Gold could see further selling pressure

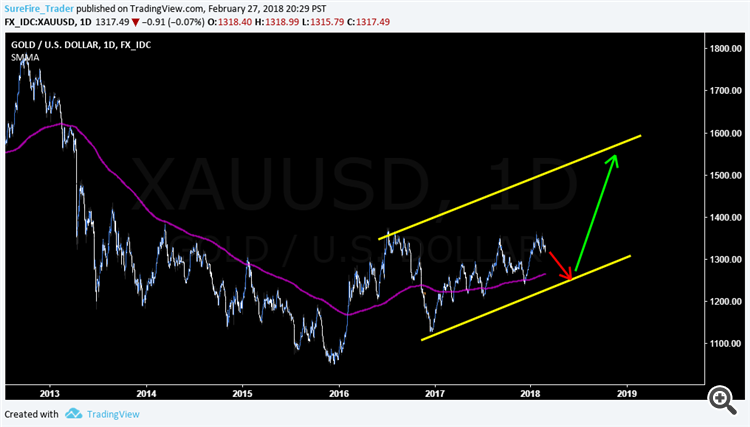

Gold Daily Chart

As the dollar is strengthening, I expect Gold to pull back from the current level to retest 1250 level or even 1200 in near term. Despite anticipating a the near term weakness, on a longer term outlook, I am bullish gold, if you are thinking of holding it through 2018 and into 2019.

Why I am bullish gold long-term? I feel the US equity market has over extended and it could be in for a further drop in coming months. After the plunge of the S&P500, the recent bounce up did not see any strong conviction. It looks like investors are unloading their net long positions on bullish days.

So, look to buy in Gold on any near term selling.

Don't Buy those Cryptocurrencies Yet.

Bitcoin (BTC) and Ethereum (ETH) are the 2 cryptocoins I am waiting to buy. But not now, but in 2 or 3 months time, for the best opportunity. In many social trading websites, most traders are calling to go long right now, expecting Bitcoin can push up and retest the $20,000 level we seen last on Dec' 2017. My opinion differs strongly.

Good things come to those who wait. I expect Bitcoin to retest the $6,000 level again and then drop below as the mid-to-long term chart pattern shows a downtrend and both BTC and ETH have not broke above the 200 period moving average. So, wait for the nice low entry of the opportunity presents.

Is S&P500 in bubble territory?

Pay attention in the next few weeks. When there isn't a significant buying bias supporting the current level, we can expect further erosion to continue. If index drops and retest 2535 low again, this could confirm another level of selling pressure thereafter.

The next support level will around 2169 if the downward trend continues.

About the Author

Ramesh is an active trader producing over 200% gain in 2017 and author of 3 trade strategy development books sold on Amazon. He is the creator the10/20/30 Rule™ that could transform a mediocre trading system to become a top performer by following a systematic and thoughtful approach on strategy development.

website: www.forexnewrulebook.net