Yesterday’s trading was not to our liking with the euro and pound moving sideways within limited price ranges. We now hope for better and more profitable market conditions today as we have a big risk event coming up. Sterling traders prepare for high volatility with the focus shifting to the Bank of England’s monetary policy announcement. Today is a ‘Super Thursday’ in the UK, when the rate announcement is accompanied by the publication of the meeting minutes and of the quarterly Inflation Report.

Apart from this major risk event, investors consider prospects for U.S. tax cuts and President Trump’s Fed pick. Trump plans to nominate Federal Reserve Governor Jerome Powell to the job as a new Fed Chair, according to four people familiar with the decision. Powell as the next Fed Chair would closely mirror the Fed’s stance under Janet Yellen since he also supports gradually rate increases. Trump will announce his decision today at 19:00 UTC. Given broad expectations that Powell would be the pick, the U.S. dollar slightly declined against other major currencies on the news. Generally speaking, Powell is relatively dovish-leaning on monetary policy and represents a bit of continuation of the current monetary policy course under Yellen.

The most interesting event, however, will be the BoE decision and traders in the GBP/USD should watch out for large market swings. The market is pricing in a 90 percent chance of a rate hike from the BoE which would be the first move since the central bank cut interest rates in the aftermath of the Brexit. However, there are warnings BoE Governor Carney is making the wrong move at the wrong time. Having prepared investors for the first rate increase in a decade, the BoE has little choice but to move, even though Brexit is clouding the outlook while a subsequent slowdown would prevent the central bank from hiking again. With the BoE being particularly concerned with Brexit, a rate hike could be a ‘one-and-done’ while such a move is unlikely to mark the beginning of a rate cycle at this point.

In more ways than one, it’s an unusual rate increase. While inflation is rising due to the weakening pound, economic growth is below average. The BoE therefore faces a tricky problem. It has to raise rates due to rising inflation that is significantly above target but it is also concerned about the negative economic and financial implications of the Brexit fallout.

Let us quickly focus on the possible trading scenarios.

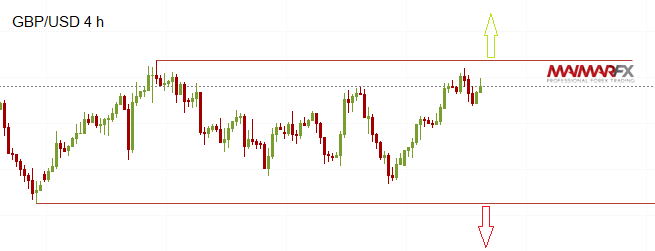

Neutral scenario (most likely): The BoE hikes in order to retain its credibility but will not commit to a tightening cycle (One-and-done rate hike). The GBP/USD could initially rise on the outcome but is likely to fall back towards the lower barrier of its recent trading range (see chart below). We expect the pair to trade between 1.34 and 1.30.

Bullish scenario (unlikely): The BoE hikes and makes clear that it intends to follow a hawkish course with further rate hikes in the medium-term, similar to the Fed. The pound will skyrocket and could quickly break 1.3450 and further 1.36. The next target would be 1.40.

Bearish scenario (possibly but would be a shock): No rate hike. The BoE could alleviate the negative effect on the pound by confirming that a rate hike will come in December. No rate at all is not an option since inflation is running above target while BoE policymakers must also keep their credibility. In such case, the pound could fall towards 1.30 before it recovers losses on prospects of a later rate hike.

The BoE decision will be announced at 12:00 UTC, alongside new economic forecasts and Carney will hold a press conference 30 minutes later.

If you want to know how we trade this high risk event, sign up for our professional signal service.

Here are our daily signal alerts:

View our daily signal alerts http://www.maimar.co/category/daily-signals/