Reward Multiplier product pages

MT4 version here demo version here

MT5 version here demo version here

First run

To run the Reward Multiplier for the first time, in the Metatrader option dialog (Ctrl+O) tick the "Allow automated trading" option in the "Expert Advisors" tab, then attach the Reward Multiplier to the chart, and in the "common" tab of expert properties dialog tick "Allow live trading" option.

Panel

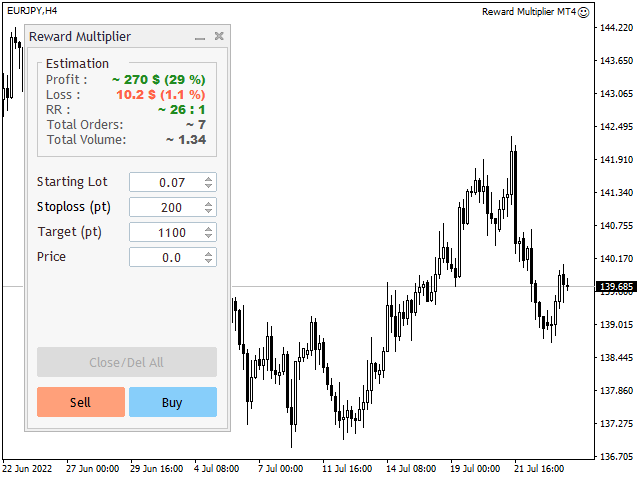

The panel has two parts. Above is the "Estimation" section that shows potential profit/loss, reward to risk ratio, number of orders and the total number of lots that will be opened in a successful process.

Below you can set up and open the first trade by entering starting lot, stop loss distance in points, final target distance in points, and price for the pending order (if you want to set a pending order for the first trade). By setting the starting lot, stop loss and target distance the estimation info will be updated. At the bottom of the panel there are buy/sell and close buttons. If you set a price for the pending order the buy/sell will change to appropriate stop/limit buttons. The close button is for closing all orders before reaching the target or in cases that you didn't set a target at first. You see the running profit above the close button when there are open orders.

Settings

In the expert settings window you can set the magic number, Market Orders Only option, trade commission, panel scale, and panel font size.

If you don't use pending orders you can set the "Market Orders Only" option to true.

If you want to use this tool in a commissioned account you can set "trade commission per lot" in the setting.

Some tips on using the tool:

- If you have set the final target don't close the orders early. In the final stages of the process total volume is huge and every pip makes a considerable profit. You don't want to miss those profits. Sometimes there will be a pullback and trades will be closed at breakeven and you might regret that you didn't close them earlier but in the long run this is the better approach.

- After finding the potential trade opportunity set stop loss and target distance based on the situation and check the potential profit/loss and reward to risk ratio on "Estimation" info. The target distance should be wide enough relative to stop loss to be room for more orders. If the RR ratio isn't impressive, you may want to play with SL and target settings to see if that improves. Because of the large profit change in the final stages, a few pips of change can make a huge difference. For example, if the final target is at the S/R level, based on the situation you may want to move the target a few pips beyond the level and hope that price would penetrate it(maybe a false break). Sticking to the rules is truly crucial in most trading cases, but not here.

- It's not easy to find price rallies with short pullback which is ideal for this tool. Most of the time the trades will be closed with a pullback to the breakeven level. Several trades in a row with no profit or with a small loss(the first order SL hit) are expected. So start with a smaller lot size compared to your regular trades and be patient.

- I don't recommend news trading with this because during major news releases with very fast price moves, in most brokers, orders and stop losses might be executed with big slippage. For example if there are several buy orders with an overall huge volume, the breakeven stop loss might activate at a lower price than the set SL price and cause a big loss.

You may want to look into ATR Scanner Pro too. It monitors the market volatility and also helps to find consolidations easier in the market.

Some notes:

- The first order must have a stop loss for the Reward Multiplier to start the process of adding more trades. You can leave the target field blank and close the orders with the close button yourself but it's not recommended because a moment of delay in closing the orders from the broker server can make a big difference in profit.

- You can test the MT4 version in MT4 strategy tester visual mode. Note that profit estimation might be erroneous in strategy tester when you test in the past dates because the exchange rate of the instrument vs your account currency might be different from today.

- Estimation in recent dates and live trades is fairly accurate.In live trades estimated profit may be slightly different from final profit because of the floating spread that affects the open price of the new orders.

- MT5 version doesn't work in the strategy tester.

- High leveraged trading accounts are needed for this tool (1:100 and more).

You can test the MT4 version in strategy tester visual mode.