Recently, I published my new "Legacy of Gann" indicator, which immediately interested the trading community. Numerous questions began to come in, although it seemed to me that I showed everything in some detail on the demo videos.

In general, I realized that clarification is required - what is obvious and understandable to me will not necessarily be understandable to others.

This article will summarize the questions on the indicator and the answers to them.

At the very beginning, I must say that the idea of the indicator is not mine. The author of the idea and the algorithm is Kirill Borovsky, a well-known specialist in the Russian-speaking trading environment on the heritage of W.D. Gann. He conducts training courses on trading on the principles formed by W.D. Gann. However, I myself have not been to these courses, so my videos and this text reflect my understanding and my method of working with the indicator, which may not coincide with the author's.

I use this indicator only for setting targets, fixing profit. But the author of the algorithm, Kirill Borovsky, uses this tool as the only one in his trading (well, at least he says so).- How to build triangles? For what points? Lots of options...

- Impulse and correction triangles - how to build them? What targets are worked out in the correction and in the impulse?

- Everything looks beautiful in history, but how does it work in real time?

- I still don't understand how to build triangles in real time?! Point 3 changes its position all the time! How to understand that it's time to build a triangle?

- Is it possible to automatically build triangles in the indicator?

- What is the difference between building targets according to W.D. Gann for indicators "Legacy of Gann" and "Pattern-123"?

- Some more tips

- Links

Question: How to build triangles? For what points? Lots of options...

If you have difficulties, then the easiest way to search for points is by ZigZag, you can even use the standard one. At the same time, you will get the targets of the current timeframe. With practice, you will see 123 points without any additional tools.

One of the main criteria for placing the triangle vertices (Pattern-123 points) is that these points should be clearly visible to the naked eye. Look at examples of building targets on different timeframes:

1. Such a triangle has the right to exist, but its vertices are indistinct. Zigzag also does not display this pattern. This is the construction and targets of the lower timeframe.

2. These are the targets of the current timeframe - the optimal construction. Zigzag also defines these patterns.

By the way, the coincidence of targets from different triangles enhances this level.

3. Targets of the higher timeframe - it is more convenient to build such triangles there.

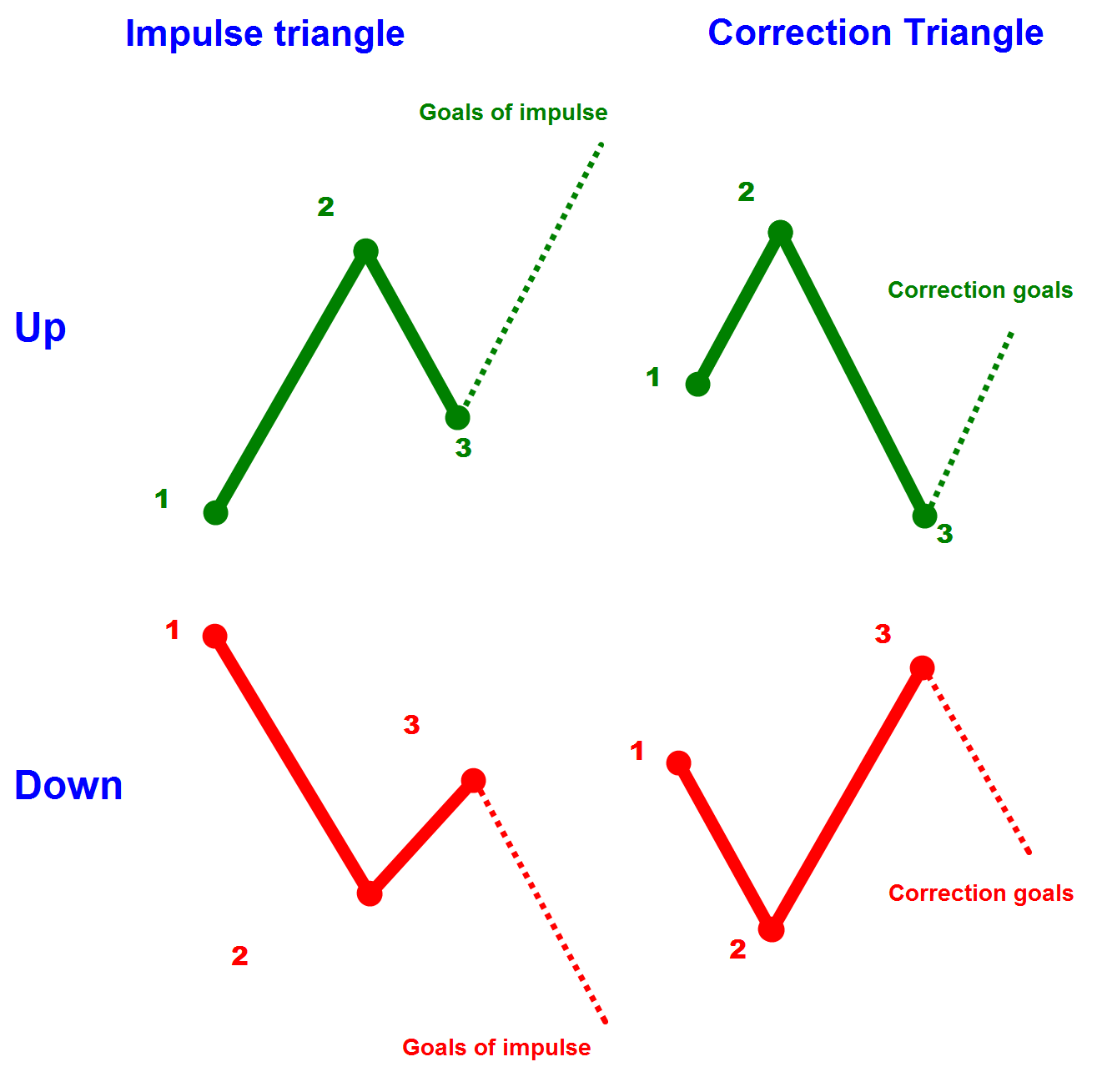

Question: Impulse and correction triangles - how to build them? What targets are worked out in the correction and in the impulse?

We build impulse triangles when we want to know the target of an impulse. We start building at the expected end of the correction.

We build correction triangles when we want to know the correction targets. We start building at the expected end of the impulse.

How to more accurately determine the end of the impulse/correction (point 3 of Pattern-123), see below .

Please note that if the price did not reach the 1st zone of the impulse triangle and turned around in the area of the Preliminary Target, then this is not an impulse, but, most likely, a corrective movement of the higher timeframe.

That is, it is necessary to analyze the market situation on a higher timeframe so as not to look for impulses where there are none:

The most likely target for a corrective triangle is the Preliminary Target. The probability of its achieving, according to Borovsky, is 95%. In general, this target is almost always worked out in all types of triangles, so it is recommended to fix part of the trade at this level, and transfer the rest to breakeven, if the situation allows, of course.

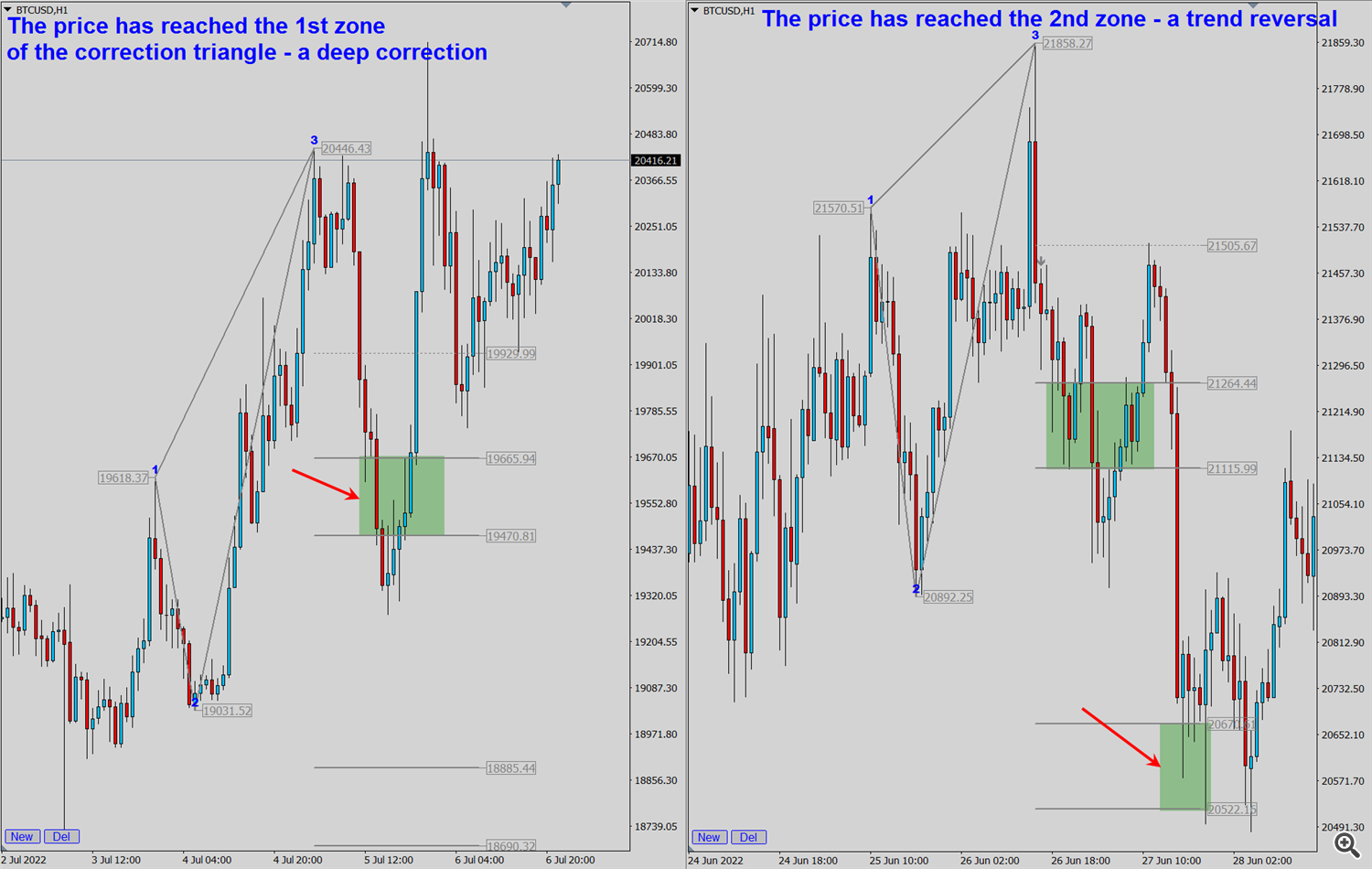

If the price has broken through the Preliminary Target of the correction triangle and reached the 1st zone of taking profit, this is either a deep correction of the higher TF, or even a trend reversal. The achievement by the price of the 2nd zone clearly indicates a change in the trend on the higher TF.

Question: Everything looks beautiful in history, but how does it work in real time?

Works just as beautifully as it does on history. In the demo video, I gave examples of working out targets in real time.

Here is the most recent example:

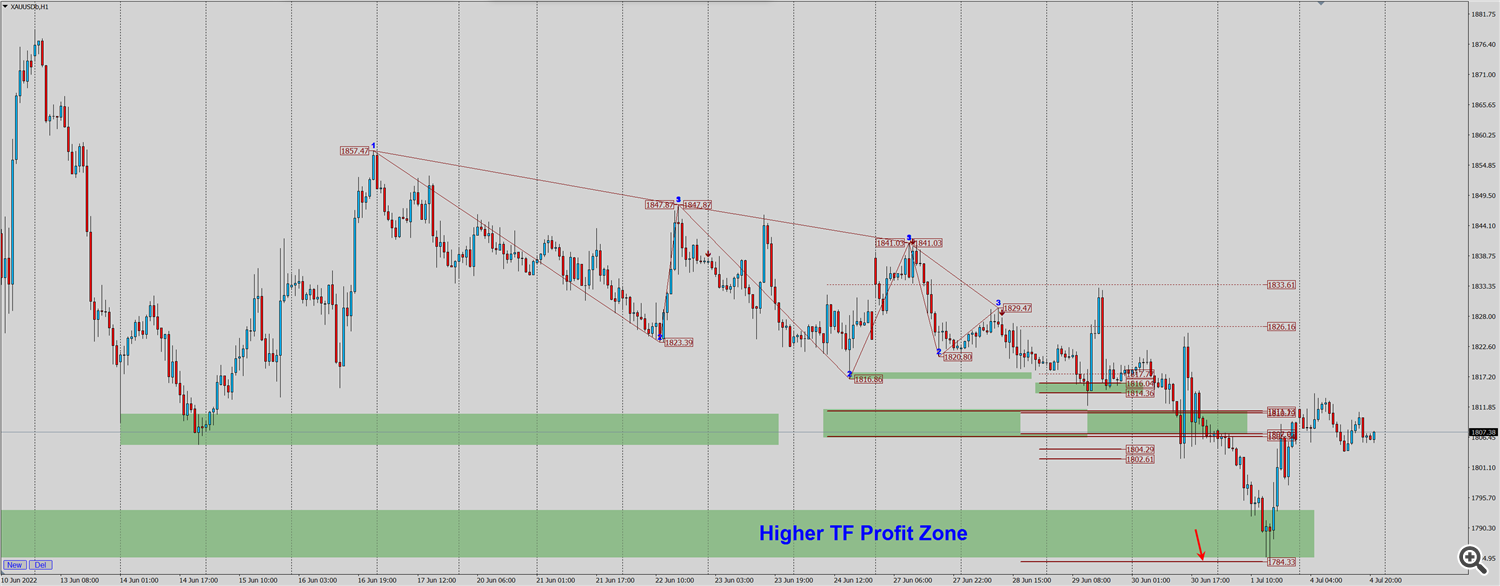

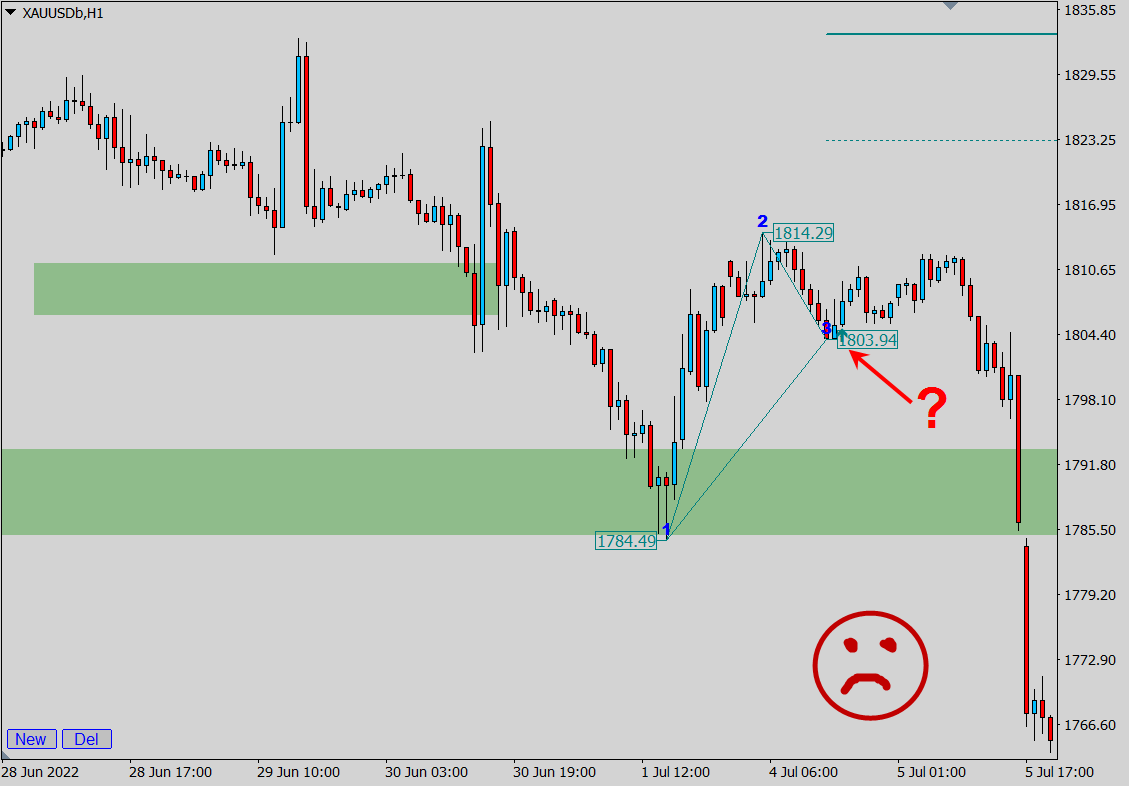

Gold, TF H1. Profit zones were built on June 28:

The zone of the current timeframe built above was worked out on June 30. And on July 1, the targets of the higher TF, built earlier, were fulfilled:

The skill of building profit zones comes with practice. The more you mark up these targets (in history and in real time), the more confident you will feel.

In real time, I advise you to take screenshots of your markup and then see how it worked out.

Question: I still don't understand how to build triangles in real time?! Point 3 changes its position all the time! How to understand that it's time to build a triangle?

The problem of quickly rebuilding the triangle following the price may arise if you use this indicator as the only one - to enter a trade and set targets. If you, like me, use the indicator to find profit-taking zones only, and enter the market on other signals of your trading system, then you will not have this problem.

The main issue is the position of point 3 - points 1 and 2 are already fixed, but point 3 is not yet. Let's look at the example of an impulse triangle - in this case, point 3 is the end of the correction (everything is the same with correction triangles, only point 3 will be the end of the impulse):

1. As long as there is a strong movement, without recoil movement, there is no point in calculating targets.

2. When the movement slows down (at least 2 bars in the opposite direction), i.e. there was a preliminary point 3 - we try to build a triangle. Please note - this is a preliminary building only! It can be canceled when the movement continues. And this can happen several times!

3. When an arrow signal appears, we can assume with a high degree of probability that point 3 is fixed, and the triangle has begun its work towards the targets.

In fact, this is an early signal, and after the arrow appears, the price may not reach even the Preliminary Target and turn around, and we will catch the stop-loss, but this rarely happens. As a rule, the price after the signal reaches at least the Preliminary Target - it is recommended to close part of the trade on it and transfer the balance to breakeven. In order not to get into such rare, but unpleasant situations, it is highly recommended to additionally analyze and build targets on a higher timeframe!

For example, look at the picture below: we built a triangle with buy targets, received a signal to start working the triangle towards the targets, but the price did not even reach the Preliminary Target - we will get a loss if we open a buy on this signal.

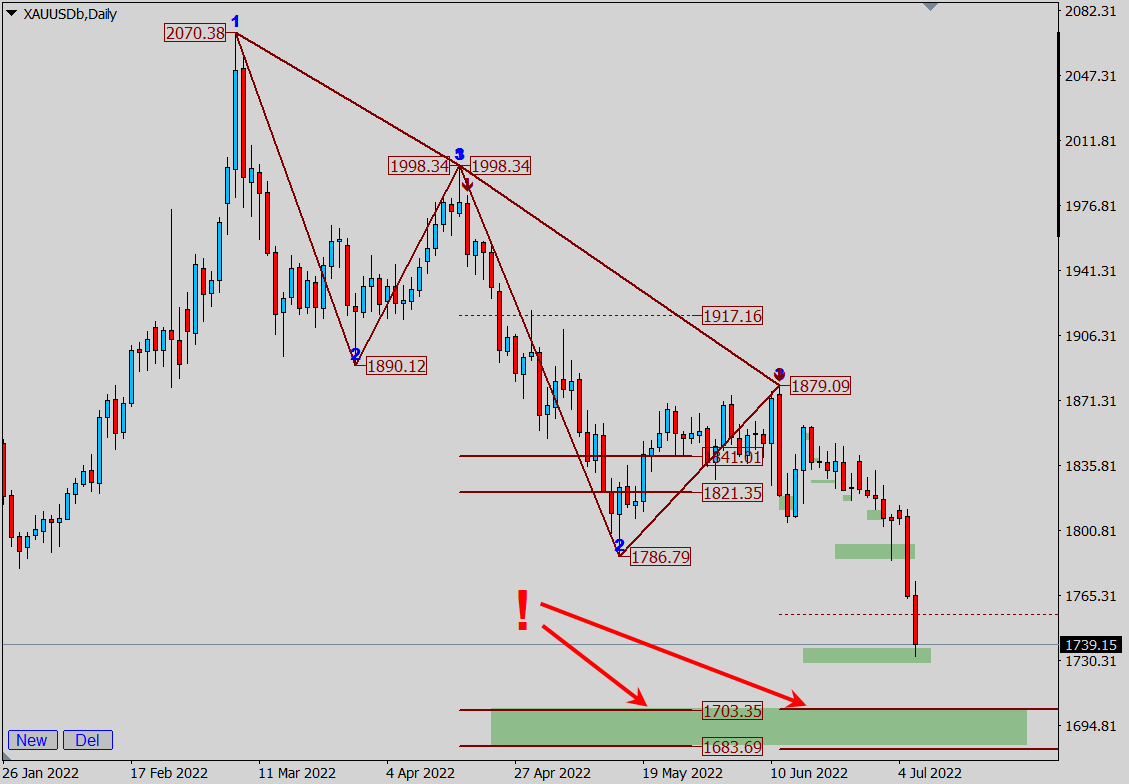

Let's look at the higher timeframe - a strong downward trend, there can be no talk of buying! Therefore, it would be correct to build down targets, and we see that the targets of the H1 and H4 timeframes are very close, which increases their importance.

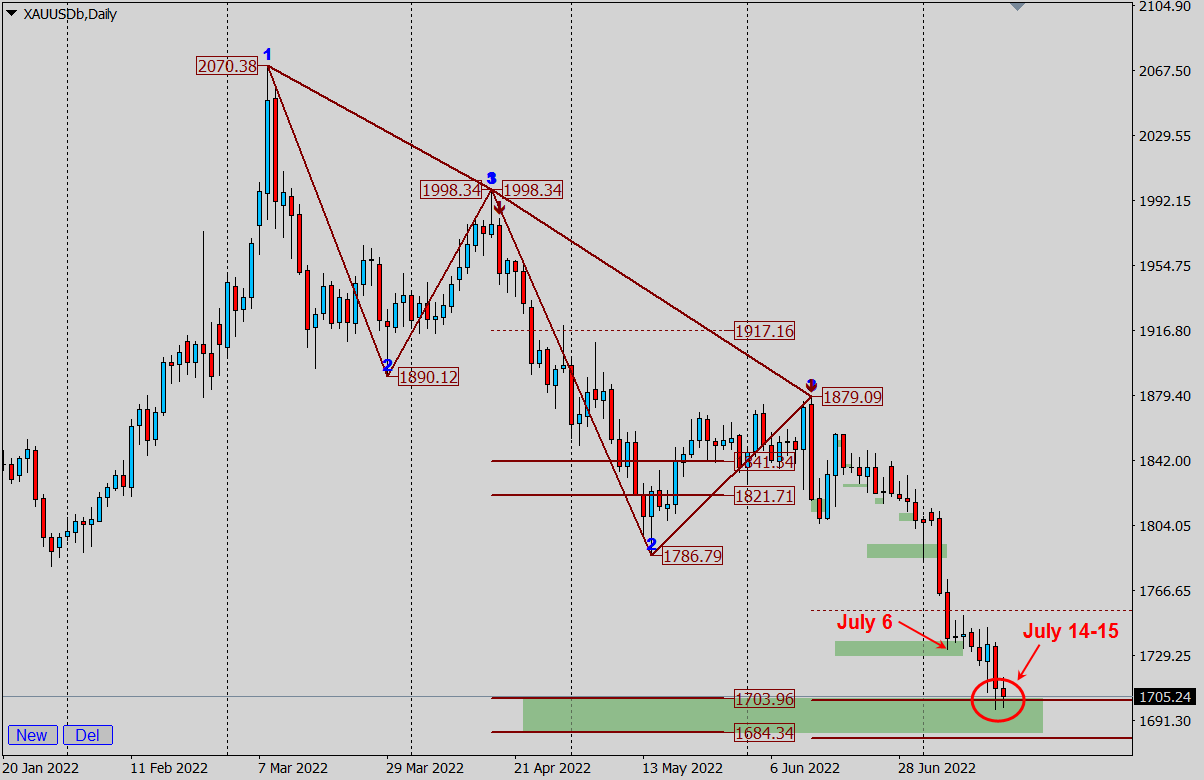

But I would take into account the targets of an even higher TF: look at D1 - the targets of the two triangles coincide completely!

The above screenshots were taken on July 6th.

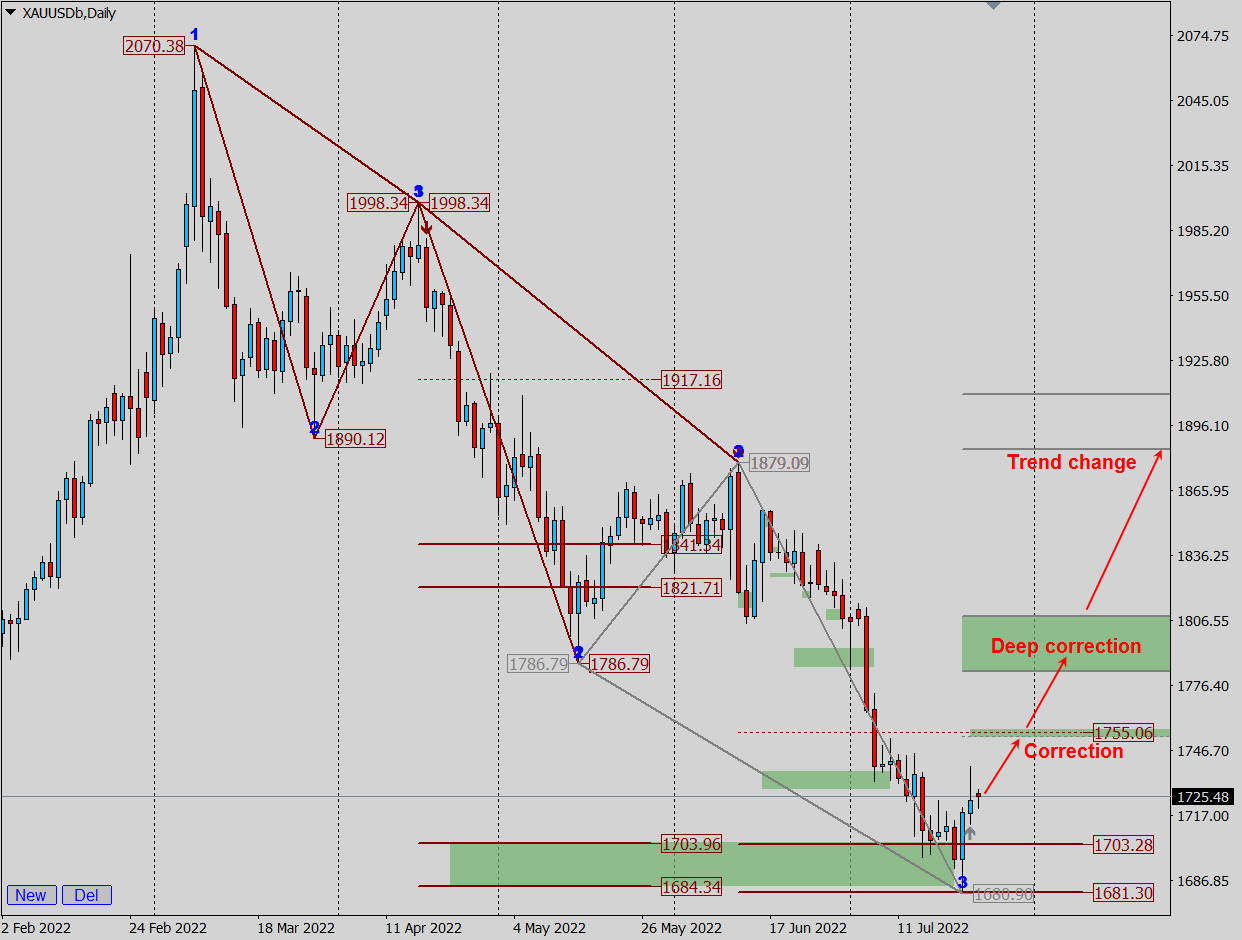

And now I am supplementing the article with a new picture - the targets of the global TF on Daily has been completed on July 14-15!

A new addition from July 25 - there is a clear touch of the zone border and a rebound for a correction, at least.

What can I say?.. I don't know how it works. But it works and I just use it...

Let's build next targets and together we will monitor their progress in real time:

Question: Is it possible to automatically create triangles in the indicator?

In my opinion, there is no point in automatic construction, since the definition of targets is a creative process: we analyze targets from different timeframes, and on each timeframe we simultaneously look at the targets of several triangles, impulse and corrective...

In general, I will not have confidence in automatically constructed triangles, I will still double-check these constructions, correct and supplement them.

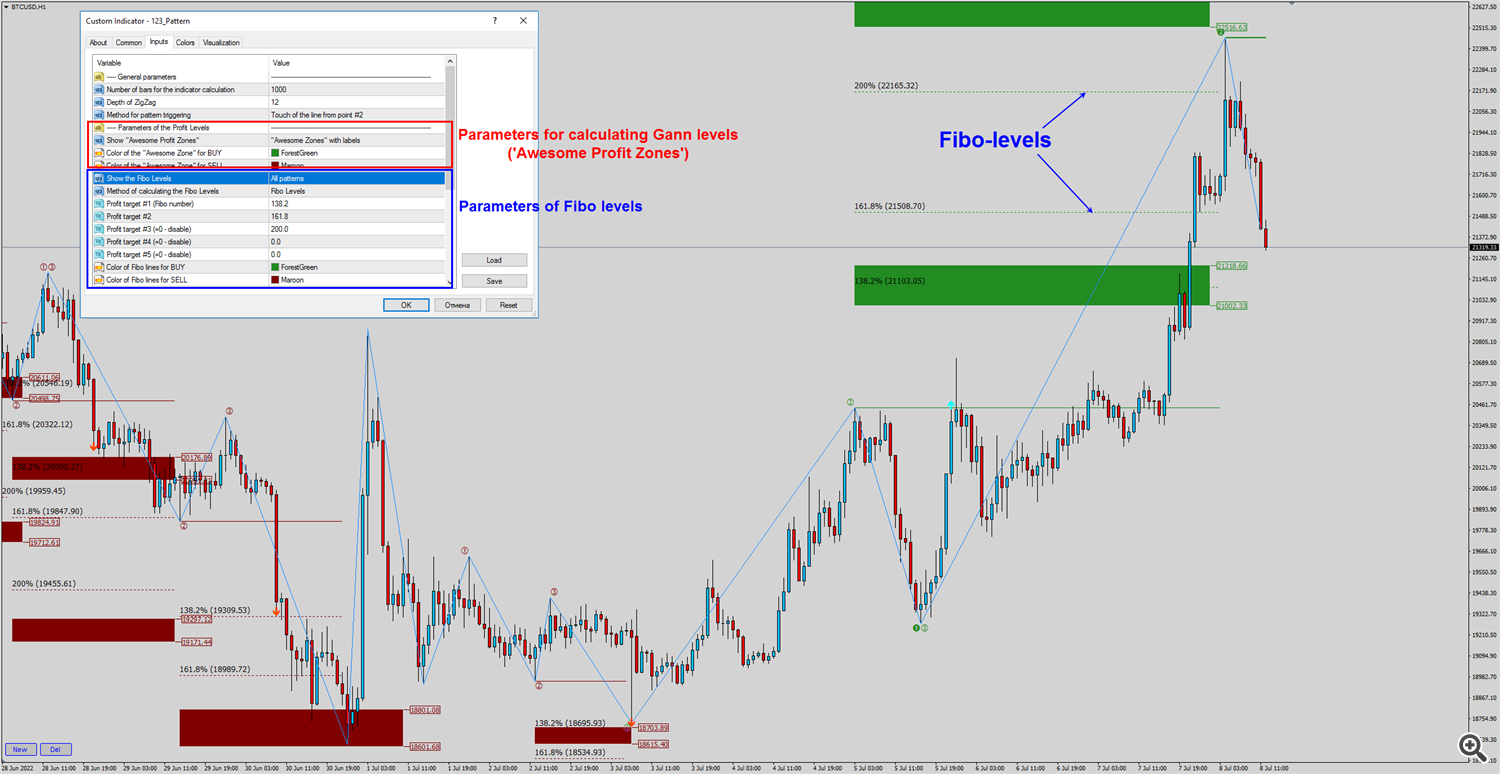

However, you can see the simplest automatic construction of Gann levels in the " Pattern-123 " indicator ( version for MT4 , version for MT5 ). There these levels are called "Awesome Profit Zones". But they are built on impulse triangles only:

Question: What is the difference between building targets according to W.D. Gann for indicators "Legacy of Gann" and "Pattern-123"?

The "Legacy of Gann" indicator is intended for manual construction of Gann levels.

In manual mode, you can build not only impulse targets, but also correction targets, movement targets from different timeframes in any combination.

The coincidence of different levels greatly enhances their significance.

The "Pattern-123" indicator automatically calculates Gann levels and Fibo targets using a zigzag.

With this indicator, you can quickly assess the possible levels of profit taking.

But it can build far from all targets, but for the current timeframe only and on impulsive movements only (similar to the impulsive triangles of the "Legacy of Gann" indicator).

Some more tips

1. Be sure to build not only impulse, but also correction triangles to see the correction target (in most cases, this is the Preliminary Target). This will help you track the moment when the correction develops into a trend change - then the targets of the 1st zone begin to be fulfilled, and then the 2nd zone.

2. I recommend building several triangles: higher/lower TF, impulse/correctional triangles. And watch the coincidence of targets from different triangles.

3. Do not expect a price reversal immediately after touching the calculated level. Because there is not always a reversal when the target is reached. Maybe just a slowdown and a slight correction, and then the trend will continue to the next zone or even to the target of the higher timeframe.

Therefore, be sure to connect more targets of the higher TF! This way you will see a bigger picture.

4. It takes practice to understand how to build triangles. Go through the history, mark all movements sequentially with impulse and correction triangles. See how the targets are being worked out (taking into account the higher TF).

Links:

1. "Legacy of Gann" indicator (MT4 version , MT5 version)

2. Indicator "Pattern-123" : MT4 version, MT5 version