DJIA: investors monitor the negotiations of representatives of the United States and China

As you know, last Thursday, US President Donald Trump announced a number of measures aimed at reducing the US trade deficit with China by $ 100 billion from the current record level. "Our trade deficit with China, according to various estimates, ranges from $ 375 billion to $ 504 billion. We have a situation with a colossal theft of intellectual property, corresponding to the loss of hundreds of billions of dollars", Trump said before signing the memorandum.

China reacted negatively to this decision of the White House. "The US actions do not meet the interests of the Chinese side, or the interests of the American side, or the interests of the whole world, becoming a bad precedent. In any case, the Chinese side will not be indifferent to seeing how its legitimate interests are damaged, we are fully prepared to defend our interests in a resolute manner", the Ministry of Commerce said in a statement.

The increased threat of the beginning of world trade wars, provoked by US protectionist actions, contributed to a sharp drop in world stock indices.

Investors also sold the dollar, moving funds into defensive assets, such as the franc, yen, gold.

On Tuesday, the dollar and major US stock indexes are rising. The optimism of investors is fueled by reports that high-ranking representatives of the United States and China are negotiating to resolve the recent contradictions in the trade relations between the two countries.

The chief economic adviser to the Chairman of the People's Republic of China, Liu He, met with representatives of American companies and other representatives of the business community, counting on the resumption of the dialogue. Chairman of the State Council of China Li Keqiang on Monday evening reaffirmed Beijing's readiness to continue negotiations with the US in order to resolve the contradictions in trade and reach a mutually beneficial result.

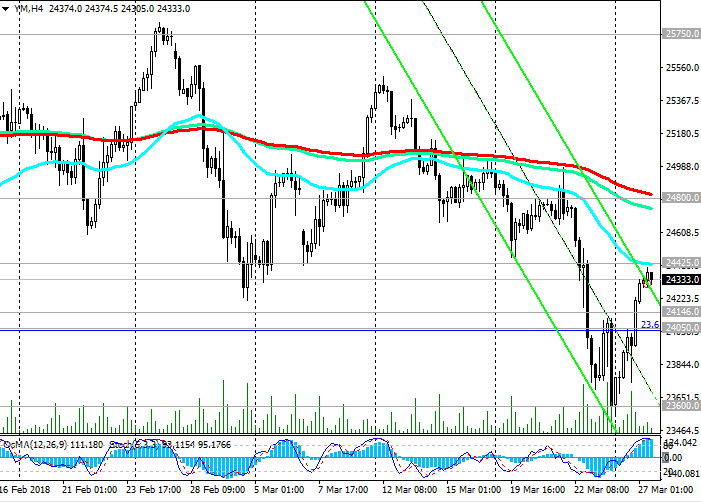

The Dow Jones Industrial Average rose 2.8% on Monday to 24200.00 points, the S&P 500 grew 2.7% to 2660.00 points, and the Nasdaq Composite gained 3.3% to 7220.00 points. On Tuesday, the recovery of indices continues.

If China and the US come to an agreement that suits both sides, then the recovery of the indices will continue. Otherwise, the stock markets are waiting for another collapse. Trade wars have not brought long-term benefits to anyone, although, in the short term, a party that introduces protectionist measures can gain advantages in trade.

For today, the economic calendar is empty. The dynamics in financial markets is currently determined by the situation in the US trade relations with their largest trade and economic partners.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

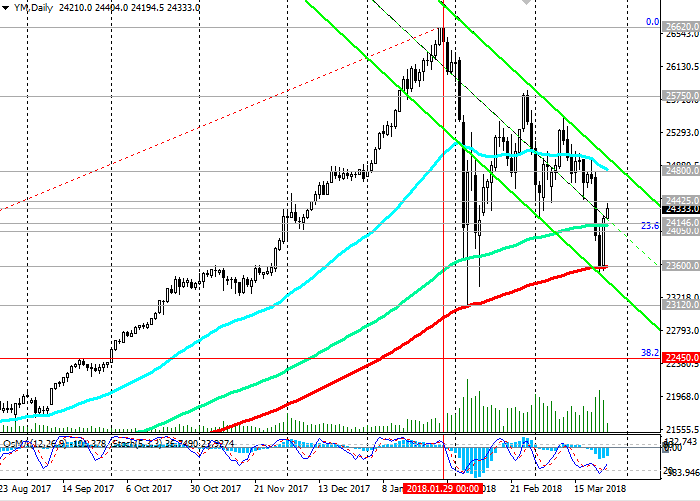

Support levels: 24146.0, 24050.0, 23600.0,

23120.0, 23000.0, 22450.0

Resistance levels: 24425.0, 24800.0, 25000.0, 25750.0, 26620.0

Trading Scenarios

Buy Stop 24500.0. Stop-Loss 24270.0. Take-Profit 24800.0, 25000.0, 25750.0, 26620.0

Sell Stop 24270.0. Stop-Loss 24500.0. Take-Profit 24146.0, 24050.0, 23600.0, 23120.0, 23000.0, 22450.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com