This post will serve as the full manual for the Price Action Toolkit EA which you can purchase here:

MT4: https://www.mql5.com/en/market/product/78238.

MT5: https://www.mql5.com/en/market/product/78238

NOTE FOR MT5 USERS: The MT5 version does not have the "scaling in to trades" feature due to limitations in MT5.

For pre sales questions or support join the Telegram group here: https://t.me/market_structure_trader_chat

The price action toolkit EA is primarily designed for scalpers but can be used on all timeframes to quickly enter the market with correctly calculated lot sizing based on your stop level, making it simple to not over expose yourself to unnecessary risk. It allows you to quickly enter trades (instantly or at candle highs and lows with pending orders) and then adjust stops and take profits quickly as the market moves with you or against you. allowing you to scale into winners or close losing trades FAST!

FEATURES:

Fast Trade Execution Buttons

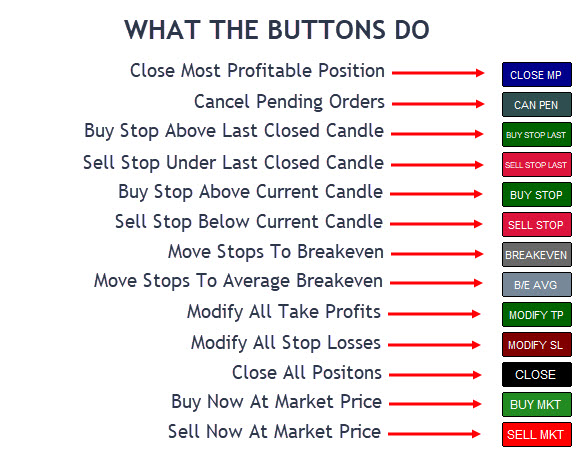

It places quick trade execution buttons on your chart which will automatically open, close or adjust trades instantly. As well as the normal entry buttons you have a fast close button to exit all positions, move your stop to breakeven (or your average breakeven if you have more than one trade open), place buy and sell stops above the current or last candles high and low and also the ability to close out only your most profitable position so you can take a partial profit on positions you scale into with multiple trades as they start to work for you.

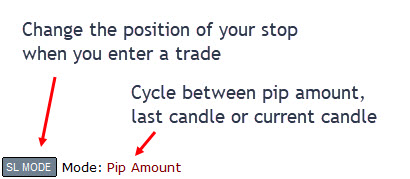

The stop loss mode button allows you to quickly change your stop strategy for each trade. You can toggle between placing your stops at a set number of points (conservative) or at the current or last candles high/low (aggressive).

Candlestick Pattern Recognition

The EA shows on the chart when the most commonly used scalping candlestick patterns are detected including hammers and shooting stars (long wick candles), bullish and bearish engulfing patterns, strong close candles, equal highs and lows and 2 inside bar patterns.

There is also an EMA (exponential moving average) filter for the patterns which can be used to filter out only long or short patterns based on the current trend.

Session Opening Ranges & Recent Ranges

The EA will automatically draw the opening ranges to help spot and trade opening range breakouts at the 2 main trading session starts (Frankfurt and New York). You can choose two opening ranges per session and also adjust the start and end times of these sessions and the opening ranges you want to identify. The EA comes defaulted to UTC+2 which most brokers use and draws in the opening 5 minutes and 90 minutes but these can be adjuted as required.

You can also have the last 5, 15, 30 and 60 candles high and low ranges drawn on the chart which adjust as price moves helping you to spot breakouts from recent consolidation periods.

Automated Trading

You can set the EA to automatically trade for you based on opening ranges, candlestick patterns and also it will auto scale into winning positions for you so you can maximise on your winning entries taking the psychology out of adding to your winners for you which many traders struggle to do. The EA will also auto trail stops to lock in profits on positions that move your way and minimise risks on any trades in profit that may be subject to large, fast moves against you.

Exit Strategies

You can set the EA to auto exit for you based on a percentage account increase for your open trades which helps you achieve targets automatically. If you are using the automated trading facilities for candlestick pattern recognition and opening ranges you can also set a daily profit target which will stop all automated trading when hit. Locking in those profits and preventing over trading of the account which often results in you giving back a lot of your hard earned profits!

There is also an option to have the EA exit your positions on signs of a reversal. Then the last candle in your direction is reversed your positions will close. e.g. If long the EA monitors the low of the last bull candle and when price closed below that level (potential reversal or pullback) it will exit your positions and bank the profit ready for the next entry.

Scalping Practice In The Strategy Tester

The buttons are all available in the strategy tester so you can practice trading and taking manual and/or semi automated entries.

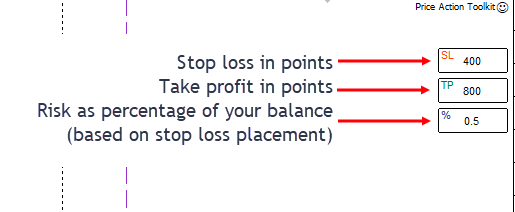

THE BUTTONS AND INPUTS ON THE CHART:

SETTINGS OVERVIEW:

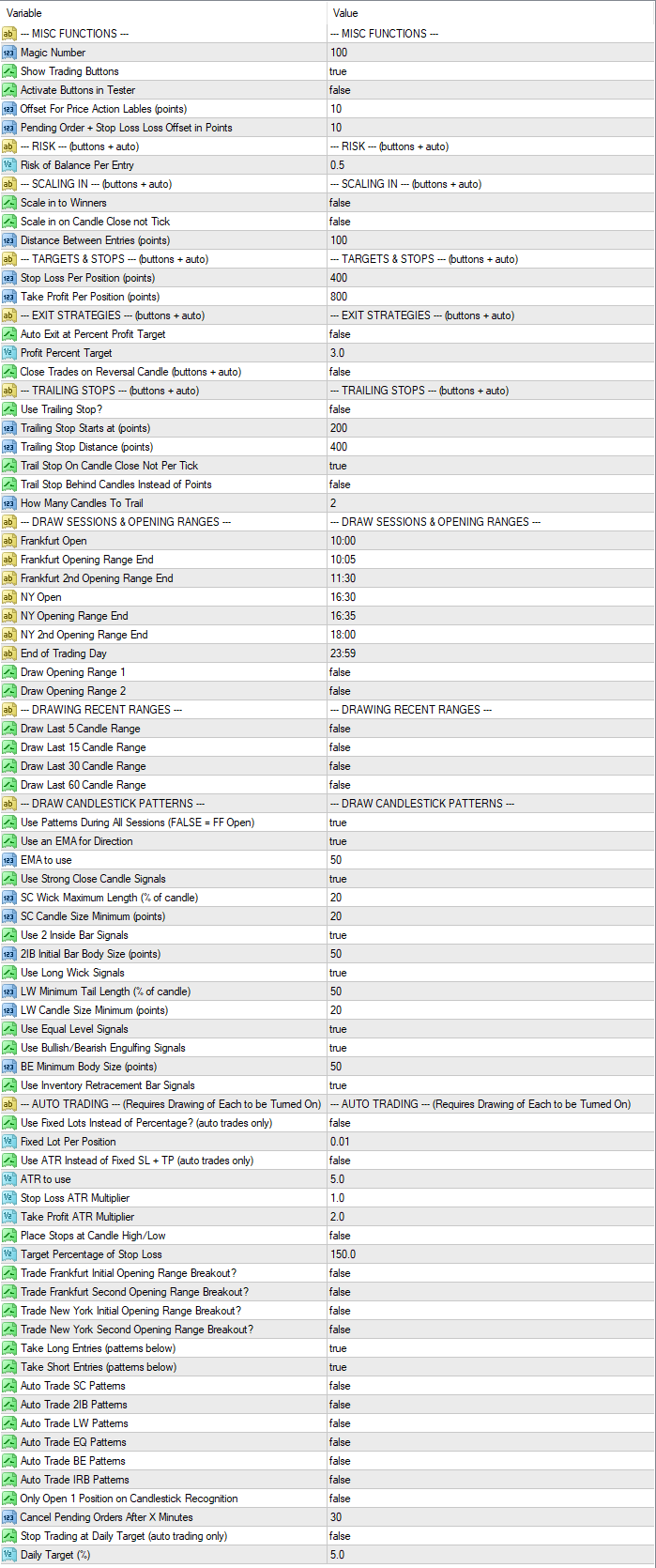

Below is a screenshot of all the settings available for the EA and to follow will be a description of each and what it's designed to do for users.

--- MISC FUNCTIONS ---

Magic Number - This should be unique for EVERY instance of the EA you use. The EA uses the magic number to identify which trades it has placed and when to scale into positions and take profits. Just enter a unique number here every time you place the EA on a chart.

Show Trading Buttons - This will show the fast trading buttons or hide them. You would only hide the buttons if you are using the EA to auto trade for you solely and not take any manual trades yourself.

Activate Buttons in Tester - You can use the EA in the strategy tester to practice trading. If this is set to TRUE the buttons will appear in the tester and it will use the default stop and take profit targets you enter in the risk settings. It does not have the entry boxes you will see when live trading with the buttons to quickly adjust the risk, TP and SL.

Offset For Price Action Label (points) - This is how far away from the candle high or low the labels will be placed to identify candlestick patterns. You will want to adjust this depending on the timeframe and instrument you are trading.

Pending Order + Stop Loss Loss Offset in Points - This is used for pending buy and sell orders used in aut trading and for the buy and sell stop buttons. Trades will be placed this number of points away from the high or low of the candle being used as an entry.

--- RISK --- (buttons + auto)

Risk of Balance Per Entry - Here you enter the amount you want to risk per trade taken either manually with the buttons or with the auto trading features. You can alter this dynamically when using the EA buttons also by using the inputs which appear in the top right corner of your chart. This is what the EA will default to when placed on the chart.

--- SCALING IN --- (buttons + auto)

Scale in to Winners - This feature will automatically scale into winning positions for you as price moves in your favour. When a trade works it's best practice to add to your position and increase the risk and the reward when a trade starts to work. When set to TRUE the inputs below will become active and the EA will start to add to your position using the risk perameters, stop loss and take profit perameter you have set. By default it will automatically get you into extra positions as soon as price has moved a certain distance (specified below in the inputs) immediately.

Scale in on Candle Close not Tick - If set to TRUE the EA will only add to positions when a candle has closed and is more than your set distance from the initial trade. This will get you into additional trades a little slower and give your trade more time to breathe but is less aggressive and will not maximise on big fast movements quite as much.

Distance Between Entries (points) - This is the distance in points the EA will use to add your additional positions as price moves in your favour. The smaller the number the more aggressive and fast your entries will be. I would recommend using around 1/2 your stop loss distance as a minimum.

--- TARGETS & STOPS --- (buttons + auto)

Stop Loss Per Position (points) - This is the amount of points from the entry your stop loss will be placed.

Take Profit Per Position (points) - This is the amount of points from the entry your take profit will be placed.

--- EXIT STRATEGIES --- (buttons + auto)

There are two common exit strategies available to automatically get you out of your positions. You can use both, either or none as you wish. Auto exiting at a profit will kick in if a trade runs in your direction quickly and reversal candle exits help if there is a strong move against you and will get you out of your positions and reduce your risk.

Auto Exit at Percent Profit Target - If set to TRUE the EA will automatically close out all positions you have open when it hits the target profit level.

Profit Percent Target - This is the target profit amount to reach before closing out your positions. You can use fractions of a percent here for sclaping as required (e.g. 0.25 = 1/4%, 1 = 1% etc).

Close Trades on Reversal Candle (buttons + auto) - If set to true the EA will automatically get you out of positions when price starts to turn against you. The logic for this function trails an invisible stop under the last candle traded in your direction. When price closes below this level the EA will close your positions in that direction.

e.g. If you are long in a short the EA will place an imaginary stop above the high of the last BEAR candle. Every time a new BEAR candle is painted that stop will be moved down. So as your trade trends in your direction the EA will be monitoring for signs of BULL strength and automatically get you out when it is detected.

EXAMPLE OF THE REVERSAL CANDLE EXIT SYSTEM WORKING:

--- TRAILING STOPS --- (buttons + auto)

Trailing stops will follow price as your trades move in your favour and reduce the risk on your positions and/or lock in profit depending on how far price has moved and when you require the trailing stop to kick in.

Use Trailing Stop? - Automatically trail your stop loss when your position moves into profit.

Trailing Stop Starts at (points) - Start trailing the stop loss only when price has moved this many points into profit from yout entry.

Trailing Stop Distance (points) - Once the trailing stop start is reached adjust the stop to this distance from the current price. The EA will auto trail your entry by this many points every tick that is moved in your direction.

Trail Stop On Candle Close Not Per Tick - If TRUE the EA will only adjust your stop loss when each candle closes. This is useful to stop you getting taken out by long wicked candles that push against you then retrace in your direction.

Trail Stop Below Candles Instead of Points - If TRUE the EA will trail your stop loss a certain number of candles behind your position. If you are long it will use the low of the candles and if short the high.

How Many Candles To Trail - If the setting above is true this is the number of candles that will be used to trail your stop loss.

--- DRAW SESSIONS & OPENING RANGES ---

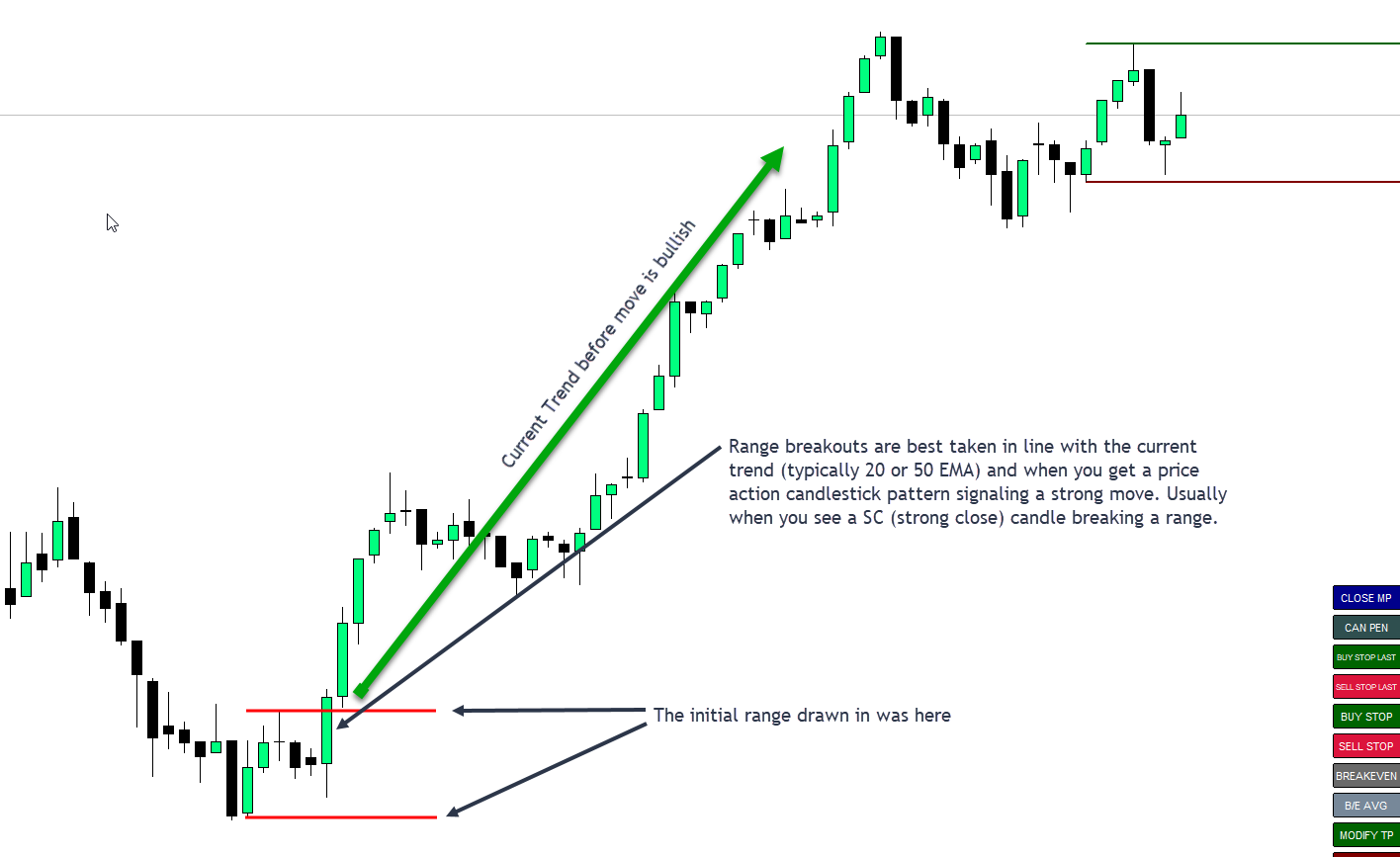

The EA will draw in the opening ranges of each session for you and you can choose two different opening ranges for each major session (Frankfurt + New York). Many price action traders using smaller timeframes like M1, M5 and M15 will use these initial opening ranges to find breakout trades to play at the open and also to look for the potential high or low of a day/session.

The most commonly used are the 5 or 15 minute opening range to establish the initial trades at the open and then play the break of this to get the initial move which can last anything from 5 or 10 minutes to an hour. Then the 90 minute range to establish the potential high or low of the day or session. The EA has as default the 5 and 90 minute ranges but you can adjust these to your desired ranges.

NOTE: The times are your BROKERS candle times not your local times. Most brokers use UTC+2 which is what the EA is set to as default so you can adjust these as necessary to match your broker.

Frankfurt Open - The time the Frankfurst session starts.

Frankfurt Opening Range End - The first opening range to draw the levels at.

Frankfurt 2nd Opening Range End - The second opening range to draw the levels at.

NY Open - The time the New York session starts.

NY Opening Range End - The first opening range to draw the levels at.

NY 2nd Opening Range End - The second opening range to draw the levels at.

End of Trading Day - The end of the trading day for the instrument you are trading. This is the last candle before your broker suspends the instrument for the overnight swaps. This is only used to designate where the NY session opening lines will end and is usually 23:59 on most brokers.

Draw Opening Range 1 - If TRUE will draw in the first opening ranges on your chart.

Draw Opening Range 2 - If TRUE will draw in the second opening ranges on your chart.

EXAMPLE OF HOW THE OPENING RANGES ARE DRAWN AND HOW TO USE THEM:

--- DRAWING RECENT RANGES ---

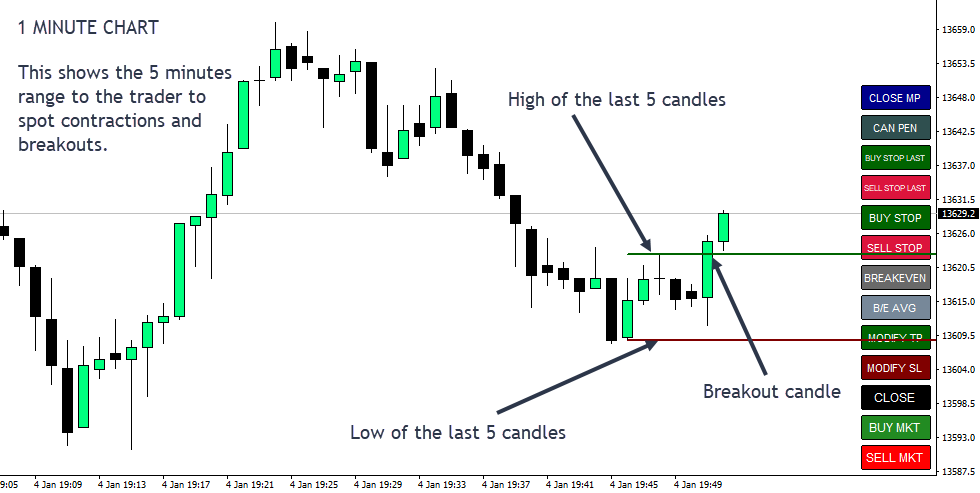

These settings will draw in a range high and low on the last X number of candles you select. These are designed for the 1 minute chart traders and will allow you to see visually the 5, 15, 30 and 60 minute ranges. These can be used on any timeframe though to help you spot consolidations/accumulations in prcie and play the breakout of those ranges.

Draw Last 5 Candle Range - draws the high and low of the last 5 CLOSED candles.

Draw Last 15 Candle Range - draws the high and low of the last 15 CLOSED candles.

Draw Last 30 Candle Range - draws the high and low of the last 30 CLOSED candles.

Draw Last 60 Candle Range - draws the high and low of the last 60 CLOSED candles.

EXAMPLE OF THE RECENT RANGES DRAWN:

AFTER THAT RANGE WAS BROKEN:

--- DRAW CANDLESTICK PATTERNS ---

Price action candlestick patterns are powerful signals to alert the trader to potential moves starting. The EA will draw in the most commonly used patterns and these should ideally be taken only if other confluences confirm the price action you are seeing on the chart. The most common confluence used is an EMA (exponential moving average) although there are many other confirmation conditions you can implement like an oscillator (RSI or stochastic) or support and resistance etc...

When a candlestick pattern is detected the EA will draw the initials of that pattern either above or below the candlestick depending on whether it is bullish or bearich in nature.

Use Patterns During All Sessions (FALSE = FF Open) - By default the EA will only draw patterns that appear after the initial opening session (Frankfurt open) but if yu want to see them all day long (i.e. during the Asian session) you can set this to TRUE.

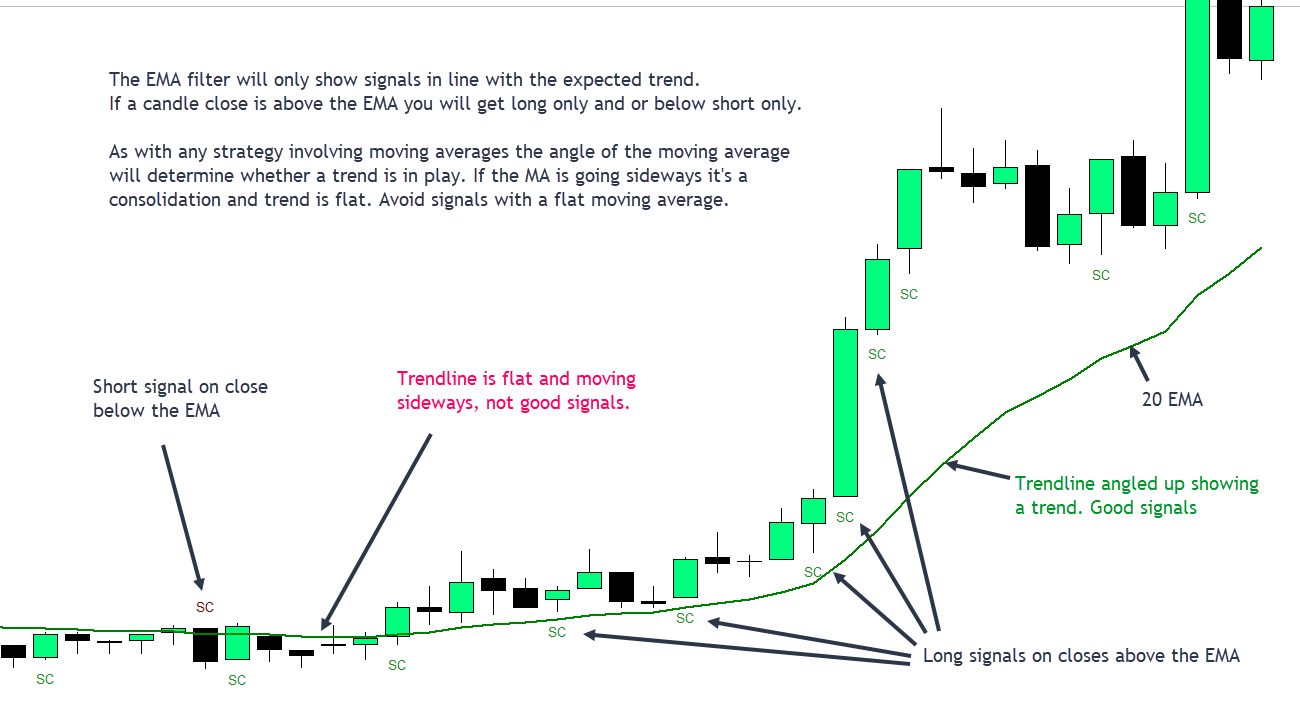

Use an EMA for Direction - If TRUE the EA will only draw in and/or auto trade the patterns that are confirmed by the moving average period you select. e.g. the candle must CLOSE above or below the moving average depending on whether bullish or bearish.

EMA to use - If using an EMA this is the period that will be used to confirm the patterns.

HOW TO READ MOVING AVERAGES WITH PRICE ACTION:

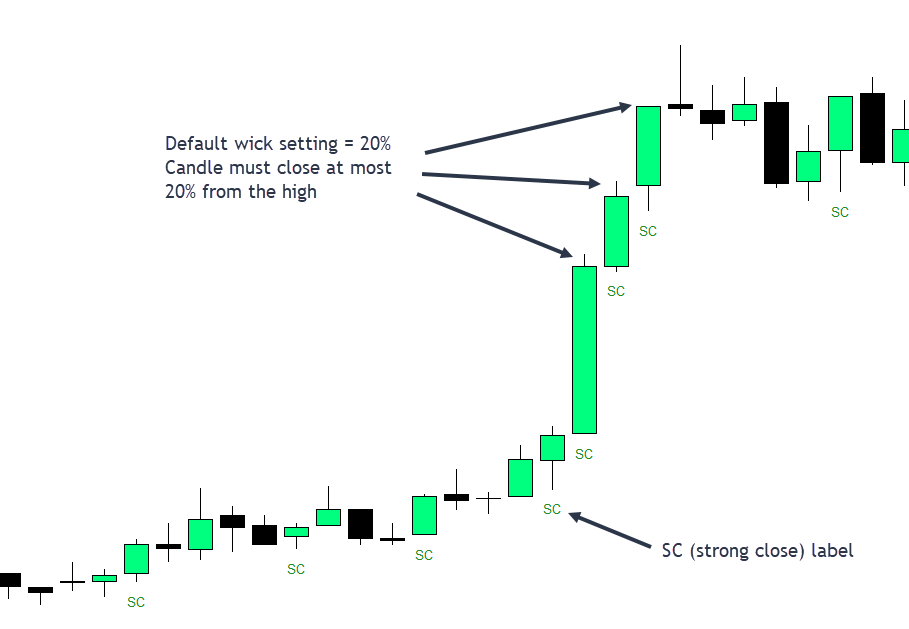

Use Strong Close Candle Signals - If TRUE the EA will label these candles for you.

Strong Candle signals (SC) are candlesticks that close strongly near their high or low showing signs of aggressive buying or selling. These are often the start of a continued push in a direction and you will often get a strong move for at least another 1 or 2 candles, often more. The SC candle is most effective following a period of accumulation/consolidation and you can use these effectively in conjunction with the recent range feature.

SC Wick Maximum Length (% of candle) - This is the percentage of the total candle length that the close must fall within. The smaller this percentage the stronger the close and more powerful the signal.

SC Candle Size Minimum (points) - This is the minimum size of the candle in points. You will need to adjust these for different instruments to fine tune the signals. e.g. FX pairs have much smaller candle ranges than indicies etc...

EXAMPLES OF STRONG CLOSE CANDLES:

Use 2 Inside Bar Signals - If TRUE the EA will label these 3 candlestick patterns for you.

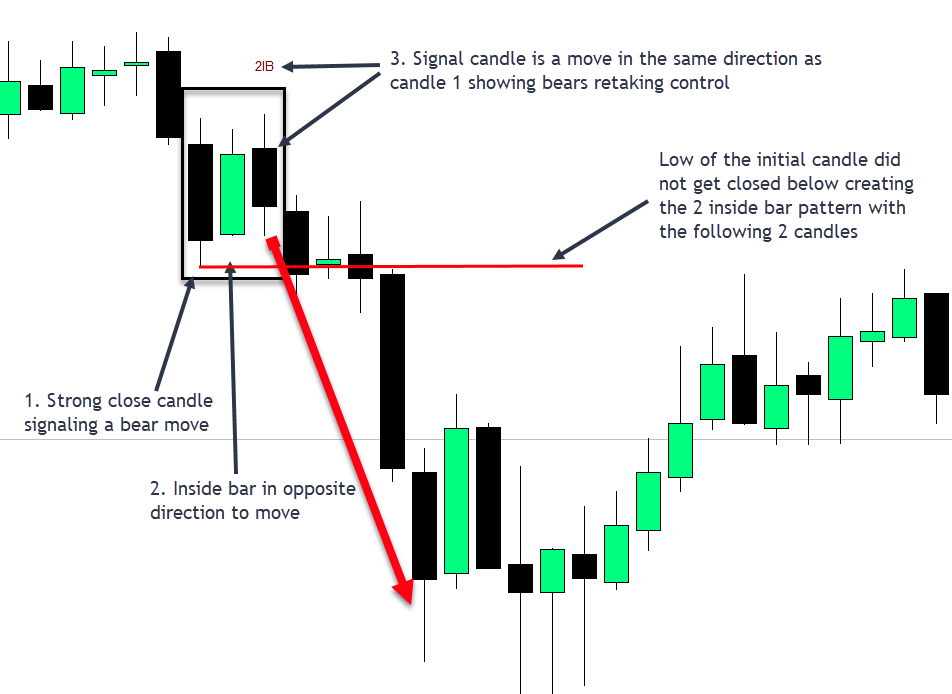

2IB patterns consist of 3 candlesticks. The first is a strong close candle which is typically a large bar. After the large initial move the second candle is a pullback in price (opposite candle) which is profit taking on the initial move and/or sellers trying to reverse that move and escape being trapped in their position. The third candle in the pattern is another push in the same direction as the initial move showing signs the move will continue. The 2nd and 3rd candles however should not break the high of the initial move.

2IB Initial Bar Body Size (points) - This is the size of the initial move and the body of that candle.

EXAMPLE OF THE 2 INSIDE BAR PATTERN:

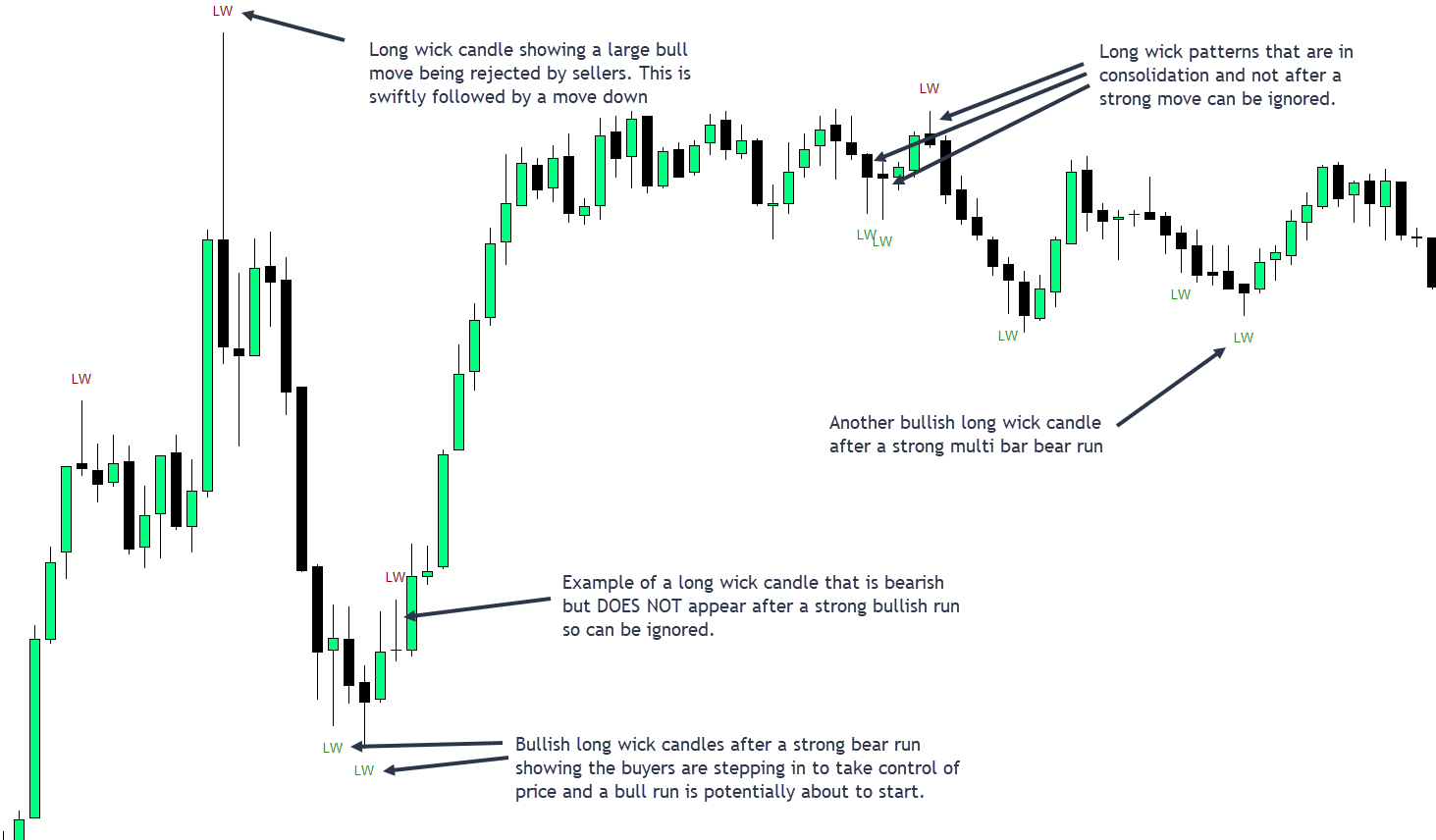

Use Long Wick Signals - If TRUE the EA will label these candles for you.

Long wick candlesticks are often referred to and used as hammers or shooting stars only but in reality and candle that has a long tail or wick is a potential sign of a trend pullback or reversal. The EA will ony show these if they appear and are making a new high or low in the last 5 candlesticks. This helps to filter out some of the many long wick candles you will find during sideways movements.

This candlestick has a couple of important characteristics that are often misread by traders.

1. These should not ideally be used with a moving average filter as they will be best signals at the end of trend moves. e.g. they will usually be taken counter-trend. Bullish long wick candles are best taken after a stong bear move and bearish long wick candles after a strong bull move.

2. Long wick candles that appear in a consolidation or sideways movement should be ignored. These are just signs of movement up and down (accumulation of positions) and general buying and selling action.

LW Minimum Tail Length (% of candle) - This is the minimum percentage the tail of the candle needs achieve to be classed as a long wick (LW) candlestick. The longer the tail the higher the rejection and stonger the signal.

LW Candle Size Minimum (points) - This is the minimum size of the candle in points. You will need to adjust these for different instruments to fine tune the signals. e.g. FX pairs have much smaller candle ranges than indicies etc...

EXAMPLES OF LONG WICK CANDLESTICKS:

Use Equal Level Signals - If TRUE the EA will label these 2 candlestick patterns for you.

Equal level signals are created when price touches EXACTLY the same price twice within a certain period of time. The EAs logic looks at the highs and lows of the last 15 candles and if price touches and rejects any price withing those ranges it will alert. It checks the high and low of the last 15, last 10 and last 5 candles in order.

This is a sign of rejection and is often followed by a swift move in the opposite direction.

EXAMPLES OF EQUAL LEVEL SIGNALS:

Use Bullish/Bearish Engulfing Signals - If TRUE the EA will label these 2 candlestick patterns for you.

Probably the most commong price action pattern used by traders and works at the end of trends as well as being a trend continuation pattern. Due to the nature of this patter being so common during price movement it is often advised to have a fairly large candle bodies set to filter out the smaller bullish and bearish engulfings which happen over and over again during consolidations.

These patterns are simply a sign that a strong move was attempted in one direction and then immediately reversed by the opposing party. This shows signs that the latter will likely take short term control of price action and you should expect a continuation move in that direction. The second candle in the pattern should comletely engulf the first candle and be in the opposite direction. Whether it is a bullish or bearish pattern is dictated by the direction of the second candle.

BE Minimum Body Size (points) - The minimum body size of the candlesticks. NOTE: This setting applies to EACH candlestick in the pattern so the bull and bear of the pattern must be this size at least.

EXAMPLES OF BULLISH AND BEARISH ENGULFING PATTERNS:

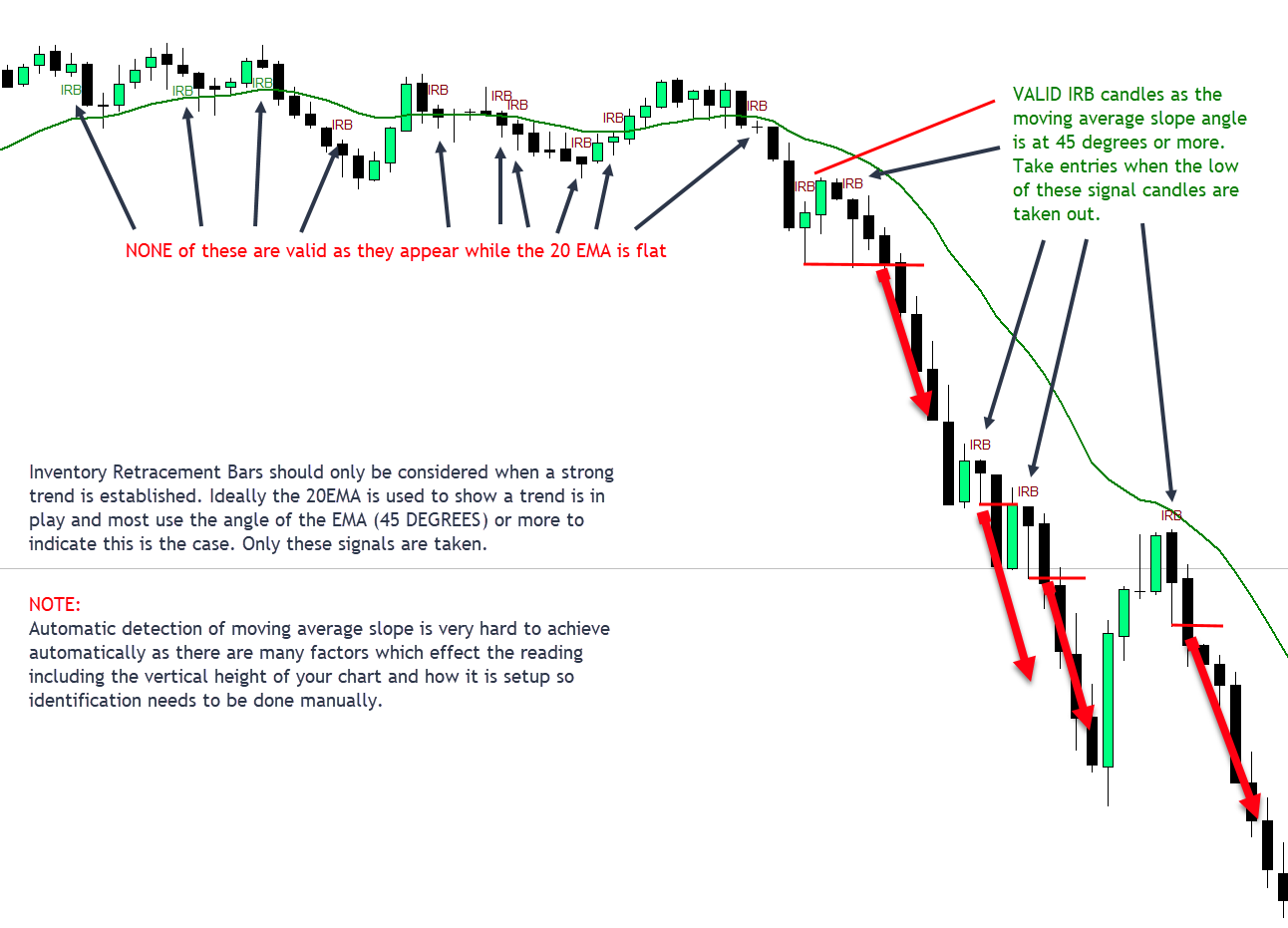

Use Inventory Retracement Bar Signals - If TRUE the EA will label this candlestick pattern for you.

The inventory retracement bar is a single candlestick pattern similar to the long wick candles but with a few differences. The logic behind these is simple, there should be a wick (tail) at least 45% of the candles total length that is on top of the candle for a BULL signals and on the bottom of the candle for a BEAR signal. These should always be filtered using an EMA (usually 20EMA) and the slope of the EMA is more important than whether price closes above or below it.

These candlesticks are strong trend continuation patterns. They show continuation moves being "absorbed" by the other party and an attempt to reverse price failing. When the low (in the case of the bearish ones illustrated below) is broken it is deemed a very bearish price move and the sellers have taken control of price action again. These moves can be strong and fast.

EXAMPLES OF IRB SIGNALS:

--- AUTO TRADING --- (Requires Drawing of Each Pattern to be Turned On)

The auto trading features of the EA are designed to assist you in getting into positions QUICKLY while manual trading and not designed to be used as a "set and forget" fully automated strategy. e.g. You see a strong trend and want the EA to take continuation candlestick patterns instantly for you which you can then manage as you watch price action unfold.

That being said many users are reporting good results completely hands off with the EA when using the percentage gain exit strategies with scaling into winners enabled and a daily profit target also set to stop over trading with the EA. I would encourage you to play with the settings in the strategy tester and find set files that work for you, however you want to use the auto trading functionality.

When and if good set files are discovered for fully automated trading I will backtest them thoroughly and publish them for general use also.

NOTE: These functions will ONLY work if you also have them set to be drawn on the chart using the settings above for opening ranges and candlestick patterns.

Auto trading will also take into account if you are using a moving average filter in the patterns section too.

FUNCTIONALITY OF AUTO TRADING CANDLESTICK PATTERNS:

The EA will not enter immediately when a pattern is detected. It will place a pending order at the high (bullish patterns) or low (bearish patterns) of the signal candle. This is best practice with all price action trading as you want the signal to be confirmed by price continuing in your direction so as you do not get taken out instantly if a pattern is immediately invalidated after the candle has closed.

There is a pending order offset which will place the order X pips above or below the candles so you can tweak that for each instrument you trade to your preference as they will have varying amounts that will be optimal. There is also a pending cancellation input which will cancel the pending orders after a set time, if for example a bearish long wick signal forms and price has not closed below the low of that candle and shot off the other way you want to close that order as it is no longer a valid signal.

By default the EA will use the RISK PERCENTAGE and STOP LOSS AND TAKE PROFIT set in the inputs above to trade. There are however further options for auto trading covered below.

Use Fixed Lots Instead of Percentage? (auto trades only) - If you would like the EA to use a fixed lot size instead of a percentage risk of your account you can set this to TRUE and designate the lot size to be used for each entry.

Fixed Lot Per Position - The lot size to use if using the setting above.

Use ATR Instead of Fixed SL + TP - If set to TRUE the EA will use ATR (average true range) instead of the fixed TP and SL figures set higher up in the settings. e.g. if the atr of an instrument is 200 points in the last 5 candles that will be what is used as the base calculation for your stop and profit using the multipliers in the inputs below. I would encourage you to test these setting thoroughly in the strategy tester for the instrument you are looking to trade as brokers vary.

ATR to use - This is the ATR number to use. As default the EA uses the last 5 candles to calculate the ATR as we are interested usually in the most recent volatility of the instrument we are trading.

Stop Loss ATR Multiplier - Whatever the ATR is in points (calculated for you automatically by the EA) your stop loss will be multiplied by the number you enter here. The default is 1, the higher the number the further away your stop will be placed. Best practice is to use 1-2 ATR as a stop loss.

Take Profit ATR Multiplier - As above, this applied to the take profit set. You would typically want this to be a higher multiplier to give you a positive risk:reward ratio. A common scalping ratio is 1:1.5 or 1:2.

Place Stops at Candle High/Low - This will place your stop loss at the high of a bear candle or low of a bull candle then entering a trade. This will use the pending offset distance for the stop also. This is a more aggressive entry strategy and will usually enter you with a larger lot size (if using risk percentage) but will also allow you to scalp out much faster too. Then using this filter the EA will place your take profit at a percentage of the risk in points which is set using the next input below.

Target Percentage of Stop Loss - This is the distance to your take profit order and is based on how far away the stop is placed when using a candle high/low. The default is 150%. e.g. if your stop is at 100 points the TP will be placed at 150 points. This represents a 1:1.5 risk:reward ratio so you can adjust this to your preferred risk:reward based on your timeframe, trading style and the patterns you are trading.

Trade Frankfurt Initial Opening Range Breakout? - If set to TRUE the EA till automatically trade breakouts of the initial opening range you set both long and short during the Frankfurt session.

Trade Frankfurt Second Opening Range Breakout? - If set to TRUE the EA till automatically trade breakouts of the second opening range you set both long and short during the Frankfurt session.

Trade New York Initial Opening Range Breakout? - If set to TRUE the EA till automatically trade breakouts of the initial opening range you set both long and short during the New York session.

Trade New York Second Opening Range Breakout? - If set to TRUE the EA till automatically trade breakouts of the second opening range you set both long and short during the New York session.

NOTE FOR THE OPENING RANGE BREAKOUTS: The EA will only take ONE trade in each direction for each breakout. It will NOT continuously take every break of the opening range. IF the trade works or fails that is complete.

Take Long Entries (patterns below) - This when set to TRUE will only take auto trade entries long based on the candlestick patterns listed below. Note: this also uses the moving average filter for candlstick patterns if you have that enabled.

Take Short Entries (patterns below) - As above but only takes short entries.

Both of the settings above fr long and short trade entries are designed to be used if you have a specific bias on an instrument for the day or period you are trading.

FOR ALL OF THE BELOW SETTINGS:

If TRUE the EA will trade this candlestick pattern by placing a pending order at your chosen offset above or below the candle sepending on whether bulligh or bearish.

Auto Trade SC Patterns - Set to TRUE to trade these.

Auto Trade 2IB Patterns - Set to TRUE to trade these.

Auto Trade LW Patterns - Set to TRUE to trade these.

Auto Trade EQ Patterns - Set to TRUE to trade these.

Auto Trade BE Patterns - Set to TRUE to trade these.

Auto Trade IRB Patterns - Set to TRUE to trade these.

Only Open 1 Position on Candlestick Recognition - If set to TRUE the EA will only take the first pattern it sees and not EVERY SINGLE pattern that is drawn. If using the "add to winners" functionality this is usually best practice as if a trade goes your way you will get scaled in with more position sizing that way. You may however want to take EVERY pattern that appears and not use scaling in. This is something you can experiment with and tweak to your personal style of trading and risk appetite.

Cancel Pending Orders After X Minutes - The amount of time after the pattern is detected to remove the pending orders if the signal is not triggered into a trade. This is calculated from the candle AFTER the signal candle.

Stop Trading at Daily Target (auto trading only) - Is set to TRUE when a daily percentage gain is achieved on the account the EA will stop automatically trading. This helps if you have a tendancy to OVER TRADE and give back profits gained when you ahve a good day. This only applies to the auto trading functionality and not the buttons or "add to winners" scaling in features.

Daily Target (%) - The percentage gain on your account the EA will stop all auto trading functionality at.

Stop Drawing Patterns and Auto Trading At This Time - This is set to the end of the day but if you want the EA to stop drawing the candlestick patterns and stop auto trading before that you can designate a time here. All pattern drawing and auto trading will end at this time.