A2SR - Here is the right time for short-term trades (scalping) can begin.

Hello traders,

greetings.

Scalpers and short-term trader asked me

-- when the right time for short-term trading (scalping) can be started?

I am sure you already know that sideways occur shortly after the price rally is over.

-- Yes. Sideways session occurred just after the price rally was over.

- When is the good time for short-term trades (scalping) can begin?

- Scalping on sideways session

after price rally has ended.

The question is: -- when the price rally will end -- ?

-- In A2SR, here is the several ways to find out that simply.

Generally, price rally occurs when there is news or speech or comments

from someone who is very influential, such as :

-- the central bank, the president of a country that has a big influence to market, or

-- something happens that surprises market players like trade war at this time, etc.

1.1. Wait for price rally to reach Strong SR -- a level area that close to :

1.1.1. ADF (Avg. Daily Fall - when price rally down)

1.1.2. ADJ (Avg. Daily Jump - when price rally up)

Actually, I have provided some examples here.

How about commodity, Gold (XAUUSD) today.

Before price fell there, we found ADF at 1275.20

Actual SR level that close to ADF : 1275.49 (DSR.1) and 1275.46 (Actual level)

That area is called the strong Support area.

Why is it called Support?

-- because the price falls from above.

Fig.1 - XAUUSD - H1 - fell after break through a strong breakdown

We can see here, 3 candle of H1 means 3 hours.

Sideways has lasted 3 hours -- Prices just go up and down there,

and repeatedly bounce after prices touch the strong Support area.

Fig.2 - XAUUSD - H1 - after 3 hours

Sideways within next 5 hours:

Fig.3 - XAUUSD - H1 - after 5 hours

Note.

A2SR does not lagging nor repaint.

-- because A2SR is leading technical indicator.

-- the right tool for SR Strategy.

So, even though we use a different time frame, then

-- the strong support area stays in the same place.

Fig.4 - XAUUSD - M5

-- in the lower time frame, we can see bullish flag and pennant has started from the bottom price here:

Scalper can work there :)

-- by use the technique number 2 below. Scalping before news

Generally, prices enter the sideways session when market players

are still waiting for important news or speech to come.

2.1. Wait for the first time price hits a fresh SR level,

- - - because market will usually make a 1st test before break through a level.

Fig.5 - 1st test a level - H1

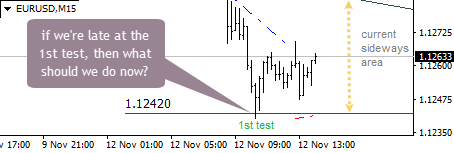

Fig.6 - 1st test a level - M15

Wait for scalping at stronger SR area

-- The intersection between the trendline that says "Support/Resistance" + SR level is Strong SR

Fig.7 - 1st test a level - H1

-- and can be applied to all time frames.

H4 https://www.mql5.com/en/blogs/post/725203

H1 https://c.mql5.com/6/816/A2SR_EURUSD_181026.gif

M15 https://www.mql5.com/en/blogs/post/725203#comment_11238550

Market has a movement in every level of demand (support) and supply (resistance).

That's called SR Strategy. That's all about reversals and breakouts.

People can study SR Strategy from anywhere, even on google :)And ...

the good news today :

Traders no longer need to manually search and draw SR (including chart breakouts pattern)

-- because A2SR provides the actual SR and complete instruments that needed by traders.Market in session sideways and rally has a movement for

1. Reversals at Strong SR

-- This technique is able to use for any time frame, including lower scale such as M15, M5 and even M1 for scalping.

2. Breakouts on Next Key Breakout/Breakdown

and price rally at strong Breakout/Breakdown.

example at https://youtu.be/Kd1N-uPxvaY

I will continue writing to more complete the contents of this topic in every chance I have.

Thanks for reading,

wish you all the best this year.