This post provides the necessary information to run the Victorious EA as intended and Frequently Asked Questions.

Victorious EA is an automated trading system that can trade any symbol and time frame and simultaneously supports up to 4 strategies.

The system allows you to customize completely different trading strategies without using any constructor. Strategies are created by switching the EA settings with a few mouse clicks.

For examples of strategies and test results, see the official product page in the MQL Market.

CONTENTS

General settings

- Time management

- Money management

- Safety

- Market noise

Combining strategies in the same EA

Strategy settings

- [1] Trade this strategy

- [1] Directions of opening

- [1] Risk per trade, percentage of the deposit

- [1] Chart pattern:

- Strong trend patterns,

- Trend correction patterns,

- Breakout patterns,

- Counter-trend (reversal) patterns,

- Take Profit placement options

- [1] Max / Min correction

- [1] Take Profit compression factor

- [1] SL scale factor when Opening

- [1] SL scale factor when Moving / Adding

- [1] Minimum TP / SL ratio

- [1] Maximum TP / SL ratio

- [1] Look for a false breakout

- [1] Move Stop Loss:

- Stop Loss movement along the trend line,

- Stop Loss movement by local extremums

- [1] Close when getting profit, bets

- [1] Close when price pauses

- [1] Close after false breakout

- [1] Close after acceleration

FAQ

- What is the minimum deposit required for the EA to work correctly?

- How can I speed up the strategy testing process?

- Why didn't the EA open a position?

- Why didn't the EA move the Stop Loss level?

- How does the EA close positions?

GENERAL SETTINGS

Time Management - Trading schedule settings

The Time management group of settings allows you to set the schedule of trading sessions for position trading, intraday, or intra-week trading. Setting values:

- Start time of trading session daily – Start trading every day at [hour : min]

- Last opening time daily – The time of the last position opening every day at [hour : min]

- Close all positions daily at – Close all positions daily at [hour : min]

- Close all positions on Friday at – Close all positions every Friday at [hour : min]

Money Management - Target profit, acceptable loss, and number of trades settings

The Money management group of settings makes it possible to adjust daily and weekly target profit (upon reaching which the robot stops and does not trade at that day/week), limit daily and weekly loss, and assign the maximum number of position openings. Setting values:

- Daily target profit, percentage of the deposit – If the EA makes this profit, then it no longer opens positions on that day

- Daily loss limit, percentage of the deposit – If the EA gets this loss, then it no longer opens positions on that day

- Daily maximum number of openings – The maximum number of positions that the EA can open per day

- Weekly target profit, percentage of the deposit – If the EA makes this profit, then it no longer opens positions this week

- Weekly loss limit, percentage of the deposit – If the EA gets this loss, then it no longer opens positions this week

- Weekly maximum number of openings – The maximum number of positions that the EA can open per week

Safety - Reliability and safety settings

The Expert Advisor can and should be installed simultaneously on several trading symbols. When Safety settings are enabled, each Expert Advisor (on its trading symbol) can keep its log file and make backups as well.

These settings allow the EA to stay operational in case of sudden terminal reboots, communication issues, and other problems in the trading environment. Setting values:

- Keep a personal log – This copy of the EA maintains its log file

- Make backups – This copy of the EA makes backups (saves important data to files)

However, in the tester, the Safety settings must be disabled to speed up the testing process.

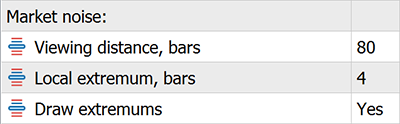

Market noise - Market noise filtering settings

Market noise settings are responsible for price chart recognition and market noise filtering. Setting values:

- Viewing distance, bars – Number of candles (bars) to the left that robot observes on the chart

- Local extremum, bars – Minimum distance between two local extremums, bars

- Draw extremums – The EA shows local extremums it found

The picture below shows an example of the Market noise settings:

On the chart, it looks something like this:

It makes sense to set larger values of Local extremum, bars for smaller time frames. There is much more market noise on small time frames, especially during periods of low liquidity.

COMBINING STRATEGIES IN THE SAME EA

Each copy of the EA (attached to a specific trading symbol) supports up to 4 strategies simultaneously and acts like this.

First, EA checks the strategy [1] signal for opening a position. If there is a signal, Victorious EA opens a trade. Otherwise, it looks for a strategy [2] opening signal. And so on, up to strategy [4].

Thus, you can set different rules for long strategy [1] and short strategy [2]. Another option is as follows. Strategy [1] processes the breakout signal. At the same time, strategy [2] handles a false breakout signal in case of a false breakout. Etc.

General settings apply to all strategies. Numbered settings [1, 2, 3, 4] apply only to a specific strategy.

STRATEGY SETTINGS

The Victorious EA strategy settings allow you to assign specific rules for opening positions and managing them (moving the Stop Loss level and closing positions in various options).

These settings apply to each of the four strategies individually. Set a specific strategy in the settings group with the corresponding number.

[1] Trade this strategy - Allowing or denying the strategy. Permitted trading days

Setting values:

- No – Strategy prohibited. All other settings of this strategy don't matter. The robot ignores them.

- Yes. Any day – The strategy is allowed on any day of the week, including Saturday and Sunday. This option is relevant for trading stocks and futures, including on the Moscow Exchange. The fact is that Saturday may not be an ordinary day off, but a trading day. This event happens if the holidays of different countries do not coincide.

- Yes. Any day but weekend – The strategy is allowed any day but Saturday and Sunday. This option works well for Forex trading, where Saturday and Sunday are usually not trading days.

- Yes. Any day but friday and weekend – The strategy is allowed any day except Friday, Saturday, and Sunday. Enable this option if, for some reason, you do not want to use this strategy on Friday. For example, if you're going to trade stocks intraday and open only long positions. Stock prices often fall on Friday.

- Yes. Friday only – The strategy is only allowed on Friday and prohibited on other days. This option is good for you if you want to profit from the fall in stock prices on Friday when many traders close their positions before the weekend.

- Yes. Weekend only – The strategy is only allowed on Saturday and Sunday, but prohibited on other days. This option is suitable for trading cryptocurrencies if your broker provides trading on weekends.

[1] Directions of opening - Permitted opening directions, Flexible opening, Strict opening

In this option, Flexible opening means that EA (after receiving a signal) opens a position at any price, even after a significant price gap.

Select the option with Flexible opening if you want to buy or sell on time at the market open.

For intraday trading, select the option with Strict opening to open a position only if the price is relatively close to the signal price level. You can choose from the following options:

- Long and Short. Strict opening – Long and Short are allowed. Strict opening. EA processes any signal of this strategy to open positions.

- Long only. Strict opening – Long only allowed. Strict opening. The robot only opens long positions. Any short signal from this strategy is ignored.

- Short only. Strict opening – Short only allowed. Strict opening. The robot only opens short positions. Any long signal from this strategy is ignored.

Other options for this setting are similar. The only difference is Flexible opening instead of Strict opening.

[1] Risk per trade, percentage of the deposit - Risk per trade as a percentage of Equity

Because of various time frames and price volatility, open positions will have different Stop Loss widths every time. However, the risk per trade will always be the same for a specific strategy. You can assign it from 0.1 to 15 percent of the deposit.

All strategies have the same settings. That is why you can set a different risk for different strategies combined in the same EA.

[1] Chart pattern - Graphic pattern for opening a position

Victorious EA finds local lows and highs using the Market noise group of settings. After that, the robot detects signals based on combinations of these local extremums.

The EA understands a Chart pattern as a sequence of local extremums and the Take Profit setting rule.

The robot discriminates between 3 groups of trend patterns (10 patterns in total) plus two counter-trend patterns.

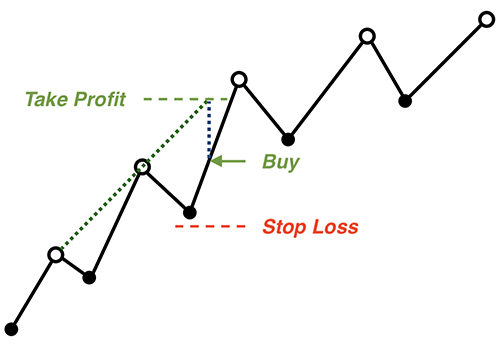

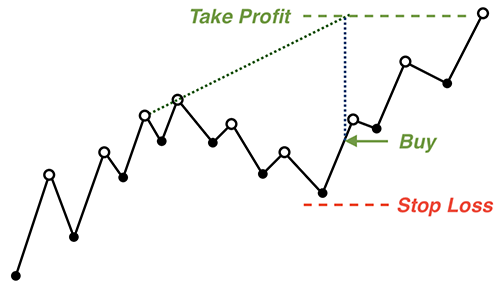

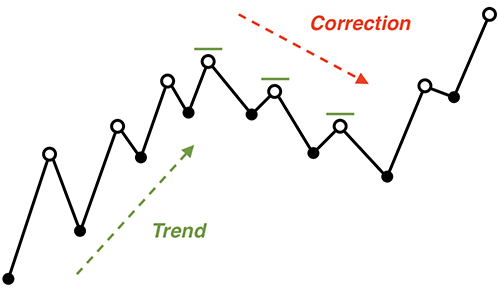

Strong trend patterns

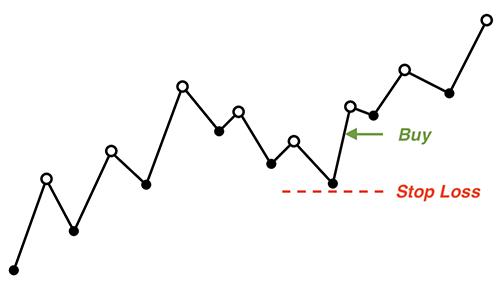

The pattern looks like this:

Choose one of the following options to open positions using this pattern:

- Trend. No TP - Open positions in the direction of the current trend. Do not place Take Profit.

- Trend. Sloped trend line TP - Open positions in the direction of the current trend. Place Take Profit along the sloped trend line.

- Trend. Channel line TP - Open positions in the direction of the current trend. Place Take Profit along the sloped channel line.

The EA always sets Stop Loss depending on the current volatility of the trading symbol. Namely, at the nearest price extremum. See below for an explanation of the Take Profit placement options.

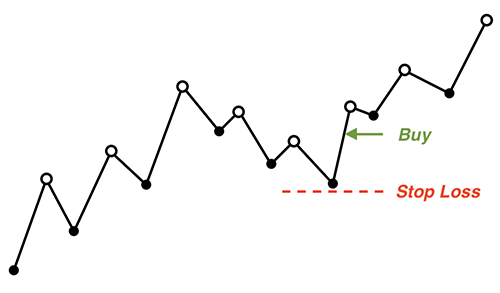

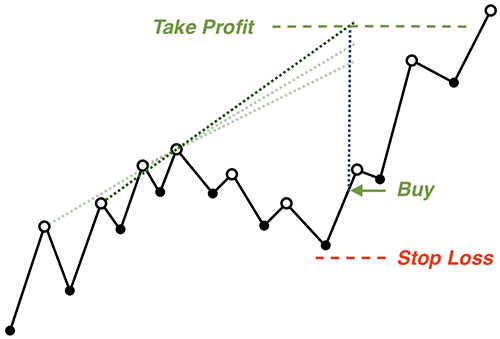

Trend correction patterns

The pattern looks like this:

Choose one of the following options to open positions using this pattern:

- Correction. No TP - After the correction ends, open positions in the direction of the trend. Do not place Take Profit.

- Correction. Sloped trend line TP - After the correction ends, open positions in the direction of the trend. Place Take Profit along the sloped trend line.

- Correction. The steepest trend line TP - After the correction ends, open positions in the direction of the trend. Place Take Profit along the steepest trend line.

- Correction. Horizontal TP - After the correction ends, open positions in the direction of the trend. Place Take Profit on the horizontal resistance (support) line.

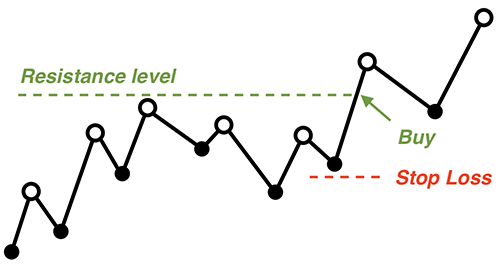

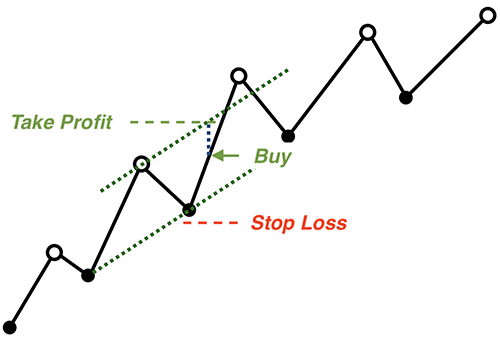

Breakout patterns

The pattern looks like this:

Choose one of the following options to open positions using this pattern:

- Breakout. No TP - If the level is broken, open positions in the direction of the trend. Do not place Take Profit.

- Breakout. Sloped trend line TP - If the level is broken, open positions in the direction of the trend. Place Take Profit along the sloped trend line.

- Breakout. The steepest trend line TP - If the level is broken, open positions in the direction of the trend. Place Take Profit along the steepest trend line.

These are groups of trend-following patterns. If you choose any of them, Victorious EA enables a trend filter that prevents counter-trend trading.

The robot observes the price chart for the distance specified in Market noise -> Viewing distance, bars.

This way, you can adjust the EA sensitivity to trend changes. As a rule, this parameter has a significant influence on the trading results.

Counter-trend (reversal) patterns

The reversal patterns look the same as Trend correction patterns. But if you choose these patterns, Victorious EA will not activate the trend filter. Therefore, the EA will open positions when correction ends and when the trend is finished.

In practice, the robot opens trades using counter-trend patterns in any direction.

Choose one of the following options for opening positions by reversal patterns:

- Range. Horizontal TP - Open counter-trend positions. Place Take Profit on the horizontal resistance (support) line.

- Reversal. No TP - Open counter-trend positions. Do not place Take Profit.

You can successfully combine Reversal patterns with opening positions after a false breakout. See below for finding false breakouts.

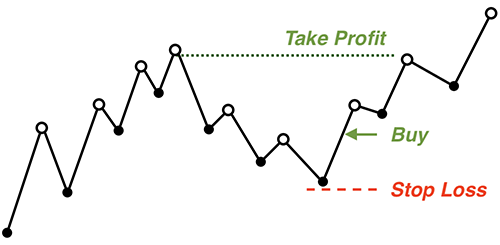

Take Profit placement options

The above options for setting Take Profit for various Chart patterns are as follows.

Sloped trend line TP - Take Profit along the sloped trend line for Trend pattern group:

Sloped trend line TP - Take Profit along the sloped trend line for Correction and Breakout patterns group:

The steepest trend line TP - Take Profit along the steepest trend line for Correction and Breakout patterns group:

Channel line TP - Take Profit along the sloped channel line for Trend pattern group:

Horizontal TP - Take Profit on the horizontal resistance (support) line for Correction and Range patterns group:

Warning: When choosing any pattern that provides Horizontal TP, the robot looks for a suitable resistance (support) level. The EA ignores the signal if the target level is too close, too far, or not found at all.

See below how to set the minimum and maximum Take Profit and Stop Loss ratios.

[1] Max / Min correction - The maximum or minimum number of extremums within the correction, acceptable for opening a position

This setting is an additional essential filter for the selected Chart pattern.

For trend-following patterns, this is the maximum number of extremums within the correction. For reversal patterns, this is the minimum number of extremums within the correction.

The picture below shows an uptrend with a correction. The correction has two local maximums (except for the local maximum, where the correction has begun).

Suppose you have selected a trend-following pattern and set Max / Min correction = 1. In this case, the EA will not open a long position here. The robot will consider the correction too long and assume that the trend is over.

Reversal patterns have a different understanding of the Max / Min correction. For them, this is the minimum number of extremums within the correction, acceptable for opening a position.

If you select the Range. Horizontal TP or Reversal. No TP, the EA will check if the correction is too short. To avoid opening a position too early.

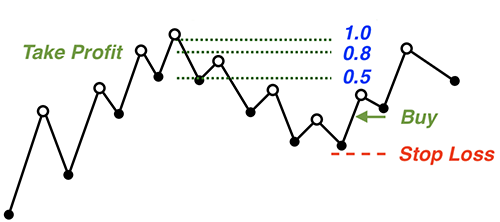

[1] Take Profit compression factor - By what factor (how many times) to reduce Take Profit

Prices often do not reach the calculated Take Profit level. There are different ways to resolve this issue. The easiest way is to reduce the distance to the Take Profit level in advance using a factor of its decrease.

The figure below shows the calculated Take Profit level for a long position (line 1.0) when choosing Take Profit compression factor = 1.0. The rest of the lines show Take Profit levels when choosing other values.

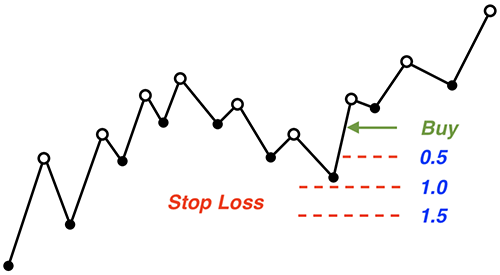

[1] SL scale factor when Opening - By what factor (how many times) to scale Stop Loss when opening a position

When opening a position, you can protect it from high volatility using this setting. Another possibility of this setting is to make the largest possible bet with a very close Stop Loss level.

In the figure: Line 1.0 is the calculated Stop Loss level with SL scale factor when Opening = 1.0. The rest of the lines are Stop Loss levels with a decreasing or increasing factor.

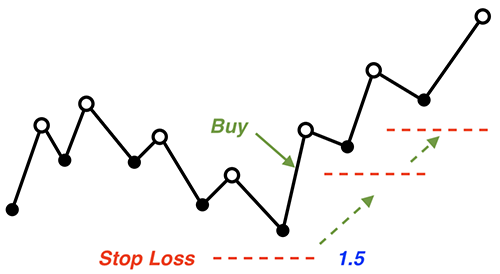

[1] SL scale factor when Moving - By what factor (how many times) to scale Stop Loss when moving its level

The setting is similar to the previous one. This parameter will help you protect a profitable position from high volatility to keep it open for as long as possible. To do this, select values greater than 1.

Another possibility of this setting is to make the EA more sensitive to trend changes to close the position as soon as possible. To do this, select values less than 1.

The figure below shows an example where both Stop Loss scaling settings are equal to 1.5.

[1] Minimum TP / SL ratio - Minimum Profit / Risk ratio acceptable for opening a position

You can adjust this ratio to avoid entering trades too late when Take Profit is too close. The robot checks this ratio only if you set the Take Profit for the strategy. Otherwise, the EA ignores this parameter.

Set values less than 1 to build scalping strategies.

[1] Maximum TP / SL ratio - Maximum Profit / Risk ratio acceptable for opening a position

The maximum Profit / Risk ratio is also configurable. The EA checks this parameter only if you set the Take Profit for the strategy. This ratio is helpful for all types of trading.

Also, you can use this parameter to adjust the height of the range when trading in the range.

[1] Look for a false breakout - Victorious EA need to find a false breakout to open a position

The EA opens positions only after false breakouts appear if you enable this setting. The robot ignores the rest of the signals of this strategy.

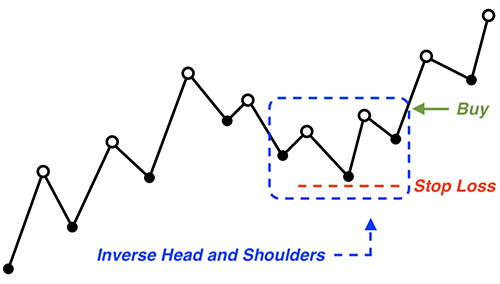

For example, opening a long position after a false downward breakout may look like:

There is also a false breakout here:

There are more complex false breakout patterns on the market. Victorious EA knows how to recognize them. You can choose from the following options:

- No - Don't look for a false breakout.

- Yes. Any breakout - Look for any false breakout to open a position.

- Yes. Head and shoulders only - Look for the Head and Shoulders (Inverse Head and Shoulders) pattern on the chart to open a position.

The Head and Shoulders pattern is a particular case of a false breakout. This type of false breakout occurs when the price has already confirmed it by drawing the right shoulder.

The EA opens positions in this (more cautious) way when Yes. Head and shoulders only is selected.

If you choose Yes. Head and shoulders only, opening a long position looks something like this:

Also, the robot sets Stop Loss along the line of the Head only when you select Yes. Head and shoulders only. In other cases, the EA places Stop Loss at the nearest price extremum. See the picture above.

[1] Move Stop Loss - Victorious EA moves the Stop Loss level of open positions

You can choose from the following options:

- Don’t move – Do not move the Stop Loss level.

- Along the trendline – Move the Stop Loss level along the trend line.

- Along the trendline, if profit – If position is profitable, move the Stop Loss level along the trend line.

- By local extremums – Move the Stop Loss level by local price extremums.

- By local extremums, if profit – If position is profitable, move the Stop Loss level by local price extremums.

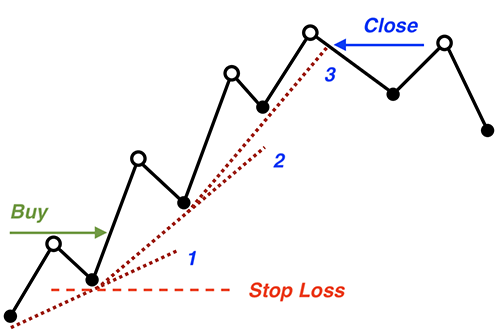

Stop Loss movement along the trend line

If you select the options Along the trendline or Along the trendline, if profit, the robot acts as follows. When a new price extremum appears, the EA builds a new support (resistance) line using two extreme points. Then the EA moves the Stop Loss level along this line. See the image below for details.

There is a difference between these two options. When Along the trendline, if profit is selected, the robot will start Stop Loss movement only after the position is profitable. This option helps you not to close a good position ahead of time.

On the other hand, if you choose Along the trendline, the robot moves the Stop Loss level even for a losing position at the moment. This option can be beneficial if the position is initially bad. Then the robot will get rid of it as soon as possible, without losing the total bet.

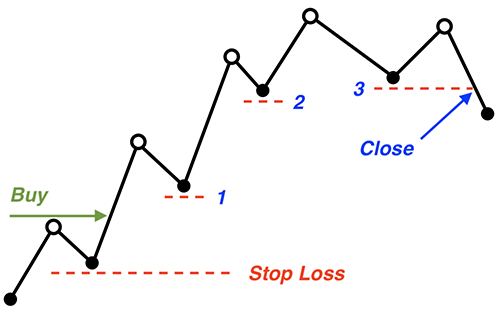

Stop Loss movement by local extremums

If you select the options By local extremums or By local extremums, if profit, then Victorious EA moves Stop Loss level to the extreme local price point when this extremum appears. This option is beneficial on long-term trends, as sloping support lines are often falsely broken.

As in the previous case, the difference between the two options is the same. When By local extremums, if profit is selected, the robot starts Stop Loss movement only after the position becomes profitable.

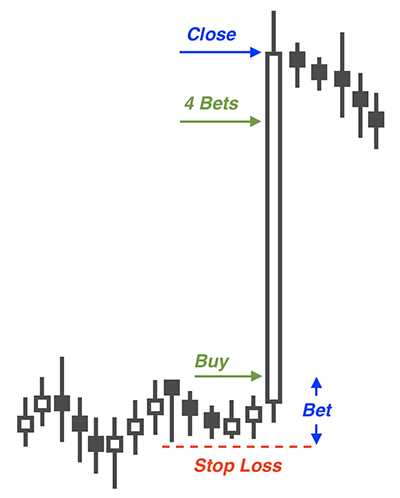

[1] Close when get profit, bets - The EA closes positions when their profit reaches the specified number of bets

If this parameter is enabled, EA closes a position when a new bar of the working time frame appears if the profit becomes of a specified size. The number of initial bets measures the profit.

The picture below shows more details. [1] Close when getting profit, bets = 4.0 means that the EA closes the position when the distance from market price and the opening price becomes more than four distances from the opening price to the Stop Loss price. Closing occurs when a new bar of the working time frame appears.

You can completely refuse this type of closing position by selecting the Don't close option.

[1] Close when price pauses - The robot closes positions if the price pauses

If the parameter is enabled, the EA acts as follows. In a long position, Victorious EA closes the trade when a new local high appears. When short, Victorious EA closes the trade when a new local low appears.

That is, the EA closes positions if it expects a price pause or reversal. You can choose between the following options:

- No - Do not close positions if the price pauses.

- Yes, Any pause, if profit - Close a long position when the first local high appears after the opening if the position is profitable at the moment. Close a short position when the first local low appears after the opening if the position is profitable at the moment.

- Yes, Final pause, if profit - Close a long position when a new local high appears above the opening price if the position is profitable at the moment. Close a short position when a new local low appears below the opening price if the position is profitable at the moment.

The option Yes, Any pause, if profit is more cautious. The option Yes, Final pause, if profit allows the price to go further from the opening price on average.

Use this setting to build counter-trend trading strategies and scalping strategies.

[1] Close after false breakout - The EA closes positions after a simple false breakout

The setting allows you to close positions when a false breakout appears. This setting refers to a false breakout that does not require any confirmation. The picture below shows false breakouts of that kind on the Bitcoin price chart (circled in blue):

You can choose from the following options:

- No - Do not close a position after a false breakout.

- Yes, if profit - Close a position when a false breakout appears if the position is profitable at the moment.

This close signal only occurs if the breakout appears when the position is profitable. Otherwise, the robot ignores the signal.

[1] Close after acceleration - The Expert Advisor closes positions after the price movement accelerates

The setting allows the EA to exit the position after a significant acceleration of the price movement. Closing occurs when a new bar of the working time frame appears.

The signal is helpful to take the profit before the price reversal begins. You can choose options:

- No - Do not close a position after the price movement accelerates.

- Yes. Any acceleration, if profit - Close a profitable position after the price movement has accelerated, even if the acceleration began before opening the position.

- Yes. Final acceleration, if profit - Close a profitable position after the price movement has accelerated, only if the acceleration began after opening the position.

Selecting the Yes. Any acceleration, if profit option can be part of a scalping strategy. At the same time, the option Yes. Final acceleration, if profit is used to profit from more significant moves in a volatile market.

These are all Victorious EA settings for now. In the future, I will expand this trading system and supplement it with new functions. I am going to implement new exciting ideas in the next version of the Expert Advisor.

Rent now, use all the features of Victorious EA, and receive all updates for free in the future!

FAQ

What is the minimum deposit required for the EA to work correctly?

The Expert Advisor works with any balance in any currency. The minimum amount to trade depends on many Victorious EA settings and the current volatility of the trading symbol. If you trade on a small time frame (1 or 5 minutes), with high leverage (1:500), and high risk (15 % of the deposit), then $50 is enough for you.

If you want to trade larger time frames with less risk, you need a more considerable amount of money.

How can I speed up the strategy testing process?

Because of its versatility, Victorious EA is forced to perform many different calculations on every tick.

Therefore, the EA can sometimes slowly test strategies, especially on highly liquid trading symbols. The fact is that the history of quotes for these symbols contains a large number of ticks. So, to speed up testing, you can do the following:

- Disable all other resource-intensive programs and processes on your computer except MT5 tester.

- In the EA settings, set the No for the settings Keep a personal log and Make backups. Testing speed largely depends on these settings.

- In the EA settings, set the No for the Draw extremums setting. Drawing the graphics additionally loads the computer.

- On the Settings tab, in the tester, uncheck the Visual mode with the display of charts, indicators, and trades box. Then you will not see trades on the price chart but rather speed up testing.

Why didn't the EA open a position?

If the robot was supposed to open a position, but this did not happen, there may be several reasons:

- Check the Time Management and Trade this strategy settings. Perhaps the EA received a signal at a non-trading hour or on a non-trading day.

- Check your Money Management settings. Perhaps one of the limits has been reached. It can be the number of openings per day or week, target daily (weekly) profit, the daily (weekly) loss limit.

- Check the Directions of opening setting. Perhaps this direction of trading is prohibited. Or Strict opening is on, and the price has already gone too far.

- Check the Risk per trade, percentage of the deposit setting. Compare that to Equity. Perhaps the risk per trade is minimal, as is the Equity. And when calculating lots, the robot received a value less than the minimum lot. Therefore, the EA did not open this position.

- When using a trend-following Graphic pattern, the EA does not trade counter-trend. Perhaps it was a signal to open a counter-trend position.

- Check the Max / Min correction setting. Maybe the correction turned out to be too long (for a trend pattern) or not long enough (for a counter-trend).

- If the strategy assumes setting a Take Profit, it is possible that the Minimum TP / SL ratio or Maximum TP / SL ratio settings did not allow opening this position.

- If you enabled the Look for a false breakout setting, the robot may not open a position because it did not detect any false breakout.

Why didn't the EA move the Stop Loss level?

If the EA was supposed to move the Stop Loss level, but this did not happen, there may be several reasons:

- Perhaps, in the Move Stop Loss setting, the option Along the trendline, if profit or By local extremums, if profit is selected. In this case, the EA only moves the Stop Loss level if the new Stop Loss level (for a long position) is higher than the position opening price. Moreover, the EA does it, taking into account the SL scale factor when Moving setting.

- The EA moves the Stop Loss level (in a long position) only when a new local high appears. In the same way, the EA moves the Stop Loss level (in a short position) only when a new local low appears. If the price does not show new highs (lows) after opening a position or the last movement of the Stop Loss level, the EA does not move the Stop Loss level.

How does the EA close positions?

Positions opened by Victorious EA can be closed:

- Manually, if you need it for any reason.

- By the Take Profit, if set.

- By the Stop Loss (losing positions or profitable positions after the Stop Loss movement).

- By the time. You can adjust it through the Time management settings.

- On signals to close. You can set them in the settings:

- Close when get profit, bets

- Close when price pauses

- Close after false breakout

- Close after acceleration

The robot applies the closing on signals only for profitable positions.

Download Victorious EA for free from the official product page in the MQL Market. Choose a strategy for your trading symbol and trade it with Victorious EA.

Good luck with your trading!