BASIC CONCEPTS OF FINANCIAL MANAGEMENT TO CHOOSE THE BEST SIGNAL PROVIDERS

Dear, today I want to share with you a basic concept to choose the best signal providers using the filters offered by the MQL5 website combined with financial management, in order to reduce risk exposure.

Step 01:

Establish a relationship:

Think about protecting capital, for that you cannot think only of risk, but also of return. Example:

I'm risking 15% (Maximum withdrawal,%) and earning 30%

(Profit / month,%), so (profit / month,% / maximum reduction,%) = 2

This means that you are gaining twice the risk.

Step 02:

Set a Deadline:

Understand how long your capital will double, example:

Earning 30% Profit / Month,%, in just over three months I will double my capital.

Step 03:

Make your financial management:

Think of the signal provider as a money machine, don't confuse it with a money management machine, managing money is always your job. So think that you earn 30% Profit / Month,%, in just over three months you will double your capital, then withdraw the money to a secure account, and ready now your risk is zero. Call this capital base. The rest of the money you call profitable and leave for six months, and make a new redemption of 50% of the total value, so you will be applying knowledge of financial management.

Tip:

It is also important to think about the operational costs involved, such as expenses with VPS, monthly subscription fee and, therefore, whenever you make a withdrawal, add these costs to avoid additional expenses.

Conclusion:

I have analyzed the MQL5 signal provider filter and will share data with you that I consider relevant to a good signal provider.

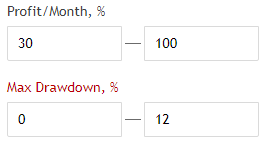

Profit/Month, % = Min 0 - Max 30 - Max 100

Max Drawdown, % = Min 0 - Max 12

The image looks like this:

Good trades