Here I have collected the most interesting notes and examples that I published earlier in March about the AOTI indicator. I will continue to make such information collections in the future. I hope this will be useful.

![]()

All-in-One

Trade Indicator (AOTI)

All-in-One

Trade Indicator (AOTI)

AOTI-EA-Assistant

(AEA)

AOTI-EA-Assistant

(AEA)

![]()

Once again about the importance of using additional indicator signals

What should we do if the price has gone further than our goals? Where to fix profits?

So how do we trade short-term (and you?), then we are looking at the next strong price levels. And the reaction of the price and the indicator to these levels. See the example below for a Climax Bar (2 red dots above and below the candle)formed on the chart at a strong support level.

The price can go further in the sell. But it may not go... Therefore, if we have not closed a profit before, or we still have an open part of the position, then this is a good place and time to fix a profit.

It was also possible to fix the profit before. A few bars earlier, we see a Reversal Arrow and a Support Micro-Level. It is called micro only because it works effectively at this point, but in fact, it is not micro at all, but a strong and proven level built by the AOTI indicator.

![]()

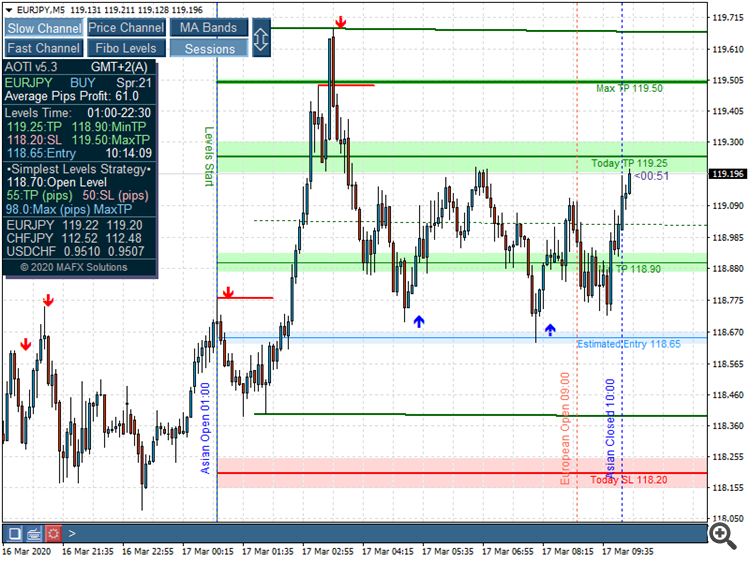

Next example:

Everything is simple here. The MaxTP level almost coincides with another strong price level. As well as a number of confirmations: Reversal Arrow, Climax Bar...

If you did not set a hard stop earlier, then we fix the profit here.

![]()

But... If you have not closed positions at the Today TP level and were waiting for the Max TP level to be reached, then exiting before the opening of an important trading session (European, New York sessions) is a good idea. Since at the opening of a new session, the price gets a new impulse and can turn around. Or we can set a breakeven in such a situation if the price has not yet reached the profit level at the time of opening a new session.

![]()

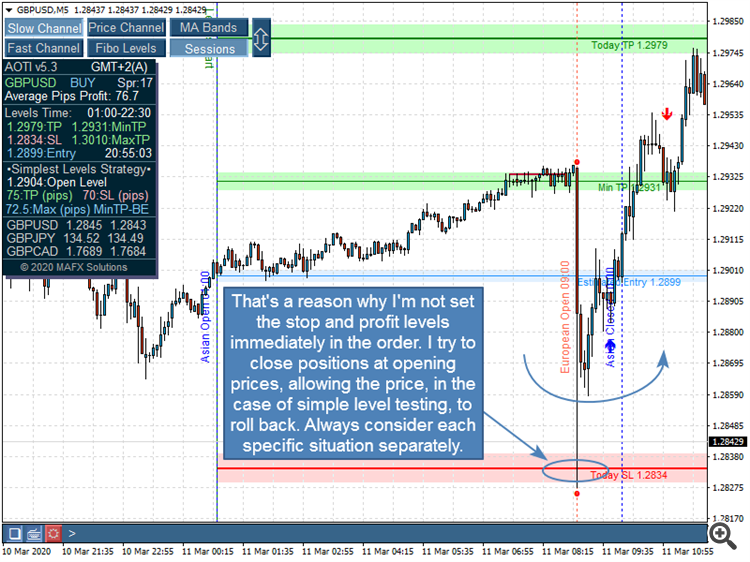

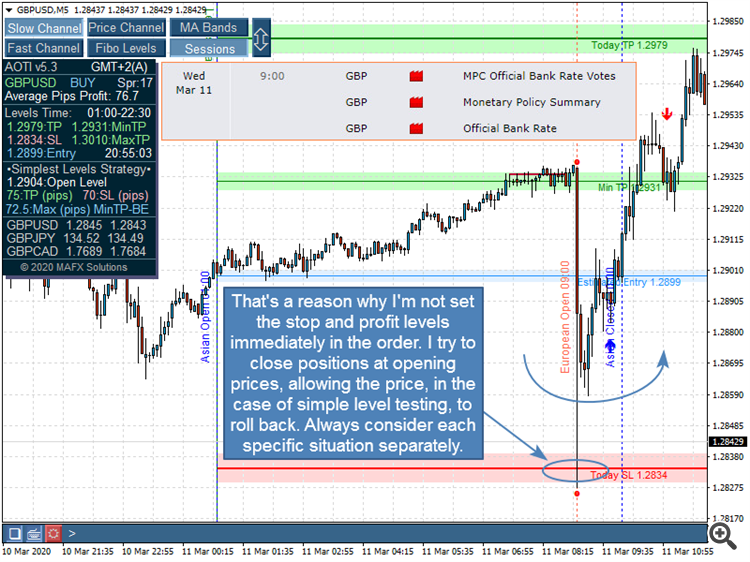

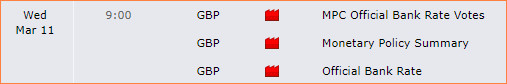

About GBP. Why did the Pound jump so much at the opening of the European session?

It's simple - the release of several important news for the Pound.

But this is not what I wanted to tell you all - the importance of news release is already clear to everyone. I want to tell you about a feature that I have been using for a long time.

Since the AOTI indicator calculates levels that are important for currency pairs (I have already shown examples of this), the price tends to touch them in one way or another. These levels seem to attract the price. And very often it happens that the price barely touches the level, knocks out our stop and then goes in the right direction for us. There are several reasons for this. The main one is the accumulation of orders of large market players at important levels. A lot of theory is devoted to this. Let's not waste time now. The most important thing for us to understand is that our levels attract the price.

That's a reason why I'm not set the stop and profit levels immediately in the order. I try to close positions at opening prices, allowing the price, in the case of simple level testing, to roll back. Always consider each specific situation separately.

![]()

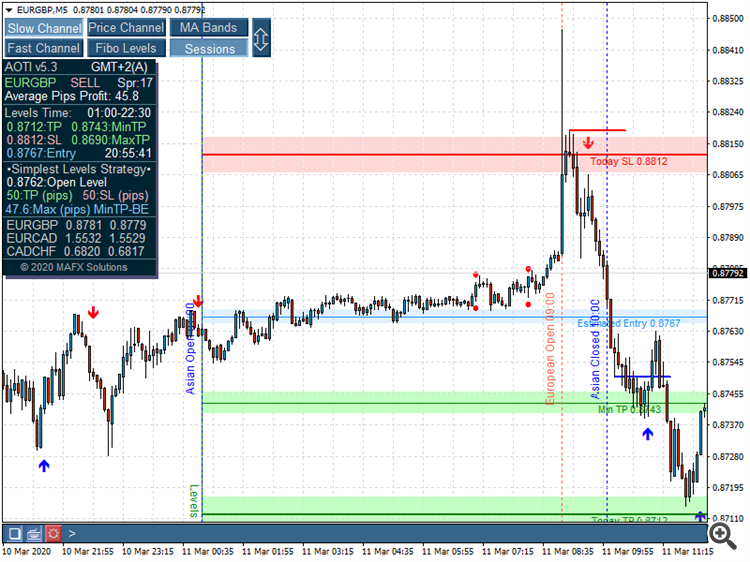

Another example for EURGBP

The price builds a Pin-Bar at the Stop Level, which is accompanied by a Micro-Resistance Level (which builds the AOTI indicator). Similarly, the price tests an important level and goes in our direction.

For this reason, trading with a semi-automatic assistant system is much more efficient than a fully automated EA's, that can 't handle all the market nuances.

You only need practice, and you will be invincible!

Main (but simple) rules:

Look at the market in a combination of factors.

If you find it difficult to keep control of multiple currency pairs at once, then select the few that are most understandable to you. With time, you will be able to add other pairs and control a large number of currency pairs simultaneously, and this will not be a problem for you.

Follow money management.

![]()

A few more examples of complex analysis and achieving success in trading:

![]()

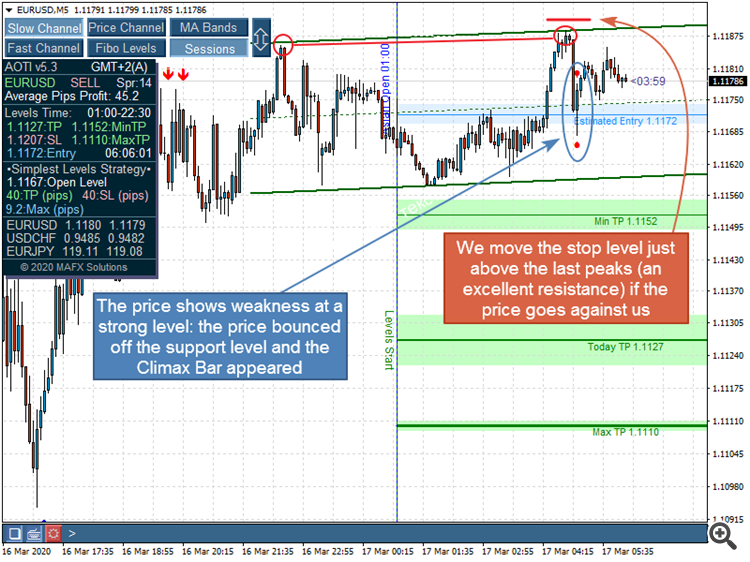

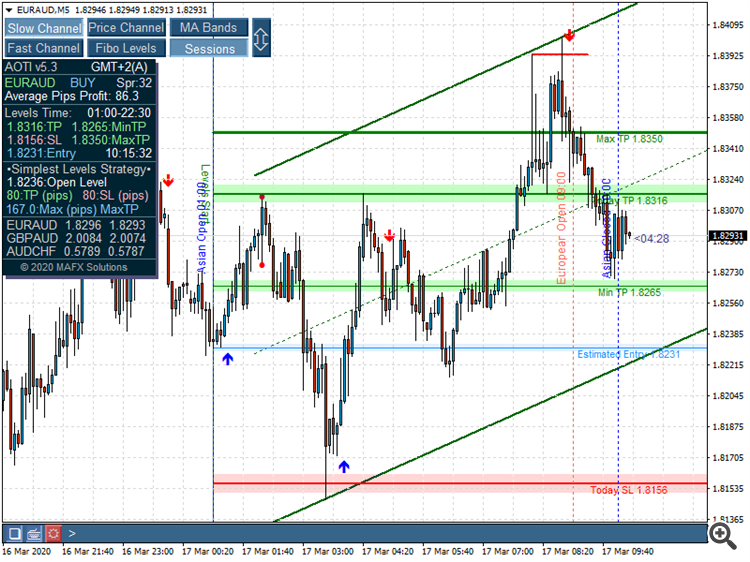

As I wrote earlier about closing positions when the price touches our levels:

Since the AOTI indicator calculates levels that are important for currency pairs (I have already shown examples of this), the price tends to touch them in one way or another. These levels seem to attract the price. And very often it happens that the price barely touches the level, knocks out our stop and then goes in the right direction for us. There are several reasons for this. The main one is the accumulation of orders of large market players at important levels. A lot of theory is devoted to this. Let's not waste time now. The most important thing for us to understand is that our levels attract the price.

That's a reason why I'm not set the stop and profit levels immediately in the order. I try to close positions at opening prices, allowing the price, in the case of simple level testing, to roll back. Always consider each specific situation separately.

In the following example, the situation is repeated.

We can close a position on a stop from the market, but I prefer to close only at the close of the candle to avoid downed stops.

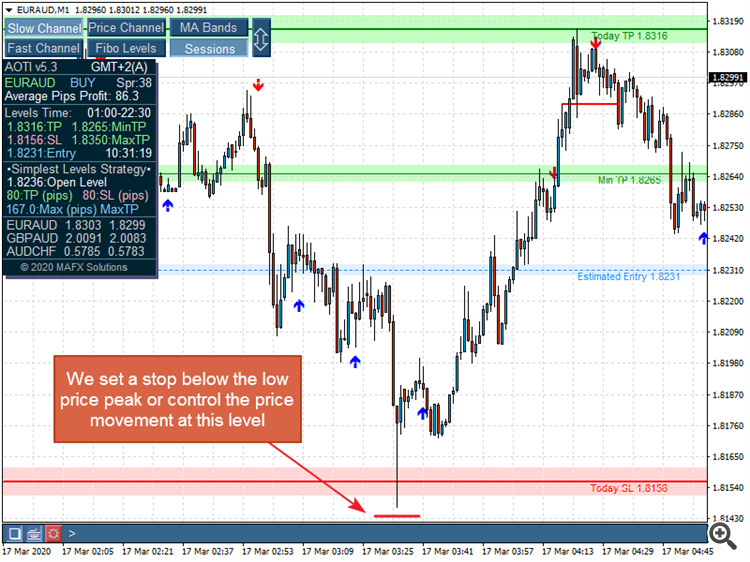

And here we go to M1:

We see that this is only a short (less than a minute) impulse, after which the price reached our target levels.

![]()

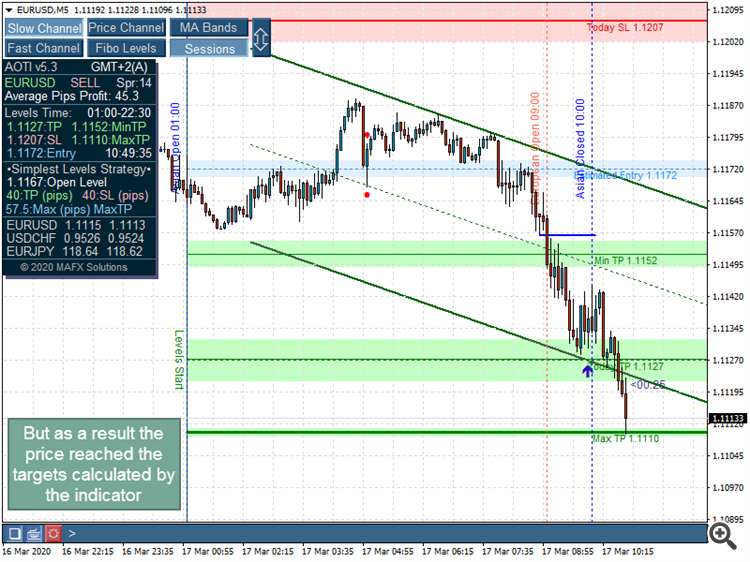

The same situation applies to close positions when the price reaches target levels.

We have several options. We can fix the profit at the target level. We can wait for the candle to close and pull the stop under the candle that breaks through the level and then wait for additional signals about stopping the movement: micro support/resistance levels, Climax Bar.

![]()

Understanding all this comes with practice. And the AOTI indicator is a tool that makes the market picture clear for understanding. I have been improving the indicator 's functionality for a long time, filling it with new features and even more useful tools to make the indicator as useful and convenient as possible, not only for me but for all of you! Unfortunately, not all things that are clearly visible to the eyes can be uniquely programmed and automated since there are a lot of nuances. But I've already done a lot of work and will continue to do so to make the indicator even better for everyone. I hope that all this will be useful for you, and I try not in vain.

To be continued...

---