Trading strategy for MetaTrader 4 based on the SFT Normalized ATR indicator

The strategy is suitable for any currency pairs, as well as for trading metals, indices, options and cryptocurrencies (Bitcoin, Litecoin, Ethereum, etc.)

An indispensable tool for cryptocurrencies, especially for intraday scalping - for selecting coins "in the game".

Trading can be done on any timeframe.

Depending on your preferences, trading can be both scalping, intraday, and medium-term, long-term.

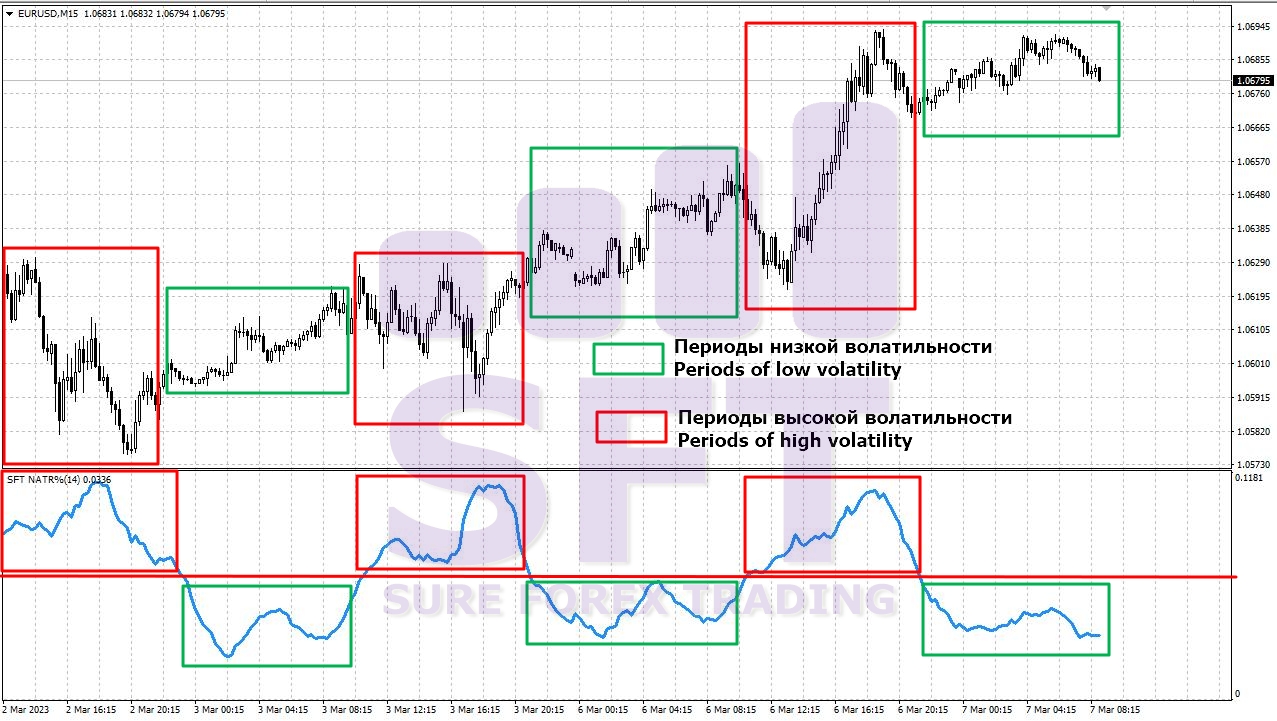

The basis for opening deals is the indicator for determining the volatility of the SFT Normalized ATR

It shows volatility as a % of the instrument's total volatility, not in pips like the regular ATR

This allows you to bring the values of any of the studied instruments to a common denominator and determine the periods of volatility surge and flat

You can trade using this indicator alone.

It is recommended to work according to this strategy only with reliable and trusted brokers who have no problems with the withdrawal of earned funds.

It is desirable that the company has ECN , NDD , STP or PRO accounts with a small spread and a low commission per transaction.

We recommend trading with RoboForex - they are where we test all our products

Installation and setup

For more information on how to choose, install, test for free, as well as buy indicators, see YouTube in training videos

The settings described in this manual are specified for the EURUSD currency pair.

For other instruments, additional adjustment of the indicator parameters may be required.

With a little experimentation, you can choose the settings for any trading instrument.

Trading with the SFT Normalized ATR indicator

Indicator settings

- NATR Period - indicator period;

Trading Rules

Recommended to use as a volatility filter for any trading systems

- During periods of high volatility, trend systems and breakout trading work well

- During periods of low volatility, channel and pullback systems and rebound trading work well.

You can also exit on the established orders SL and TP.

When using SL and TP, it is desirable to set the SL for the nearest extremum, and make the TP equal to 1 to 2 SL sizes.

This indicator has proven itself well when used together with a free indicator SFT Oh My Scalper

Indicator SFT Normalized ATR

Indicator SFT Normalized ATR

Try our other indicators, among which there are completely free ones, as well as paid ones, but with the possibility of free self-testing. You can find a complete list of our products here:

We wish you stable and profitable trading!

To be the first to know about all new and bonus products. And also to receive various benefits and chips on the topic of trading.

Subscribe to our telegram channel:

And don't forget to add as a friend: SURE FOREX TRADING

Thank you for using our software!

If you liked it, then do a good deed and share the link with your friends.