GBP/USD: deficit of the foreign trade balance of the UK increased_07/04/2017

Current dynamics

The deficit of foreign trade in goods in the UK in February (with correction) rose to 12.5 billion pounds (forecast was 10.7 billion pounds). At the same time, the foreign trade deficit for January was revised to 12.0 billion pounds from 10.8 billion pounds. Manufacture in the manufacturing sector of the UK in February fell by another 0.1% after a decrease of 0.9% in January. The level of industrial production in annual terms in February fell to 2.8% from 3.2% in January (the forecast was + 3.7%).

Such disenchanted investors data led today (08:30 GMT) by the British Office of National Statistics. In response to the data presented, the pound fell in the foreign exchange market. The pair GBP / USD lost 30 points in a moment. And the pressure on the pound and the GBP / USD pair persists.

Today in the foreign exchange market as a whole, the negative background prevails after it became known about the US missile strikes against Syria. There was a sharp increase in demand for yen and precious metals. These assets act as shelters during a political or financial crisis on the world stage.

June gold futures on the basis of yesterday's trading on COMEX rose by 0.4% to 1253.30 dollars per ounce. During the Asian session, the price-spot jumped above the level of 1265.00.

The pound is under pressure amid Brexit talks, when British Prime Minister Theresa May signed a decree last week to launch an official process for Britain's withdrawal from the European Union.

The focus of investors today will be the meeting of US President Donald Trump with Chinese President Xi Jingping and the publication of data from the US labor market in March (12:30 GMT). According to the forecast, an increase in the number of new places created in the non-agricultural sector of the US economy (NFP) by 180,000 is expected (after an increase of 235,000 in February); unemployment should remain at 4.7%. If the average hourly earnings grow by more than 0.2% (as it was in February), the report will show a very stable labor market in the US, which will help to strengthen the positive sentiment of investors regarding the rapid rate increase in the US. This will cause the growth of the dollar. Conversely, a weak labor market report will weaken the US dollar, including in the GBP / USD pair.

Support and resistance levels

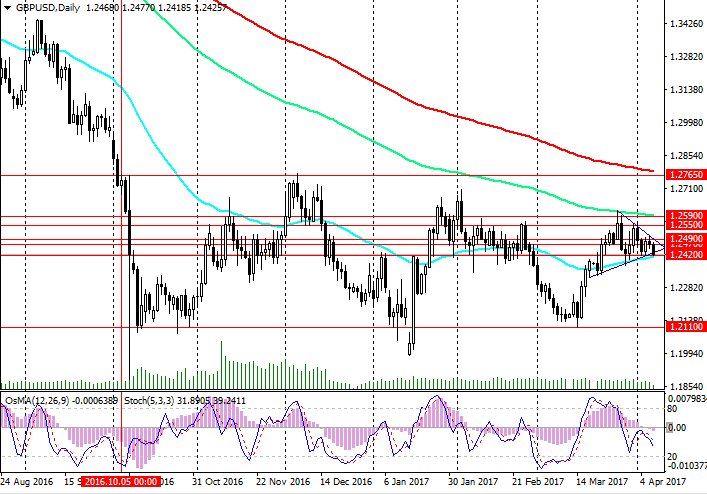

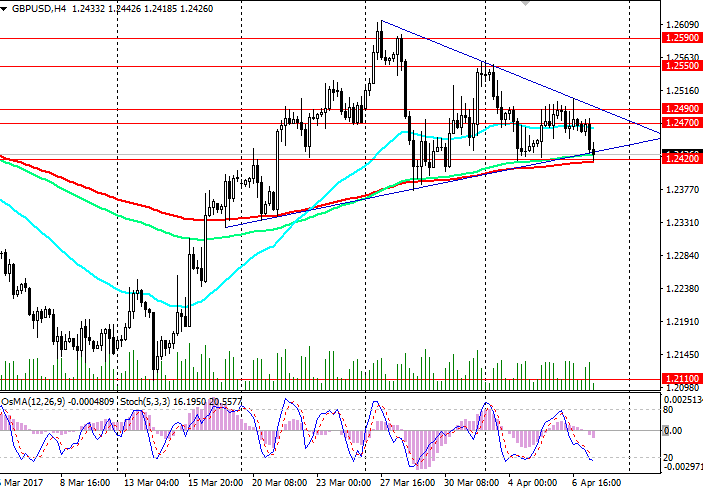

Starting in October, the pair GBP / USD traded mostly in the range between 1.2765 (EMA200 on the daily chart) and 1.2110. The peculiar midline of this range is the level of 1.2420. Currently, this line is the EMA50 line on the daily chart and EMA200 on the 4-hour chart. In the short term, the level of 1.2420 is a strong support level. Also on the 4-hour chart formed a tapering triangle, and the price is currently on the lower edge of the triangle.

Despite the indications OsMA and Stochastic, recommending sales, the rebound from the current level is likely to follow. Short-term objectives may be the levels of 1.2470, 1.2490, through which the upper line of the converging triangle passes. In case of breakdown of the level of 1.2490, further growth of the GBP / USD pair should be expected with the nearest targets of 1.2550 (April highs), 1.2590 (EMA144 on the daily chart). A more distant goal is the level of 1.2765.

If the GBP / USD pair returns to the zone below the level of 1.2420, its decline may resume. The nearest target is support level 1.2110.

The different focus of monetary policies in the US and the UK, the exit from the EU are powerful fundamental factors that put pressure on the GBP / USD pair.

Negative dynamics of the pair GBP / USD so far prevails.

Support levels: 1.2420, 1.2390, 1.2340, 1.2110, 1.2000

Resistance levels: 1.2470, 1.2490, 1.2550, 1.2590, 1.2700, 1.2800

Trading Scenarios

Sell Stop 1.2390. Stop-Loss 1.2450. Take-Profit 1.2340, 1.2150, 1.2100

Buy Stop 1.2450. Stop-Loss 1.2390. Take-Profit 1.2470, 1.2490, 1.2550, 1.2590, 1.2700.