Trading Plan Tips for Beginners Using MQL5 Signals or Expert Advisors

Introduction

Trading in the financial markets can be a daunting task for beginners. The vast amount of information and analysis that needs to be done can be overwhelming. To help simplify the process, many traders turn to automated trading tools such as MQL5 signals and Expert Advisors (EAs). However, choosing the right signal or EA can be challenging. In this article, we will provide some tips on how to select the right MQL5 signal or EA for your trading plan.

What is an MQL5 Signal?

MQL5 Signals is a service provided by MetaQuotes, the developer of the MetaTrader trading platform. It is a social trading network that allows traders to copy trades of successful traders from around the world. MQL5 signals can be bought or sold in the MQL5 Market, and can be executed automatically in your trading account.

Tip #1: Check the Portfolio Track Record

When selecting an MQL5 signal, it is crucial to check the portfolio track record. The portfolio track record should have a minimum of 6 months of trading history. It is also important to check the profit and loss (P/L) and the drawdown of the signal.

Drawdown is the percentage decline of the account balance from the highest peak to the lowest trough. A drawdown of more than 25% is considered high and should be avoided. A high drawdown may mean that the strategy used by the signal is high risk and may lead to significant losses.

Tip #2: Check the Signal Provider's Background

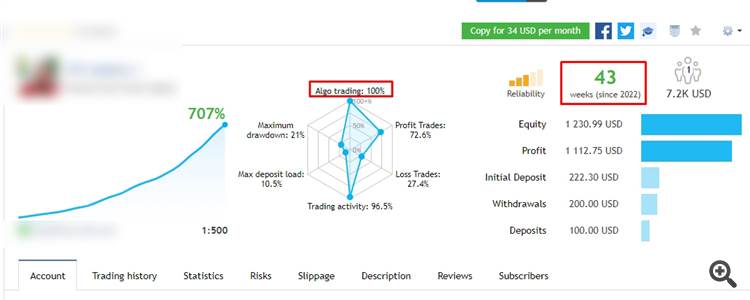

It is also essential to check the background of the signal provider. If the signal provider uses an Expert Advisor (EA) to execute trades, it is recommended to choose a signal provider who is also an EA developer. This ensures that the EA used in the signal is up to date with the latest market conditions and trading strategies. The way to ensure that an MQL5 Signal is run by an Expert Advisor is to look at the percentage value of Algo Trading. Make sure the Trading Algo of an Expert Advisor is 100% which indicates that the signal is actually executed by an Expert Advisor without any intervention by the trader. If AlgoTrading is not 100% or less than 100%, you can be sure that the account is not run by an Expert Advisor or there is a technical problem that causes the value of AlgoTrading to drop.

Figure 1. Example of a signal portfolio in the red Algo Trading box, the length of time this trading account was run using an Expert Advisor, and the drawdown value on the Signal.

Tip #3: Monitor the Signal Performance Regularly

After selecting an MQL5 signal, it is essential to monitor the signal's performance regularly. This ensures that the signal is still performing according to the initial expectations. A signal that has been profitable in the past may not necessarily remain profitable in the future.

Tip #4: Use a Risk Management Strategy

Using a risk management strategy is vital in trading. It ensures that you do not lose all your capital in one trade. It is recommended to use a fixed percentage of your trading account balance per trade. This percentage should be based on your risk tolerance and trading style.

What is an Expert Advisor?

An Expert Advisor (EA) is an automated trading system that executes trades based on a set of rules. It is programmed in the MQL language and can be used on the MetaTrader platform. EAs are available in the MQL5 Market and can be purchased or rented for a fee.

Tip #5: Try the Demo Version of the EA

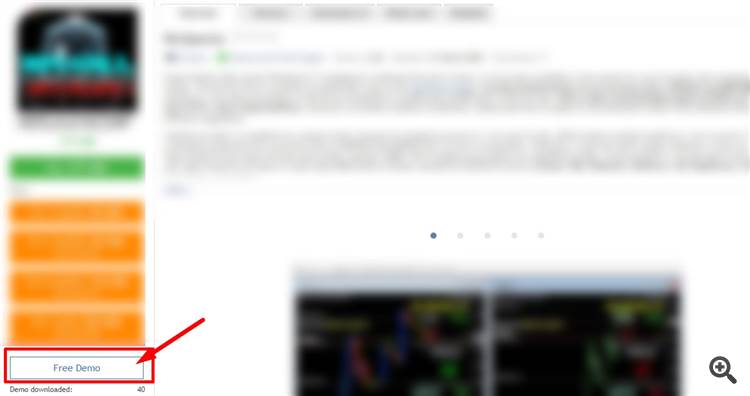

Before buying an EA, it is essential to try the demo version of the EA. The demo version allows you to test the EA's performance on historical data without risking your capital. It is recommended to test the EA on at least one year of historical data. In the example below, when you choose an Expert Advisor on MQL5 Market, on the left side, you will find a link to try the Demo version provided. You can backtest using the Strategy Tester provided by the Metatader 4 or Metatrader 5 terminal.

Figure 2. Position of the Expert Advisor demo version link on MQL5 Market

Tip #6: Check the Drawdown of the EA

Like the MQL5 signal, it is crucial to check the drawdown of the EA. A drawdown of more than 25% is considered high and should be avoided. It is also essential to check the profit factor of the EA. The profit factor is the ratio of the gross profit to the gross loss.

Tip #7: Monitor the EA Performance Regularly

After purchasing an EA, it is essential to monitor the EA's performance regularly. This ensures that the EA is still performing

according to expectations and is not experiencing any issues. Monitoring the EA regularly can also help you identify any changes that need to be made to the EA or your trading plan.

Tip #8: Use a VPS for Automated Trading

Using a Virtual Private Server (VPS) for automated trading can be beneficial. A VPS allows your trading platform and EA to run 24/7 without interruption, ensuring that your trading plan is executed according to your strategy. A VPS also provides a stable internet connection and reduces the risk of power outages or computer crashes.

Tip #9: Have Realistic Expectations

When using automated trading tools such as MQL5 signals or EAs, it is important to have realistic expectations. No trading strategy is 100% profitable, and losses are inevitable. It is important to have a realistic profit target and to not expect to get rich quick. A profitable trading plan takes time and effort to develop, and it is important to be patient and consistent in your approach.

Tip #10: Avoid Over-Optimization

Over-optimization is the process of creating a trading system that is specifically designed to fit historical data. This is done by using complex algorithms and adjusting parameters to fit past market conditions. While this may result in impressive backtesting results, it does not necessarily mean that the system will perform well in the future. In fact, over-optimized systems are often too rigid and inflexible to adapt to changing market conditions.

To avoid over-optimization, it is important to use a simple and robust trading system that can adapt to changing market conditions. Avoid using too many indicators or parameters, and instead focus on the fundamentals of the market and the specific conditions that you are trading in.

Tip #11: Consider the Broker's Trading Conditions

When selecting a signal or EA, it is important to consider the broker's trading conditions. This includes factors such as spreads, commissions, and order execution speed. Trading with a broker that has high spreads or commissions can significantly reduce your profitability, while slow order execution can lead to missed trading opportunities.

To ensure that you are trading with a broker that provides optimal trading conditions, it is important to do your research and compare different brokers. Look for a broker that offers competitive spreads and commissions, fast order execution, and reliable customer support.

Tip #12: Use Multiple Signals or EAs

Using multiple signals or EAs can help diversify your trading portfolio and reduce the risk of relying on a single trading system. By using multiple signals or EAs, you can take advantage of different trading strategies and market conditions.

When using multiple signals or EAs, it is important to ensure that they are not correlated and that they are not trading the same currency pairs or markets. It is also important to use proper risk management techniques, such as adjusting lot sizes or using a portfolio approach.

Tip #13: Stay Informed About Market News and Events

Staying informed about market news and events can help you make informed trading decisions and adjust your trading plan accordingly. This includes monitoring economic data releases, central bank announcements, and geopolitical events.

By staying informed about market news and events, you can anticipate potential market moves and adjust your trading strategy accordingly. This can help you avoid unexpected losses and take advantage of profitable trading opportunities.

Tip #14: Continuously Evaluate and Improve Your Trading Plan

Finally, it is important to continuously evaluate and improve your trading plan. This includes monitoring the performance of your signals or EAs, adjusting your risk management strategy, and making changes to your trading plan as needed.

By continuously evaluating and improving your trading plan, you can stay ahead of the market and adapt to changing conditions. This can help you achieve long-term profitability and success in the forex market.