crosses if the news item impact one of these currencies |

| 7.8 | {OpenMinutes:Profit:MinGridSize:IsAllGrid?} | ||

| 7.9 | minutes Before Extreme news | Duration (in minutes) BEFORE Extreme News release | |

| 7.10 | minutes After Extreme news | Duration (in minutes) AFTER Extreme News release | |

| 7.11 | Keywords to check, comma separated- syntax {Currency}:{words} | ||

| 7.11 | Place new trade during News? | Enable placing new trade entry (from Donchian entry signal) during News window | If true, then EA will place new Donchian signal order during News window. If false, then no new trade from Donchian signal will be placed |

| 7.12 | Policy for existing gridOrder during News | Policy for Sonic to deal with any existing grid still open when News hit | PolicySyntax <newGridOrder?>:<Multiplier>:<MaxLot>:<StepGrid> Syntax explain: <newGridOrder?>: whether to open new subsequent grid layer <Multiplier>: the lot multiplier during news time <MaxLot>: the max lot size that the grid is allowed to open during news time <StepGrid>: the step grid distance scalingfactor that applied during news time Example: "true:1:0.05:1.5" This means that, during news duration window, any existing grid would be: "true": allow to open new grid layer (level) "1": the lot multiplier for new grid order will be 1 "0.05": the biggest lotsize grid can open is 0.05 "1.5": current grid step will be increased by 1.5 times. For example if gridstep outside of News window is 200 then during news time, this would become 300 points |

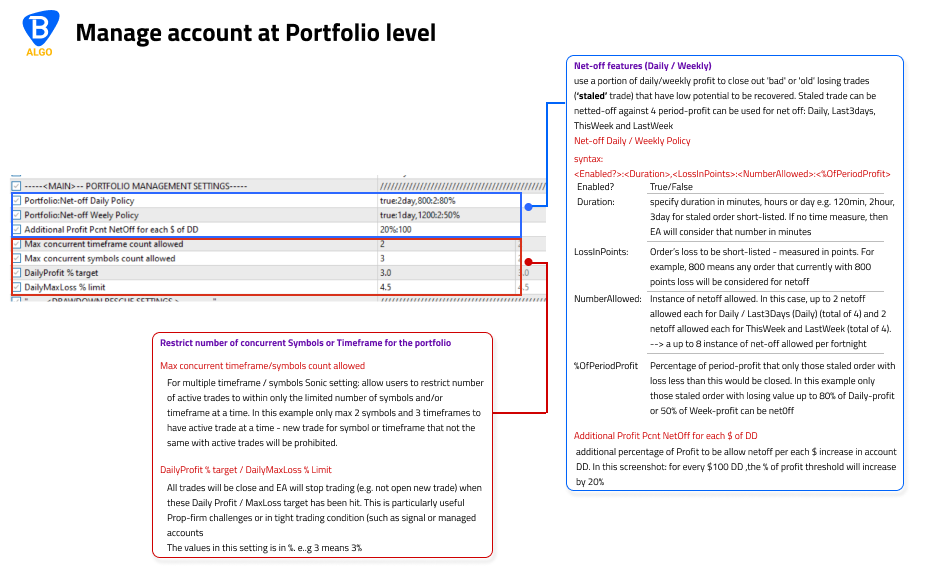

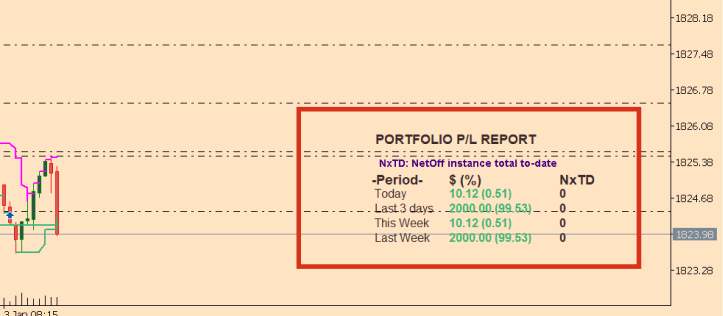

8. PORTFOLIO MANAGEMENT SETTINGS

Net-off: use a portion of daily / weekly profit to close out 'bad' or 'old' losing trades ('staled' trade) that have low potential to be recovered.

| # | Inputs | Description | Values and examples |

|---|---|---|---|

| 8.1 | Portfolio:Net-off Daily Policy | Daily &Last-3-day Net-Off policy. | Syntax (for item #8.1 and #8.2): example: "true:2day,800:2:80%" <Enabled?>: Toggle On(true) or Off (false) Net-Off <Duration>: specify duration in minutes, hours or day. e.g. "120min", "2hour", or "3day" for staled order short-listed. If no time unit specified (number only), then EA will consider that number to be in "minutes". Only active orders with duration equal to or more than this will be considered candidate for Net-Off |

| 8.2 | Portfolio:Net-off Weekly Policy | ThisWeek & LastWeek Net-Off policy | As above item #8 |

| 8.3 | Additional Profit Pcnt NetOff for each $ of DD | additional percentage of the period's Profit to be allowed Netted off per each $ increase in account's Drawdown. | example: "20%:100" This means that for every $100 increase in current account Drawdown, the % of profit thresdhold will increase by 20%. Using the example in item #8.1 above this means that - when account drawdown is -$100 or more then %OfPeriodProfit would be 100% (80% + additional 20%). - when account drawdown is -$200 or more then %OfPeriodProfit would be 120% (80% + additional 40%). .. and so on. This allow NetOff to automatically 'adjust' the threshold as account Drawdown increase, easier to close down 'bad' trade |

| 8.4 | Max concurrent timeframe count allowed | allow users to restrict number of active trades to within only the limited number of timeframes at a time | Example: assuming user to have Sonic trading 3 timeframe (M5, M15, and H1) - if user set this field to "2" then there only max 2 timeframes to have active trade at a time, new trade for the timeframe that |

| 8.5 | Max concurrent symbols count allowed | as above but for number of symbols | As above |

| 8.6 | DailyProfit % target | Daily profit target in percentage. This is computed base on sum of all currently active and closed trade's profit against the account Balance at the beginning of the day. All active trades will be closed and EA will stop trading once this is reached | |

| 8.7 | DailyMaxLoss % limit | Daily profit target in percentage. This is computed base on sum of all currently active and closed trade's Profit/Loss against the account Equity at the beginning of the day. All active trades will be closed and EA will stop trading once this is reached |

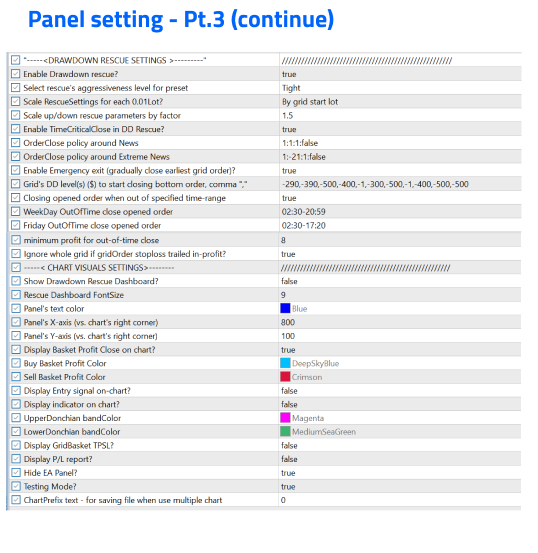

9. DRAWDOWN RESCUE SETTINGS

| # | Inputs | Description | Values and examples |

|---|---|---|---|

| 9.1 | Enable Drawdown rescue? | Toggle On(true) or Off(false) Drawdown Rescue | |

| 9.2 | Select rescue's aggressiveness level for preset | DD rescue will use built-in preset for rescuing logic. There are three level of rescues aggressiveness, "Tight", "Normal" and "Loose" which is already optimized for each assets type ("Forex", "Gold", and "Other assets"). | - "Tight": DD rescue kick-in early when grid level reach 4 or 5 layer. Often close pair order in loss to exit bad situation or if grid is highly 'stretched' - "Normal" DD rescue kick-in somewhat early when grid level reach 5 or 6 layers. Mostly close order with break-even or small loss - "Loose" DD rescue kick-in late when grid level reach 7 or 8 layers. Mostly close order with profit or sometimes break-even, occassionaly with small loss ---------------- **Author note: I mostly use Tight or Normal |

| 9.3 | Scale RescueSetting for each 0.01Lot? | Scaling option- allow user to choos between 2 options: - By Grid Start Lot - From user input | Use-case: when user has grid starting at different lot size e.g. 0.03 instead of 0.01 then the scaling factor will applied automatically for all the rescue internal logic that checking lot-size driven metrics such as profit level to rescue / close orders Explain on the scaling option - "By Grid Start Lot": rescue setting will be scaled by a factor that computed base on the grid's start lot against 0.01. For example: if grid start lot is 0.05 then the scaling factor would be 5 (= 0.05 / 0.01) - "From user input": rescue setting will be scaled by this factor that set by user in item #9.4 below. For example if user set this to "2.0" then all the rescue logic will be mutliplied by 2 |

| 9.4 | Scale up/down rescue parameters by factor | the user-defined scaling factor for DD rescue when user choose "From user-input" in item #9.3 above | |

| 9.5 | Enable TimeCriticalClose in DD rescue? | Toggle On(true) or Off(false) TimeCriticalClose mode in DD Rescue | TimeCriticalClose mode: close top (latest) and bottom (earliest) orders in a grid when the bottom order's duration has pass certain number of minutes. Often useful for trade strategy or symbol volatility that is time-sentitive (such as gold or index). For more information about this mode please see BlueSwift GridRescue manual here |

| 9.6 | OrderClose policy around News | ||

| 9.7 | OrderClose policy around ExtremeNews | ||

| 9.8 | Enable Emergency Exit (gradually close earliest grid order)? | ||

| 9.9 | Grid's DD level(s) ($) to start closing bottom order, comma "," seperated | ||

| 9.10 | Closing opened order when out of specified time-range(OutOfTime) ? | Toggle On(true) or Off(false) OutOfTimeClose mode in DD Rescue | True/False If True: EA will try closing grid's opened order(s) when out of specified time-range |

| 9.11 | WeekDay OutOfTime close opened order | OutOfTime time-range for weekdays (Monday-Thursday) | List of time-ranges, seperated by comma (,) similar to #1.14 and #1.15 above Example - "01:30-22:59" - "01:30-08:30,16:00-20:15" OutOfTimeClose will activate outside of these rangs. For example if user set "01:30-08:30,16:00-20:15" then grid orders would be closed (provide that the grid meet the profit level condition in #9.14) when broker's server time is between the following Time-range for Monday to Thursday: - 00:00 - 01:29 - 08:31 - 15:59 - 20:16 - 23:59 |

| 9.12 | Friday OutOfTime close opened order | OutOfTime time-range for Friday | Same as #9.11 above but for Friday only --> useful for those user who want to stay out of market going into weekend by defining an early exit time for Friday |

| 9.13 | minimum profit for OutOfTime close | The OutOfTime profit-to-close | Example: if set this to "8" then OutOfTime bot will close all grid that has the grid's profit $8 or more |

| 9.14 | Ignore whole grid if gridOrder stoploss trailed in-profit? | Prevent OutOfTimeClose to close grid that already has basket StopLoss trailed in-profit | True/False If true, then for any grid that already have their Basket StopLoss trailed into in-profit, OutOfTime bot will not close them out. This to make sure any grid trailed in-profit can maximize potential gain instead of being close prematurely by OutOfTime module. |

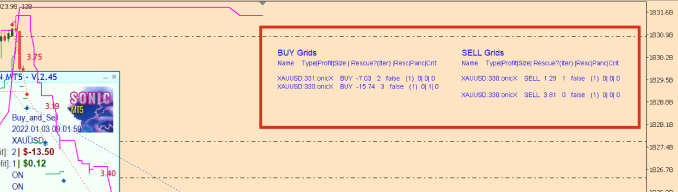

10. CHART VISUAL SETTINGS

| # | Inputs | Description | Value and examples |

|---|---|---|---|

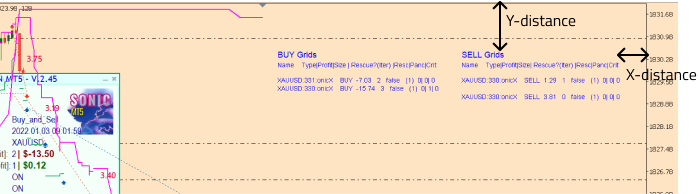

| 10.1 | Show Drawdown Rescue Dashboard? | Toggle On(true) or Off(false) drawdown rescue dashboard (see screenshot ==>) |  |

| 10.2 | Rescue Dashboard FrontSize | Text fontsize for DD rescue dashboard | |

| 10.3 | Panel's text color | Text color for DD rescue dashboard | |

| 10.4 | Panel's X-axis (vs. chart's right corner) | X-Distance gap (in pixels) of the DD rescue dashboard vs the Right chart border |  |

| 10.5 | Panel's Y-axis (vs. chart's right corner) | Y-Distance gap (in pixels) of the DD rescue dashboard vs the Top chart border | |

| 10.6 | Display Basket Profit Close on chart? | Toggle On(true) or Off(false) profit tag display on-chart |  |

| 10.7 | Buy Basket Profit Color | ||

| 10.8 | Sell Basket Profit Color | ||

| 10.9 | Display Entry signal on-chart? | Toggle On(true) or Off(false) for signal entry arrow display on-chart |  |

| 10.10 | Display indicator on chart? |  | |

| 10.11 | UpperDonchian bandColor | ||

| 10.12 | LowerDonchian bandColor | ||

| 10.13 | Display GridBasket TPSL? | ||

| 10.14 | Display P/L Report? |  | |

| 10.15 | Hide EA Panel? |  | |

| 10.16 | Testing Mode? | True/False If True: some internal operations in the Expert will be run less frequently. This is useful to help speeding up EA backtest. | |

| 10.17 | ChartPrefix text - for saving file when use multiple chart | A text string which to be added to the beginning of the save file name on local drive | This is used to seperate different set of saved file in local drive when user use Expert more than one chart. This is to avoid any in-flight grid operation is mixed up between two or more Expert instance in case when the terminal is rebooted (see screenshot) |

Set files:

Please find the attached set files for Sonic EA below for quick set up.

Other set files are made avaible in our Telegram channel (via Google Drive). ==> Please reach out to me for this.