EUR/USD: this year the ECB can curtail the large-scale program QE

According to the chief economist of the ECB, Peter Pret, the ECB is close to achieving the conditions under which it is possible to complete the program of buying bonds. According to Pret, the Eurozone labor market is strengthening. The unemployment rate is declining, and this accelerates the growth of wages, which is becoming a key condition for stronger inflation, the target level of which is just below 2%.

Now, as part of the quantitative easing program, the central bank buys assets at 30 billion euros a month and will continue to purchase at least until September.

Since the beginning of the current week, the Euro has been growing on the information that at a meeting on June 12 the ECB may discuss an exit from the quantitative easing program.

At the end of last week, a member of the ECB's Governing Council, Sabine Lautenschlager, said that the ECB could decide at the June meeting to close the asset purchase program later this year.

Peter Pret signaled on Wednesday that the central bank's leaders are increasingly confident in the return of inflation in the Eurozone to the target level amidst the strength of the economy and the growth of salaries. This means that this year the bank can curtail a large-scale asset purchase program.

Nevertheless, more conservative investors believe that the growth of the euro will be limited, even if at a meeting on June 12 the ECB will signal the completion of the QE program. As ECB President Mario Draghi previously said, interest rates will remain near zero for a long time, even if the quantitative easing program is curtailed.

And it is this issue that will be decisive in determining the direction of the further movement of the euro and the EUR / USD.

Later on Wednesday, the attention of market participants will switch to publication (at 12:30 GMT) of important macro statistics from the US, including data on the foreign trade balance for April. In the last month, the US trade deficit narrowed from -57.6 billion dollars to -49 billion dollars. If the data again indicates the growth of the deficit, the dollar may fall. In any case, at the time of publication of macro data, volatility in currency pairs with the dollar, including in the EUR / USD, can significantly increase.

Before the meetings of the ECB and the Fed next week, investors will attach great importance to macro data.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

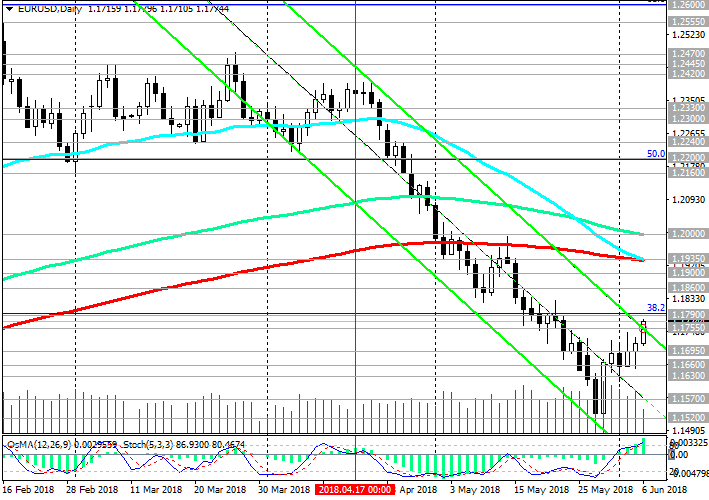

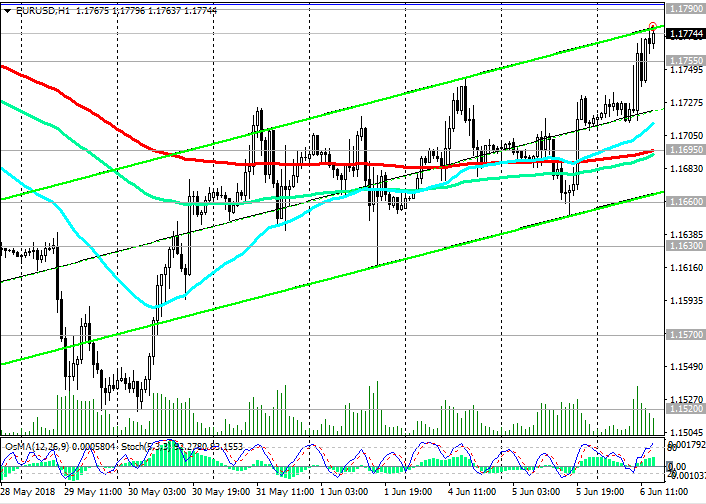

Support levels: 1.1755, 1.1695, 1.1660, 1.1630, 1.1570, 1.1520

Resistance levels: 1.1790, 1.1860, 1.1900, 1.1935, 1.2000

Trading Scenarios

Sell Stop 1.1730. Stop-Loss 1.1810. Take-Profit 1.1695, 1.1660, 1.1630, 1.1570, 1.1520

Buy Stop 1.1810. Stop-Loss 1.1730. Take-Profit 1.1860, 1.1900, 1.1935, 1.2000

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com