Today, on the last trading day of the week and month, investors will pay attention to the publication at 12:30 and 14:00 (GMT) of another block of important macro statistics for the United States, among which is the core personal spending price index (PCE) for April (Fed uses the PCE annual core price index as the main indicator of inflation) and the final estimate of the University of Michigan Consumer Confidence Index. This indicator reflects the confidence of American consumers in the economic development of the country. A high level indicates growth in the economy, while a low level indicates stagnation. The preliminary estimate was 65.7 (after 59.4 in March, 62.8 in February, 67.2 in January 2022, 70.6 in December, 67.4 in November, 71.7 in October, 72.8 in September 2021). The final score is 62.0, which may also have a negative impact on the dollar.

Also at 12:30 pm (GMT), Statistics Canada is to release its February GDP report. GDP is considered an indicator of the overall health of the Canadian economy, and is expected to grow by +0.8% (from +0.1% in December and +0.2% in January). The relative growth of the indicator may support the quotes of the Canadian dollar, including in the USD/CAD pair.

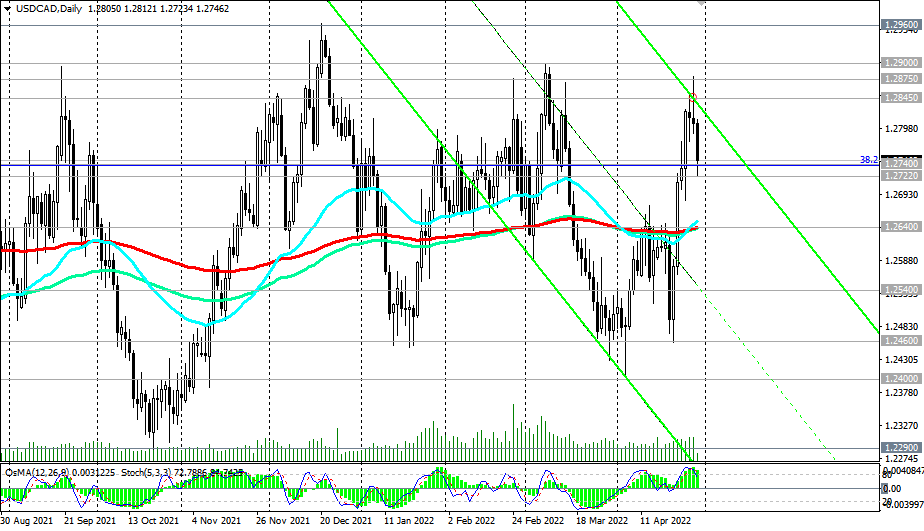

Today, against the backdrop of weakening USD, the USD/CAD pair is declining, trading at the time of publication of this article near the 1.2745 mark.

Overall, it can be said that USD/CAD is trying to fully restore the long-term trend, strengthening from the lows near 1.2000, reached in May 2021.

Above support at 1.2540, this is still a bull market. A break of USD/CAD into the zone above the resistance level of 1.2845 will mean the final completion of the downward correction and the exit, so to speak, “to the operational space” for further growth

Support levels: 1.2740, 1.2722, 1.2640, 1.2540, 1.2460, 1.2400, 1.2290, 1.2165, 1.2050, 1.2000

Resistance levels: 1.2800, 1.2845, 1.2875, 1.2900, 1.2960, 1.3000, 1.3100

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex