AUD/USD: The Australian dollar is leading the decline against the US dollar

As Philip Lowie, the RBA's governor, said today, the bank expects "a gradual decline in the unemployment rate, which should help accelerate the growth of salaries", adding that "based on the current situation, we are aimed at further reducing unemployment and are on the way to the middle of the target inflation range 2% -3%”.

According to Lowie, the RBA's optimistic forecasts regarding inflation and GDP growth in 2018 look quite realistic. So, the GDP growth of Australia in 2018 should be 3.0%, unemployment will decrease, and the growth rate of wages should accelerate.

The minutes of the September 5 meeting of the RBA on Tuesday show that the scale of employment growth indicates that the economy of the country has overcome all the difficulties associated with changes in activity in the mining sector.

Nevertheless, today the Australian dollar – is in the leaders of decline against the US dollar. As you know, yesterday the Fed made it clear that it could raise interest rates again this year and next month it will start selling previously purchased treasury bonds. At the moment, the portfolio of assets of the Federal Reserve is about 4.5 trillion dollars, and reducing the balance of the Fed will be tantamount to tightening monetary policy.

The prospect of raising interest rates is negative for commodities, the price of which is expressed in US dollars. The probability of an increase in rates in 2017, according to the CME Group, is now more than 68% against 41% a week earlier.

Australia is the largest exporter of primary commodities, including iron ore, liquefied gas. The strategic partner of Australia and the buyer of its primary commodities is China.

Today, Standard & Poor's downgraded China's credit rating to A + from AA-. Now the S & amp; P rating corresponds to the Moody's rating, lowered in May, and the Fitch rating, which was lowered in 2013. And it also affects the Australian dollar, putting pressure on him.

We are waiting for data from the USA today. At 12:30 (GMT) a number of macro data will be published, including the weekly report of the US Department of Labor, which contains data on the number of initial applications for unemployment benefits. The result higher than expected indicates a weak labor market, which has a negative impact on the US dollar. The forecast is expected to grow to 300,000 from 284,000 in the previous period, which should negatively affect the dollar.

Nevertheless, the pressure on the AUD / USD pair in the absence of important news from this country is likely to remain until the end of the week.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

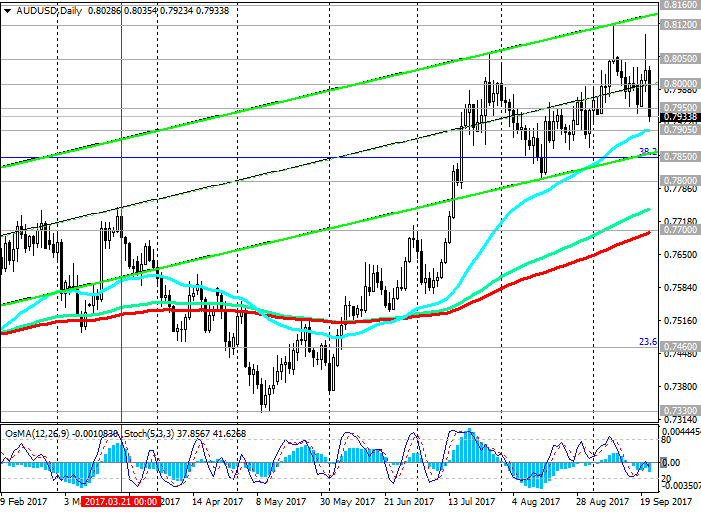

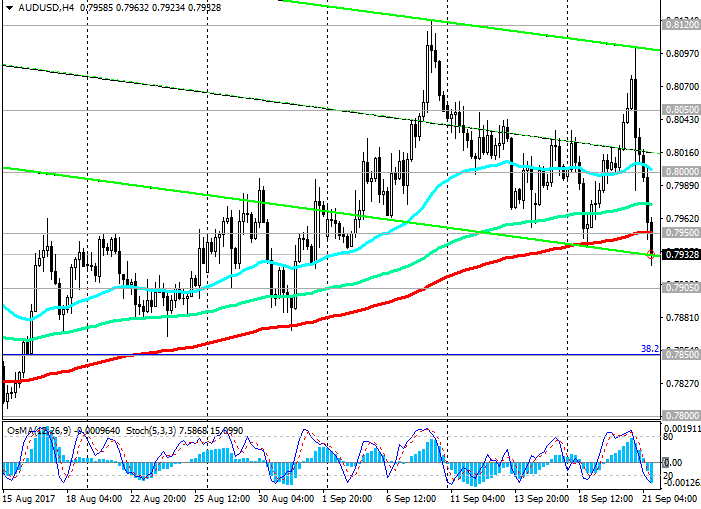

The AUD/USD today broke through two important support levels of 0.8000 (EMA200 on the 1-hour chart, EMA50 on the 4-hour chart, EMA200 on the weekly chart), 0.7950 (EMA200 on the 4-hour chart) and develops a downward correction to the support level of 0.7905 ( EMA50 on the daily chart).

Deeper downward correction, while maintaining a general upward positive medium-term dynamics, is allowed up to the support level of 0.7850 (the Fibonacci level of 38.2% correction to the fall wave of the pair since July 2014, the minimum of wave is near 0.6830 level). Here, the bottom line of the ascending channel passes on the daily chart.

Despite today's decline, the pair AUD / USD keeps positive dynamics and grows in the upward channels on the daily and weekly charts, the upper limit of which runs near the level of 0.8160 (50% Fibonacci level).

The return above the level of 0.8000 will cause the resumption of purchases of the pair AUD / USD.

You can return to consideration of short positions in case of breakdown of the support level of 0.7850.

In case of breakdown of the support level 0.7800 (EMA144 on the weekly chart), the AUD / USD decline will accelerate with the target at the support level of 0.7700 (EMA200 on the daily chart, EMA50 on the weekly chart). The breakdown of the support level of 0.7460 (the Fibonacci level of 23.6%) will return the pair AUD / USD to the global downtrend beginning in July 2014.

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts were deployed to short positions.

Support levels: 0.7905, 0.7850, 0.7800, 0.7700

Resistance levels: 0.7950, 0.8000, 0.8050, 0.8120, 0.8160

Trading Scenarios

Sell in the market. Stop-Loss 0.7960. Take-Profit 0.7905, 0.7850, 0.7800

Buy Stop 0.7960. Stop-Loss 0.7930. Take-Profit 0.8000, 0.8050, 0.8100, 0.8120, 0.8160

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com