Learn why Market Structure and Order flow is the key to the market

Market structure

Market structure in financial trading is crucial because it reveals trends, identifies support/resistance levels, gauges market sentiment, and helps manage risk. Understanding it allows traders to make informed decisions on entry/exit points and adapt strategies to market conditions.

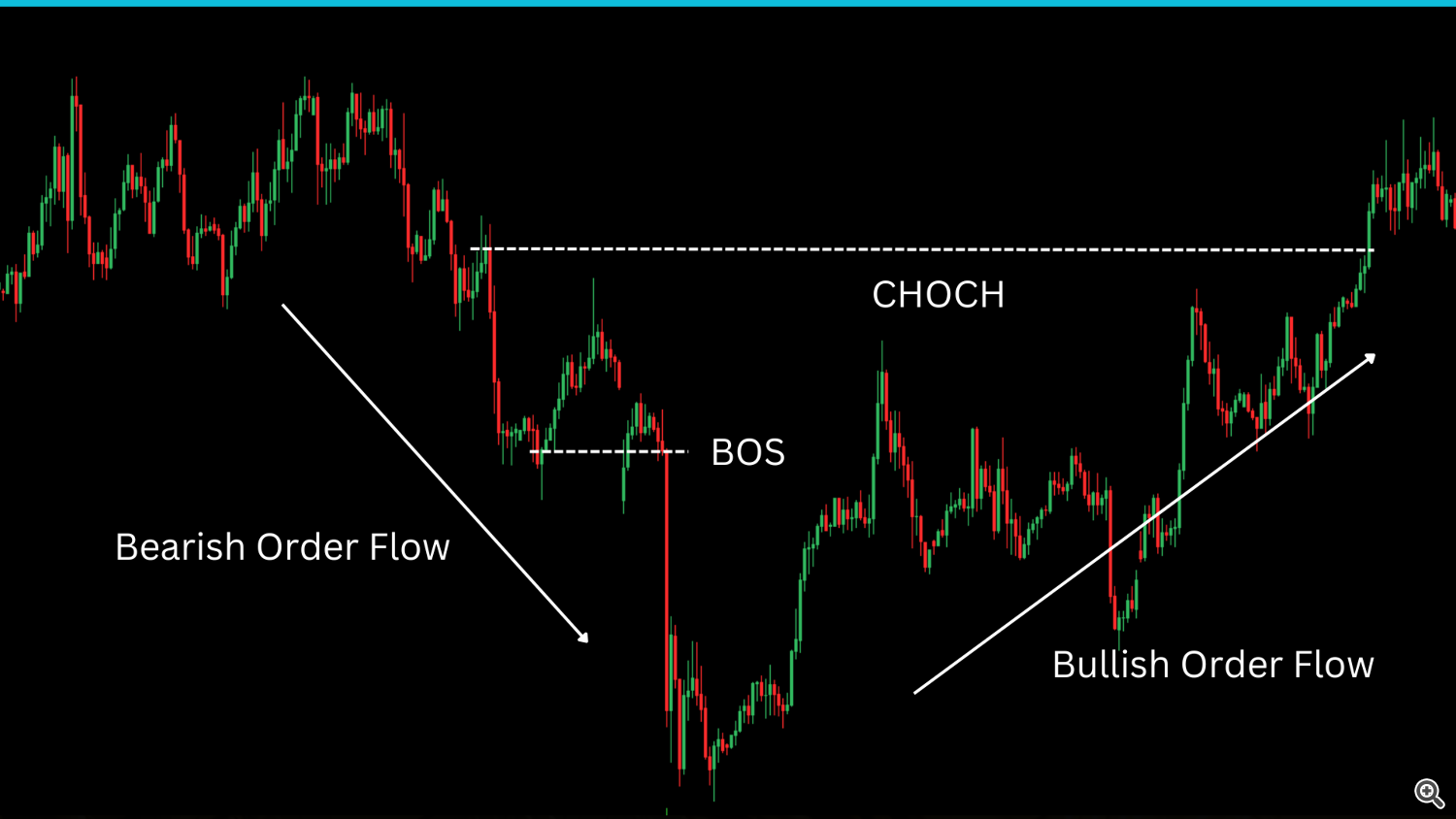

Market structure in forex trading describes how prices move to form trends, identifying swing highs, swing lows, and support/resistance levels. Traders use this to understand market behavior, predict future price movements (bullish, bearish, or consolidating), and determine entry and exit points. Key concepts include higher highs/higher lows (uptrend), lower lows/lower highs (downtrend), and equal highs/lows (ranging market), as well as breaks of structure (BOS) and changes of character (ChoCh) to signal trend shifts.

To get a well detailed analysis of Market structure, watch the video to the end: