True Direction Oscillator (TDO)

TDO & Pure Momentum

TDO is an index that measure price rate of change using the principle of "Pure Momentum".

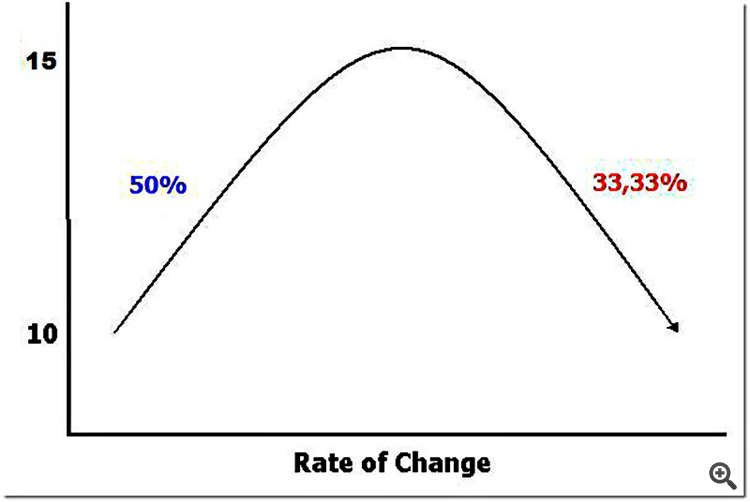

When a security price advance from 10 to 15 then price rate of change is 150% but when it declines back from 15 to 10 then price rate of change is 33.3% only.

That is why technical analysis indicators like "Price Rate of Change" (ROC) or "Momentum" gives higher readings for ascending price movements than that given to descending ones. TDO fixes this problem to help traders at reading momentum correctly depending on a simple calculation method that explained in the next two steps:

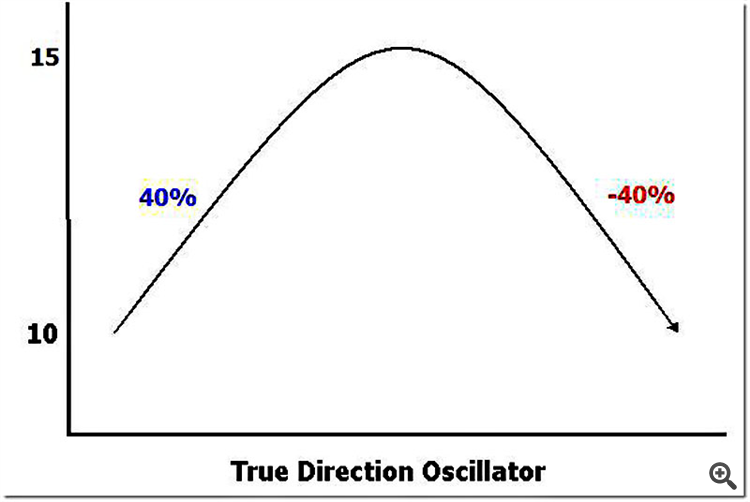

1) Center = (A + B) / 2

2) TDO = 100 x (A – B) / Center

By this, price rate of change calculation is in more balance, which is important for traders and technical analysis to help them compare between ascending and descending price movements.

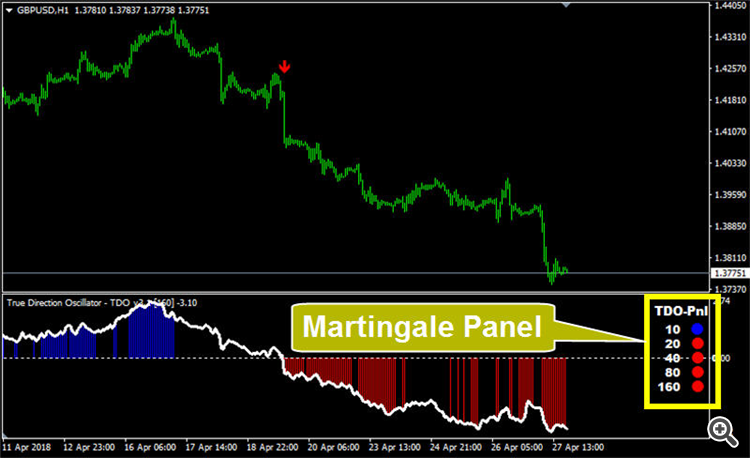

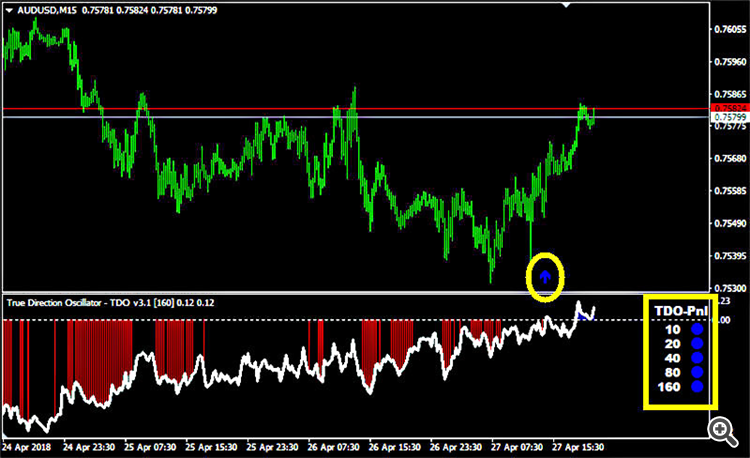

TDO & Martingale Panel

Choosing a calculation period for any oscillator is a problem that every technical analyst face, because price movement have different time cycles. If the technician choose a short period, he will miss long-term cycles and vice versa. That is why I developed what I call " Martingale Panel" (MP).

Martingale Panel calculate five TDO with 5 different periods (which is: 10 – 20 – 40 – 80 & 160 by default) to cover a wide range of market cycles.

The old version from TDO used Multi Time Frame Panel (MTF) but I did not like this method despite its popularity, because MTF is not balanced. As an example, one-day candle is 6 x 4 hours candles but 4 hours candle is 4 x 1 hour candle, does this make any sense.

Also, there is no standard time frame for different trading platforms. As an examples Time frames used on Meta trader 4 differ from those used in Meta trader 5.

MP is more balanced than MTF. AS an example, TDO calculated from 160 candles is 2 x TDO calculated from 80 candles, which is 2 x TDO calculated from 40 candles and so on. Therefore, when we look at MP we know that it is more balanced and can judge market trend effectively.

MP show the status of TDO calculated for the last candle on the chart. It is as a scanner for TDO calculated with different periods.

When all TDO (10-20-40-80-160) is above zero MP color is blue, alert is on and TDO shadows color is blue, because trend is getting stronger to the upside than before.

When all TDO (10-20-40-80-160) is below zero MP color is red, alert is on and TDO shadows color is red, because trend is getting stronger to the downside than before.

TDO & Smart Shadows

TDO use what I call "Smart Shadows" (SSH) that change its color when MP is in-line and all TDO is calculated at the same direction. This show you the area on the chart when all TDO is in-line wither to the upside or to the downside. When SSH appear it indicate that trend is getting stronger.

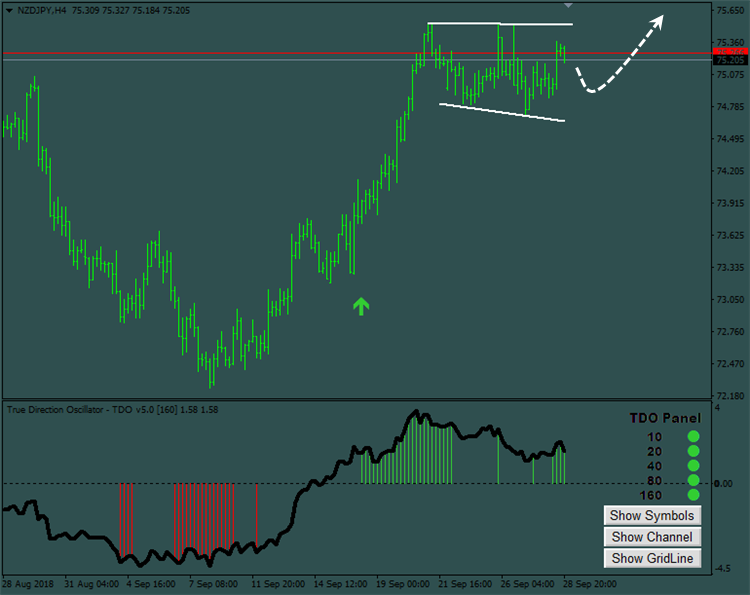

TDO & Arrow Signals

This also work as a filter for false breakouts. When TDO cross zero line but MP is not in-line then no buy/sell signal appear on the chart. This eliminate the number of signals and show you only strong signals with high success rate.

Here is an example for a Buy signal.

Another example for a Sell signal.

TDO in percent

TDO calculation done in percentage. This make it possible to compare between different securities from different markets.

If TDO for AUDUSD is +3.24% and TDO for XAUUSD is +2.5% then AUDUSD got more momentum than XAUUSD.

If TDO for S&P500 is -2.5% and TDO for EURUSD is +1.1% then, S&P500 momentum to the downside is stronger than EURUSD momentum to the upside.

TDO & Bermaui Utilities

In version 4.0 and above I added some utilities to help customers and make TDO much more effective. I call those tools Bermaui Utilities. The new features are:

- Symbol Switch Panel.

- Channels.

- Rounded Numbers Grid.

- Zig Zone levels.

You can reach any of them by clicking the buttons at the right corner of TDO indicator window. Now let us know more about them with more details.

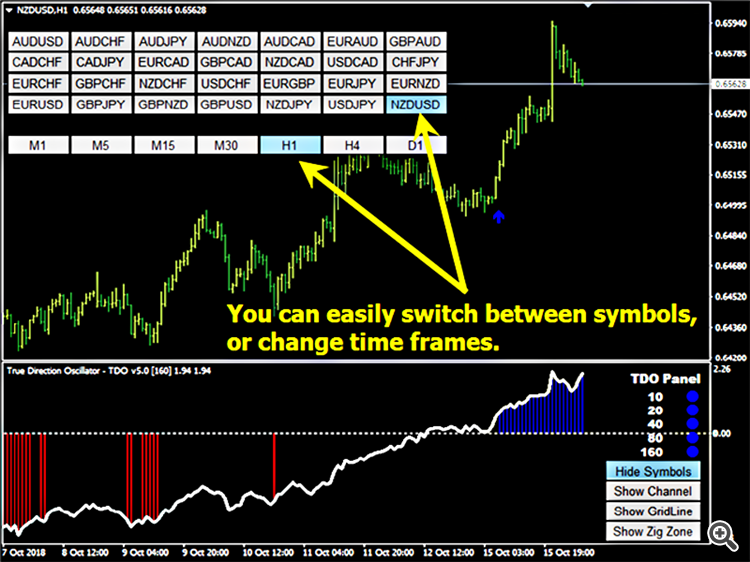

Symbol Switch Panel.

With TDO version 4.0 and above you don't need to add TDO to all charts that you trade, because you can switch from one chart to another on the same window. This will decrease the number of open charts on your terminal and make it easy for you to scan all charts you have interest in. All you have to do is to click on the "Symbol Switch Button" and choose the symbol you want to open its chart.

Channels

The user can choose between two kind of channels.

- Standard Deviation Channels.

- Linear Regression Channels.

Standard Deviation Channels are calculated by plotting two parallel lines above and below an x-period linear regression trend line. The lines are plotted x standard deviations away from the linear regression trend line.

Standard Deviation Channels can be used to enhance several types of technical analysis techniques. Here are some ideas:

- Validate candlestick patterns. Enter long on bullish engulfing lines only if they form below the bottom channel line.

- Validate overbought/oversold signals. Close long (or enter short) when prices have recently fallen below the top channel line.

- Validate support/resistance breakouts. If prices have broken above a long-term resistance level, wait until the prices break above the upper channel on above average volume.

Developed by Gilbert Raff, the Regression Channel is a line study that plots directly on the price chart. The Regression Channel provides a precise quantitative way to define a price trend and its boundaries.

The Regression Channel is constructed by plotting two parallel, equidistant lines above and below a Linear Regression trend line. The distance between the channel lines to the regression line is the greatest distance that any one high or low price is from the regression line.

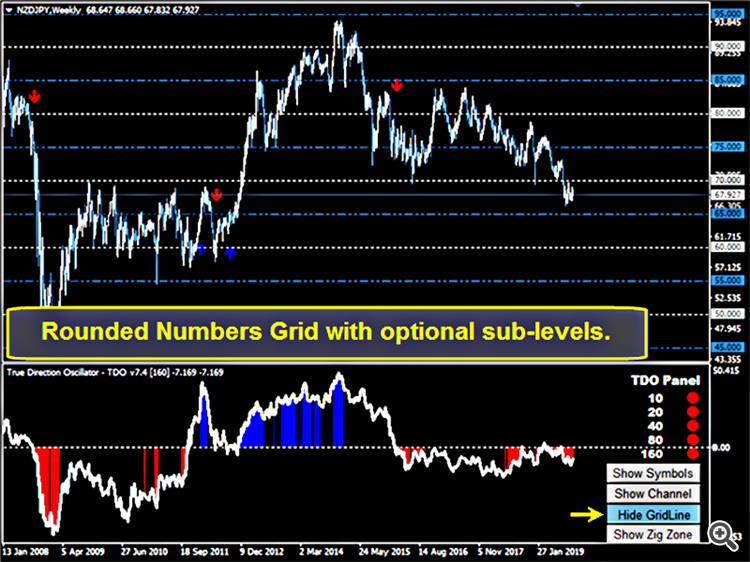

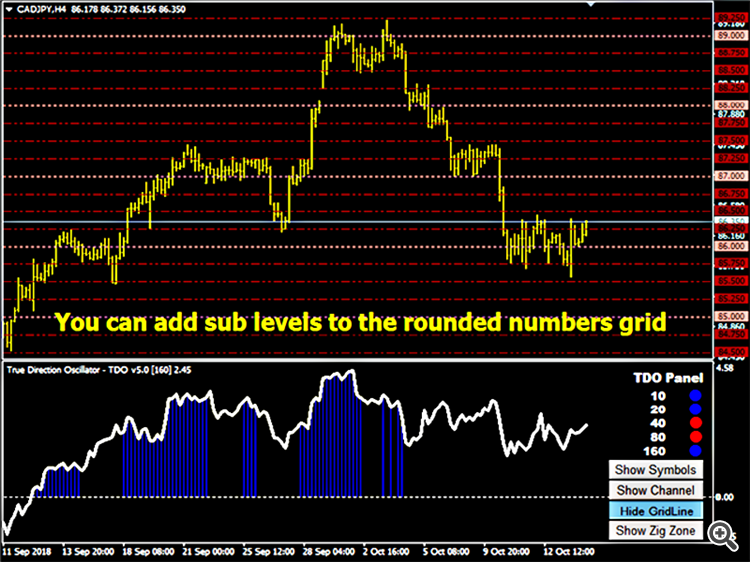

Rounded Numbers Grid.

If you’ve been trading on charts for long enough, you’ve surely noticed the odd behavior that prices will have a tendency to exhibit when a ‘round’ number (prices such as .9900 or .9800) is seen.

Traders will often call these whole number intervals ‘double-zeros,’ as these prices are at even numbers such as 1.31000 on EURUSD, 1.57000 on GBPUSD or 132.00 on GBPJPY. The chart below will identify the ‘Double-Zero’s’ on the current CADJPY chart.

Some traders will even take this a step further by looking at the number directly in the middle of these whole numbers or ‘the fifties.’ These levels, such as 1.31500 on EURUSD or 131.50 on GBPJPY can often come into play in the same manner as the ‘double-zeros.’

Notice that many of the price swings on the above chart take place around one of these levels. This is why we want to incorporate these levels into our support and resistance studies.

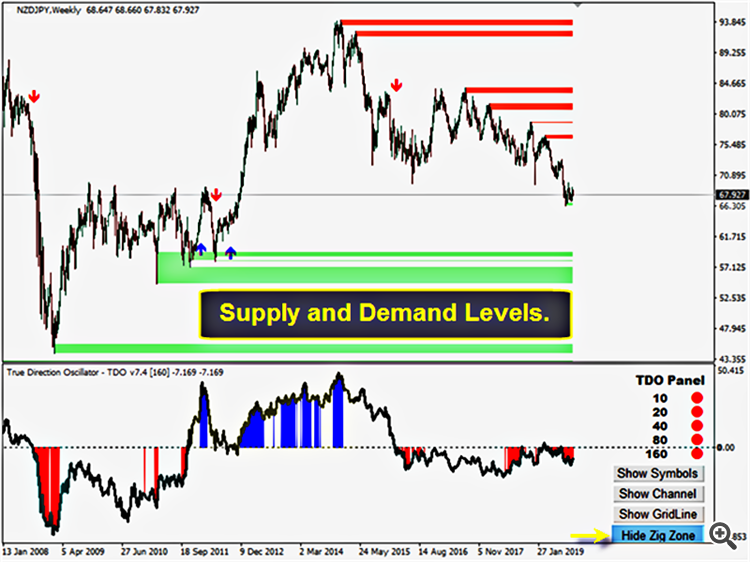

Zig Zone levels.

Or Supply & Demand Zones. This tool searches the chart, to find peaks & valleys. Then it draws support and resistance areas on the chart. This idea is really helpful at defining trading targets and stop loss.

By the end, I hope you find TDO a good investment tool for you. If you want farther information then you can also take a look at those articles:

- True Direction Oscillator F.A.Q: https://www.mql5.com/en/blogs/post/722015

- TDO video library: https://www.mql5.com/en/blogs/post/722018

- You can buy or rent TDO from this link: https://www.mql5.com/en/market/product/12914

If you have any question send it to me and I will answer as soon as I am online. I wish all of you happy trading with True Direction Oscillator.

Muhammad Al Bermaui, CMT

![[MANUAL] - True Direction Oscillator [MANUAL] - True Direction Oscillator](https://c.mql5.com/6/803/splash-717970.jpg)