Against the background of positive macro statistics, received on Wednesday from the US, and after the publication of the minutes from the March meeting of the Fed, the dollar strengthens against the defensive assets such as gold, yen, franc.

As follows from published protocols, the leaders of the Fed are more confident in achieving a target inflation rate of 2% during the year, confirming plans for a gradual increase in interest rates. At the December meeting, the leaders of the Fed planned to raise the interest rate in 2018, and they confirmed two more rate hikes.

In the past year, the drop in unemployment was the argument for higher rates. Since October 2017, unemployment is 4.1%, remaining near the lowest level in 18 years. The leaders also said that the weakening of inflation is temporary, and inflationary pressures have grown in recent months. As reported on Wednesday by the Ministry of Labor, the basic consumer price index in the US rose in March by 2.1% compared to a year earlier. This is the strongest growth in the index since February 2017.

The dollar also replayed a part of losses on the publication on Tuesday of the producer price index (PPI), which in March rose by 0.3% compared to the previous month, which may speak of increasing inflationary pressure in the economy.

Now investors will pay attention to the fact that the basic index of prices for personal consumption expenditures, which the Fed prefers, in March grew by 1.9% compared to March 2017. The Ministry of Commerce will publish it later this month. In February, the growth of the index was 1.6% (with the target level of 2.0%).

This index is preferred for the Fed in determining the level of inflation. But if it turns out to be worse than the forecast, then the probability of 4 rate increases this year will significantly decrease, which will have a negative impact on the dollar.

From the news for today, we are waiting for publication at 12:30 (GMT) of data on the number of new (initial) applications for unemployment benefits in the US over the past week. The result above the expected indicates a weak labor market, which has a negative impact on the US dollar, and vice versa. Previous value of 242 000, forecast - 230 000, which should positively affect the dollar in case of confirmation of the forecast.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

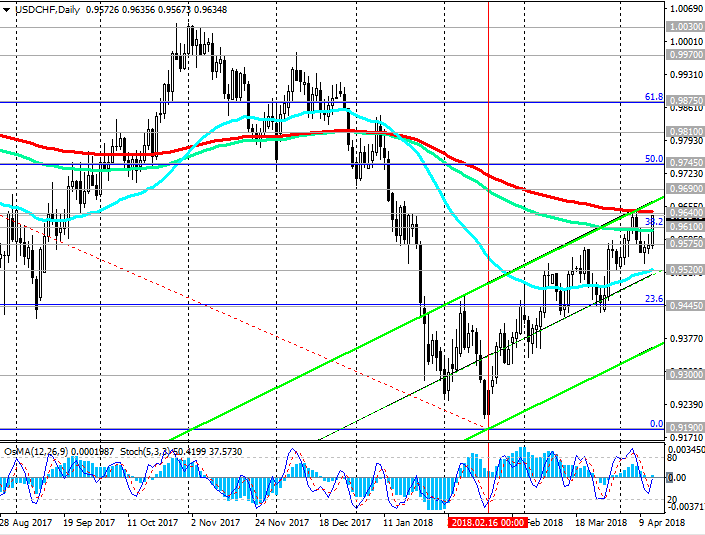

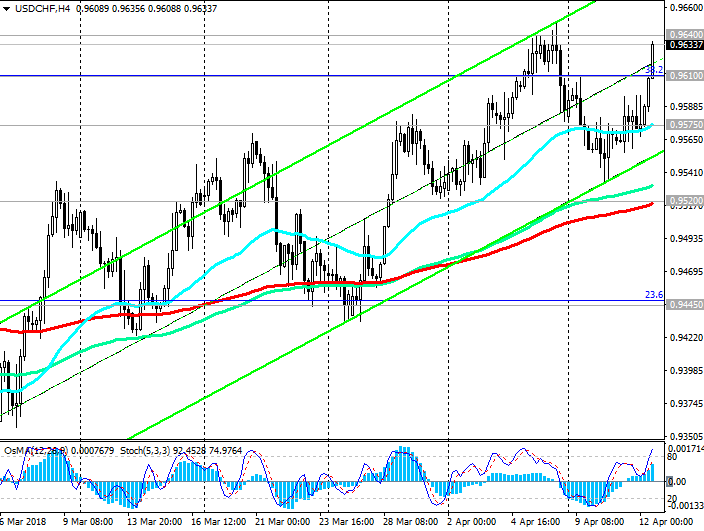

Support levels: 0.9610, 0.9600, 0.9575,

0.9520, 0.9445, 0.9400, 0.9300

Resistance levels: 0.9640, 0.9690, 0.9745, 0.9810, 0.9875, 0.9900, 0.9970, 1.0000

Trading Scenarios

Buy Stop 0.9650. Stop-Loss 0.9590. Take-Profit 0.9690, 0.9745, 0.9810, 0.9875, 0.9900, 0.9970, 1.0000

Sell Stop 0.9590. Stop-Loss 0.9650. Take-Profit 0.9575, 0.9520, 0.9445, 0.9400, 0.9300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com