Trading strategy for MetaTrader 4 based on the SFT Horizontal Volume indicator

Multicurrency strategy - suitable for any currency pairs, as well as for trading metals, options and cryptocurrency (Bitcoin, Litecoin, Ethereum, etc.)

Trading can be conducted on any timeframe.

Depending on your preferences, it can be used both scalping and intraday, as well as medium-term and long-term.

The basis for opening deals is the SFT Horizontal Volume indicator.

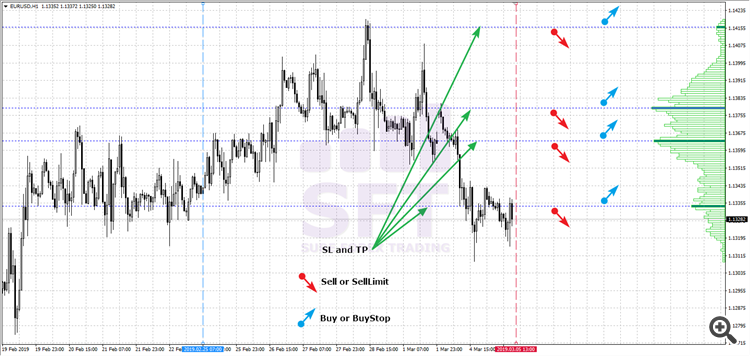

It shows tick volumes in the selected range as a horizontal histogram

Highlights the highest and most significant price levels.

From these levels, you can trade, as well as use them to set StopLoss and TakeProfit

At the end of the article there are links to the indicator with a description and the possibility of free download, as well as its video review.

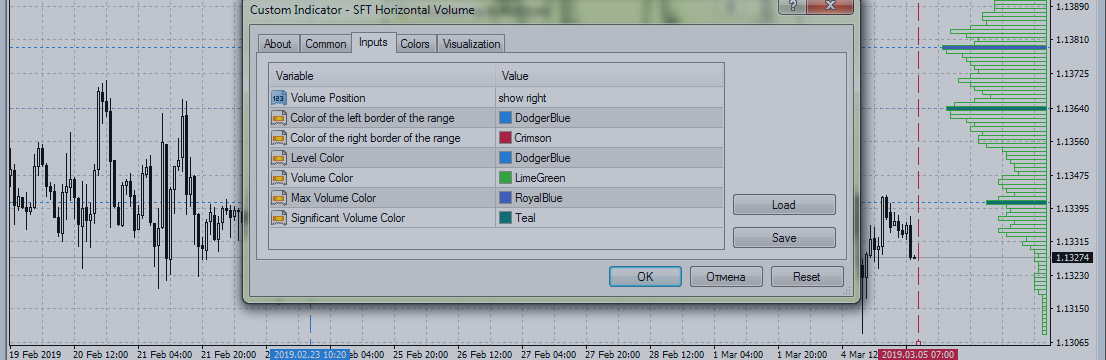

Installation and Setup

Learn more about how to choose, install, test for free, as well as buy indicators, see YouTube on video tutorials.

The indicator is set on a chart with initial settings.

For ease of display, you can change its colors.

Trading with the SFT Horizontal Volume indicator

Trading Rules

To trade with the trend in continuation of the current movement:

When trading market orders or options:

- When the price breaks from top to bottom of the levels of maximum and significant volumes, open Sell or Put (for options)

- When the price breaks through the bottom up levels of maximum and significant volumes, open Buy or Call (for options)

When trading pending orders:

- Expose above the levels of maximum and significant volumes, at a distance of spread from them, pending orders BuyStop

- Expose below the levels of maximum and significant volumes, at a distance of spread from them, pending orders SellStop

For countertrend trading on corrections:

When trading market orders or options:

- When the price approaches the bottom to the levels of maximum and significant volumes, open Sell or Put (for options)

- When the price approaches the top to the levels of maximum and significant volumes, open Buy or Call (for options)

When trading pending orders:

- Expose below the levels of maximum and significant volumes, at a distance of the spread from them, pending orders SellLimit

- Expose above the levels of maximum and significant volumes, at a distance of spread from them, pending orders BuyLimit

Well proven in collaboration with the free indicator SFT Bullet Arrow

StopLoss can be set either on the nearest support / resistance line of the SFT Horizontal Volume indicator, or beyond the previous extremum, and TakeProfit can be set to 1 to 2 sizes from StopLoss.

It is recommended to work with this strategy only with reliable and proven brokers. Who have no problems with the withdrawal of funds.

It is also desirable that ECN has accounts with a low spread and a low commission per transaction.

Before you decide to open a trading account, be sure to read online reviews about your broker.

Well, if you have difficulties with choosing a company, then in my blog you can find brokers with whom I personally work .

These companies can be trusted.

For more than seven years of experience working with them, no problems have arisen.

Always adequate trading conditions, quality support and quick withdrawal.

Choose any of them: LIST HERE

Try our other indicators,

among which there are completely free, as well as paid, but with the possibility of free self-testing.

A complete list of our products can be found here:

Indicator and its review:

- SFT Horizontal Volume Indicator : https://www.mql5.com/en/market/product/36459

- Video review of the SFT Horizontal Volume indicator : https://youtu.be/Vc382KzFnq8

We wish you a stable and profitable trade!

To find out first about all new and bonus products.

And also receive various utility and chips on the topic of trading.

Subscribe

And do not forget to add as a friend: SURE FOREX TRADING

Thank you for using our software!

If you like it, then do a good deed and share the link with your friends.